QUOTE OF THE DAY

Chicago Tribune: Quinn’s class war is a distraction

All of us understand why Gov. Pat Quinn and his political brain trust want to change the subject — that is, why they urgently want to distract Illinois voters. We can even sympathize with Team Quinn. When your state is one of only two where unemployment rose last year, when its current jobless rate is America’s second-worst, when its creditworthiness is dead last nationwide, when its debts total some $200 billion, when you’re the guy who demanded the 67 percent income tax increase … well, if you don’t distract people with an alternative narrative, they’re sure to focus on their state’s downward mobility.

So you talk indignantly about nine homes as if you just discovered them — Who knew? As if your opponent, Bruce Rauner, hasn’t acknowledged that he’s a successful venture capitalist. As if dunk-tank politics will liberate you from the problems on your watch: I’ll win if I just get enough people who resent the rich to take out their frustrations on that guy, my opponent. Dunk him!

But when a politician talks about other politicians’ homes, he risks inviting voters to think about their homes — the ones they wish they could own, the ones their growing households can’t afford to expand, the ones with mortgages they can’t pay, the ones already in foreclosure. On that last front: Numbers from RealtyTrac, a real estate research firm, identify Illinois as having the nation’s third-highest foreclosure rate in 2013, better only than the rates of real estate basket cases Florida and Nevada. And that metric is moving in the wrong direction: In 2012, Illinois had the nation’s fifth-worst foreclosure rate.

Crain’s: Here’s real proof that downtown doesn’t need TIFs

At first glance, there’s nothing surprising about the surge in development on Michigan Avenue between Wacker Drive and Millennium Park.

After all, the stretch forms a nexus between downtown office towers, Mag Mile shopping and a glittering tourist attraction. And it’s got plenty of drab low-rise buildings ripe for redevelopment.

It seems only natural that developers would grab sites for high-end hotels and apartment buildings, while restaurants pop up to serve nearby office workers, residents and tourists strolling Michigan Avenue.

Reason: Rhode Island Wants Moms To Urge Their Kids To Get Health Coverage Via Dating, Hookup Apps

Are you a mother in Rhode Island and want your grown children to get health insurance? Luckily for you, the Rhode Island state government launched a Facebook ad campaign today warning 23-33 year-olds that if they don’t get health coverage through the Rhode Island exchange (HealthSourceRI) their moms could find them on OkCupid, Tinder, or Snapchat and urge them to get covered.

Really.

According to BuzzFeed the Rhode Island state government recently soft launched Nag Toolkit, a site that teaches mothers how to track down and stalk their kids on dating and hookup apps as well as social media apps to remind them to get health insurance.

Built in Chicago: Dismantling Geek Stigma: Chicago Startups Nurture Tech Talent

When it comes to Chicago’s technology and startup scene, the Windy City has often been called the next Silicon Valley, a breeding ground for innovation and entrepreneurship where new businesses thrive and the “next big things” take shape. Companies like Groupon, Orbitz, Grubhub, and Ifbyphone have taken the technology scene by storm, moving into cool, creative spaces, setting up shop, and making waves.

But it’s not all fun and game-changing: Technology companies — especially startups — face a unique set of challenges, and organizations like the Illinois Technology Association (ITA) frequently host events to discuss them. Last week’s forum, for example, focused on the challenge tech startups and small businesses face in finding and retaining interested, qualified talent, especially in the context of an educational landscape that is known to be suffering in the skill areas that tech companies value: science, technology, engineering, and math (STEM).

