QUOTE OF THE DAY

The Atlantic: The Last Refrigerator

Ten years ago on this day in September, the last Maytag refrigerator moved down the assembly line in Galesburg, Illinois, a quiet little city of 32,000 on the western edge of the Rust Belt. Workers signed the white appliance with a black Sharpie as it passed, said their goodbyes, and left to start new lives.

In that same spot, a century earlier, a few dozen men hammered out steel plowing discs in a little brick workshop for nearby prairie farmers. A sprawling patchwork of buildings swallowed the old workshop in the postwar years and, by the early 1970s, the factory buzzed with the work activity of nearly 5,000 people. Called “Appliance City” by some, it supplied millions of appliances each year to America’s kitchens. Today, a decade after the shuttering, the autographed refrigerator sits in the Galesburg Antiques Mall. The former Appliance City site—the size of over 40 football fields packed together—is now mostly rubble and weeds.

Chicago Sun Times: Lawyers allege state Sen. Donne Trotter took $2,000 in FBI sting

State Sen. Donne Trotter took $2,000 in cash from a convicted felon who got the money from an undercover FBI agent posing as an Indian businessman, lawyers for a South Side man allege.

And C. Gregory Turner’s attorneys hinted that other Chicago politicians also were approached as part of a federal sting in 2009.

Turner is due to stand trial later this month for illegally lobbying on behalf of Zimbabwean president and international pariah Robert Mugabe.

Bloomberg: Ohio, Illinois Sticking With Hedge Funds as Calpers Flees

As the largest U.S. retirement plan prepares to dump hedge funds for good, its peers aren’t rushing to follow.

Pension funds including those in New Mexico, Ohio and Illinois said they don’t plan to exit the asset class after the $298 billion California Public Employees’ Retirement said this week it will pull its entire $4 billion in hedge-fund investments. New Jersey’s $77 billion state pension fund in June said it had added $1.1 billion to hedge funds since the start of its 2014 fiscal year, to protect against risk after a six-year bull market in stocks.

“There are a lot of endowments and some public funds that have done it successfully for years, and they have done it with better economic outcomes than Calpers,” said Orin Kramer, the former chairman of New Jersey’s investment council, who was a proponent of investing in hedge funds. “I don’t think the funds that have been able to devote resources to hedge funds and have been doing it well will stop.”

