Pension costs consume 90 cents of every tax-hike dollar

Missing from the discussion on state revenues is what happened with all the money from Illinois’ last major tax hike.

The 2011 income-tax hike put more than $31.6 billion in new revenue in the hands of Illinois state government. To put that number into perspective, $31.6 billion is more than what Illinois spends on all core government services (e.g., education, health care, human services, public safety) in a full budget year.

But Illinois didn’t use that money for education, health care or human services. Instead, the state used the tax-hike revenue to pay approximately $3.6 billion in old bills, make approximately $8 billion in pension obligation bond payments and put the remaining $21 billion into the state’s pensions systems, according Illinois Senate President John Cullerton.

That’s right. Nearly 90 cents of every tax-hike dollar went to pay for pensions.

Gov. Bruce Rauner has been criticized for introducing a budget that spends only what Illinois will raise in revenue during the next budget year – a new concept for a state that hasn’t had a balanced budget in more than a decade. Key to Rauner’s plan is allowing the 2011 temporary income-tax hike to sunset as scheduled.

But the idea of cutting taxes hasn’t been popular in Springfield. Many lawmakers have instead proposed a number of income-tax hikes, as well as an array of tax hikes on guns and gun parts, casinos, sweetened drinks, satellite TV providers, and financial transactions.

Missing from the discussion on state revenues is what happened with all the money from Illinois’ last major tax hike.

Illinois is still drowning under the weight of its pension debt despite dumping the entire tax hike into pensions and unpaid bills. Consider the following:

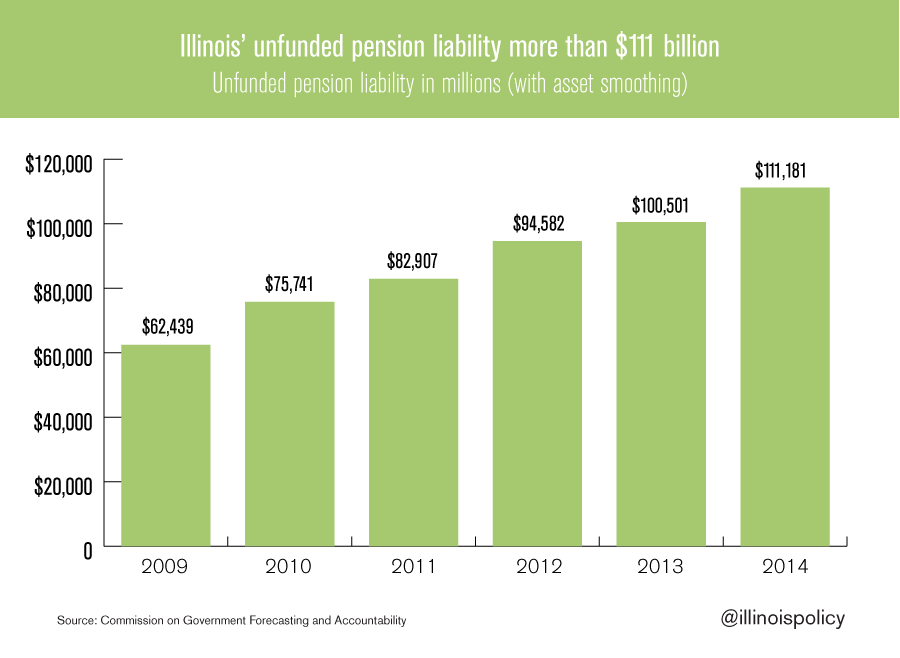

- In 2011, Illinois’ unfunded pension debt was $82.9 billion. Today, it exceeds $111 billion.

- In 2011, Illinois’ general fund pension payment was $3.7 billion. Today, it exceeds $6 billion.

- In 2011, Illinois’ unpaid bills totaled $8.5 billion. Today, the backlog still exceeds $6 billion, and actually increased while the tax hike was still in effect.

Illinois lawmakers need to build a spending plan based on the amount of revenue the state will have next year instead of trying to build a revenue plan based on how much they want to spend. Doing so will take a comprehensive pension-reform plan that finally puts an end to the nation’s worst pension crisis.