Madigan’s broken pension promise

When House Speaker Michael Madigan pitched his Illinois pension bill late last year, he got pushback for promoting legislation that hadn’t been officially scored by an independent actuary. That pushback was fair game. Illinois has the nation’s worst-funded pensions and an unfunded liability of $101.5 billion. With the number of failed pension fixes this state...

When House Speaker Michael Madigan pitched his Illinois pension bill late last year, he got pushback for promoting legislation that hadn’t been officially scored by an independent actuary.

That pushback was fair game. Illinois has the nation’s worst-funded pensions and an unfunded liability of $101.5 billion. With the number of failed pension fixes this state has passed over the last two decades, any new legislation should be transparent and fully vetted before a vote.

Not to worry, was the response. The General Assembly had debated these same reforms for two years. The state actuary would quickly calculate the “savings” of the pension bill and confirm Madigan’s promise of $160 billion in savings to the state.

Well, Madigan finally released the scoring of the law. Not surprisingly, the results from The Segal Company, the actuary that ran the numbers for the state, proved that Madigan oversold the reform.

The bill saves only $137.4 billion, not the $160 billion promised. That’s a drop in expected savings of $22.6 billion.

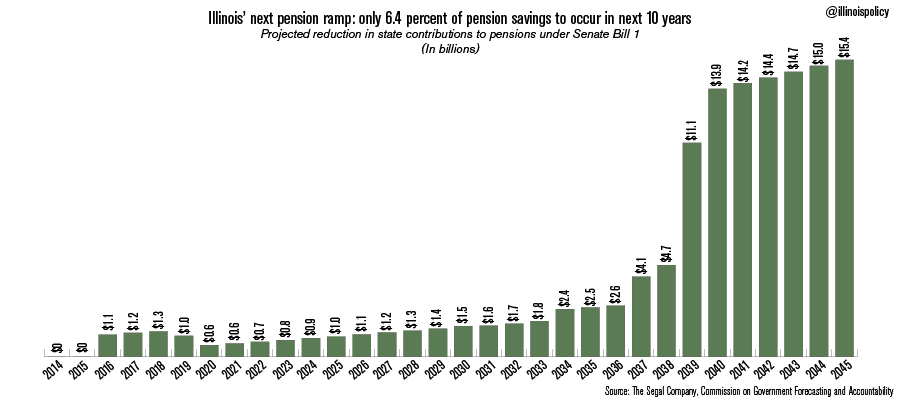

What’s worse, Senate Bill 1’s savings are heavily backloaded. According to the actuary’s report, more than 80 percent of the bill’s savings occur from 2035-2045.

Madigan released the report during Gov. Pat Quinn’s budget address, while all the media focus was on Quinn’s proposals. That’s what you do with bad news – you bury it and hope no one notices.

But there are four other reasons why SB1 was disappointing:

- It took leadership almost four months to release SB1’s scoring. Perhaps Madigan and team wanted to delay the truth – the bill doesn’t deliver what was promised.

- The savings are back-ended. Just 6.4 percent of all savings from the pension deal will occur in the first 10 years. Amazingly, 82.3 percent of the savings are projected to occur from 2035-2045.

- Nearly 40 percent of SB1 savings are from accounting gimmicks and future taxpayer funds. Only 60 percent of the savings from SB1 are from benefit reforms such as changes to cost-of-living adjustments and retirement ages. The remainder is not savings but rather a future syphoning of taxpayer funds from roads, schools and public safety.

- Madigan’s pension proposals saved less and less. Madigan’s original SB1 proposal saved $180 billion. It included a 2 percent increase in worker contributions to help increase savings. In contrast, the version of the law that passed did an about-face on worker contributions. It reduced them by 1 percent. That 3 percent swing in worker contributions dropped the projected savings to $160 billion. And now, with the new scoring, the savings have collapsed to $137.5 billion.

SB1 falls dramatically short of the reforms needed to save Illinois. Even more, this bill, much like the 2011 tax hike, will deflate pressure for real reform for years. Neither Quinn nor Madigan are not going to risk the wrath of unions by trying for more reform. Instead, they will continue to pretend the problem is fixed.

But by keeping the defined benefit system at the core of state worker retirements, Madigan’s bill ensures the unfunded liability will continue to rise as it has over the past 20 years.

Make no mistake: This bill was a step backward.

The official scoring proves it.