Legislative exemption ignores the real budget crisis

As the state of Illinois moves deeper into budgetary crisis, the people of Illinois are depending upon government leaders to confront serious fiscal challenges with maturity, wisdom, courage and responsibility. The character exhibited by our governor and legislative leaders in this crisis will determine the trajectory of our state for years to come. Focus on...

As the state of Illinois moves deeper into budgetary crisis, the people of Illinois are depending upon government leaders to confront serious fiscal challenges with maturity, wisdom, courage and responsibility. The character exhibited by our governor and legislative leaders in this crisis will determine the trajectory of our state for years to come. Focus on the real issues will be essential.

But Illinois’ legislative leaders recently took their focus off the real crisis in pursuit of political gamesmanship.

In the final hours of the 2014 spring session, the legislative leaders enacted an exemption from the annual budget process for all spending related to the Illinois General Assembly and its legislative agencies as a reaction to a pension reform spat with the governor from the prior year. The exemption covers not only legislators’ salaries, but the entire operating budget of the legislative branch as well. Obviously, their actions did not help solve the real budget crisis; rather, they insulated their own piece of the pie from review and reduction, and gave their actual spending budget room to grow by 17 percent.

Practical impact

The measure protected not only the $14 million appropriated annually to the state comptroller for payment of legislators’ salaries, but gave the same protection to the entire $120 million operating budget of the legislative branch controlled by the legislative leaders. The measure dictates, in practical terms, that at least $120 million must be appropriated to legislative operations each year, and, if it is not, the legislature can still spend up to $120 million without an appropriation each year.

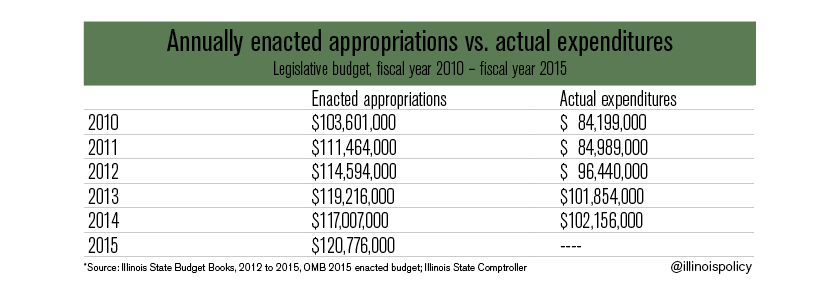

Surprisingly, this not only protects the legislative budget from reductions, but also gives it substantial room to grow. Over the last five years, actual spending from the legislative budget has never exceeded $103 million. Because the new measure will require a minimum of $120 million in appropriations, legislative spending could grow by 17 percent next year.

The actual expenditures shown above include rising contributions to the General Assembly Retirement System. These contributions rose to $13.9 million in 2014 from $0 in 2010. That number will stand at $15,8 million in the 2015 budget. There is room for much more growth in future years.

In truth, there was no need for the legislative leaders to pass this measure, which passed on a near straight party-line vote (one Republican “yes” vote and two Democrat “no” votes). After all, the General Assembly has the final say on all appropriation matters. And even if the governor takes action with a line-item or reduction veto, the General Assembly has the power to override the veto. Still, the measure provides total insulation from the annual budget process, allowing the legislature to sidestep any bothersome obstacles that may arise.

Constitutional challenges

One can quite easily argue that by enacting this measure, the General Assembly overstepped its constitutional authority. Several aspects of the measure are constitutionally suspect and should not be ignored.

From a substantive perspective, the legislative branch’s special exemption from the annual budget process raises the following concerns:

- It restricts the governor’s constitutional responsibility to “prepare and submit to the General Assembly … a State budget …” pursuant to Article VIII, Section 2 of the Illinois Constitution.

- It restricts the governor’s constitutional authority to use line-item and reduction vetoes in the annual budget process pursuant to Article IV, Section 9 of the Illinois Constitution.

- It constitutes an undue restriction by the legislative branch of a power that properly belongs to the executive branch, in contravention of the checks and balances in Article II, Section 1 of the Illinois Constitution, which states, “the legislative, executive and judicial branches of government are separate. No branch shall exercise powers properly belonging to another.”

These three substantive matters of constitutional law are key issues in drawing the lines of separation between the executive and legislative branches of government. The measure in House Bill 274 changes the constitutional balance of powers between the executive and legislative branches, and it should be tested in court or removed by legislative amendment. The General Assembly always has the final say when it comes to appropriations in any event, so an attempt to override the governor’s constitutional authority in the appropriation process is uncalled for.

From a procedural perspective, the passage of House Bill 274, which resulted in passage of the legislature’s special exemption from the annual budget process, raised additional constitutional questions:

- The enacted law may constitute “special legislation” according to Article IV, Section 13 of the Illinois Constitution, which states, “The General Assembly shall pass no special or local law when a general law is or can be made applicable.” There seems to be no rational relationship to a legitimate state policy in creating this special exemption for the benefit of just one class of beneficiaries (legislators). Of course, a general law granting a continuing appropriation to all agencies of state government would be an even worse law.

- The original content of House Bill 274, which had gone through the required legislative process, was removed and replaced with completely new content on the last day of session. Thus, the content that was enacted did not meet the requirement in Article IV, Section 8 of the Illinois Constitution for a bill to be read by title on three different days in each house.

- The compilation of the various unrelated provisions in House Bill 274 into a single bill is inconsistent with the “single subject rule” in Article IV, Section 8 of the Illinois Constitution, which states, “Bills … shall be confined to one subject.”

These last three issues address matters that are more structural or procedural in nature. The Illinois Supreme Court is often reticent to review the procedural matters that arise from the provisions of Article IV of the Illinois Constitution. But the court will act when it sees the legislature overstep its authority under the single subject rule or the special legislation prohibition, even as it applies strong presumptions supporting the constitutionality of legislative action.

That said, the Illinois Constitution was written with an intent – a spirit – to encourage procedural transparency and substantive clarity and coherence in the lawmaking process. The constitutional rules intended to stop, or at least discourage, passage of laws without public or legislative review, passage of laws giving special treatment to select groups, or passage of laws cluttered with multiple unrelated provisions.

As we enter a new season of severe budgetary crisis, greater cooperation, coordination, honest debate and transparency are called for, and the General Assembly should hold itself to a higher standard.