QUOTE OF THE DAY

Most of the political class seems to have decided that ObamaCare is working well enough, the opposition is fading, and the subsidies and regulation are settling in as the latest wing of the entitlement state. This flight from reality can’t last forever, especially as the evidence continues to pile up that the law is harming the labor market.

On Thursday the Federal Reserve Bank of Philadelphia reported the results of a special business survey on the Affordable Care Act and its influence on employment, compensation and benefits. Liberals claim ObamaCare is of little consequence to jobs, but the Philly Fed went to the source and asked employers qualitative questions about how they are responding in practice.

The bank reports that 78.8% of businesses in the district have made no change to the number of workers they employ as the specific result of ObamaCare and 3% are hiring more. More troubling, 18.2% are cutting jobs and employees. Some 18% shifted the composition of their workforce to a higher proportion of part-time labor. And 88.2% of the roughly half of businesses that modified their health plans as a result of ObamaCare passed along the costs through increasing the employee contribution to premiums, an effective cut in wages.

Chicago Sun Times: 400 out of work as Hostess shutters Schiller Park plant again

Workers at Hostess Brands’ Schiller Park bakery were blindsided by news Wednesday that the company plans to close the plant where the iconic Twinkie snack cake was invented more than 84 years ago.

“When we heard the news, it was shocking to us as well as our membership there,” said Donald Woods, president of the Bakery, Confectionery, Tobacco workers and Grain Millers International Union Local 1. “They were working like 12 hours, six days a week, and they were looking for this plant to be a part of their future.”

Hostess said Wednesday it expects to close the plant in October “to enhance its production and distribution capabilities and efficiencies.”

Chicago Tribune: Illinois will receive $300 million in Bank of America settlement

Bank of America and the Justice Department have reached a record settlement of almost $17 billion to end a long-running probe into the marketing and sale of toxic mortgage securities by the bank and particularly its Countrywide Financial and Merrill Lynch units.

For Illinois, the $16.65 billion national settlement means $300 million, $200 million of which will be cash payment to the state’s pension system, making it whole for losses sustained as a result of the risky investments. The deal also includes $100 million in consumer relief for struggling Illinois homeowners, according to the Illinois Attorney General’s office.

Five other states — California, Delaware, Kentucky, Maryland and New York — also participated in the settlement.

Crain’s: Enough with the ‘millionaire tax’ scare tactics

This November at the polls, voters will have the opportunity to weigh in on a number of issues that have been rattling around inside the dome in Springfield, including a so-called “millionaire tax.” It’s important for voters to have the facts to help them make informed decisions on election day. Unfortunately, the author of a recent opinion piece (“Other states offer lessons on Quinn’s misguided ‘millionaire tax’ ”) provided little more than talking points to back up his opposition to the measure.

A “millionaire tax” asks those with higher incomes to pay a higher income tax rate than those with lower incomes, helping address the fact that middle-class and low-wage Illinoisans currently pay nearly three times their share of their income in state and local taxes than those making over a million dollars a year.

While certainly not a silver bullet to address the revenue woes Illinois faces, it would help the state better invest in things that provide a foundation for its economy, such as a modern and efficient transportation system and a well-educated and healthy workforce. A 2011 study in the National Tax Journal found that New Jersey’s increase to its tax rate for income over $500,000 “raises nearly $1 billion per year and tangibly reduces income inequality, with little cost in terms of tax flight.”

Chicago Tribune: Key red light camera player cooperating with feds

The alleged bagman in a $2 million bribery scandal over Chicago’s red light camera contract is cooperating with federal authorities and has testified in the ongoing grand jury investigation, the Tribune has learned.

Martin O’Malley, 73, the Chicago-based consultant for Redflex Traffic Systems Inc. since the contract began in 2003, has admitted that much of the $2 million he was paid by the company was used as payoffs to a top city manager who oversaw the traffic camera program from the beginning, according to sources familiar with the investigation.

