Kankakee County asks voters to hike county-level sales taxes by 800%

Kankakee County already has one of the highest average property tax rates in the country. In 2012, the Tax Foundation ranked Kankakee County as having the 79th-highest property taxes in the nation out of more than 800 of the largest counties in the U.S. Soon, Kankakee County could have one of the highest sales-tax rates...

Kankakee County already has one of the highest average property tax rates in the country. In 2012, the Tax Foundation ranked Kankakee County as having the 79th-highest property taxes in the nation out of more than 800 of the largest counties in the U.S.

Soon, Kankakee County could have one of the highest sales-tax rates as well.

Elected officials in the county have placed two sales tax hike referendums on the ballot. Combined, the proposals could increase county-level taxes by 800 percent. This includes a 1 percent school facilities sales tax and a 1 percent public safety sales tax proposal.

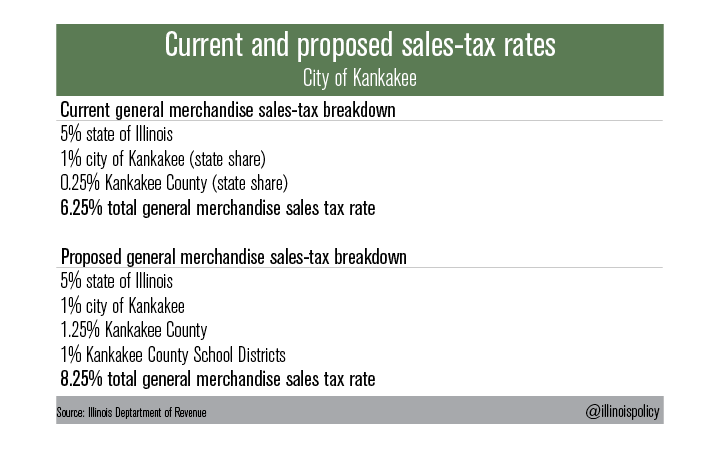

Currently, Kankakee County’s sales-tax rate of 6.25 percent is significantly lower than most of Illinois. The Tax Foundation states that the average sales-tax rate in Illinois is 8.13 percent – the 10th-highest rate in country.

And the county has reaped the economic benefit of the lower rate for years.

Kankakee County sits just outside the higher-tax Cook and collar counties area. As such, one of Kankakee County’s most important strategic economic advantages has been its low sales tax rates.

Kankakee County is also adjacent to Lake and Newton Counties in Indiana. Unlike most counties in Illinois, Kankakee County has a lower sales tax rate than the Hoosier state. Currently, the sales tax rate in most of Kankakee County is 6.25 percent, while Indiana has a statewide sales tax rate of 7 percent.

But Kankakee’s proposed sales tax rate is significantly higher than neighboring Indiana, and higher than most of Illinois. As a border county, the hike would result in lost shoppers and tax revenue to surrounding counties and states, hurting the county’s retail industry particularly hard.

The bottom line is this: Kankakee’s competitive edge would severely deteriorate if the pair of sales tax hike referendums are passed by voters on Nov, 4. The dual referendums would hike the county-level portion of the sales tax from .25 percent to 2.25 percent, an 800 percent increase.

Statewide in Illinois, average sales, property and income tax rates are at all-time highs.

The Kankakee County tax hikes will add to the ever-growing tax burden citizens must pay during difficult financial times. It would increase the cost of everyday items including diapers, toilet paper, food, clothing, home-improvement supplies, gasoline, electronics, holiday and birthday gifts, furniture, and much more.

These two sales tax increases have the potential to dramatically reshape Kankakee County’s economic environment and future development. That is, unless Kankakee County voters choose to reject higher sales taxes and preserve the county’s competitive economic advantage come November.