QUOTE OF THE DAY

Chicago Tribune: Emanuel pension plan clears first hurdle in Springfield

Mayor Rahm Emanuel’s pension proposal cleared the first of several hurdles shortly after House Speaker Michael Madigan unveiled a measure today that sets a course for property tax hikes on homeowners and benefit cuts for City Hall workers.

The proposal could be on a fast-track through the General Assembly. The bill cleared a House committee today on a 6-4 vote, setting it up for consideration by the full House. Then it would need to get through the Illinois Senate, where Senate President John Cullerton, an Emanuel ally, has set a hearing on the pension measure.

The pension changes, opposed by several labor unions, emerged less than 48 hours after Emanuel outlined his proposal, which aims to shore up two city pension funds. The proposal, which is sure to be challenged in court, does not take up the underfunded systems for police, fire and Chicago Public Schools teachers.

Education Week: Illinois Governor’s Race Puts Unions in Tough Position

Powerful teachers’ unions in Illinois are faced with a vexing problem in this year’s gubernatorial race: a Democratic incumbent they’re unhappy with, and a Republican candidate they view as a threat to the rights of unionized public workers.

The race in Illinois has the potential to be a test case for the political consequences of taking high-profile steps aimed at curbing pension obligations, at a time when many states are anxious about the long-term fiscal health of their retirement-benefit systems. Estimates about the unfunded liabilities across states vary widely, but the total nationwide ranges into the hundreds of billions of dollars. And Illinois faces the most acute unfunded pension problems of any state.

In Illinois’ case, public-employee unions are disappointed with Democratic Gov. Pat Quinn’s record because he signed a high-profile bill into law last year designed to curb pension costs—the unions have decried the move and swiftly sued to overturn it. And they have a troubled history in Chicago with his running mate, former Chicago schools chief Paul Vallas.

Washington Post: High court voids overall contribution limits

The Supreme Court struck down limits Wednesday in federal law on the overall campaign contributions the biggest individual donors may make to candidates, political parties and political action committees.

The justices said in a 5-4 vote that Americans have a right to give the legal maximum to candidates for Congress and president, as well as to parties and PACs, without worrying that they will violate the law when they bump up against a limit on all contributions, set at $123,200 for 2013 and 2014. That includes a separate $48,600 cap on contributions to candidates.

But their decision does not undermine limits on individual contributions to candidates for president or Congress, now $2,600 an election.

Forbes: Let’s Call Time-Out On Unionizing College Football Players

Last week, a regional director of the National Labor Relations Board (NLRB) ruled that because members of Northwestern University’s football team seem close enough to “employees” of the university to satisfy the statutory definition, they can proceed in their stated desire for union representation.

The United Steelworkers union, hoping for a transfusion of dues money, helped the activist players, led by quarterback Kain Colter, push their petition for a union certification election. Conceivably, the union could wind up negotiating on behalf of the Northwestern players with the university over all matters that are subjects of collective bargaining under the law – compensation, hours, benefits, and working conditions.

This is unprecedented. Unions currently represent quite a few workers at universities, including faculty members, but not undergraduates who are on sports teams. Regional director Peter Ohr, who made the ruling, points out that the players receive compensation, even if it’s not taxable cash, in the form of scholarships and training; also, they are required to put in a lot of heavily supervised time relating to the team if they want to continue to play. That is enough, in his view, to bring them under the definition of employees, and therefore eligible to seek union representation under the National Labor Relations Act. (That’s the worst of our lousy labor laws, as I wrote about here.)

Chicago Tribune: Emanuel’s pension fix: Shrink benefits, raise taxes

Mayor Rahm Emanuel is proposing to raise property taxes and cut retirement benefits for some city workers to start digging out of a massive pension debt he inherited.

But the proposal the mayor and his top aides outlined late Monday would not address huge pension shortfalls for Chicago police, firefighters and teachers. Nor would it deal with the city’s most immediate, pressing financial problem: a state requirement to pay a whopping $600 million more toward police and fire pensions next year, a provision that could lead to a combination of tax increases, service cuts and borrowing.

