‘Keep Your Promise’: IL lawmakers must let temporary tax hikes sunset

Temporary tax hikes notoriously stick around longer than planned. Pennsylvania passed a 10 percent tax on alcohol to pay for damage from a flood in 1936. The state continued to levy the tax after the flood damage was paid for. Today the rate is 18 percent. But lawmakers across the country have been better at...

Temporary tax hikes notoriously stick around longer than planned. Pennsylvania passed a 10 percent tax on alcohol to pay for damage from a flood in 1936. The state continued to levy the tax after the flood damage was paid for. Today the rate is 18 percent.

But lawmakers across the country have been better at keeping their word when passing temporary tax hikes recently.

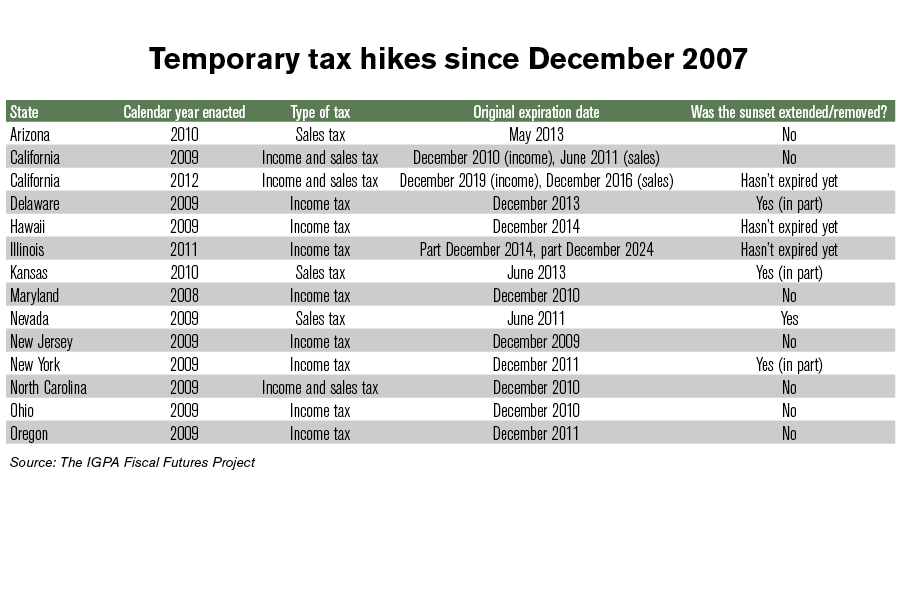

Thirteen states have passed temporary income or sales tax increases since December 2007 (California passed two). More often than not, those states allowed the tax hikes to sunset or expire on time rather than extending higher rates. Seven states let the tax hikes sunset as scheduled, four states extended or partially extended the tax hikes and three states have not yet reached their sunset date.

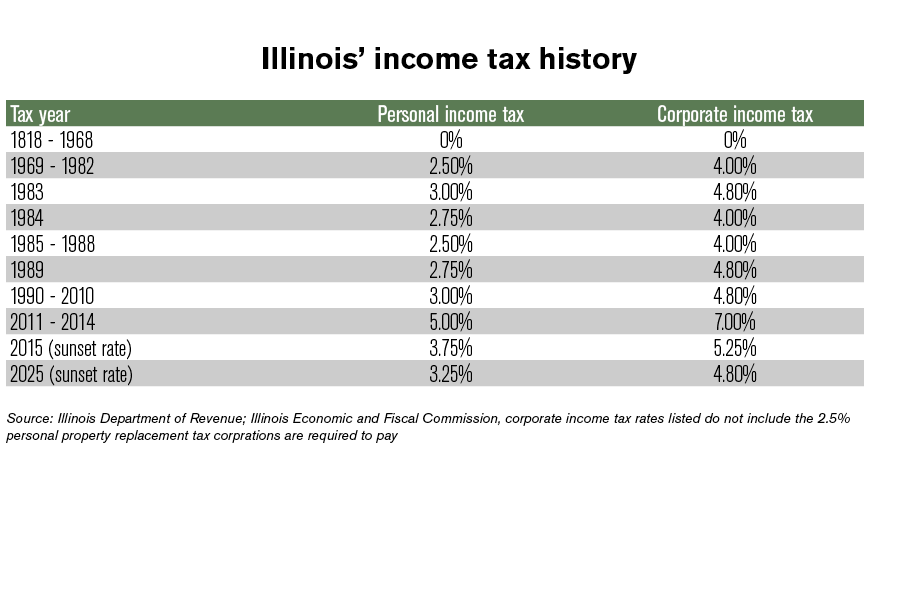

Illinois politicians should follow the crowd. They passed a record temporary income tax increase on individuals and businesses in 2011. The tax-hike rates are slated to sunset less than six months from now.

Illinois’ 2015 budget accounts for the tax-hike sunset. But there are plans in the works to break that promise and make the temporary tax hike permanent when lawmakers reconvene for lame-duck session in January.

This isn’t the first time Illinois politicians have been in this situation. Illinois’ income tax rates have fluctuated a number of times since former Gov. Richard Ogilvie singed the original tax into law. A temporary tax increase was passed in 1983, after which the rates reverted to 1982 levels. The personal and corporate income tax rates were increased again in 1989. These higher rates were scheduled to sunset but became permanent.

Illinois politicians need to keep their promise and let the temporary income tax hike sunset in January 2015. Thankfully, Illinois Policy Action has launched an initiative to make sure that happens.

Illinois Policy Action is asking all House and Senate members to sign our “Keep Your Promise” pledge, which will affirm politicians’ stated opposition to keeping permanent the temporary 5 percent income tax rate. Signing this pledge doesn’t just assure constituents that Illinois politicians still deserve some sliver of trust, it is an affirmation of a pro-growth tax policy that Illinois’ businesses and families desperately need.