5 reasons why Illinois’ latest spending plan insults taxpayers

Lawmakers made no serious attempt to balance the new budget, instead counting on a federal bailout. They accepted an $1,800 raise for themselves, while only making significant cuts to education.

The Illinois General Assembly on May 24 approved Illinois’ 20th consecutive unbalanced spending plan. Gov. J.B Pritzker is expected to sign the legislation.

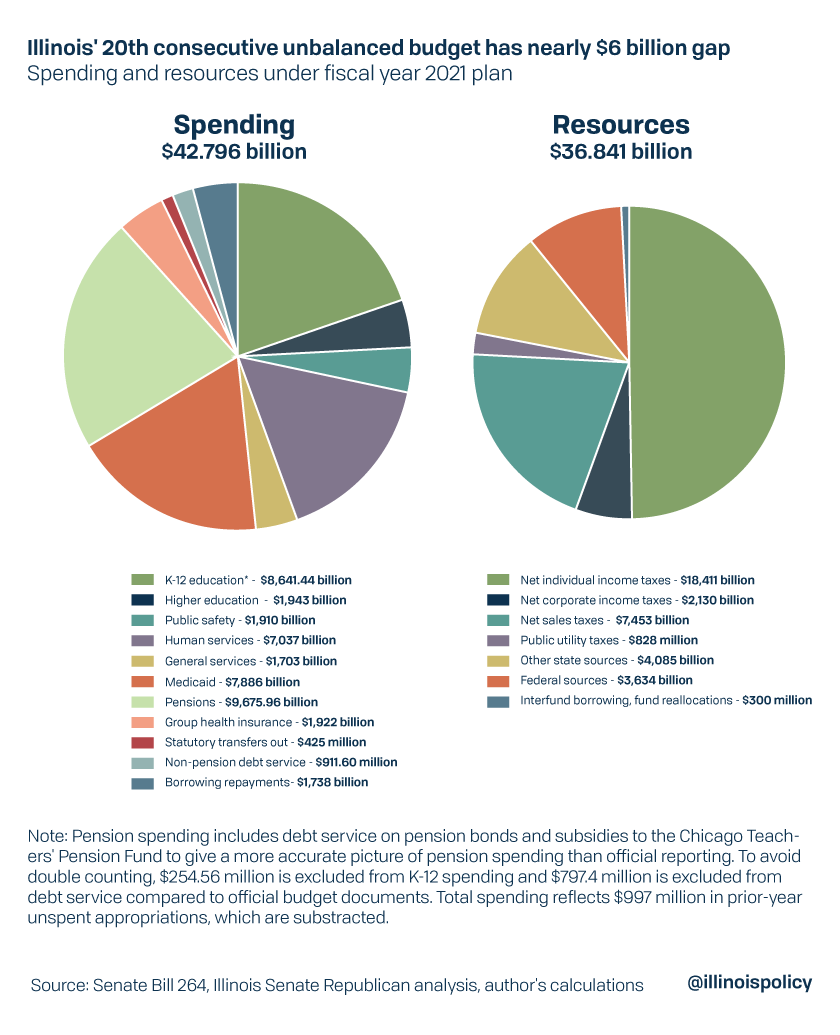

Lawmakers made no serious attempt to balance the budget, despite a constitutional requirement to do so. The $42.8 billion in approved spending exceeds available resources by nearly $6 billion.

Meanwhile, Illinoisans across the private sector are struggling to responsibly manage their own finances amid economic fallout from COVID-19 and related government shutdown orders. As of May 23, over 1.15 million residents had filed for unemployment benefits. Many businesses remain shuttered, and those that are operating under restrictions face drastically reduced income.

Five facts demonstrate why Illinois’ latest irresponsible spending plan is an insult to taxpayers who are facing unprecedented challenges of their own, largely due to government-ordered business shutdowns intended to fight COVID-19.

1. The plan failed to take all available steps to prevent an $1,800 raise for lawmakers while private sector Illinoisans face record unemployment and lost income

Amid record job losses and lost business income, lawmakers failed to take all actions available to them to stop automatic salary increases that will increase their pay by an estimated $1,800 per year.

Some Democratic lawmakers seem to be under the impression they did indeed prevent the raises, according to social media posts. Because the actual text of the budget legislation appropriates the same amount of money as the prior budget year, and because $0 is appropriated for legislator cost of living adjustments, or COLAs, some confusion is understandable.

