Chicagoans the most-taxed residents in Illinois, paying more than 30 city taxes

Not only are city officials making Chicagoans pay more for services that aren't working, they are making them shoulder the highest tax burden in the state.

Chicago taxpayers aren’t getting the three things that matter most to city residents: a quality education for their children, safety for their families and good jobs. What’s worse, residents have to pay more than 30 city taxes worth more than $1,000 per household – for services that simply aren’t working.

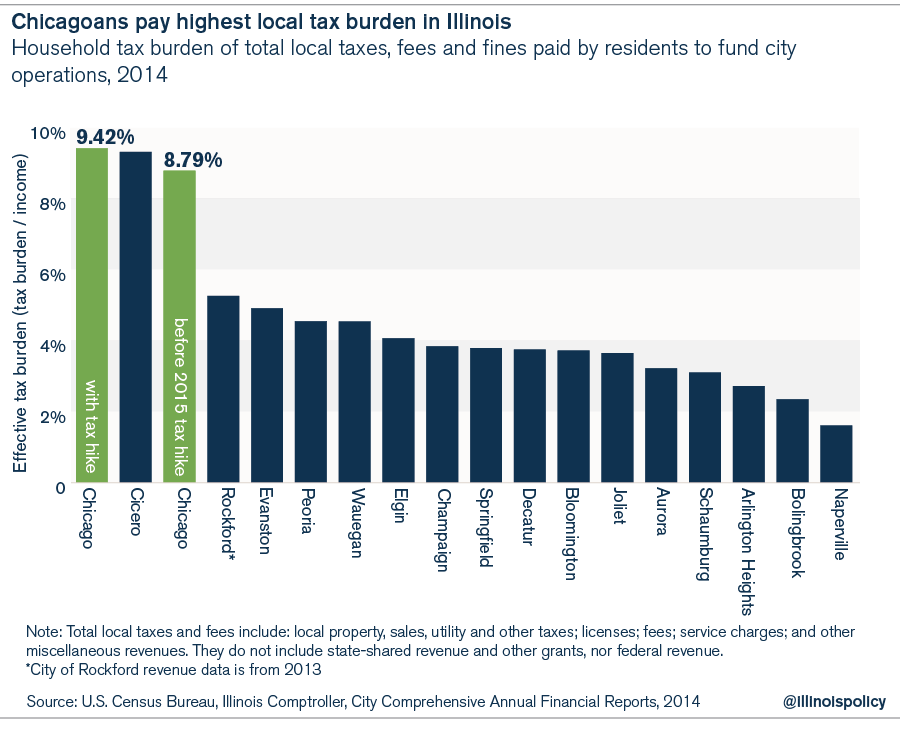

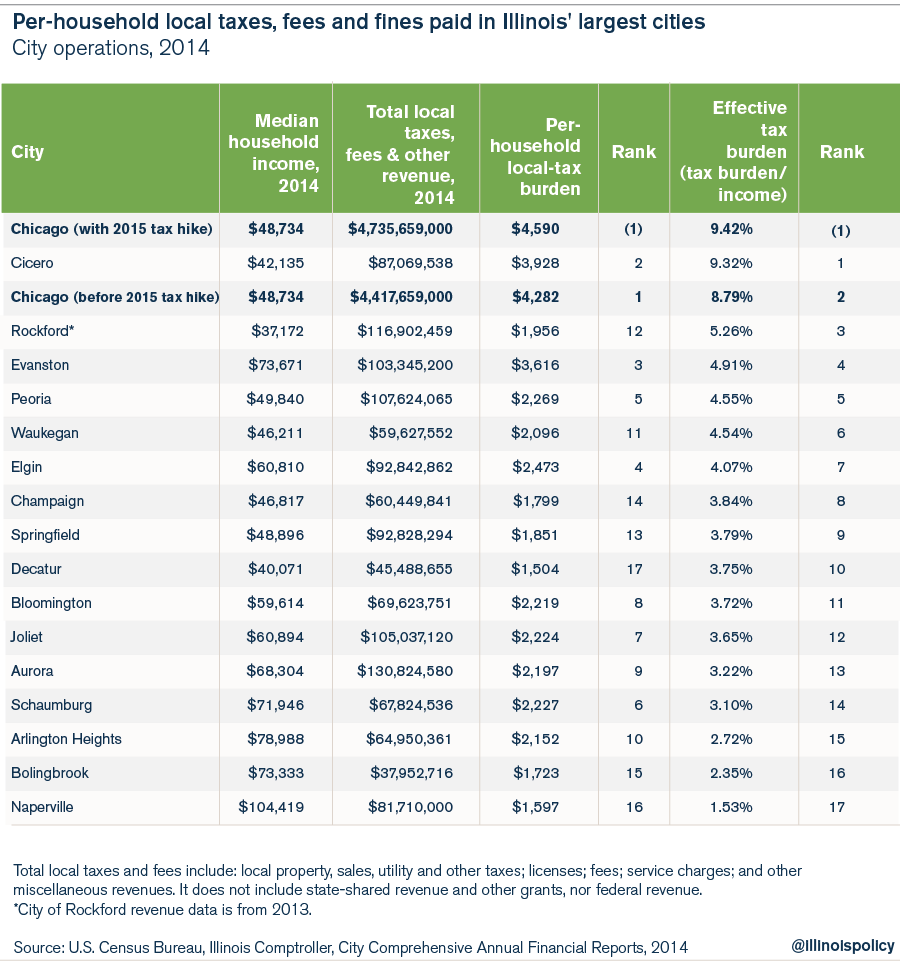

The Illinois Policy Institute added up all the local taxes, fees and fines that Chicagoans pay to finance City Hall’s operations, including those from the city’s newly approved tax hikes, and compared the totals to Illinois’ other largest cities. When measured as a percentage of household income, Chicagoans now pay the highest effective tax rate in the state.

Nearly 10 percent of Chicagoans’ household incomes go to pay for core city services that include police, fire and road repair. That figure does not include the cost of education, which is covered by another taxing district, the Chicago Board of Education. Nor does it include Cook County taxes, which were recently hiked to ameliorate the county’s own government-worker pension crisis.

Only Cicero competes with Chicago for its excessively high tax burden. That’s because Cicero households pay taxes and fees that are comparable to those in Chicago, yet their median incomes are even lower.

But after Cicero, Illinois’ largest cities burden their taxpayers with significantly lower effective tax rates. Taking into account the new taxes effective in 2015, Chicagoans pay nearly six times the tax rate residents in Naperville pay for their city operations, nearly three times what residents in Aurora pay, and more than 2.5 times what those in Springfield pay.

