Chicago drivers gouged at the pump this Memorial Day weekend

An estimated 32 million drivers will hit the road this Memorial Day weekend, according to AAA. And those leaving from the Chicago area will feel much more pain at the pump. The national average for a gallon of gas is $3.65. In Illinois, the average price per gallon is $3.83. But the average price per...

An estimated 32 million drivers will hit the road this Memorial Day weekend, according to AAA.

And those leaving from the Chicago area will feel much more pain at the pump.

The national average for a gallon of gas is $3.65.

In Illinois, the average price per gallon is $3.83.

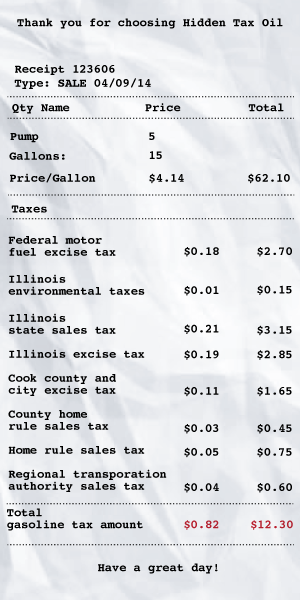

But the average price per gallon in Chicago is a whopping $4.14.

One of the major reasons why the city’s prices are so high is because of Illinois’ additional gas sales tax burden.

One of the major reasons why the city’s prices are so high is because of Illinois’ additional gas sales tax burden.

Traditional gas taxes such as “motor fuel taxes” are a fixed amount per gallon. These taxes generally pay for road maintenance and other transportation expenses — and motorists in all states pay these taxes. Combined, the federal, state, county and Chicago motor fuel taxes total $0.82 per gallon at today’s price. That leaves the raw price per gallon at $3.32.

But not only does Illinois have the nation’s fifth-highest state excise tax rates — it also is one of only seven states to apply an additional sales tax onto gas purchases.

These taxes don’t show up on your receipt — they’re hidden by being built into the price per gallon advertised along the roadways. Even worse, unlike the motor fuel taxes — which are a fixed amount per gallon — the sales taxes are set as percentage rates.

As the price of gas goes up in Illinois, so does the amount you pay in taxes.

The state’s 6.25 percent sales tax adds $0.22 per gallon to the price of gasoline in Chicago. The county and city sales taxes add an additional $0.11 per gallon to the price.

And unlike most states, where gas-tax dollars fund roads and transportation services, the revenue generated by state sales taxes goes to the state’s general fund. That means Illinois is pouring gas-tax dollars into various government spending, including pensions and human services.