Even as Emanuel vowed to put his pension proposal on paper in the coming days so it can be considered by state lawmakers, the changes face an uncertain future. Although Emanuel aides say the proposal comes out of talks with more than 30 city unions, not all of them are on board. A lawsuit is all but certain, especially after one group of unions issued a statement calling Emanuel’s concept “an unconstitutional approach that makes onerous cuts to the pension benefits of nearly 50,000 active and retired public servants.”

WSJ: The ObamaCare Copperheads

Suddenly ObamaCare is a roaring success, happy days are here again and liberals are euphoric, or claim to be. There are more than a few reasons to doubt this new fairy tale, not least the behavior of Senate Democrats running for re-election this year.

In the Rose Garden Tuesday, President Obama reported that 7.1 million people had signed up so far, confirming a Monday night White House news leak. “That doesn’t mean all our health-care problems have been solved forever,” he conceded with customary modesty. The government appears to have tapped heretofore-unknown reserves of bureaucratic efficiency by releasing numbers timed to this campaign-style pep rally.

Yet for months the Health and Human Services Department has refused to disclose crucial contextual data, such as how many insurance contracts are in force, the market-by-market totals and how many beneficiaries were previously covered. Regardless of your partisan sympathies, the White House’s selective disclosure is a crime against transparency and accountable government.

The Southern: Report: Madigan influenced Chicago transit hiring

A task force asked to scrutinize metropolitan Chicago’s transit agencies said it found evidence that House Speaker Michael Madigan directed Metra to hire and promote certain candidates, contributing to an environment in which corruption and mismanagement could flourish.

Madigan told reporters in Springfield on Tuesday that he had not had a chance to read the task force’s report since its release Monday and declined to give a detailed response. Separately, Madigan’s spokesman dismissed the report as “amateurish” and said the claims pertain to things that allegedly happened so long ago that Madigan couldn’t be expected to recall if any were true.

Gov. Pat Quinn created the panel in August to come up with recommendations for overhauling the Chicago-area transit system after the former CEO of Metra said he was forced from his job at the commuter rail agency for resisting political interference, including from Madigan. Among the panel’s 15 members were Illinois Transportation Secretary Ann Schneider and Patrick Fitzgerald, the former head of the U.S. attorney’s office in Chicago.

Washington Free Beacon: Employers Say Obamacare Will Cost Them $5,000 More Per Employee

Obamacare will cost large companies between $4,800 and $5,900 more per employee and add hundreds of millions to their overhead, according to a new survey.

The American Health Policy Institute conducted a confidential survey of 100 large employers—those with 10,000 or more employees—asking what costs they expect to incur from Obamacare over the next decade.

Factoring in the health care law’s added mandates, fees, and regulatory burdens, employers anticipate cost hikes between $163 million and $200 million in 2016, a 4.3 percent increase. By 2023, employers will be paying 8.4 percent more than “what they would otherwise be spending” for their employees’ health care.

WSJ: Using Twitter to Forecast New Applications for Unemployment

A surprising number of people filed initial claims for unemployment benefits last week, at least if you believe an index based off Twitter.

Economists at the University of Michigan have developed a technique that scans billions of tweets, looks for people tweeting about losing their jobs and then creates a prediction for the Labor Department’s weekly report on initial filings. Their prediction: 342,000 people filed new claims for jobless benefits last week.

Their algorithm analyzes the vast fire hose of Twitter and can pick out tweets like this: “2011 was interesting. I ended an engagement, got laid off, started a small biz, and it looks like I’ll be moving this year too. Whew!” (That’s an example the economists used in their paper, among those identified as “job loss” tweets.) Add all those up, figure out how tweets translate to jobless filings, and you have a formula for making a prediction.

