QUOTE OF THE DAY

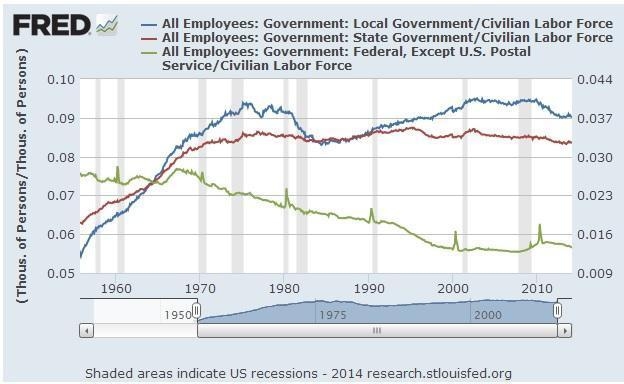

Muniland: Fixed costs squeeze state and local government hiring

I’ve said for several years that hiring by state and local governments is unlikely to rebound after the declines following the 2008 recession. Governments have been faced with increasing costs for Medicaid, pension and retiree healthcare, which are fixed in law and through contract negotiations and are therefore difficult to adjust. The most viable way for governments to balance their budgets was initially through layoffs; now it’s through hiring freezes. Employment data from the Federal Reserve Bank of St. Louis proves this point:

Bloomberg: Vermont’s Single-Payer Dream Is Taxpayer Nightmare

Of the plans that states have hatched for the Affordable Care Act, none has been bolder than that of Vermont, which wants to implement a single-payer health-care system, along the lines of what you might find in Britain or Canada. One government-operated system will cover all 620,000 of Vermont’s citizens. The hope is that such a system will allow Vermont to get costs down closer to Canada’s, as well as improve health by coordinating care and ensuring universal coverage.

Just two small issues need to be resolved before the state gets to all systems go: First, it needs the federal government to grant waivers allowing Vermont to divert Medicaid and other health-care funding into the single-payer system. And second, Vermont needs to find some way to pay for it.

Although Act 48 required Vermont to create a single-payer system by 2017, the state hasn’t drafted a bill spelling out how to raise the additional $1.6 billion a year (based on the state’s estimate) the system needs. The state collected only $2.7 billion in tax revenue in fiscal year 2012, so that’s a vexingly large sum to scrape together.

Chicago Tribune: Why Illinois and Chicago pols are so frantic to raise your taxes

Feb. 8, 2011. Michael Madigan sounded the knell, his cadence solemn. The man who runs Springfield warned of a new and austere epoch. His topic was pension funds edging toward dry-hole desperation. But it easily could have been children’s schooling in Chicago, or sheriffs’ staffing in counties statewide, or care for the disabled in prairie towns galore: Illinois would not have enough money to meet its commitments. “Again, tough decision-making, telling people, ‘You’re not going to get everything you thought you were going to get,'” the House speaker said to rapt colleagues. “Telling people, ‘You may have to pay in more.’ Not easy stuff. So we all better get ready for it.”

Not everybody believed. The old-timers recalled those gauzy assurances from state budget director Robert Mandeville, 25 years earlier, that fully funding the pension system “doesn’t make sense”: Times were fat; investment earnings surely would cover shortfalls in contributions.

Even today many lawmakers, reluctant to admit their shortsighted naivete, still blame Illinois’ problems on a recession that ended five years ago this June.

Daily Herald: Illinois Senate approves ban on ticket quotas

SPRINGFIELD — Legislation that would ban police departments from issuing quotas on tickets has been approved in the Illinois Senate.

The (Springfield) State Journal-Register reports the bill prevents any law enforcement agency from requiring officers to write a certain number of traffic citations within a specific time period. Police officers also couldn’t be evaluated on the number of citations they issue.

The measure was drafted by Sen. Andy Manar, a Democrat from Bunker Hill.

Barron’s: Chicago’s Lessons for Muni Holders

If you’re worried about the impact on the municipal bond market of underfunded government pension plans, you’d do well to look at what happened in Illinois last week.

The state legislature passed a bill that would aid two of Chicago’s woefully underfunded municipal pension systems by raising employee contributions and cutting cost-of-living adjustments (legislators balked at a property-tax increase originally included in the bill). One of the pension plans is only 57% funded, the other 38%; the bill aims to lift the funding for both to 90% by 2055.

Illinois remains the lowest-rated state in the nation, largely due to widespread pension shortfalls. Following passage of the pension-reform bill, yields on its 10-year bonds fell to 3.42% from 3.67% a week earlier. The new rate was 1.05 percentage points higher than the average triple-A- rated 10-year munis, according to Thomson Reuters Municipal Market Data. The earlier rate had been 1.14 points higher.

The News Gazette: UI group looking at pension supplement

The University of Illinois is moving toward a supplemental pension program that would contribute money to a tax-deferred retirement savings plan for thousands of employees stung by the state’s recent pension reform.

The package under consideration also would include matching contributions for employees who put money into their 403(B) retirement accounts, as well as additional help for prominent faculty and others affected by a new salary cap on pension benefits.

A university committee has been studying how the UI can alleviate the financial losses employees will incur under pension changes approved by legislators in November, which are also being challenged in court.

CARTOON OF THE DAY