Illinois businesses burdened by much more than taxes

A recent study of the business tax burden in the 50 states and District of Columbia ranks Illinois as 27th in the nation. Portrayed as being “not so bad” in the media sheds a lot of light on Illinois’ current economic position. But while Illinois ranks in the middle of the pack for business tax...

A recent study of the business tax burden in the 50 states and District of Columbia ranks Illinois as 27th in the nation. Portrayed as being “not so bad” in the media sheds a lot of light on Illinois’ current economic position.

But while Illinois ranks in the middle of the pack for business tax burden, this study does not show the true burden that businesses face in the state. That’s because it doesn’t take into account the litany of anti-business measures outside of taxes that have contributed to Illinois’ anemic economic recovery.

Neither the state’s costly and heavy-handed regulatory regime, nor the fourth-worst workers’ compensation system in the nation are measured by the study. But both are notoriously damaging to the state’s business climate.

Other examples, such as the waiting time of 32 days required to start a professional services business in Chicago, shouldn’t be overlooked.

These types of roadblocks have chilling effects on Illinois’ future job growth, and that’s because they hit entrepreneurs the hardest.

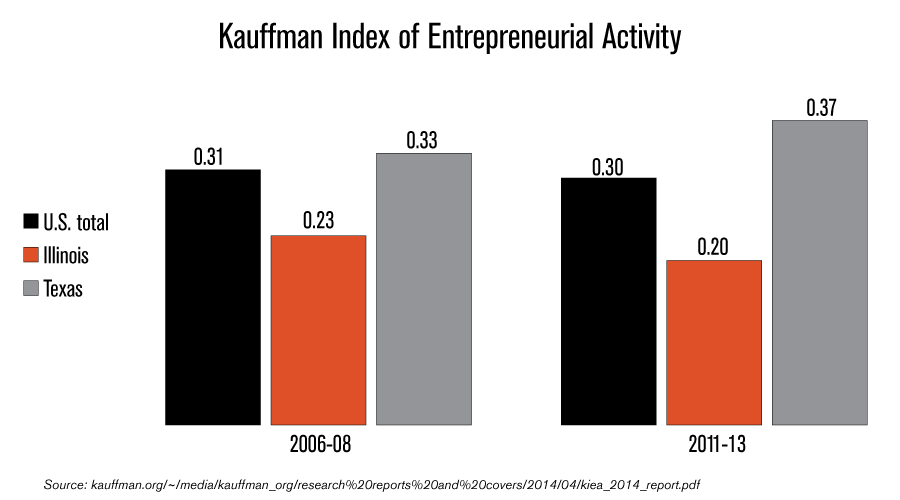

Data from the 2013 Kauffman Index of Entrepreneurial Activity reveal that Illinois has one of the lowest entrepreneurship rates in the nation. This index is one of the most important indicators of future job growth. It measures new business start-ups by examining the percentage of people ages 20-64 who do not own a business in the initial month of the survey, but who own one in the following month (only businesses where 15 or more hours are worked are included). Unfortunately, Illinois has slipped in both its overall score and its relative rating compared to the rest of the nation.

According to the index, entrepreneurial activity dipped slightly nationwide between the 2006-2008 and 2011-2013 time periods. During the 2006-2008 timeframe, Illinois’ entrepreneurial activity outpaced just six states, remaining well below the rest of the nation. During the 2011-2013 timeframe, Illinois’ activity outpaced only five other states. Illinois’ entrepreneurial activity was already well below the national average. The drop between these two time periods represents a 13 percent drop in activity from its already-low level. Meanwhile, Texas improved its rating to 0.37 during the 2011-2013 timeframe from 0.33 during the 2006-2008 timeframe.

Taking a look at the business tax burden is important, but that’s not a complete picture. Other factors, such as obstacles to starting a business and other burdens, such as workers’ compensation and regulatory costs, must be taken into account when assessing Illinois’ broken business climate and sluggish growth.