Asked about O’Malley’s cooperation agreement in an interview this week, his attorney acknowledged that O’Malley has testified before the grand jury and admitted his role in the alleged decadelong conspiracy. O’Malley, who is charged with one count of conspiracy to commit bribery, is expected to eventually plead guilty in the case.

Chicago Sun Times: IDOT cuts jobs at center of Quinn hiring dispute

Gov. Pat Quinn’s administration, stung by a federal lawsuit alleging illegal hiring amid a tough re-election campaign, announced Thursday it will eliminate 58 transportation agency jobs at the center of the dispute.

Erica Borggren, acting secretary of the Illinois Department of Transportation, announced the move along with other actions she said were necessary to restore public trust in the sprawling agency. But a spokesman for Bruce Rauner, the Republican businessman trying to unseat Quinn in November’s election, criticized the moves and questioned Quinn’s portrayal of himself as a reformer.

Borggren — who took over in July after the previous director resigned amid charges of illegal patronage hiring — said that in addition to cutting “staff assistant” positions and abolishing the title, IDOT would create a board to oversee hiring and continue a freeze on hiring for positions that can be filled by a favored candidate, regardless of merit. The agency said that the 58 people who hold the jobs currently at IDOT will be laid off.

Journal Standard: “Tax fighting” organization shines spotlight on Stephenson County pension payouts

A retired local teacher stands to collect $4.2 million over the course of his lifetime pension payout, according to Chicago-based organization Taxpayers United of America.

The group held a press conference Wednesday at the Freeport Hampton Inn at which it released documents naming scores of retired public employees in Stephenson County receiving what the group calls “gold-plated government pensions.”

The documents highlight one 2003 retiree from Freeport School District 145 who is receiving more than $130,000 in annual pension, increasing by 3 percent compounded interest per year. The organization said that retiree already received more than $1.1 million from the fund and stands to get $3 million more by the time he turns 85. The group said he contributed less than $120,000 to his pension and retired at age 56.

Sneed: Karen Lewis’ union members can’t keep facts straight

The desk set . . .

Attention! Chicago Teachers Union President Karen Lewis, a former chemistry teacher, needs an eraser.

Last week, Lewis, who is eyeing a mayoral bid, told the Chicago Sun-Times she would make no “rookie mistakes” about campaign finance law.

It seems the same can’t be said of her facts.

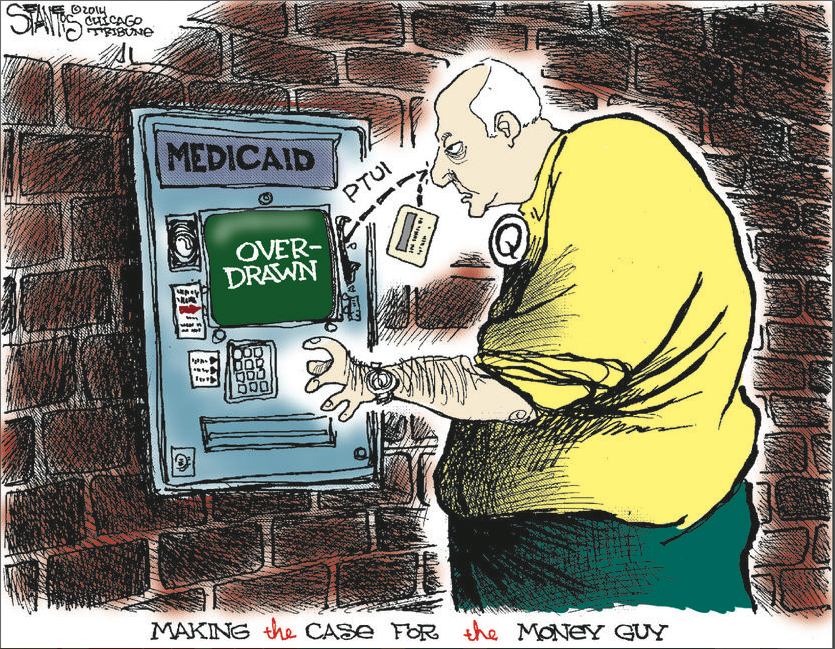

CARTOON OF THE DAY