Illinois’ warped welfare system traps families in poverty

A new report from the Illinois Policy Institute details an insidious poverty trap created by the “welfare cliff.”

The U.S. welfare system is supposed to serve as a leg up to those in need. But for poor families in Chicago and across the state, Illinois’ welfare system can function more like a boot on the neck than a helping hand.

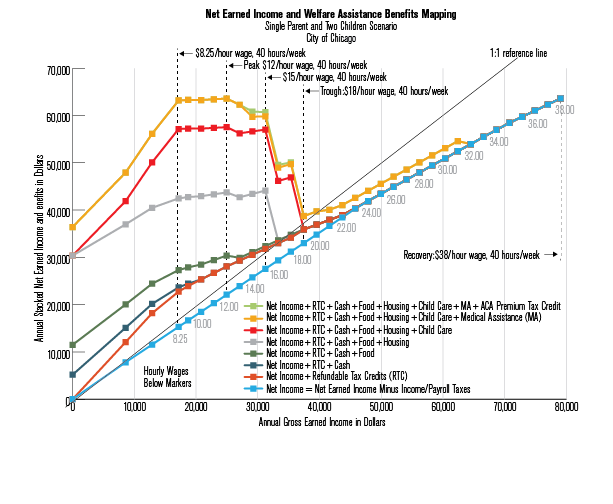

Welfare benefits are structured with intent to address the myriad struggles associated with poverty, and even more, to serve as a foundation for upward economic mobility. But a phenomenon known as the “welfare cliff” creates a poverty trap, making pay raises detrimental because they are outweighed by an even greater, simultaneous decline in welfare benefits.

Research from the Illinois Policy Institute details the welfare cliff experienced by single-parent, two-children households and two-parent, two-children households in Cook, Lake and St. Clair counties, and the city of Chicago.

The research model assumed that families have been aided by refundable tax credits, such as the state and federal Earned Income Tax Credit; cash grants through the Temporary Assistance for Needy Families program; and assistance for food, housing, health care and child care.

Under these assumptions, a working single parent in Chicago would be foolish to take a pay raise to $18 an hour from $12 an hour. They’d fall from the top of the welfare cliff and see a drastic net reduction in benefits, leaving them with as much as one-third less in household resources. This loss would only be made up again by finding a job paying $38 an hour.

Similarly drastic effects were observed in downstate St. Clair County, as well as northern Lake County, for both single- and two-parent households.

Per the study: “This result reveals a tremendous disincentive to seek work that pays more, essentially trapping single parents between the minimum wage and $12 per hour. It is unlikely that persons in this situation would be able to triple their incomes in order to recover lost benefits from the cliff.”

Creating this cavernous earnings gap for poor families to leap across in order to make up for lost welfare benefits is nothing short of cruel.

The welfare cliff detailed in the study is created by a combination of programs that taper off too quickly or are too generous to begin with. Specifically, housing benefits, child-care assistance and health-care assistance programs taper off very steeply. It is with this poor design, and narrow-minded designers, where one can lay blame for the associated poverty trap.

While the state of Illinois currently has little authority to reform these programs, state and local officials must fight for Illinois families by lobbying the federal government for more discretion in welfare spending. This is the first step in addressing the inexcusable inequalities built in to the welfare system as it stands.

Photo credit: Chuck Berman, Chicago Tribune