Illinois should repeal the death tax

Of all Illinois’ taxes, its death tax is the most morbid. Only 15 states in the U.S. levy a tax on death, and Illinois has the second-highest rate. Death taxes include estate and inheritance taxes. They hit certain Illinois families hard. Farmers, investors and business owners often need substantial assets to generate a moderate income....

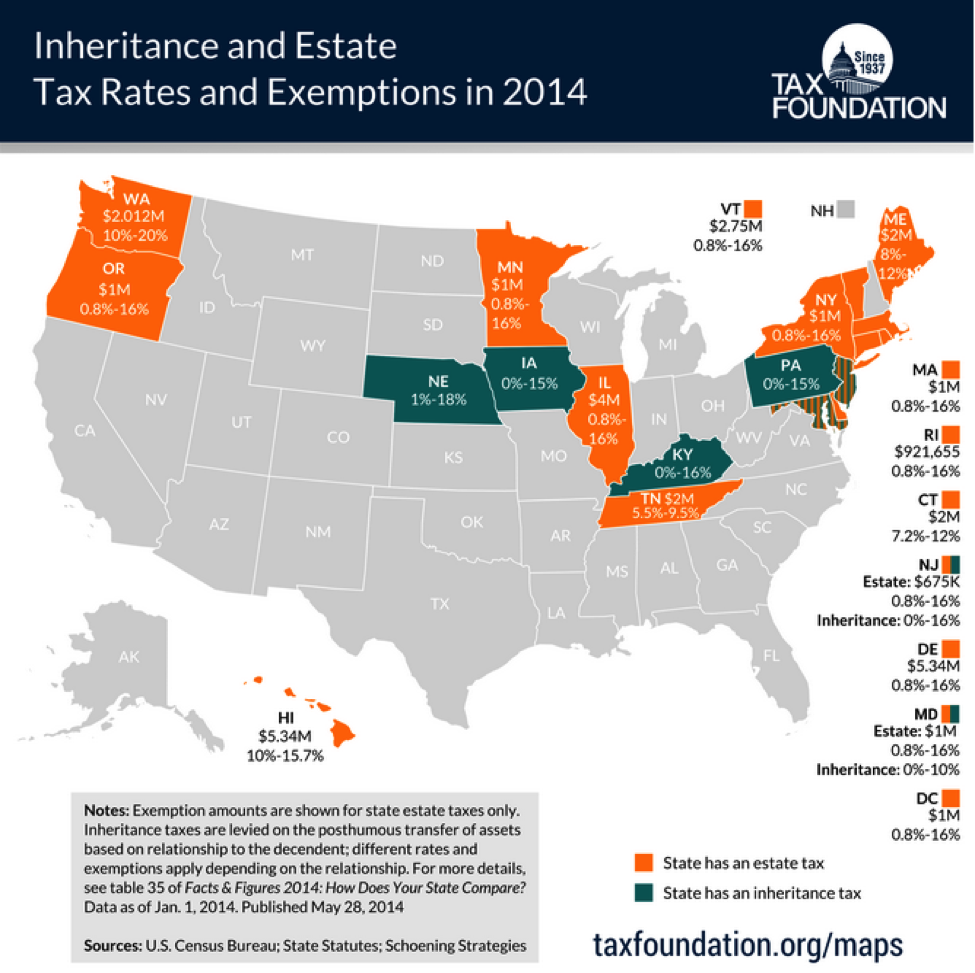

Of all Illinois’ taxes, its death tax is the most morbid. Only 15 states in the U.S. levy a tax on death, and Illinois has the second-highest rate.

Death taxes include estate and inheritance taxes. They hit certain Illinois families hard. Farmers, investors and business owners often need substantial assets to generate a moderate income.

Not only that. The death tax chases wealthy retirees out of the state.

Wisconsin and Missouri don’t have death taxes, and Indiana recently got rid of its death tax. More importantly, warm states such as Florida, Texas and Tennessee don’t tax death or income. This puts pressure on Illinois’ borders, as wealthy retirees have an incentive to leave.

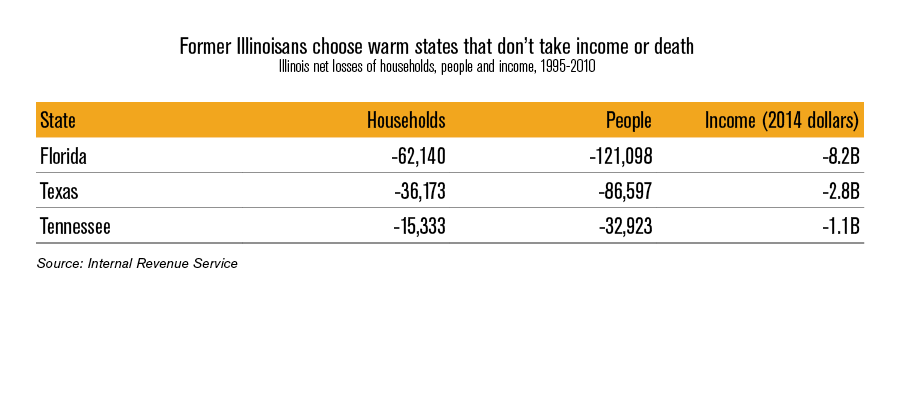

Illinois loses a tremendous number of people who retire to warmer states with no death taxes. Many of the same states, such as Florida, Texas and Tennessee, also lure younger Illinoisans with better job creation and no income taxation.

According to data from the Internal Revenue Service, from 1995-2010 Illinois sustained a net loss of nearly a quarter-million people and $12 billion in annual income to Florida, Texas and Tennessee alone.

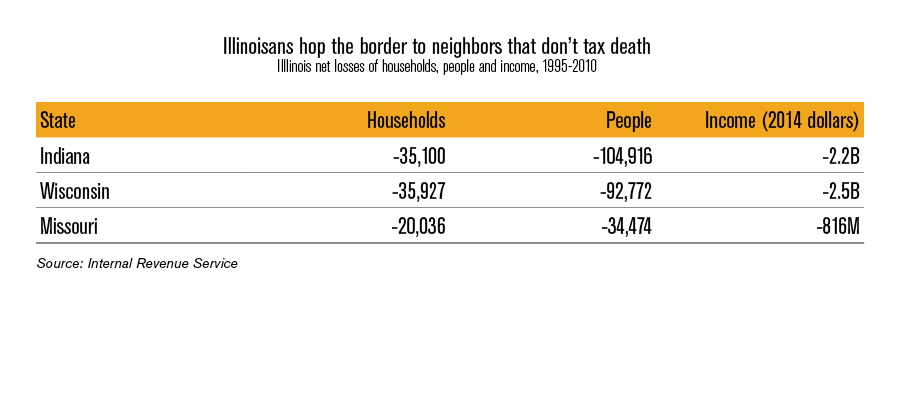

Illinois also loses people and income to its three border states that don’t have death taxes.

Illinois also loses people and income to its three border states that don’t have death taxes.

Illinois can’t change its climate. And it will require a significant shift in the General Assembly to make the economic reforms that will bring out-migration to a halt.

But the General Assembly should be able to correct obvious policy blunders. It’s time for Illinois to stop doubling down on failed policies. The Generally Assembly should repeal the death tax.