Pension facts of SB1 lawsuit plaintiffs

State workers, retirees and public-sector unions groups have filed various lawsuits challenging the constitutionality of Senate Bill 1, the state pension reform bill signed into law by Gov. Pat Quinn in December 2013. The top pensioner of those suing the state will receive $2.4 million in pension benefits over the course of his retirement. That...

State workers, retirees and public-sector unions groups have filed various lawsuits challenging the constitutionality of Senate Bill 1, the state pension reform bill signed into law by Gov. Pat Quinn in December 2013.

The top pensioner of those suing the state will receive $2.4 million in pension benefits over the course of his retirement.

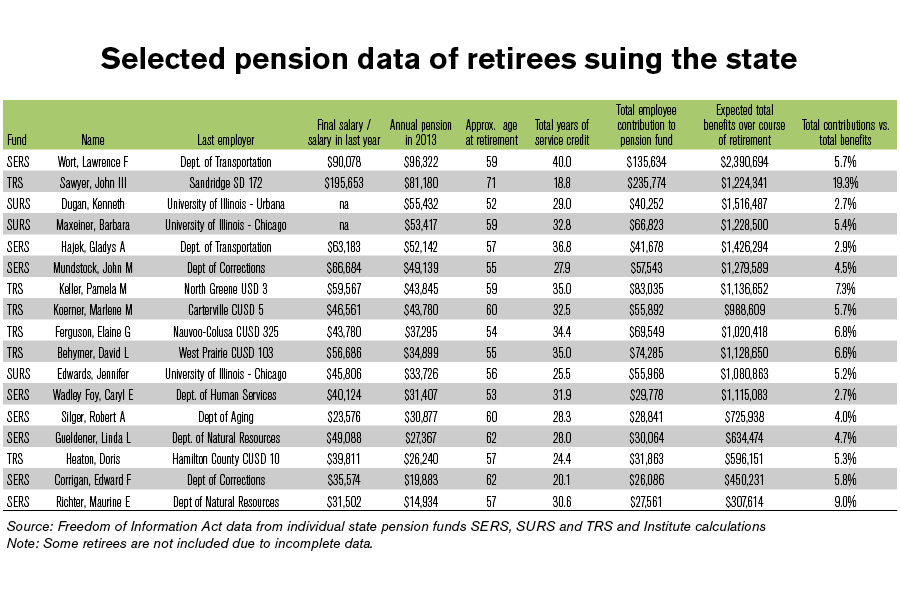

That pensioner – Lawrence Wort – is a member of the State Employees’ Retirement System, or SERS. Wort received a total of $96,322 in pension benefits last year. According to the FOIA data, Wort contributed just $135,634 toward his SERS pension over his 40-year career. His contributions will cover just 5.7 percent of his $2.4 million expected lifetime benefits.

The SB1 lawsuits contain a mix of plaintiffs: workers and retirees who are members of SERS, as well as the State Universities Retirement System, or SURS, and Teachers’ Retirement System, or TRS.

The Illinois Policy Institute has gathered some facts about the retirees suing the state, obtained from Freedom of Information requests sent to the state pension systems.

According to the data, a majority of the retirees were career workers with about 30 years of service.

Below is a list of some of the retired plaintiffs and selected facts about their pensions.

(Click to enlarge or view the PDF here)