Measures like the Common Core standards, which have been accused of having a one-size-fits-all approach to STEM education, address the skill gaps that are evident in the ability level of college students across the country. Jonathan Williams, director of state government affairs for Intel Corp, observed that the tuition dollars being spent on remedial courses in college (to fill the gaps left unfilled by ineffective STEM education in K-12) means more than coming late to the table with STEM skills, but have greater effects on the workforce (and economy) later: Students who need to complete these remedial courses in college are less likely to graduate, and therefore less likely to possess the skills required to obtain a well-paying job and thus pay back their student loans. Despite its criticisms, the Common Core is argued to be of some value if it means enabling K-12 students to achieve competency — and even excellence — pre-college; in turn ensuring that their college career will then be spent honing the skills necessary not just to improve their minds but to improve their job visibility post-college. Gaps in education are not merely that: they later translate as gaps in hiring, and more and more companies remark on the difficulty in finding quality candidates in the technology field.

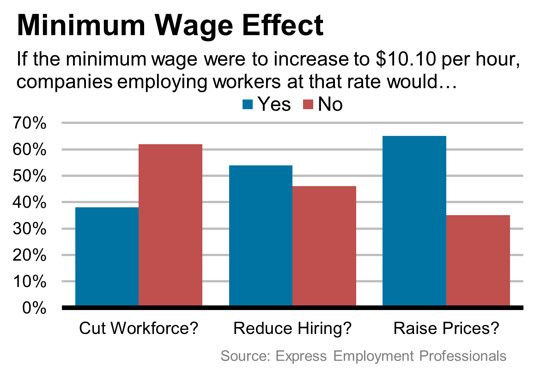

Real Time Economics: Minimum-Wage Increase Could Slow Future Hiring, Employment Survey Shows

Just over half of U.S. businesses that pay the minimum wage would hire fewer workers if the federal standard is raised to $10.10 per hour, according to a survey by a large staffing firm to be released Wednesday. But the same poll found a majority of those companies would not cut their current workforce.

About two-thirds of employers paying the minimum wage said they would raise prices for goods or services in response to an increase, the survey by Express Employment Professionals found. About 54% of minimum-wage employers would reduce hiring if the federally mandated rate increased by $2.85 per hour. A smaller share—38% — said they would lay off employees if the wage increase favored by President Barack Obamabecomes law.

The poll, designed to gauge businesses’ reaction to the wage increase, marks the latest effort by businesses and groups on both sides of the issue to shape a heated debate about whether increasing pay for workers at the bottom will help or hurt the U.S. economy.

Chicago Tribune: 2nd strike looms, UIC says it can’t meet union’s demands

As faculty at the University of Illinois at Chicago consider another strike later this semester, school officials said they are unable to meet the faculty’s demands because of uncertainty in state funding.

UIC Provost Lon Kaufman said it would be irresponsible to commit to giving faculty a specific salary increase for the next two years at a time when the university is being told to prepare for a 12.5 percent cut in state funding. The faculty union has asked for a minimum 3 percent salary increase for each of the next two years, one of the remaining contentious issues between the two sides, according to the latest proposals.

“Planning in a time of volatility is very difficult, and a contract is a planning document,” Kaufman said at a meeting with the Tribune. “It makes it extremely difficult to make some of these decisions.”

QUESTION: You started out by saying 5 million people have enrolled. Is that the correct word, “enrolled,” since we still don’t know how many people have actually paid their premiums. Is it that 5 million signed up, will we get the information on who is actually enrolled and paid their premiums?

CARNEY: CMS is working to provide more detailed data on who had already paid their premiums, what percentage of the population of enrollees that includes. We can point you to major insurers who have placed that figure at 80 percent, give-or-take, depending on the insurer, but we don’t have specific data that is going to be in a reliable enough form to provide.

