Civic Federation proposal hits Illinois taxpayers with $51 billion in tax hikes

The Civic Federation’s budget plan repeats old mistakes with multibillion-dollar tax hikes and no serious, structural reform.

The Civic Federation, a research organization that represents Chicago-area corporations and professional firms, is pushing for a $51 billion tax hike on Illinoisans over the next six years – instead of advocating for the structural reforms that Illinois really needs.

The group’s plan demands more from taxpayers’ wallets despite the fact that Illinoisans are already struggling with some of the highest taxes in the nation, a lackluster job recovery, and record numbers of residents and businesses leaving the state.

Just like 2016 and 2015, the federation is proposing the same policy mistakes that created Illinois’ fiscal crisis in the first place.

The Civic Federation’s latest plan not only avoids holding lawmakers accountable for their failures ̶ it rewards the General Assembly for its reckless behavior. The plan gives politicians billions of additional taxpayer dollars without demanding a single serious reform.

Previous experience has shown that will only lead to disaster.

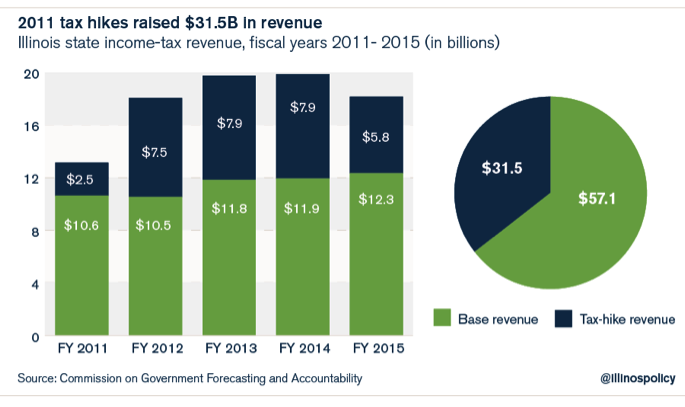

Illinois’ failed 2011 income tax hike proves why the Civic Federation’s plan would fail if implemented. Between 2011 and 2015, Taxpayers were forced to hand over more than $31 billion in additional taxes under the promise that politicians would fix the pension crisis, pay down Illinois’ unpaid bills, and turn around Illinois’ economy.

But filling Springfield’s coffers only allowed politicians to avoid the spending reforms necessary to fix Illinois. No significant reforms were passed during those four years, and Illinois is now in worse financial shape than it was before the tax hike.

The key to fixing Illinois is real spending reform – not more tax hikes that will drive even more people out of the state.

The Civic Federation’s plan: $51 billion in new taxes, no real reforms

Instead of proposing the structural spending reforms Illinois actually needs, the Civic Federation’s plan calls for major tax hikes:

- It retroactively increases individual income taxes to 5.25 percent from 3.75 percent and raises corporate taxes to 7 percent from 5.25 percent.

- It allows the state to begin taxing retirement income

- It imposes new sales taxes on services while lowering the overall sales tax rate.

Collectively, these proposed taxes would take another $51 billion from taxpayers’ wallets through 2022.

It would be foolhardy to make the same mistake twice considering how much damage the $31 billion income tax hike has already done to Illinois’ taxpayers and the state’s economy.

On top of massive tax hikes, the plan also proposes billions in additional state subsidies for local governments. And it calls for the state teachers’ pension system to take over Chicago teachers’ pensions – which amounts to a multibillion dollar bailout for the City of Chicago and Chicago Public Schools.

The last tax hike crushed Illinois

The Civic Federation’s proposal is a repeat of the same failed strategy the state embarked upon in 2011: tax hikes now with promised structural reforms later.

Back in 2011, Illinois’ politicians enacted a record 67 percent income tax hike and a 46 percent corporate tax hike during a lame duck session. Springfield politicians promised the additional revenue would stabilize the pension crisis, pay down the state’s unpaid bills, and help the economy.

Instead, state lawmakers used that infusion of new cash to avoid significant spending reforms and grew the budget instead.

As a result, the hike accomplished nothing. The pension crisis wasn’t fixed, the state’s bills weren’t paid off, and Illinois suffered the weakest economic recovery in the nation. Even worse, Illinois is experiencing an outmigration crisis – to the point where Illinois’ population has declined for three consecutive years.