Comptroller Susana Mendoza has likewise claimed she will not be issuing additional money in lawmaker checks. However, the decision may not ultimately be hers to make.

A law passed in 2014 made lawmaker pay a “continuing appropriation,” which means the money has to be paid regardless of what is actually passed in the budget. The act specifies that the money shall be paid even if “aggregate appropriations made available are insufficient to meet the levels required” and “for any reason.”

From fiscal year 2014 through 2019, lawmakers included specific language prohibiting the COLA notwithstanding any other contrary law. That same language was used to prohibit COLAs in several years before the 2014 law created the continuing appropriation.

Even that language may be insufficient to prevent automatic lawmaker pay increases. In 2019, two former Democratic state senators – Michael Noland and James Clayborne – prevailed in a lawsuit seeking to recoup backpay for years in which the COLA had been prohibited. Cook County Judge Franklin Valderrama ruled the Illinois Constitution’s ban on changing a member’s salary “during the term for which he has been elected” invalidated the attempts to stop the raises.

That case is still ongoing and no judge has yet ordered back pay to be issued. Lawmakers could and should have included provisions similar to what they passed from 2014 to 2019, to make a clear statement of legislative intent. Setting the COLA to $0 could prove to be a weak and ineffective attempt because the continuing appropriation specifically speaks to a situation in which not enough money is authorized by the budget.

As things stand, lawmakers have left open the door to future lawsuits that would force the comptroller to issue the higher pay. This could occur after the current budget year when some current lawmakers retire and no longer have to face reprisal from voters, as happened with Noland and Clayborne.

To regain control and provide a fair outcome to struggling residents, lawmakers will likely need to amend the law providing for a continuing appropriation and adjust salaries before the next General Assembly officially begins in January 2021.

2. It spends $2.4 billion more than last year and $773 million more than Pritzker proposed in February

Economic fallout from COVID-19 blew a large hole in expected revenue collections for the coming fiscal year. In April, Pritzker’s own Office of Management and Budget predicted revenues would drop by more than $4.6 billion for fiscal year 2021. A stress test conducted by Moody’s Analytics projected an even steeper drop in total revenue of between $5.2 billion and $6.9 billion depending on the severity of the economic contraction.

Despite these lower revenue expectations, Illinois will spend $2.4 billion or nearly 6% more than last year’s $40.385 billion budget. Moreover, the enacted fiscal year 2021 budget spends $773 million more than the $42.023 billion Pritzker proposed prior to the pandemic in February.

Other states governed by both Democrats and Republicans are taking their duty to balance their budgets much more seriously. For example:

- Michigan Gov. Gretchen Whitmer furloughed 31,000 state employees

- California Gov. Gavin Newsom is pushing for a 10% cut to worker salaries and education

- Pennsylvania Gov. Tom Wolf is laying off 9,000 state employees who could not work remotely

- And Indiana Gov. Eric Holcomb directed state agencies to cut spending by 15% each as the “first of what is likely to be a number of steps we’ll take to rein in state spending.”

By contrast, Pritzker told reporters on April 23 that he is not even discussing canceling $261 million in automatic raises he agreed to grant state workers in 2019. Additionally, Pritzker did not push for 6.5% cuts in agency budgets despite having asked agencies to come up with plans for those reductions last year.

3. It authorizes $5 billion in debt to be repaid with a federal bailout that doesn’t exist

To partially fill the deficit in the enacted budget, lawmakers passed Senate Bill 2009 on a party line vote. The bill grants Pritzker authority to borrow $5 billion from the Federal Reserve’s new state and local lending program. The Fed’s program is designed to provide a “liquidity backstop” for government borrowing amid concerns that the private market for state and local debt would face interruptions resulting from COVID-19 fallout.

Pritzker and many Democratic lawmakers have publicly stated they hope to be able to repay the borrowing with a bailout from the federal government, which Congress has not passed. Pritzker has repeatedly called for potential federal aid to be “unencumbered,” meaning he wants a blank-check bailout with no strings attached.

The Illinois Policy Institute has proposed a plan under which any financial assistance provided to state governments by Congress would be made contingent on certain taxpayer protections. Those conditions would ensure federal aid supports essential government services rather than being squandered through waste and mismanagement. States would have to demonstrate they have sound pensions, truly balanced budgets and sufficient rules for emergency savings or else enact significant reforms to meet those conditions.

Illinois’ latest irresponsible budget clearly demonstrates why Congress should reject blank-check bailouts and refuse to provide any financial assistance until Springfield politicians get serious about correcting their decades of mismanagement.

