by Nick Vlahos

The municipal bond rating for Peoria has been downgraded, but excessive worry about it doesn’t appear warranted. Not now, at least.

Some of the underlying reasons for the change by Moody’s Investors Service might require more immediate attention in the Illinois General Assembly.

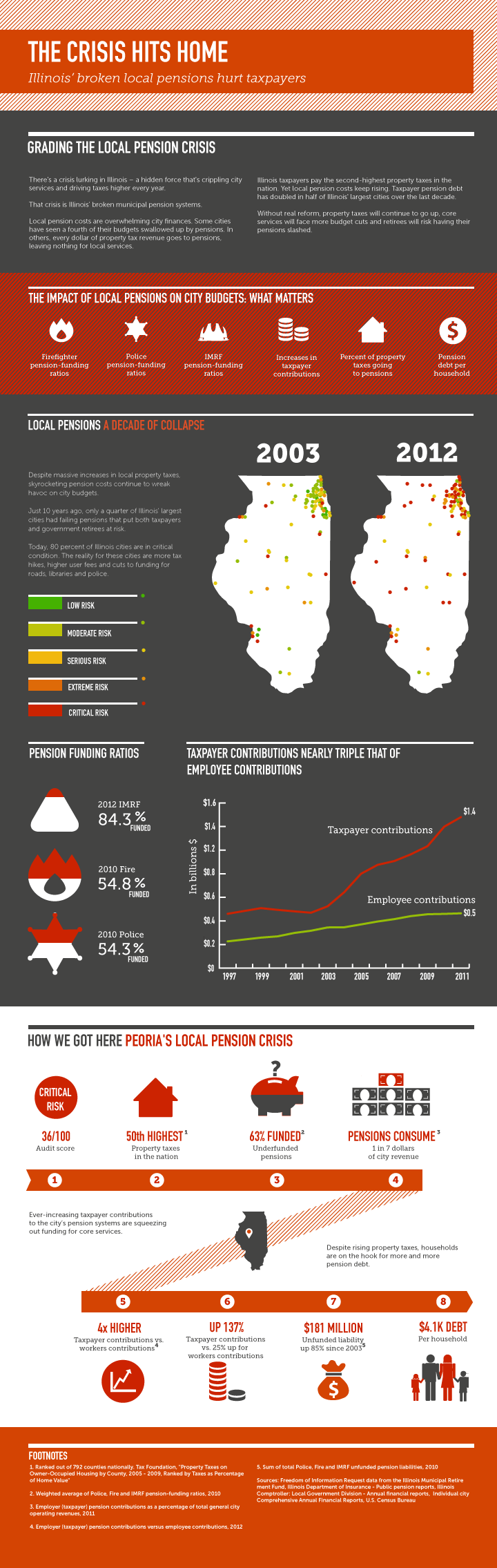

Unfunded state mandates regarding pension funds for fire, police and other city workers contributed to the bond downgrade, a Moody’s report stated. Peoria’s bond rating fell from Moody’s third-highest rating to its fourth, said David Jacobson, a spokesman for the investors service.

The new Peoria rating, AA3, is three notches higher than that of Illinois and four higher than Chicago, according to Jacobson.

“A double-A rating is still judged to be of high quality,” he said Monday.

The practical, short-term effect of the Moody’s change is the cost of borrowing money will increase microscopically, City Manager Patrick Urich said. The hike is about five-100ths of a percentage point.

“I don’t think over the long term it’s going to have a major financial impact,” Urich said.

The city is expected to issue $10 million in bonds Tuesday to fund sewer rehabilitation, sidewalk and other infrastructure improvements.

Moody’s cited the city’s above-average debt level, which the bond sale will increase to almost $200 million. But Moody’s also stated that level is expected to remain manageable.

The pension issues also appear above average.

As of the end of 2011, the city had about $40.2 million in unfunded pension liabilities in its Illinois Municipal Retirement Fund plan, Moody’s stated. The numbers for the police and fire pension funds were $81.7 million and $76.8 million, respectively.

Moody’s listed the underfunded pensions and debt as challenges for the city. So is manufacturing-sector economic volatility. Strengths were Peoria’s status as a regional economic center, its ability to raise city revenue and willingness to cut the municipal budget.

“The issues they point out in terms of our unfunded pensions, unfunded health care and debt service are points of concern we have to focus on over the long term,” Urich said.

“The simple fact is when it comes to pensions, we’re not responsible for the performance of some of the funds we have to pay into, notably police and fire. If those funds don’t perform … the city has to pay those costs.”

In fiscal year 2012, the city contributed $1.5 million less than the annual required pension contribution, Moody’s stated.

Peoria has squeezed its budget in recent years and will continue to try to increase efficiency and reduce costs, Urich said. But an official from a nonpartisan taxpayer watchdog and education group suggested the city’s situation is among the worst in Illinois.

Through taxes, Peoria property owners pay four times more toward city pensions than employees do, according to Ted Dabrowski of the Illinois Policy Institute. A decade ago, the ratio was 2 to 1.

“The problem Peoria is having is that pension payments are eating more and more property taxes,” he said. “Overall, this is a big problem across the entire state. The state is controlling the benefit levels, yet they force the cities to make the payments. They’re very much reliant on state law.”

The cuts Peoria has made are good from a budgeting perspective but not necessarily from a pension perspective, Dabrowski said. The city has less than one active employee per pensioner.

“Who’s going to make up that difference? It’s taxpayers,” Dabrowski said.

Read more at pjstar.com