Here are three ways the last tax hike failed and left Illinois worse off:

- Illinoisans have left in record numbers

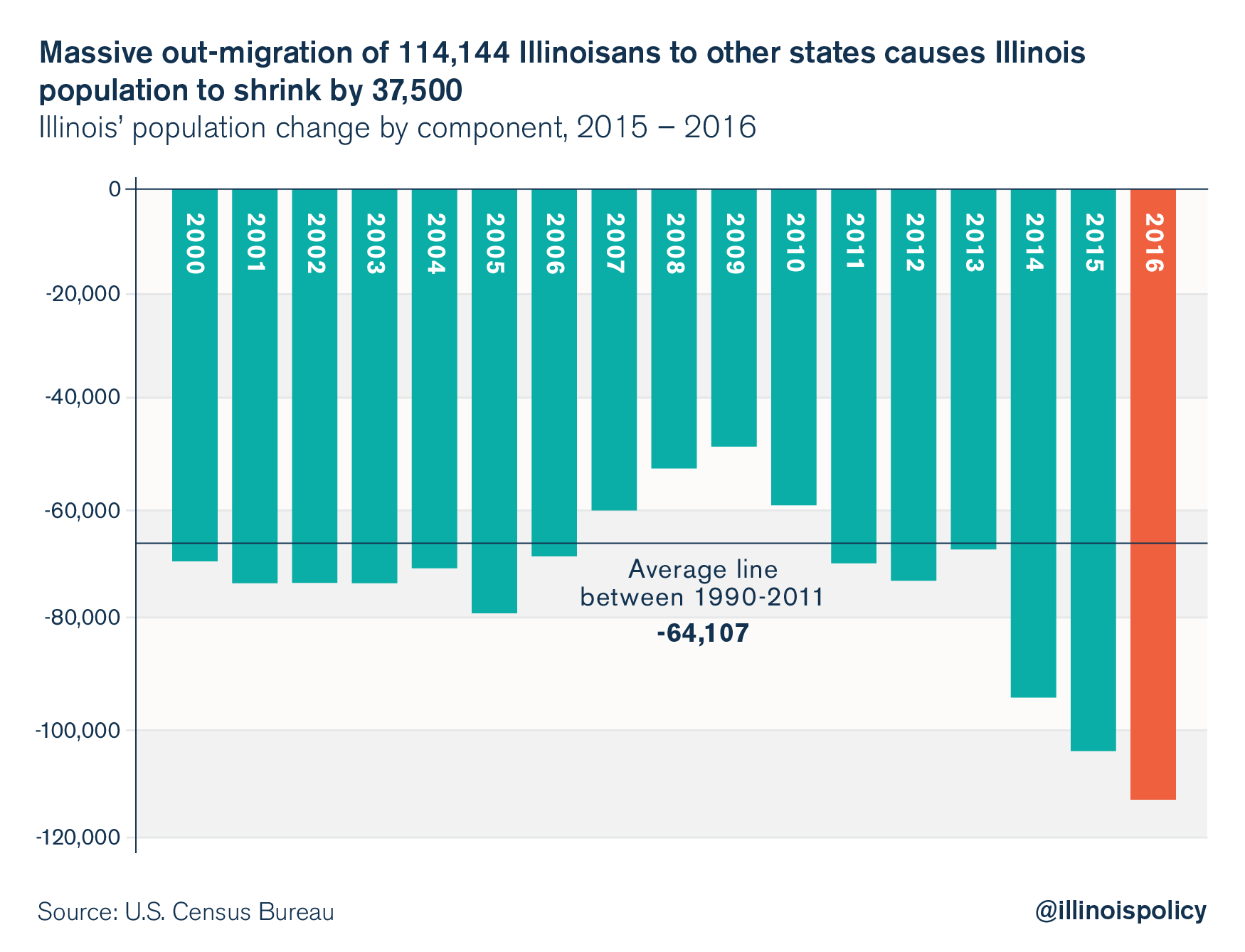

The most destructive legacy of the 2011 tax hike has been outmigration and the steady decay of Illinois’ tax base.

Residents have been leaving Illinois in record numbers. In fact, one Illinoisan left the state, on net, every 4.6 minutes in 2016.

Since the tax hike was enacted, a net 500,000 people have left Illinois, taking an estimated $20 billion in income with them.

As a result, Illinois’ population has actually shrunk for three years in a row, the only state in the Midwest to do so.