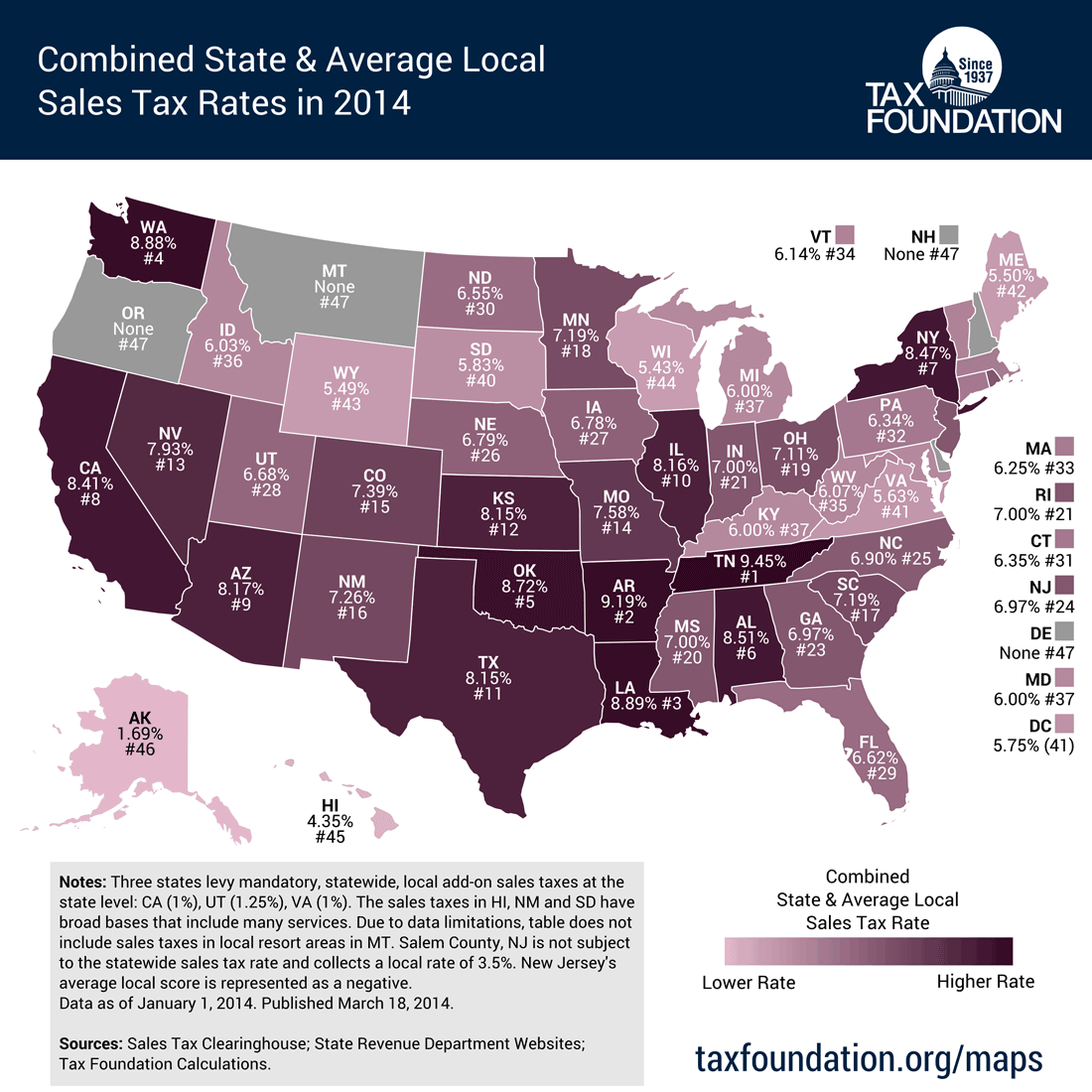

Tax Foundation: Combined State and Average Local Sales Tax Rates

This week’s map shows the state sales tax rate, plus the average local rate, for each state as of January 1, 2014. This data comes from a new sales tax report we released today which will include each state’s maximum and average local sales tax rates, as well as each state sales tax rate.

Tennessee has the highest average combined rate at 9.45%, and is followed closely by Arkansas (9.19%) and Louisiana (8.89%). On the other end of the spectrum are states with no sales taxes: Oregon, Delaware, and New Hampshire.

CARTOON OF THE DAY