4. More than 30% of Illinoisans’ tax dollars will prop up the state’s bloated pension system

Illinois’ broken pension system will consume nearly $9.7 billion, or about 31% of tax dollars state residents send to Springfield this year. When federal sources are included, such as Medicaid reimbursements, pensions will consume 26.5% of all general fund revenues. Springfield’s inaction to reform the unsustainable pensions system has seen pensions consume an ever-larger share of the budget, crowding out services that provide value to state residents. From 1990 through 1997, pension contributions accounted for less than 4% of Illinois’ general funds budget.

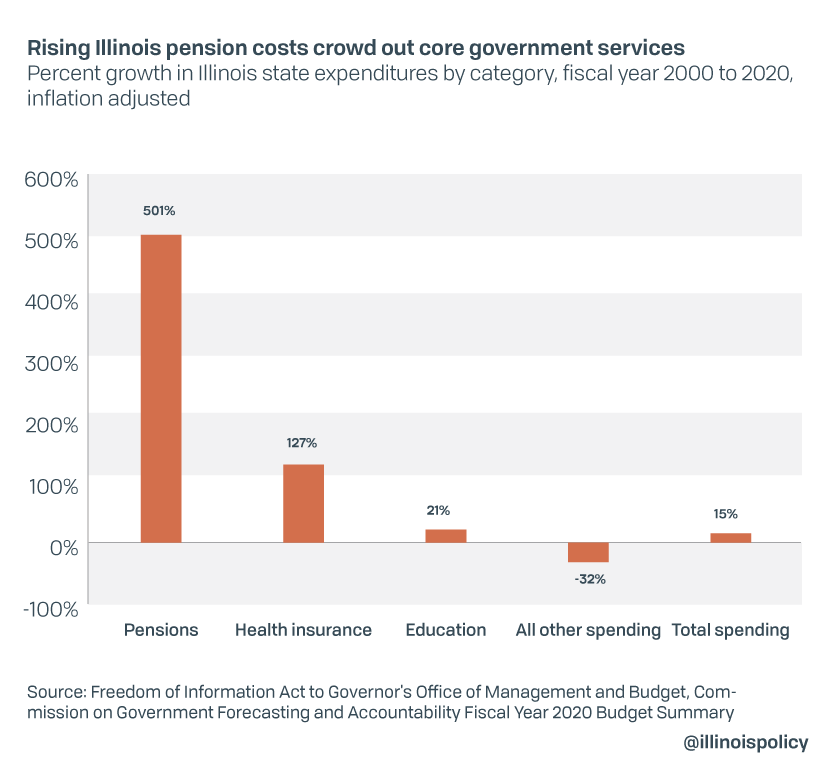

For the past 20 years, Springfield’s overspending has primarily gone to pay for pension benefits and state worker health insurance, while inflation-adjusted spending on a range of core government services has actually been reduced in real terms by nearly one-third. Yet despite the 501% increase in pension spending since fiscal year 2000, the five state pension systems have at least $138.6 billion in pension debt according to the state’s own estimates.

