Growing tax burden will push people out of Cook County and Chicago

City officials are pushing property-tax hikes, sales-tax hikes, and even a commuter tax and financial-transaction tax.

Cook County Board President Toni Preckwinkle’s wish for a $474 million sales-tax increase to help pay for the county’s growing pension debt has been granted.

The hike pushes the sales-tax rate back up to 10.25 percent in Chicago – the same as it was when Preckwinkle took office in 2010.

And that’s not the only new tax residents have to face. Preckwinkle is just the latest local leader to usher in a tax increase.

Chicago Mayor Rahm Emanuel created a new tax earlier this month that taxes Internet cloud services such as Netflix. The mayor has also warned that increased property taxes are on the way to bail out both the city and the Chicago Public Schools.

Chicago Teachers’ Union leader Karen Lewis wants a commuter tax and a financial transaction tax to keep funding the city’s inefficiencies.

Here’s the catch: Taxpayers with the means and flexibility to leave Cook County can avoid the ever-growing tax burden by simply picking up and moving, which is what many have done for 20 years.

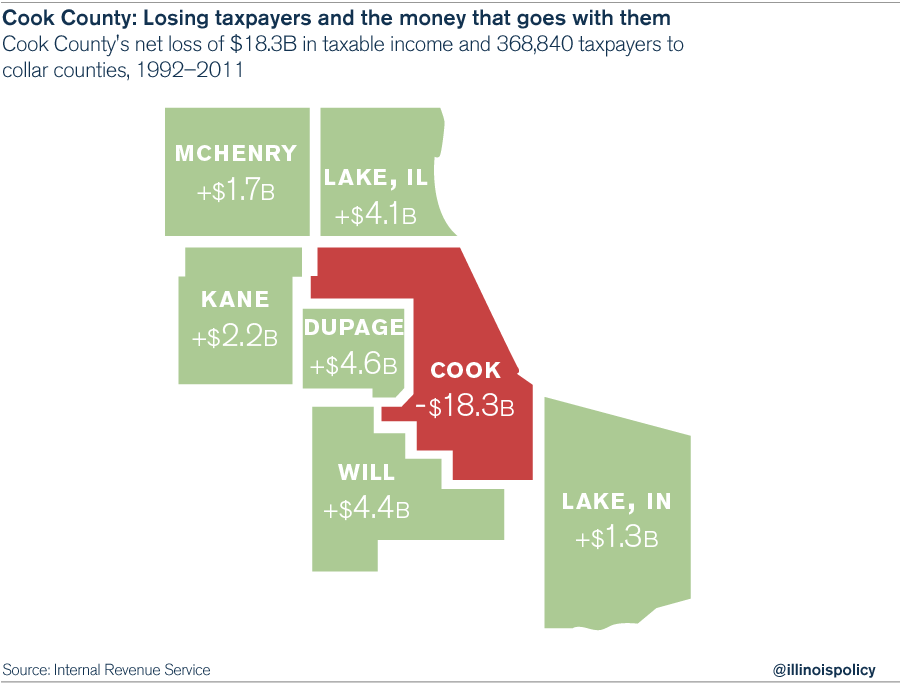

According to Internal Revenue Service data, from 1992 to 2011 Cook County suffered a net loss of 370,000 taxpayers to its collar counties and Lake County, Indiana. Those taxpayers took over $18.3 billion in taxable income with them when they left, creating an ever-growing hole in Cook County and Chicago’s budgets.

A review of the data shows the top six counties to which residents of Cook County have fled. It also reveals how much money those residents took with them:

- DuPage County won a net of 104,904 taxpayers who took more than $4.6 billion in taxable income with them.

- Will County won a net of 84,170 taxpayers who took $4.4 billion in taxable income with them.

- Lake County, Illinois, won a net of 67,906 taxpayers who took $4.1 billion in taxable income with them.

- Kane County won a net of 41,364 taxpayers who took $2.2 billion in taxable income with them.

- McHenry County won a net of 35,200 taxpayers who took $1.7 billion in taxable income with them.

- Lake County, Indiana, won a net of 35,296 taxpayers who took $1.3 billion in taxable income with them.

And within Cook County, Chicago households are the worst off.

Not only are Chicagoans on the hook for the sales-tax hike, but they’re also on the hook for a mountain of debt and several nearly bankrupt pension plans, including those of the city, its sister governments and Cook County.

Collectively, each Chicago household owes more than $62,000 in future taxes just to pay down those debts. And that doesn’t include the taxes they’ll face for future government services.

Chicago’s population is currently at 1920 levels. The city is bleeding taxpayers and it can’t afford to lose more.

The same holds true for Cook County.

Unfortunately, not everyone sees it that way.

Betty Boles, vice president of Service Employees International Union Local 73, said the sales tax hike would “make sure millions of county residents have the best possible roads and services.”

She’s right. The best roads – for people to drive right out of the county.