IL taxpayers overpaid for pensions by more than $16B under original Edgar ramp

What happens when financial gimmicks win out over real pension reform?

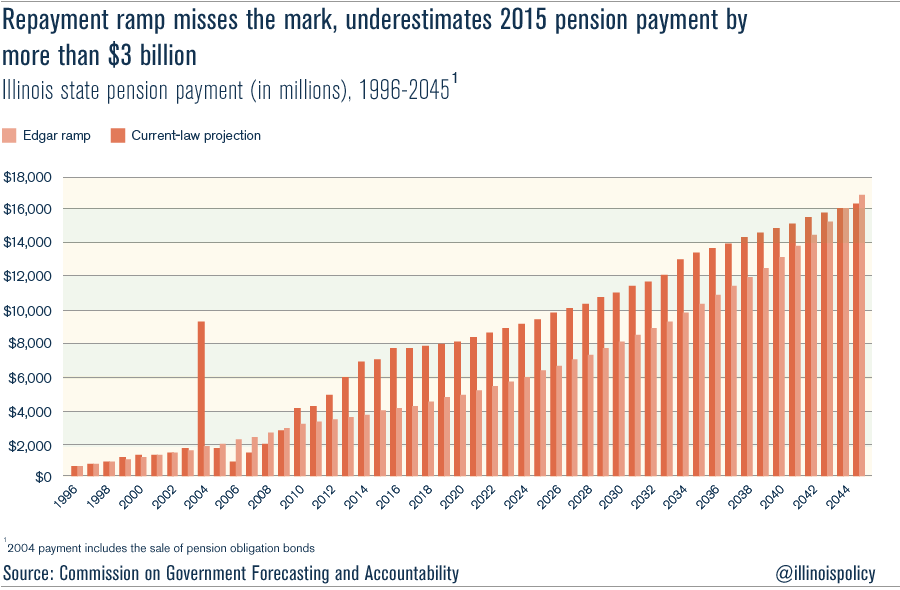

Illinois state officials predicted taxpayers would need to contribute $43 billion into the state’s pension systems between 1996 and 2015. But taxpayers actually contributed more than $59 billion to the pension system since then – $16 billion more than originally projected.

That’s because the state’s pension repayment plan completely missed the mark.

In 1994, then-Gov. Jim Edgar signed into law Public Act 88-0593 – commonly referred to as the “Edgar ramp” – which set up a 50-year payment schedule for the state’s pension liability. That plan outlined what the state needed to pay into the pension systems to bring the funding ratio to 90 percent by 2045.

According to the original estimates, Illinois’ pension payment for the current fiscal year was supposed to be $3.9 billion. But the state’s actual pension payment this year was $6.9 billion, $3 billion more than the Edgar ramp predicted.

The Securities and Exchange Commission’s 2013 indictment of Illinois for securities fraud revealed the structural failures of the state’s pension system and its irresponsible payment ramp. The SEC critiqued the state’s current pension ramp with the following statement:

“The statutory plan structurally underfunded the state’s pension obligations and backloaded the majority of pension contributions far into the future. This structure imposed significant stress on the pension systems and the state’s ability to meet its competing obligations – a condition that worsened over time.”

The Edgar ramp is the quintessential example of a failed pension reform in Illinois. And as long as the status quo defined-benefit pension system is maintained, the problem will get worse.