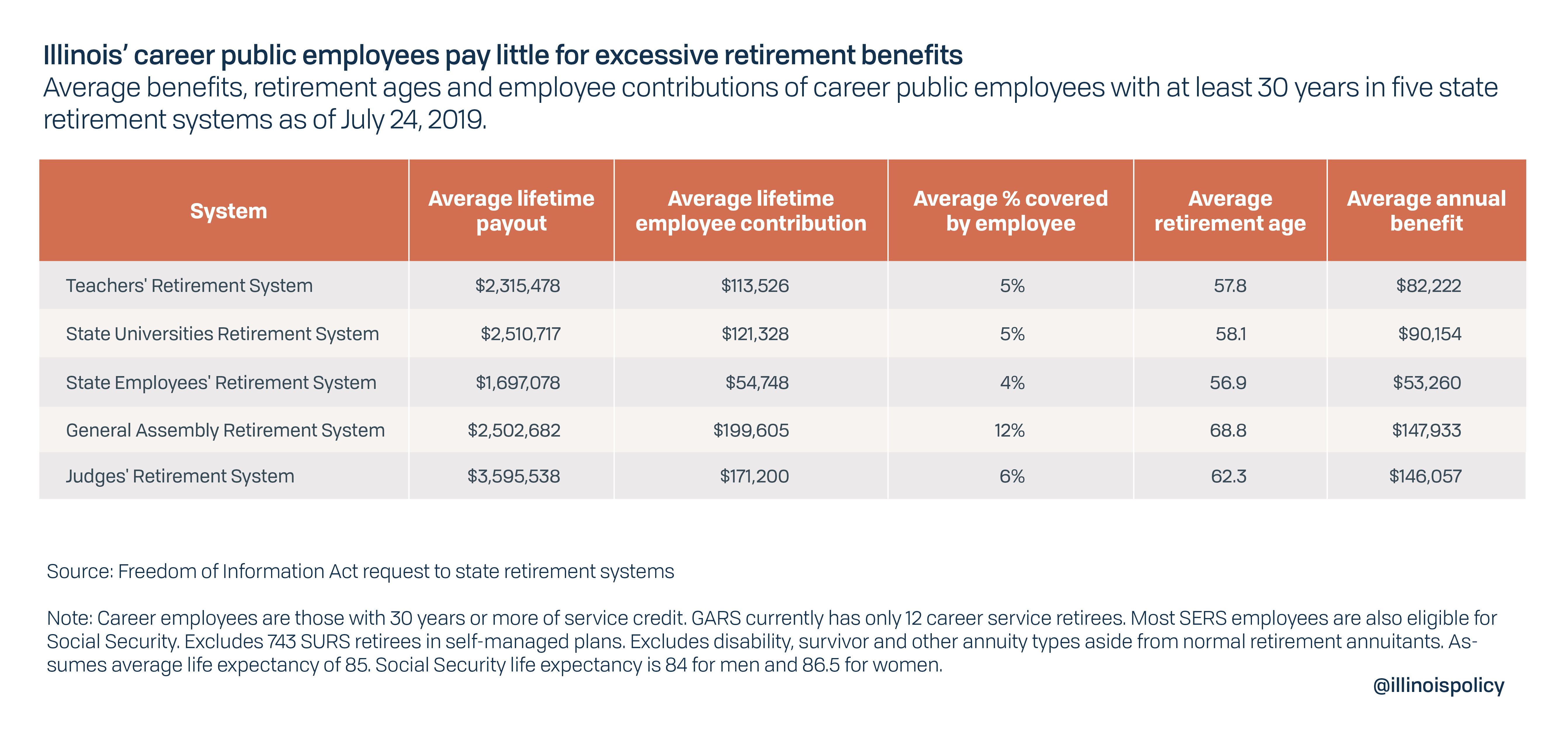

Illinois pension systems as they exist today are fundamentally unsustainable because benefits have been set at levels taxpayers cannot afford, and employee contributions set by state law are insufficient to cover a substantial enough portion of these benefits.

Career workers in the five state retirement systems, those with at least 30 years of service credit, contribute around 5% of what they receive in lifetime benefits on average. Among individuals relying solely on public pensions for retirement, total lifetime payouts range from an average as high as $3.6 million for career judges to $2.3 million for career teachers and education administrators. Career state workers receive lower lifetime benefits, a still generous $1.7 million on average, because more than 96% of them also qualify for Social Security.

As long as Springfield continues to prop up this unsustainable system, taxpayers will continue to face tax increases and cuts to services that benefit residents. Amid a global pandemic straining governments’ ability to pay for programs related to public health and safety, these excessive benefits are completely unjustifiable.

Pritzker has refused to support an amendment to the state constitution that would allow for modest reforms to make pensions affordable and sustainable, such as replacing guaranteed 3% compounding annual benefit increases with a true cost of living adjustment tied to inflation.

5. The only significant spending lawmakers cut was for K-12 and higher education

Despite increasing overall spending by $2.4 billion compared to fiscal year 2020, the budget essentially keeps education funding flat for both K-12 schools and state universities. After accounting for inflation, this equates to an education cut in real terms.

An analysis from Republican state senate staff obtained by the Illinois Policy Institute explains that the budget provides “the bare minimum” of $7.2 billion under the state’s funding formula, through which money is provided to local schools. All school districts will receive the same amount from the state as last year.

Total state K-12 spending, including grants outside of the funding formula and the budget for the Illinois State Board of Education, will increase by just $12.79 million or 0.14%.

Similarly, total general revenue funding for state universities will be held constant with the prior budget at $1.16 billion.

Government budgets reveal the priorities of elected officials. By cutting education while increasing their own pay and preserving unaffordable pension benefits, Springfield is sending a clear and disturbing signal to taxpayers about what they value most.