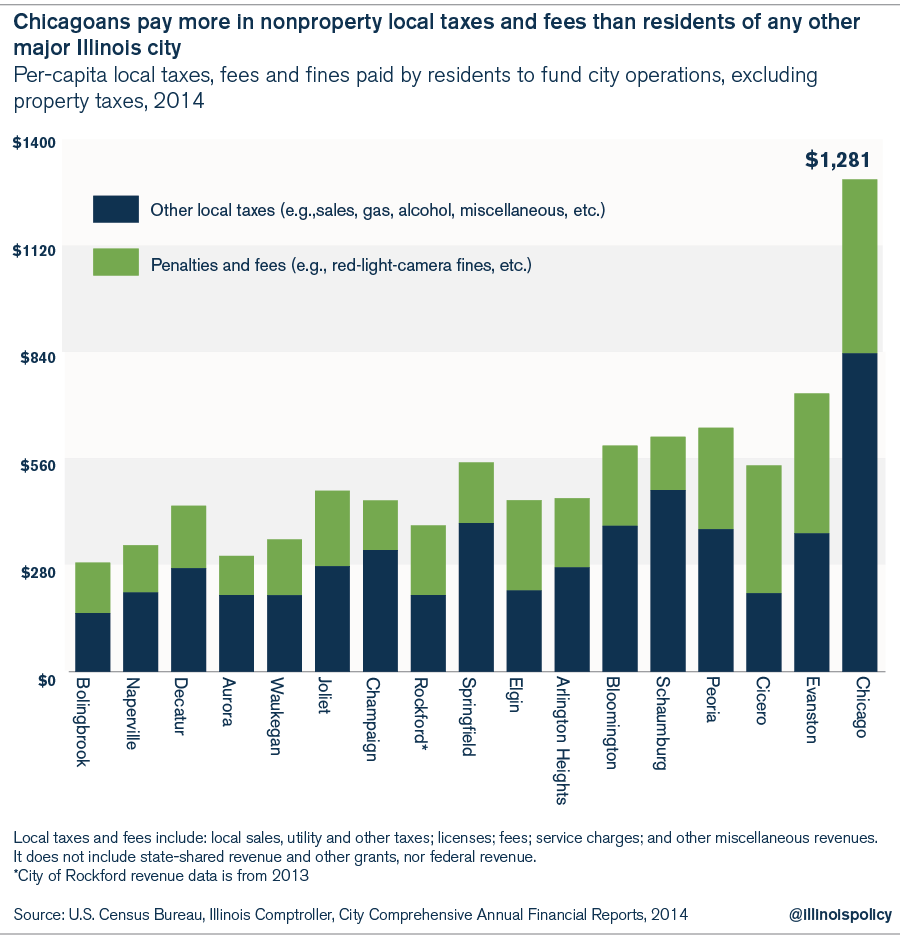

The difference in those tax rates is driven by the more than 30 different city-imposed taxes (and a host of other fees), as of October 2015, which Chicagoans must pay besides the property tax.

- Amusement tax (5 percent or 9 percent of charges for amusement)

- Amusement tax – subscribers to paid television programming (9 percent of television programming costs)

- Boat-mooring tax (7 percent docking or mooring fees)

- Bottled-water tax (5 cents per bottle)

- Chicago share of the state income tax (distributed by the state)

- Cigarette tax ($1.18 per pack)

- Electricity infrastructure maintenance fee (usage schedule starting with 0.53 cents per kilowatt hour)

- Electricity use tax (usage schedule starting with 0.61 cents per kilowatt hour)

- Emergency telephone system surcharge – landline ($3.90 per month)

- Emergency telephone system surcharge – wireless ($3.90 per month)

- Foreign fire-insurance tax (2 percent of taxable premiums)

- Fountain-soft-drink tax (9 percent of syrup price)

- Gas use tax (6.2 cents per therm on businesses that purchase gas from sellers not subject to either distributor or reseller occupation taxes)

- Ground-transportation tax (varies, including $78 per month for city cabs, $3 per day for noncity cabs)

- Home-rule retailers’ occupation (sales) tax (1 percent on food and drugs; 2.25 percent on general items)

- Hotel-accommodations tax (5.58 percent of gross rental charge, includes municipal-level tax)

- Liquor tax ($0.29 per gallon of beer, $0.36 to $2.68 per gallon of liquor depending on alcohol content)

- Motor-vehicle lessor tax ($2.75 per vehicle per rental period)

- Nonretail transfer-of-motor-vehicles tax (based on schedule of age of vehicle, from $10 to $80)

- Occupation tax – natural-gas distributor and reseller (8 percent of receipts)

- Off-track-betting tax (1 percent of wagers plus $1 on off-track-betting admissions)

- Parking tax (22 percent for daily parking, 20 percent for daily parking on weekends, 20 percent valet parking)

