QUOTE OF THE DAY

Crain’s: Get ready for some pain: New property tax bills are out

Second-half property tax bills showing up soon in your mailbox will rise on average only 1 to 2 percent from last year but, given declining home values, the real hit will be a lot bigger, figures released today by Cook County Clerk David Orr indicate.

In disclosing new tax data, Mr. Orr said the gross levy countywide will be up just 1.02 percent, to $12.1 billion, with a 1.3 percent hike in Chicago and increases just above and below that amount in suburban Cook County. That doesn’t sound too bad.

The report covers not only the city and other municipalities, but also school districts and other agencies that levy property taxes.

Catalyst Chicago: State limits junk food sales for school fundraising

Starting next year, high schools across the state must sharply limit the sale of unhealthy snacks – such as candy bars and chips – during in-school fundraisers.

The Illinois State Board of Education (ISBE) approved new, phased-in limits on so-called “exempted fundraisers” during its meeting Wednesday. In the first year, high school fundraisers can sell unhealthy foods during school hours once per week. The frequency will drop to twice a month in the second year, and once a month in the third year and beyond.

The rules – which were approved on an emergency basis pending a public comment period – respond to new strict federal nutritional guidelines on all foods and beverages sold in schools.

Real Clear Markets: The Massive Tax Increase Hidden Inside Obamacare

With this week’s federal announcement that millions of middle- and low-income people are getting a surprisingly large number of taxpayer dollars attached to their participation in the Obamacare health plans, can we begin to take seriously the idea that the fiscal policies and regulations hidden in the Affordable Care Act are shrinking our economy?

Real GDP fell last quarter, but the conventional wisdom says that cold weather gets all of the blame. If we add the self-employed to payroll employment, we would see that nationwide employment fell last month for the first time in more than a year, but we are collectively ignoring that as a statistical aberration too.

At first glance it might appear that the Affordable Care Act helps people get access to health care and disproportionately benefits low-income households without many new taxes. By one estimate, the ACA’s tax increases are less than 0.5 percent of gross domestic product, and less than several other hardly memorable tax increases of the postwar period. The White House suggested that health reform would largely pay for itself, without mentioning taxes that, individually or in combination, would have more than a “little effect” on the labor market.

WUIS: Lawmakers Work To Replace Illinois’ Eavesdropping Law

The Supreme Court found the old law overly broad. It was a crime even to record in public, where people shouldn’t really have an expectation of privacy. Because of that, Illinois’ law was considered one of the strictest in the nation.

Ed Yohnka, with the Illinois Chapter of the American Civil Liberties Union, says he wishes the court hadn’t struck down the entire law, but sees this as an opportunity for a clean slate. Yohnka says the ACLU wants…

“The continuation of all-party consent, which people in Illinois have really grown accustomed to, but also a bill that would recognize the evolving and changing dynamics of modern technology,” he said.

St. Louis Post Dispatch: Need full accounting in Illinois of spending to promote health care law

Carla K. Johnson’s excellent investigation, “Illinois’ health care campaign among nation’s costliest” (June 12), revealed that “more than 90 people, including executives from the firm and its subcontractors, billed at least $270 an hour for salary and overhead during the first four months” as part of a $33 million federal grant to Illinois to promote the Affordable Care Act. Johnson correctly pointed out that not only do these hourly wage rates for public relations professionals seem excessive, but Illinois also spent more on TV marketing and promotion than any other large state.

But that is just a dent in the total federal grants that Illinois has received to implement and promote the president’s health insurance scheme. According to federal records, the U.S. Department of Health and Human Services awarded the state of Illinois $155 million in total grants (including the one that was the focus of the AP investigation) to implement and market the ACA. While this money was spent in a number of areas, this total is the equivalent of almost $700 per person who selected a health insurance plan (but didn’t necessarily purchase one).