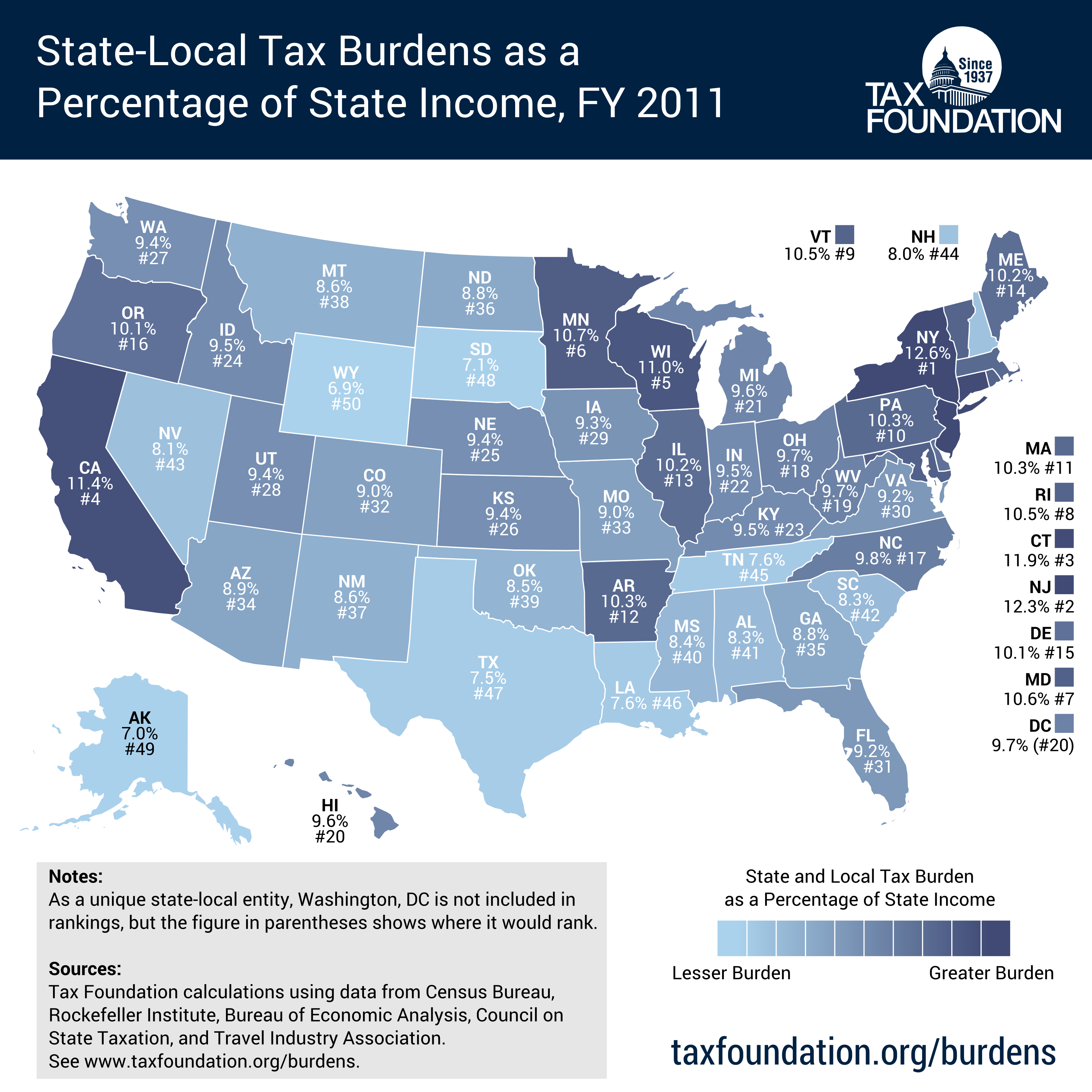

Tax Foundation: Release of Annual State-Local Tax Burdens Rankings

This morning, we released our Annual State-Local Tax Burdens Rankings which estimates the combined state and local tax burden shouldered by the residents of each state, regardless of the jurisdiction to which those taxes are paid. Using the most up-to-date data available, the report examines the state-local tax burdens in each of the 50 states in 2011.

New Yorkers had the highest burden, paying 12.6% of their collective income in state and local taxes. New Jersey (12.3%) and Connecticut (11.9%) came in 2nd and 3rd, respectively.

On the other end of the spectrum, Wyoming (6.9%), Alaska (7.0%), and South Dakota (7.1%) have the lowest burdens.

CARTOON OF THE DAY