QUOTE OF THE DAY

Chicago Sun Times: Madigan pulls plug on ‘millionaire tax’ constitutional amendment

House Speaker Michael Madigan Wednesday spiked his “millionaire tax” constitutional amendment and blamed Republicans for its demise, but the House GOP leader ridiculed that assessment as “a bit confusing” since the speaker faced defections from within his own caucus.

Madigan’s measure would have put a 3-percent surcharge on the income of those who make more than $1 million. The money would have generated an estimated $1 billion for education.

“Republicans concluded this morning to support millionaires over students in this state,” said Steve Brown, spokesperson for Madigan, D-Chicago.

WSJ: Illinois Charter Onslaught

Illinois Governor Pat Quinn faces an election challenge from Republican businessman Bruce Rauner, who has made charter-school expansion a personal and political cause. Democrats in Springfield are trying to kneecap the Republican with a burst of anti-charter legislation. Stuck in the jam is Mr. Quinn, who claims to be a reformer.

Democrats have introduced no fewer than 11 bills targeting charter schools, which have proliferated in Chicago and could mushroom statewide with more encouragement. The bills would gut a 1996 law that lets charters authorized by local school boards operate unbridled by state and union rules. One bill would extend a moratorium on “virtual schools,” including charters offering online AP classes, by four years through 2017. Another would bar charters from spending money on “marketing”—including websites and social media—and limit pay for their principals and CEOs.

A special sop to the Chicago Teachers Union would bar new charters from opening in the same or neighboring zip code of a public school that closed in the last 10 years, which would limit charter expansion to three neighborhoods in Chicago. New charter authorizations would also be conditioned on “transition impact aid” for local districts, thus giving Democrats purse-string power to block expansion.

America’s Markets: Report: 85% of pensions could fail in 30 years

You might have thought your public pension was on shaky ground, but you’re likely still being too kind.

Influential and well-regarded hedge fund Bridgewater Associates Wednesday warns public pensions are likely to achieve 4% returns on their assets, or worse. If Bridgewater is right, that means 85% of public pension funds will be going bankrupt in three decades.

Bridgewater came to these conclusions by stress testing the nation’s public pension plans, much the way banks need to be evaluated on what could happen given a wide range out outcomes.

Built in Chicago: Chicago Startups Raised over $157M in Q1 2014

Update 11:51 AM – We updated the total amount of funding raised in Q1 to $157M. We previously reported that Trustwave raised $25.5M, however we were informed by their team that it was not a raise, they filed a Form D in connection with a recent merger/acquisition.

Funding for Chicago-based digital companies accelerated in the first quarter of the year, pulling in a total of $157 million. That translates to about $1.75M million a day, a 157% percent increase over total funding raised in the same period last year.

It wasn’t just funding that accelerated in Q1: exits and launches picked up the pace, too. On average, Chicago entrepreneurs started a company every other day with 42 new companies formed. This nearly doubles the pace of startups from a year ago, when the city formed 22 startups in Q1 2013.

Chicago Sun Times: Oberweis proposes hiking minimum wage to $10 for adult workers

GOP U.S. Senate candidate Jim Oberweis threw a new minimum-wage plan on the table late Wednesday, proposing a three-year ramp-up to $10 per hour for only adult workers.

Oberweis, who is running against U.S. Sen. Dick Durbin, D-Ill., introduced an amendment to Senate Bill 2004 that would raise Illinois’ $8.25 per hour minimum wage to $9 per hour next January, $9.50 per hour in 2016 and $10 per hour in 2017.

The proposal would apply only to those 26 and older.

Chicago Tribune: ‘Oh God.’ Longtime city worker accused of stealing $750,000

A low-level clerk in City Hall embezzled almost $750,000 in permit fees over five and a half years without raising any alarms by depositing hundreds of checks payable to the city in business and personal bank accounts she controlled, federal prosecutors said Wednesday.

Antionette Chenier, a city employee since 1990, was caught only after Charter One Bank officials noticed unusual activity in the business account in January and confronted her.

In unsealing a criminal complaint charging Chenier with embezzlement, prosecutors made another embarrassing disclosure for city officials: Chenier lived in south suburban Homewood in apparent violation of the city’s residency requirement?

Chenier, a clerk for the city’s Department of Transportation, processed permit fees that allowed moving vans and Dumpsters to block public ways. Most of the stolen checks, made payable to the city’s Office of Emergency Management and Communications, ended up in the business account that she had named “OEMC Chenier,” prosecutors said.

WLS: Illinois Policy Institute: No need for increased property taxes

The Illinois Policy Institute has an alternative to avoid a property tax hike to fix Chicago’s pension problem.

Mayor Emanuel says he needs a property tax increase to help bail out city pensions but Ted Dabrowski of the Illinois Policy Institute says there is no need if the Mayor puts the city workers into a 401k-type plan.

“We cut Chicago’s pension shortfall in half,” he said. “And by cutting it in half we gain a lot of flexibility. Number two, because we stop the defined benefit program going forward, we don’t keep having this massive debt that keeps cropping up every single year. By ending the plan and cutting the debt in half, then we can manage to pay our way out of it without massive tax increases.”

Crain’s: Why are Illinois’ interest rates going down?

Bond investors are taking a shine to Illinois these days, but who gets the credit?

On its latest sale of $250 million in long-term debt, the state got much better interest rates than just a few months ago on a similar package sized at $1 billion.

Bank of America/Merrill Lynch had the winning bid today with an overall interest rate of 4.08 percent on the general obligation bonds, compared with 4.46 percent interest a small group of investment firms agreed to pay on a $1 billion bond deal in February.

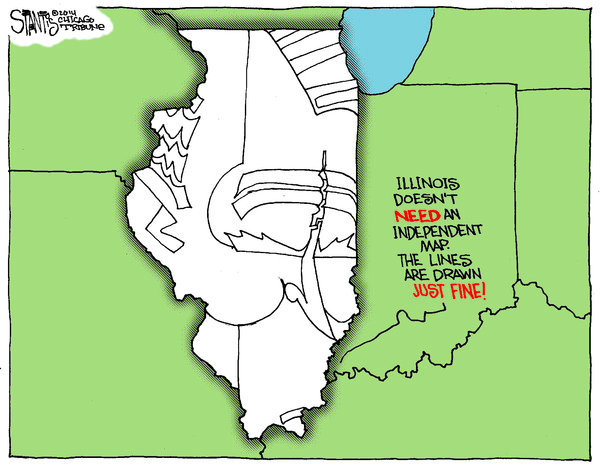

CARTOON OF THE DAY