Even though there has not been a full accounting of how, where and by whom these funds were spent, HHS is already doling out tens of millions more dollars to states to promote enrollment in 2015. Taxpayers deserve to know if the state bureaucrats are spending these scarce resources wisely. Before Illinois bureaucrats accept another dime of federal taxpayer dollars, there should be a full accounting of these funds. Without oversight and transparency, the opportunities for further shenanigans seem endless.

A taxicab is a car remade by government, modified dozens of ways by edicts within subsections of articles of the city’s taxi code.

“Everywhere on this car has been regulated,” John Henry Assabil says. “Look at it!”

He throws up his arms in the direction of his gold-colored 2012 Ford Transit Connect. The car’s medallion number — 813 — is painted in black plain gothic figures (must be black plain gothic figures) on the driver’s-side hood, on both passenger doors and, for good measure, on the rear. Inside, there is a camera mounted over the rear-view mirror, a dispatch radio bolted to the console, a credit-card reader snapped to the passenger headrest.

Chicago Tribune: New sensors will scoop up ‘big data’ on Chicago

The curled metal fixtures set to go up on a handful of Michigan Avenue light poles later this summer may look like delicate pieces of sculpture, but researchers say they’ll provide a big step forward in the way Chicago understands itself by observing the city’s people and surroundings.

The smooth, perforated sheaths of metal are decorative, but their job is to protect and conceal a system of data-collection sensors that will measure air quality, light intensity, sound volume, heat, precipitation, and wind. The sensors will also count people by observing cell phone traffic.

Some experts caution that efforts like the one launching here to collect data from people and their surroundings pose concerns of a Big Brother intrusion into personal privacy.

Public Sector Inc: Pension Calculator

A defined benefit pension guarantees workers a fixed payment throughout their years of retirement. Though increasingly rare in the private sector, it remains the standard form of retirement benefit provided by state and local governments. Pensions are now one of the most hotly-debated topics in public finance, due to their rising costs and generosity relative to what most taxpayers receive.

The pension calculator tool below is intended to inform the pension debate, by allowing users to easily compare benefit levels across all 50 states. Simply click on a state highlighted in blue in the map below to estimate the pension that you would collect after a career in government. The calculator will also provide an estimate of the total annuity cost, or how much you would need to save to replicate that guaranteed income stream in retirement. To compare generosity of benefits between states, click on the “Compare States” tab.

Crain’s: The numbers behind a Bronzeville Obama library

I got a lot of reaction to my post yesterday that the best site for the Barack Obama presidential library might be in historic Bronzeville, specifically either on land that once housed Michael Reese Hospital or adjoining property just south of McCormick Place that’s now used as a truck parking lot.

A surprising number of those I spoke with and heard from say the site is ideal: central, primed for development and of longtime importance to the city’s African-Americans. But what about the cost?

Both of those issues were dealt with in some detail about a year ago, when the city hired a group headed by architecture firm Skidmore Owings & Merrill LLP to do a detailed study of what to do with the Reese property, which the city bought in expectation of using it to house athletes in the 2016 Olympics.

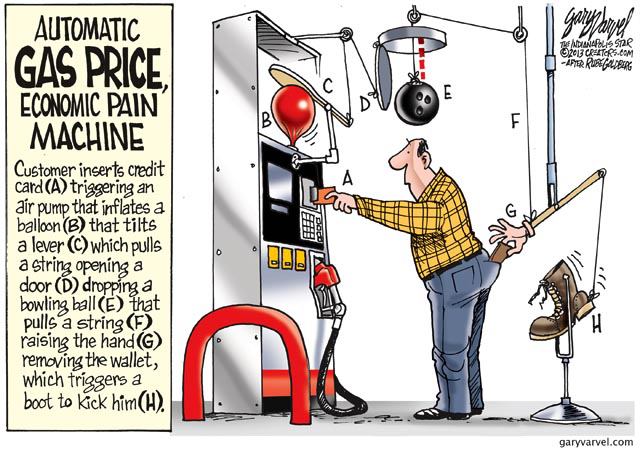

CARTOON OF THE DAY