- Personal-property-lease transaction tax (9 percent of receipts or charges)

- Personal-property replacement tax (distributed by state, 2.5 percent on corporate income, 1.5 percent on partnerships, trusts and S corporations)

- Real-property transfer tax ($5.25 per each $500 of transfer price)

- Restaurant tax (0.25 percent of retail price in addition to sales tax)

- Soft-drink tax (3 percent of price)

- Telecommunications tax (7 percent of receipts or charges)

- Tire fee ($1 for each new tire sold)

- Use tax for nontitled personal property (1 percent, except for first $2,500 each year)

- Use tax for titled personal property (1.25 percent)

- Vehicle fuel tax (5 cents per gallon)

- Wheel tax ($85.97 annually for small passenger automobile; $136.54 annually for large passenger vehicle)

They all add up. In 2014, the city collected more than $1,280 per person in various nonproperty taxes and fees. That figure is almost double what Evanston, the second-highest taxing city in Illinois, collected in nonproperty taxes and fees, and four times the amount collected in Naperville.

Higher taxes and worsening services are a real threat to Chicago’s tax base. Chicago already lost 200,000 residents in the latest decennial census. The expectation of higher property taxes to bail out the city’s other pension funds and the nearly bankrupt state of Chicago Public Schools will only make out-migration worse.

Politicians in City Hall arrogantly assume that Chicagoans will stomach more and more tax hikes.

But those tax hikes won’t be dedicated to better schools, safer streets or a better jobs climate. If they were, Chicago’s middle- and low-income families might stick around.

The truth about the recent and future tax hikes is that little of Chicagoans’ hard-earned money will go toward new and improved services. Instead, the overwhelming majority will go to pay for city-worker pension debt – for services that have already been delivered.

That means an increasingly higher tax burden and a declining quality of life. That’s not a deal Chicagoans will accept.