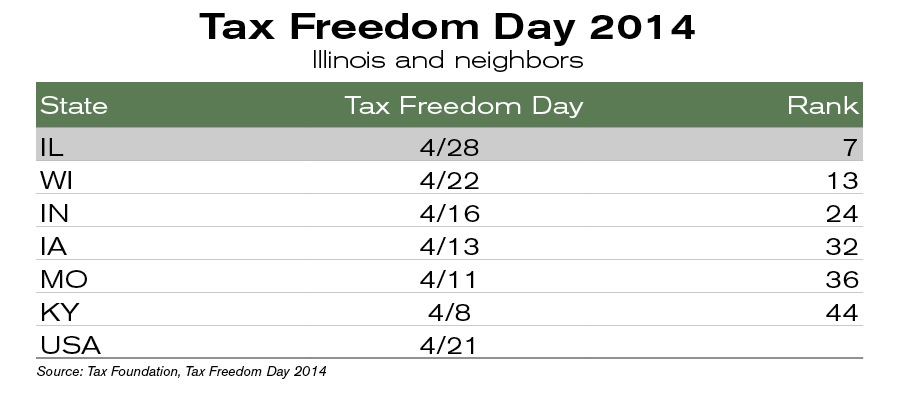

Illinois taxpayers worked 118 days into 2014 to pay for taxes

April 28 marks Illinois’ Tax Freedom Day. This day commemorates the point in 2014 when Illinoisans have worked enough to cover the rising cost of federal, state and local government. From now through the rest of 2014, Illinoisans finally will be able to keep the money they earn. Illinois’ high-tax environment pushed the state’s Tax...

April 28 marks Illinois’ Tax Freedom Day.

This day commemorates the point in 2014 when Illinoisans have worked enough to cover the rising cost of federal, state and local government. From now through the rest of 2014, Illinoisans finally will be able to keep the money they earn.

Illinois’ high-tax environment pushed the state’s Tax Freedom Day far past its neighbors and the nation. For example, Iowans have been working for themselves, not government, since April 13.

If Illinois mirrored the rest of the nation’s Tax Freedom Day, Illinoisans would have an additional week’s worth of income in their pockets.

Or better yet, if Illinois kept up with its neighbors, such as Missouri or Kentucky, Illinoisans would have two-and-a-half to nearly three weeks’ worth of extra income in their pockets.

But the nation’s seventh-latest Tax Freedom Day isn’t enough for some politicians in Illinois. Special-interest groups and politicians across the state are teaming up to increase taxes yet again in Illinois. Their goal is to swap out the state’s constitutionally protected flat-rate income tax for a progressive income tax increase.

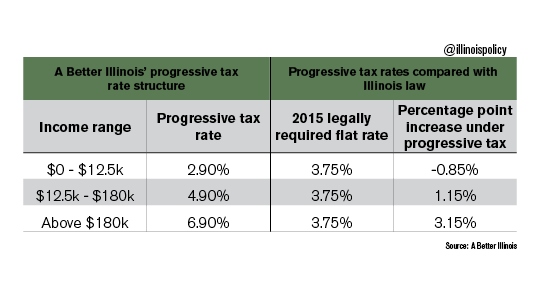

Under Illinois law, the individual income tax rate will be 3.75 percent in 2015. Under the progressive tax-hike plan introduced by state Sen. Don Harmon – and endorsed by A Better Illinois – a higher 4.9 percent would apply to income earned after $12,500.

Under Harmon’s proposal, anyone with a taxable income of more than $22,000 would see their overall state tax bill increase. That plan targets Illinois’ middle-class residents.

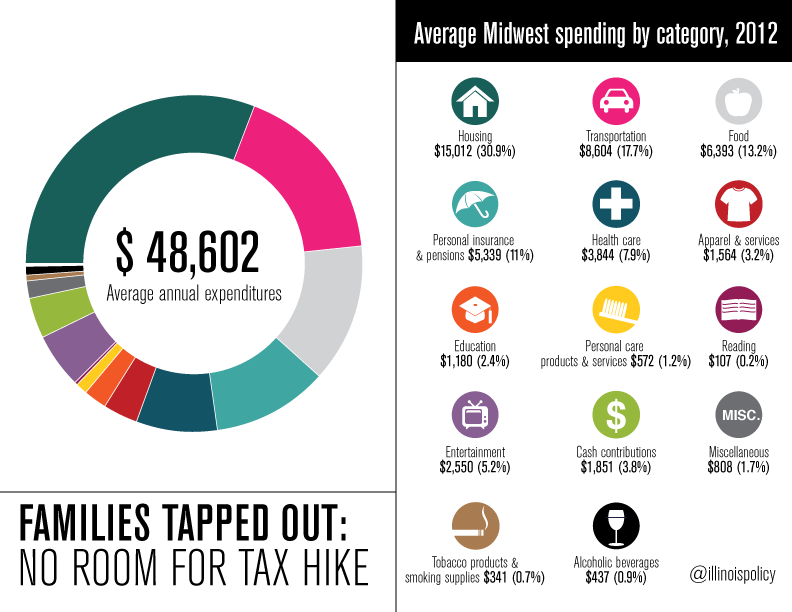

More income going to the growing price tag of government means less money left in the family budget. With the nation’s third-highest unemployment rate, Illinoisans are already struggling to make rent and pay for groceries, let alone have enough leftover at the end of the month to put away for retirement or afford to save for college.

The truth is there’s no room left in the family budget for another tax hike. Much of the family budget is already tied up in items that families need to stay afloat – such as mortgage payments, rent, car payments, groceries and health care.

The little money left over at the end of the month is spent on things like family movie nights, trips to grandma’s house and kids’ softball fees.

Illinois doesn’t need higher taxes. It needs a government that will put taxpayers first by balancing its budget, cutting spending and cutting taxes.