Illinois pension debt: It’s worse than you imagined

Last week, the Governmental Accounting Standards Board, or GASB, finalized new rules to make pension funding more transparent. These new rules require governments to use more appropriate discount rates than most public pension plans have been using. Pension plans with sufficient funds set aside to pay future benefits can continue to discount future liabilities by current investment...

Last week, the Governmental Accounting Standards Board, or GASB, finalized new rules to make pension funding more transparent. These new rules require governments to use more appropriate discount rates than most public pension plans have been using.

Pension plans with sufficient funds set aside to pay future benefits can continue to discount future liabilities by current investment targets. But plans without sufficient funds to pay those benefits will need to make substantial adjustments.

Under the new rules, public pension systems will need to calculate the date when the plans’ assets are expected to be exhausted. The benefits paid prior to that date will be discounted using the plan’s regular investment target. Most plans have that target set around 8 percent. The benefits paid after the exhaustion date, however, will be discounted using the current yield on high-grade municipal bonds, currently somewhere between 3 and 4 percent.

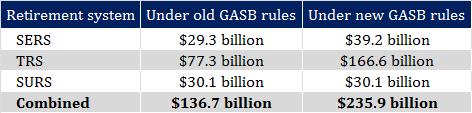

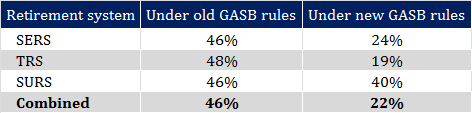

A new study by Center for Retirement Research at Boston College provides some insight on what these new rules could mean for states with low funding levels. The authors find that if these new rules had been in place in fiscal year 2010, the three largest state pension plans would have been just 22 percent funded, rather than the 46 percent that the state officially reported.

Pension plan funded ratios under old GASB rules and new GASB rules, fiscal year 2010

So, what does this all mean for the state’s pension liability? It means that the official reports are understating the pension liability by $100 billion, according to the new accounting rules.

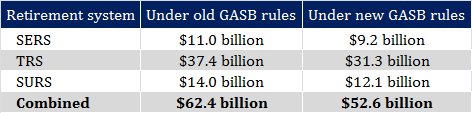

If that weren’t bad enough, the state is also overstating pension assets by “smoothing” the stock market losses over a five-year period, instead of recognizing the losses immediately. The new accounting rules will prohibit this kind of asset smoothing in the future. This let the state hide an extra $10 billion of unfunded liability in 2010.

Pension plan assets under old GASB rules and new GASB rules, fiscal year 2010

Altogether, the official reports hid $109 billion of state pension debt that the new accounting rules will require us to report. And those are just the state’s three largest plans. There are another 661 public pension plans in Illinois, which collectively report another $39.8 billion in pension debt.

Like the state’s largest three systems, however, many of these pension plans will need to revise their investment targets, meaning there are several billion dollars of pension debt currently hidden under the current accounting rules. The pension fund for Chicago teachers, for example, would have had an unfunded liability of $20 billion, nearly four times the $5.4 billion officially reported.

If that weren’t bad enough, we’ve previously reported that taxpayers are on the hook for far more than just pension debt. Using official figures, we found that state and local governments owed a combined $203 billion in retirement debt. That’s debt for pensions, for retiree health benefits and for repaying borrowed money used to keep the pension funds afloat. All in, that represented more than $41,000 in government retirement debt per household. The new GASB rules make clear that Illinois taxpayers are on the hook for hundreds of billions of dollars more than initially thought.

As we’ve warned, any solution focused exclusively on solving an $83 billion pension debt problem ignores the larger crisis at hand. The only way to rescue the finances of state and local governments is to dramatically reform the structure, incentives and accountability within government retirement systems. If lawmakers and local officials act swiftly, it is possible to maintain a fair and generous system of benefits for government retirees.

But the longer they wait, the more likely the government will fail to meet its obligations to retirees.