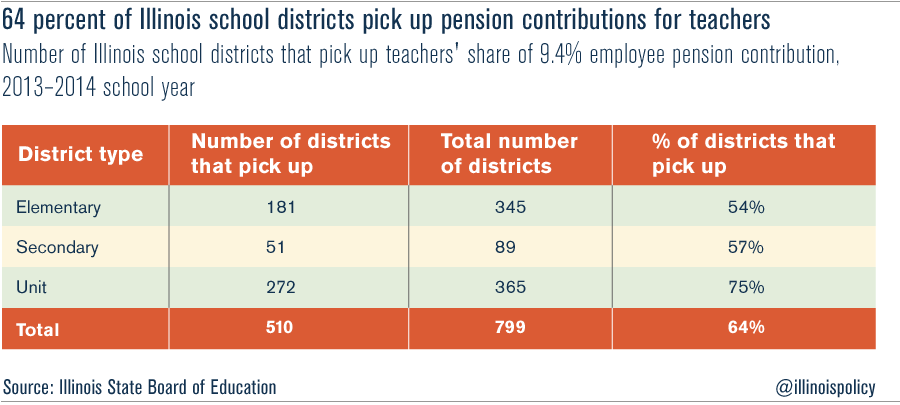

64 percent of Illinois school districts pick up pension contributions for teachers

Ending pension pickups is a simple, responsible way for cash-strapped school districts to free up money for the classroom.

Retirement savings come from three components: employee contributions, employer contributions and investment returns. That’s typically the standard for government employees and private-sector workers alike.

But school districts in Illinois have become an exception to that standard in two ways.

First, the employer does not pay the employer share of teacher retirements in Illinois. The state, not the school district, pays the employer portion of teacher pensions, even though teachers are employees of the local school districts and not the state.

Second, the employees often don’t pay the employee share of their own pensions either. Teachers are obligated by law to pay 9.4 percent of their salary into the retirement system. But over the years, school districts began paying, as a benefit, the teacher’s required contribution. This practice is referred to as a “pickup.” Pension pickups have become a standard in nearly two-thirds of Illinois’ school districts.

The end result is that many teachers are paying nothing toward their pensions. Taxpayers make the employer contribution through sales and income taxes and taxpayers pay the employee share through local property taxes and other fees.

Every year, the Illinois State Board of Education compiles its annual “Illinois Teacher Salary Study” by asking a series of questions directly to each school district, one of which is whether the district picks up the teacher’s share of the 9.4 percent employee pension contribution.

Below are the most recent results from that survey.

Click here to download the complete data set.

Almost two-thirds of school-district boards self-reported paying some or all of the teachers’ required contribution. Boards at 54 percent of elementary districts pay some or all of the teachers’ required contribution, while secondary and unit districts reported 57 and 75 percent, respectively.

In contrast, 289 school districts reported they do not pay any of their teachers’ share.

According to a 2012 Illinois Policy Institute report, requiring school districts – instead of the state – to pay the employer share of pensions for their employees would save the state more than $1 billion annually. The savings at the state level would increase costs for districts by an average of just 3.7 percent of total expenditures. But these increased costs could be significantly reduced or eliminated if school districts end the practice of paying the teachers’ portion of pension contributions. At the time of the original 2012 report, 482 school districts would see a net savings by paying the employer share while offsetting the cost by ending teacher pickups.

Cash-strapped school districts across the state should consider ending teacher pension pickups. Ending teacher pickups is a simple, responsible way for school districts to free up money for the classroom. It’s not out of line to ask employees to pay their share of the costs associated with their own retirement benefits. That’s a simple standard across most industries, public and private.