Illinois’ ‘temporary’ 2011 tax hike breaks household budgets

Illinois’ “temporary” 2011 tax hike made the state’s slow recovery even worse. The tax hikes hit at the worst possible time – right after household incomes had collapsed during the recession. Since the tax hikes, the monthly growth in the number of people working in Illinois has slowed down by 60 percent, while the monthly...

Illinois’ “temporary” 2011 tax hike made the state’s slow recovery even worse. The tax hikes hit at the worst possible time – right after household incomes had collapsed during the recession. Since the tax hikes, the monthly growth in the number of people working in Illinois has slowed down by 60 percent, while the monthly growth in payroll jobs has slowed down by 30 percent.

A glance at an Illinois household’s checkbook shows why the Illinois economy has stayed so sour.

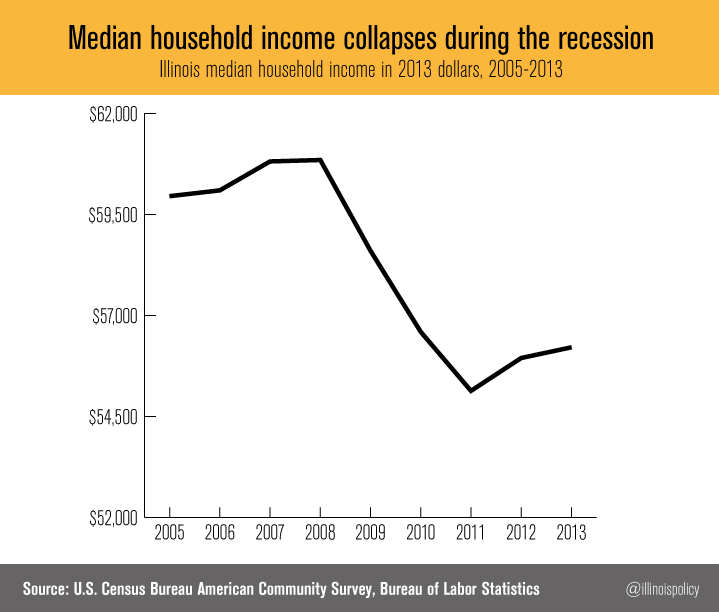

When measured with inflation-adjusted dollars, Illinois’ median household income has been falling. The big collapse occurred from 2008 to 2011, along the timeline of the Great Recession. From 2008 to 2013, the median household income dropped by $4,600.

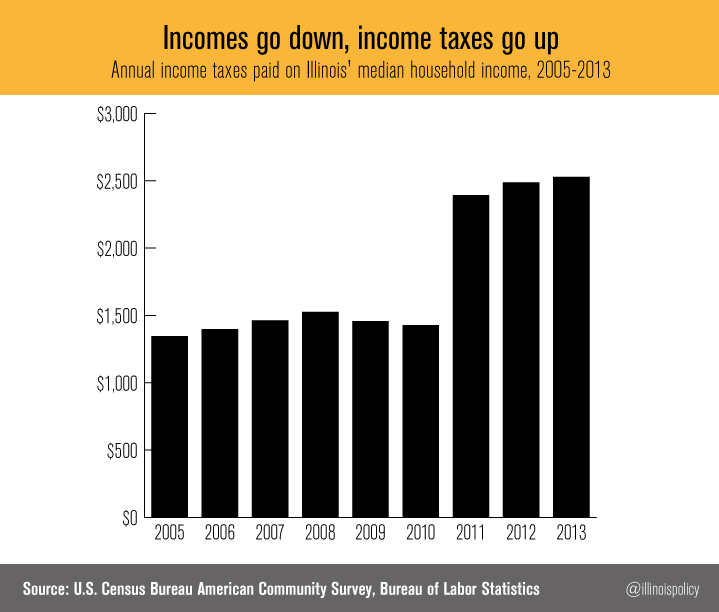

In 2011, Illinois enacted a historic income-tax hike. The income-tax rate went up by 67 percent for all households. So right after incomes had fallen from the recession, state government doubled down by crushing Illinois households with higher taxes.

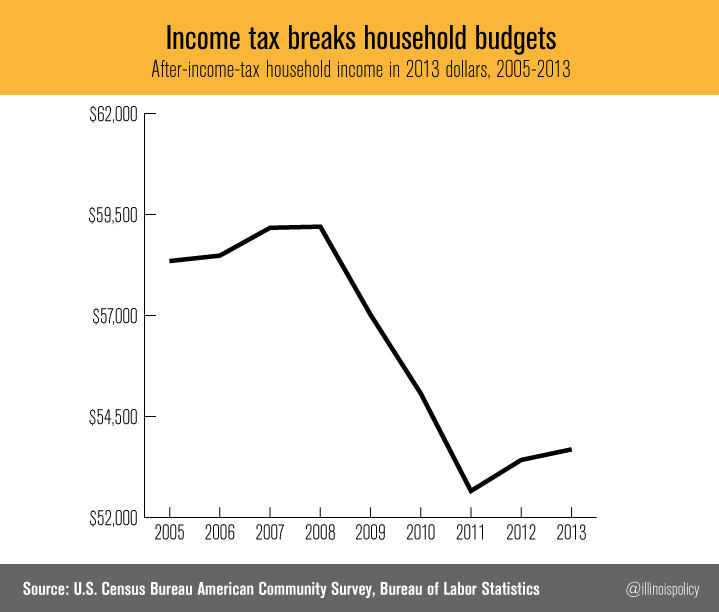

With falling incomes and rising taxes, Illinois’ economy was bound to suffer. While household income is down by $4,600 since 2008, after-income-tax household income is down by $5,500 in the same period. The income tax bit Illinois families when they could least bear it.

Illinois leadership has failed Illinois families. After breaking the state budget, legislative leaders decided to break household budgets. Right when household income was squeezed most, state government raised taxes, drastically lengthening the timeline of the state’s economic recovery.

This is a mistake than can be corrected by allowing the tax hike to sunset, as was promised. The 2011 income-tax hikes were policy errors that should not be repeated.