Moody’s: Illinois an outlier in pension debt

Illinois ranks worst in the nation on ability to pay for its pension debt.

For years, Illinoisans have been hammered with news report after news report about the state’s mountain of debt – it just keeps getting bigger. But sometimes it’s hard for taxpayers to understand what that means for them.

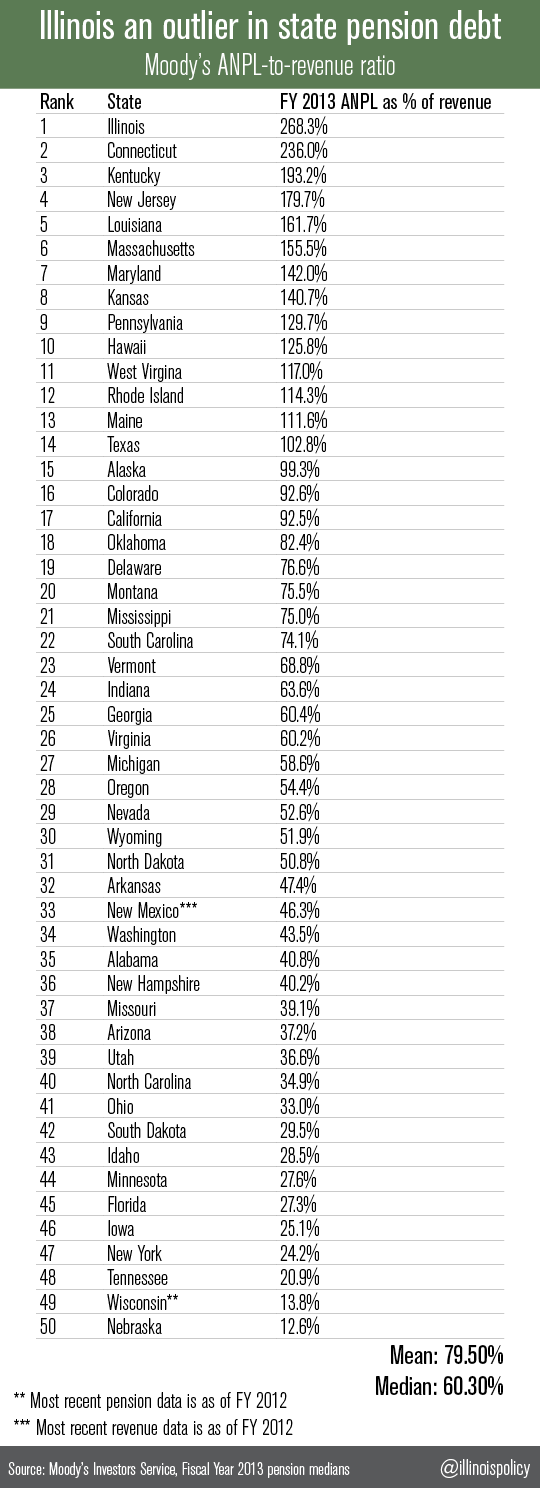

Fortunately, Moody’s Investor’s Service developed a simple metric that puts pension debt into context. The metric measures a state’s pension debt – or Adjusted Net Pension Liability – against the state’s ability to pay for that debt – its revenues. The metric is called the ANPL-to-revenue ratio.

The ANPL-to-revenue ratio represents the affordability of a state’s pension debt. Some states have revenues larger than their pension debt, while others have pension debt that far exceeds their revenue. Illinois fits into the latter category.

The median ANPL-to-revenue ratio for the nation was 60.3 percent, according to Moody’s most recent report.

States with the lowest adjusted liabilities relative to their revenues include Tennessee (20.9 percent), Wisconsin (13.8 percent) and Nebraska (12.6 percent).

States with the highest ANPL-to-revenue ratio are Illinois (268.3 percent), Connecticut (236.0 percent) and Kentucky (193.2 percent). These states are outliers because they have ANPL-to-revenue ratios at least three times the median. That means these states have the largest pension debt relative to the resources they have available to pay for that debt.

This measurement is one of the many that Moody’s uses to evaluate what a state’s pension debt means for its credit rating.

And like Illinois’ pension ranking, the state’s credit rating also is the worst in the nation.

The sad truth is Illinois hasn’t been a AAA-rated state since February 1979 – when a gallon of gas cost less than a dollar and the Dow Jones Industrial Average hovered in the low 800s. The state’s credit rating has been in a downward spiral ever since.

And a recent Illinois court ruling suggests that things may get worse. Judge John Belz of the Sangamon County Circuit Court recently ruled that Illinois’ pension reform bill – Senate Bill 1 – is unconstitutional.

While it would not have fixed the real problem with pensions in Illinois – politician control – SB 1 would have increased retirement ages on a sliding scale, scaled back cost-of-living adjustments and capped pensionable salary. The pension protection clause in the Illinois constitution blocked those reform efforts.

Belz’s ruling is the first step in what likely will be a long legal process to determine whether that law can be implemented and what types of pension reform will withstand a court challenge in the future. The case will now head to the Illinois Supreme Court, where the final decision will be made.

If SB 1 is struck down in the Supreme Court, then Illinois’ pension debt will continue to grow. The state will likely be hit with additional credit downgrades. And the severely underfunded pension systems will face the risk of insolvency.