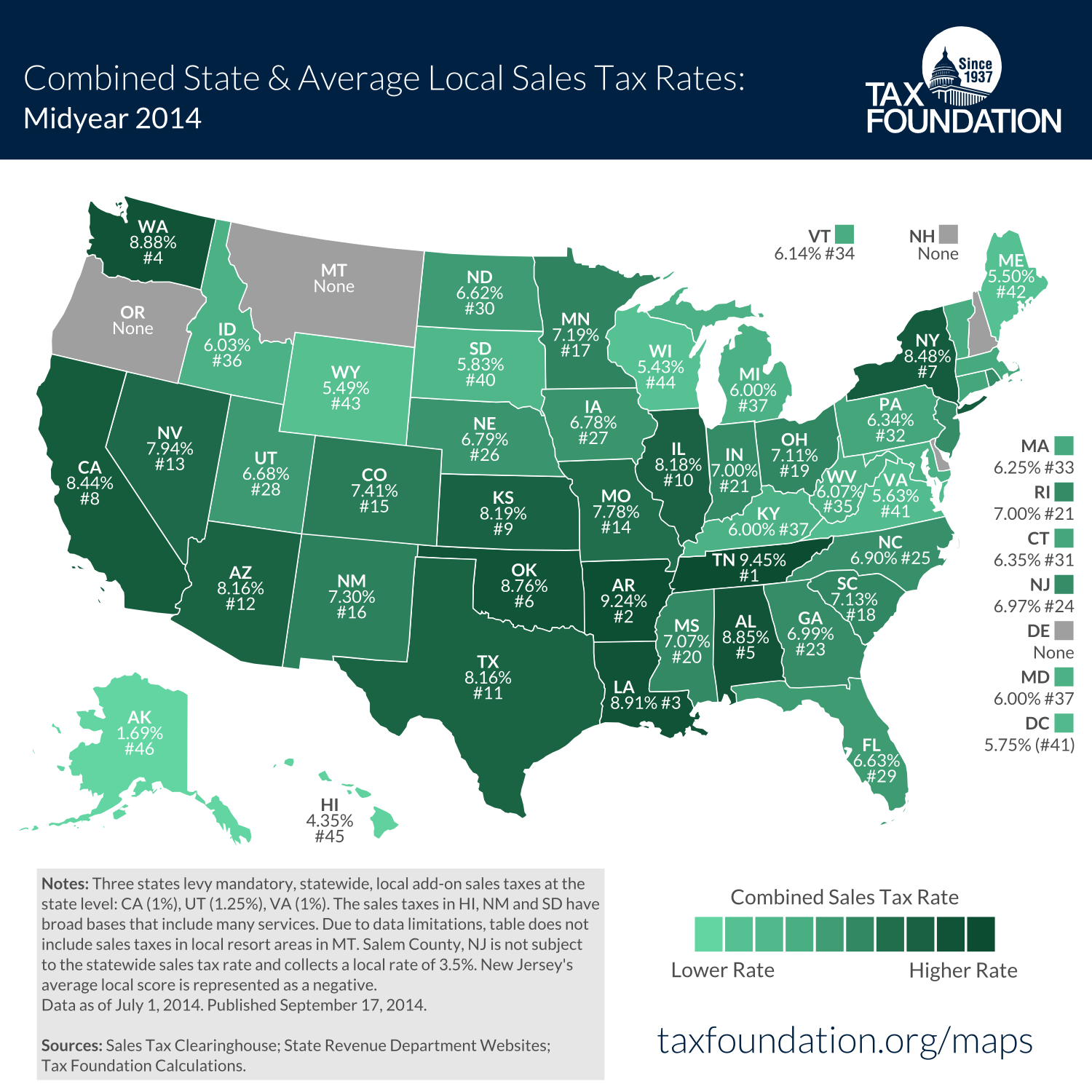

Tax Foundation: How High Are Sales Taxes in Your State

This week’s map shows the state sales tax rate, plus the average local rate, for each state as of July 1, 2014. This data comes from a bi-annual sales tax report we released yesterday which details each state’s statewide sales tax rate, along with its maximum and average local sales tax rates.

Tennessee has the highest average combined rate at 9.45%, and is followed closely by Arkansas (9.24%) and Louisiana (8.91%). On the other end of the spectrum are states with no sales taxes: Delaware, Montana, New Hampshire, and Oregon.

Wall Street Journal: Wages Grew in Most Large U.S. Counties. Did They Grow in Yours?

Average weekly wages went up in most large counties during the first quarter of 2014, reflecting a broader national increase, the Labor Department reported today.

Among the 339 largest counties, 323 experienced wage increases from the first quarter of 2013 to the same period this year, according to the the Quarterly Census of Employment and Wages. All 10 of the nation’s largest counties also had wage increases, including New York, N.Y., where the financial services industry had the largest impact on its 12% wage increase.

Nationally, the weekly average wage was up 3.8% during the period, to about $1,027.

Chester County, Pa., a Philadelphia suburb, saw the highest increase — 13.9% — boosted by a nearly 50% leap in trade, transportation and utilities wages. Benton, Ark., experienced the largest decrease in wages: 3.2%. The department reported that a decrease in professional and business services contributed to the decline.

Chicago Tribune: Suburbs squeeze medical pot firms for cash donations

Those who want in on Illinois’ fledgling medical marijuana industry are wooing local communities to let them operate within their borders — in some cases promising donations to local organizations or a cut of the profits.

Monday is the deadline for businesses to apply for state licenses, and among the many provisions for potential operators is that they have local approval for a place to grow or sell medical cannabis and can point to “community benefits.”

Competition for approved sites has gotten so intense that some municipalities are requiring that businesses pay them a cut of their revenues if they want local support.

Bloomberg: Obamacare Enrollees Are Paying Premiums. We Think.

We know that 8 million people have enrolled in Obamacare. But how many of them have actually paid their premiums? The Barack Obama administration has been curiously silent on this point. By now, it must have the data, but for some reason, it chose not to issue it.

Until now. Apparently, Marilyn Tavenner, the head of the Centers for Medicare & Medicaid Services, just told Congress that 7.3 million people have paid premiums and are currently enrolled in exchange policies. What does that mean?

It’s a little hard to tell, because according to Jason Millman of the Washington Post, she also says that this is a “snapshot” of Aug. 15, not a cumulative figure. Why does that matter? Because there’s a 90-day grace period between missing a premium payment and getting dropped from your insurance. The administration says that this figure only includes people who have “paid their premiums.” But what does that mean? That they paid a premium at least once? Or that they are current on their premium payments?

Politico: CMS glitch could cost doctors millions

Physicians who just spent hundreds of millions of dollars to install new electronic health record systems will face millions in federal penalties due to a technical glitch that affects their compliance with a federal program, vendors and doctors say.

“It’s beyond understanding why we’d be penalized after making such an investment,” said Dr. Jonathan Lowry, an eye specialist and surgeon at Morganton Eye Physicians in western North Carolina. “This was not our fault.”

The Catch-22 stems from the shifting rules that the Centers for Medicare and Medicaid Services (CMS) has established in a $30 billion program intended to incentivize physicians and hospitals to switch from paper to electronic health records. Since the program started in 2011 most providers who have Medicare or Medicaid patients have installed the electronic systems. But starting next year they can be penalized if they don’t.

Real Time Economics: Wages Grew in Most Large U.S. Counties

Average weekly wages went up in most large counties during the first quarter of 2014, reflecting a broader national increase, the Labor Department reported today.

Among the 339 largest counties, 323 experienced wage increases from the first quarter of 2013 to the same period this year, according to the the Quarterly Census of Employment and Wages. All 10 of the nation’s largest counties also had wage increases, including New York, N.Y., where the financial services industry had the largest impact on its 12% wage increase.

Nationally, the weekly average wage was up 3.8% during the period, to about $1,027.

Huffington Post: Arbitrary Interior Design Regulations Hurt Entrepreneurs, Consumers

Homeowners hire interior designers to beautify their living space. It’s an industry focused on style, design and aesthetics.

So, given the innocuous nature of the profession, it seems absurd that 26 states, plus the District of Columbia and Puerto Rico, require prospective interior designers to spend two or more years meeting the education and experience requirements necessary to receive a government-issued license to work, according to information from the American Society of Interior Designers.

Despite the hefty requirements these states place upon would-be professionals, the median annual income for interior designers in 2012 was just $47,600. The median annual income for Americans with a bachelor’s degree was $49,570.

CARTOON OF THE DAY