Illinois: $27 billion in tax increases since 2011

A new report by Americans for Tax Reform shows that Democratic governors have enacted more than $58 billion in tax increases since 2011. Republican governors, on the other hand, have collectively signed more than $36 billion in tax cuts. Maryland Gov. Martin O’Malley, one of the nation’s top five most tax-happy governors, has signed 29 tax increases...

A new report by Americans for Tax Reform shows that Democratic governors have enacted more than $58 billion in tax increases since 2011. Republican governors, on the other hand, have collectively signed more than $36 billion in tax cuts.

Maryland Gov. Martin O’Malley, one of the nation’s top five most tax-happy governors, has signed 29 tax increases into law for a total of $3.05 billion since 2011.

But one governor stands alone at the top of the tax increase peak, with the highest dollar amount in tax increase revenues.

Obvious candidates for this not-so-prestigious honor are the governors of California and New York, but the winner oversees a state mired in debt and suffering from a failed political status quo.

Illinois Gov. Pat Quinn has saddled Illinois with $27 billion of new taxes since 2011 by signing only five pieces of tax legislation. This accounts for roughly 47 percent of all state tax increases across the country.

Quinn’s dubious achievement is less surprising given what taxes were hiked: levies on corporate income, personal income and tobacco products, along with a 6.25 percent “Amazon” sales tax during his second year in office.

As we come to the halfway mark of 2014, Quinn – who has secured his party’s nomination for a second term in Springfield – is seeking to permanently extend temporarily hiked corporate and individual income tax rates, allegedly to fund education, reduce state debt and service Illinois’staggering pension liability.

As Dr. Arthur Laffer, father of supply-side economics and co-author of “Wealth of States,” once said, “No state has ever taxed its way into prosperity.”

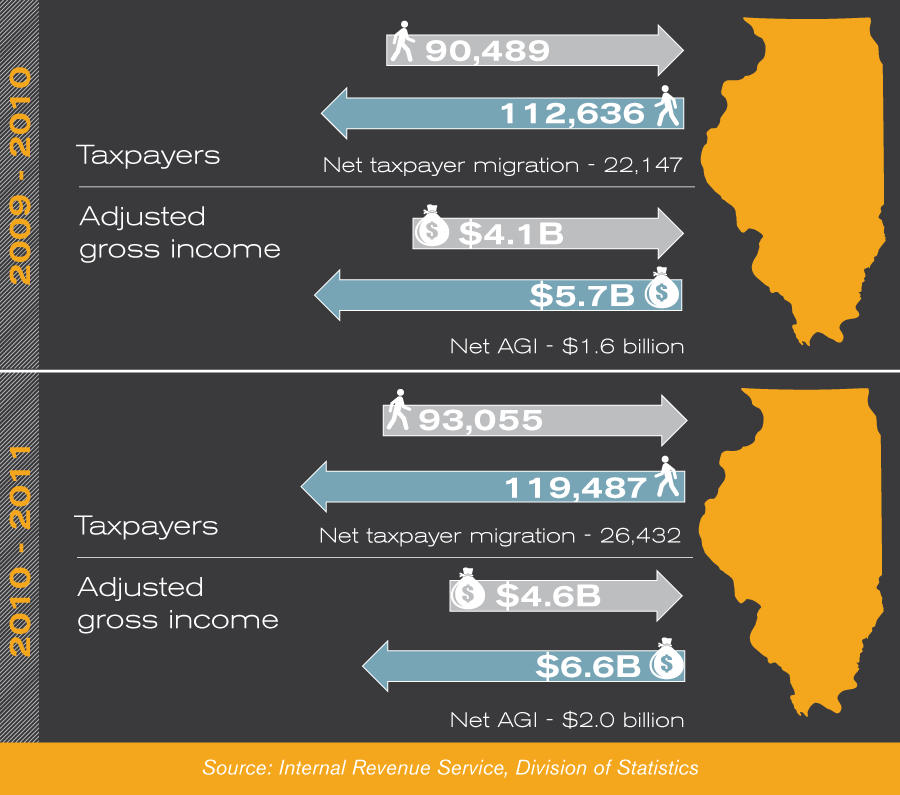

Unfortunately, Illinois politicians and lawmakers continue to ignore this lesson of economic history. Adjusted gross income, or AGI, and taxpayer migration data from the Internal Revenue Service, compiled by Travis H. Brown in his book “How Money Walks,” show that working wealth, jobs and businesses are fleeing the state, in part because of its high-tax policies.

From 1992-2011, the Land of Lincoln lost $31.3 billion in AGI – more than enough to purchase the Chicago Bulls six times. Illinois has seen the third-highest loss in working wealth, as more than half a million Form 1040 tax-filers have left for states with lower tax burdens, such as Florida, Texas and Arizona.

Now let’s examine IRS records to see how Illinois faired immediately after Quinn took office. The governor signed four tax bills during his first two years in office. Illinois experienced net AGI losses of $1.6 billion in 2009 and $2 billion in 2010. As noted in the chart below, working wealth and taxpayers have simply fled the state:

This exodus persists in our forecasts. From 2010-2014, we predict Illinois will lose $1.6 billion in AGI per year, though the losses could be as high as $1.7 billion or as low as $1.4 billion.

Rather than seeking to tax the state into prosperity, Quinn should take a page from the book of his neighbor to the north, Wisconsin Gov. Scott Walker, and cut taxes. Walker has reduced state taxes by $2 billion, unburdening Wisconsinites while accumulating a $912 million surplus, boosting the economy of the Badger State.

If Illinois is to emulate Wisconsin’s success, it must emulate its policies, such as reducing unfunded pension liabilities through negotiated restructuring. Assuming the current costs can be covered through tax hikes is grossly negligent on the part of Quinn. Second, Illinois must allow the temporary increases in corporate and individual income tax rates to expire, bringing them to 7.75 percent from 9.5 percent, and to 3.75 percent from 5 percent, respectively. This would signal to businesses, entrepreneurs and people looking for work that the state welcomes economic investment.

Not only would these reduced rates be lower than Wisconsin’s, but they would rank among the lowest three in the region, behind the economically surging states of Kansas and Indiana. An extension of the current tax rates would do the opposite. The rates are scheduled to fall already. Preventing them from doing so would be a misstep.

Unfortunately, Illinois’ current leader is forging ahead with fiscally irresponsible policies that will drive the state further into the red. The Illini who feel Quinn’s legislative model and wasteful spending aren’t working will have an opportunity to voice their displeasure at the ballot box this November.