QUOTE OF THE DAY

Chicago Tribune: Lawmakers seek regulation of e-cigarette liquids

Amid mounting safety concerns about accidental nicotine exposure, state representatives have decided they aren’t going to wait for federal regulation of electronic cigarettes to push childproofing legislation forward.

About five months ago, the U.S. Food and Drug Administration sent a proposal for regulating the devices to the White House’s Office of Management and Budget, but it is still under review.

An Illinois regulatory proposal, which the House approved 105-10 this month and now moves to the Senate, would enable the Illinois Department of Public Health to set specifications for the packaging of e-cigarette liquid, or e-liquid, refills.

Financial Times: Walgreens urged to leave US to gain tax benefit

Walgreens has come under pressure from an influential group of its shareholders, who want the US pharmacy chain to consider relocating to Europe, in what would be one of the largest tax inversions ever attempted.

At a private meeting in Paris on Friday, investors owning close to 5 per cent of Walgreens’ shares lobbied the company’s management to use its $16bn takeover of Swiss-based Alliance Boots to re-domicile its tax base.

The move, known as an inversion, would dramatically reduce Walgreens’ taxable income in the US, which has among the highest corporate tax rates in the world.

Crain’s: How Quinn is betting on insurance companies to rescue Illinois’ economy

Gov. Pat Quinn’s insurance director wants to conjure more of those special moments that brought an NBA Hall of Famer and promises of hundreds of jobs to Chicago.

Andrew Boron, director of the Illinois Department of Insurance, is pushing legislation that would provide $5 million to a new state corporation chaired by Mr. Boron to recruit out-of-state insurers. The money would be siphoned from the fees insurers and insurance brokers pay to fund the state’s regulation of them. He wants to replicate the success the department had in wooing EquiTrust Life Insurance Co. from suburban Des Moines, Iowa, which is a national hub for life insurers.

In January, Mr. Boron, Mr. Quinn and Chicago Mayor Rahm Emanuel joined former basketball great Earvin “Magic” Johnson, whom EquiTrust’s owner, Chicago-based Guggenheim Partners, named “controlling shareholder” of EquiTrust, to trumpet the headquarters move. At the time, EquiTrust CEO Jeff Lange said Chicago would gain at least 200 jobs and possibly more than 1,000 eventually from the relocation.

Forbes: New York Legislators Just Did The Unthinkable, And Voters Will Love It

Last Monday night, state legislators in New York did the unthinkable: they cut taxes. Let me reiterate that. New York lawmakers cut taxes, while passing a $140 billion budget, instead of increasing them. While some tax reform measures included in the 2014 budget come in the form of property tax rebates and a three-year phase out of the utility tax surcharge, the most notable tax cut involves the Empire State’s corporate income tax.

For the first time since 1917, manufacturers will no longer be responsible for paying corporate income tax in the state of New York. Prior to the passage of the 2014-2015 state budget, manufacturers owed 5.9 percent of their earnings to the state. In addition to eliminating the corporate income tax for manufacturers, non-manufacturing corporations will see their rates decrease from 7.1 percent to 6.5 percent – the lowest it has been since 1968. What the passage of the budget has effectively done is take Governor Andrew Cuomo’s Start-Up NY initiative, which would create select tax-free zones, and apply it throughout all of New York. Thus, this provides all businesses with the same opportunity that initially was going to be awarded to areas hand-picked by the governor.

The American: When Setting Tax Policy, Don’t Forget About Long-Run Growth

Last Friday, the House of Representatives took a sensible step to counteract the short-run focus that too often drives tax and budget policy decisions. The House voted 224-182 to pass H.R. 1874, the Pro-Growth Budgeting Act, which would require the Congressional Budget Office and the Joint Committee on Taxation to analyze the effects of major tax and budget bills on long-run economic growth.

Tax and budget policy can boost economic growth, particularly by cutting tax rates on labor and capital and reducing the deficit. Of course, the promotion of long-run growth can conflict with other goals, such as preserving tax progressivity and the safety net or providing short-run Keynesian demand stimulus. Resolving these tradeoffs sometimes requires hard choices.

Today, however, the deck is stacked against growth-oriented policy. Official budget estimates cover only a ten-year period and exclude any effects of tax and spending changes on the size of the overall economy. Although CBO and JCT have provided supplemental estimates of how a few tax and budget proposals affect the overall economy, even those estimates have been limited to a ten-year period.

Tax Foundation: What Could You Accomplish in the 111 Days It Takes to Reach Tax Freedom Day?

American’s will spend 111 days working to pay off the combined $4.5 trillion federal, state, and local tax bill in 2014, according to the latest Tax Freedom Day report.

To offer some perspective on just how long 111 days really is, here are a few things you could accomplish in the time it takes the nation to reach Tax Freedom Day on April 21.

The average required qualifying time for the guaranteed entrance to the New York City Marathon is about 4 hours. At that pace, if you ran non-stop, 24/7, you could completed 666 races for a total of 17,462 miles.

New York Post: The next ObamaCare disasters

On Friday the president used the long-awaited resignation of Health and Human Services Secretary Kathleen Sebelius to again claim victory for his namesake health law. “She got it fixed, got the job done,” Obama said. Right.

Sorry, there is plenty of more bad news ahead.

It’s not called SebeliusCare, and she wasn’t to blame for most of its problems. The horrors were mostly baked into the law, with some made worse by the president’s dishonest hard sell to get unsuspecting Americans to sign up.

Blue Sky: Fun Time Express lands $125,000 investment on ABC’s ‘Shark Tank’

Trackless train-ride provider Fun Time Express on Friday night became the second Chicago-based company this season to come away with six-figure funding from ABC’s”Shark Tank” television program.

Fun Time Express received a $125,000 investment from “Shark Tank” investors Lori Grenier and Kevin O’Leary, who will receive a combined 20 percent equity in the company.

The company follows Chicago-based Packback, which appeared on the show in late March and came away with a $250,000 investment from billionaire entrepreneur and investor Mark Cuban.

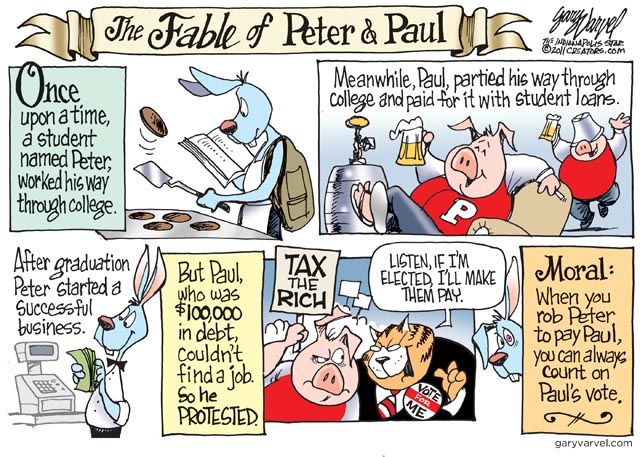

CARTOON OF THE DAY