- Illinois’ pension crisis grew by $30 billion

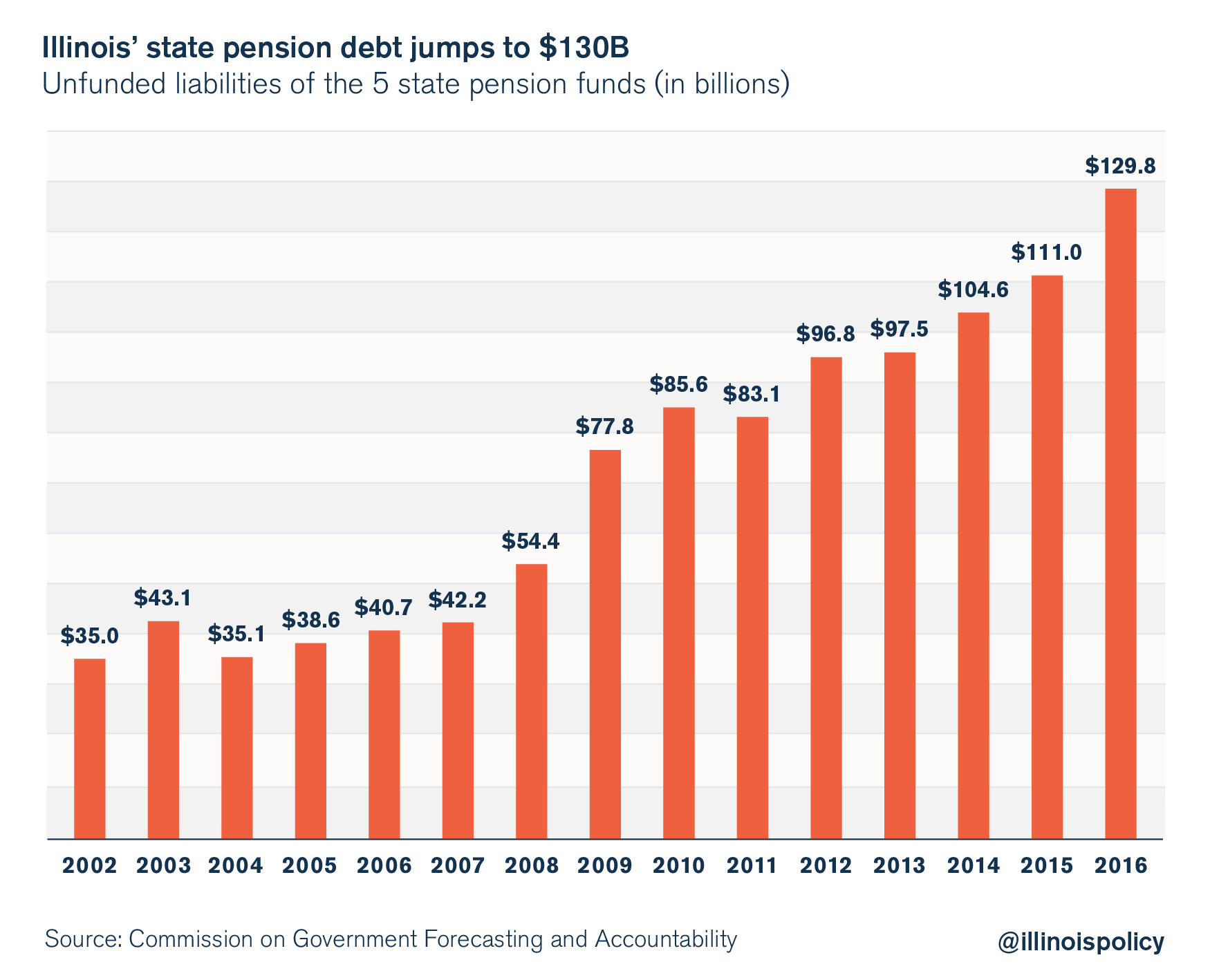

One of the justifications Illinois’ politicians gave for enacting the 2011 tax increase was that the money would help pay down a portion of the state’s pension debt.

To that end, politicians poured 90 percent of the tax hike’s $31 billion in revenue into the pension funds. The result: Illinois’ pension debt actually grew by $30 billion, to $111 billion in 2015 from $83 billion in 2011.

Today, the state’s pension funds are worse-off than ever before. Illinois’ pension debt stands at a record $130 billion and the pension funds have just 38 cents on hand for every dollar they need to pay out current and future benefits.

Pouring more money into the state’s broken pension system is clearly not the answer. Until state pensions undergo real reform, more and more state funding is going to be siphoned away from core spending – like K-12 and higher education – and toward the pension funds.

- Illinois’ unpaid bills remained unpaid

Paying down Illinois’ growing pile of unpaid bills was another justification for the 2011 tax hike. In 2011, Illinois had an $8.5 billion bill backlog that politicians in Springfield promised would be paid down.

But by 2014 – long before the current budget stalemate began – Illinois still had a $7 billion bill backlog.

For all the harm the income tax hike did to Illinois’ taxpayers and economy, the proceeds barely touched Illinois’ unpaid bills.

Illinois needs real reform, not tax hikes

The Civic Federation is pushing a proposal on taxpayers that its own private sector members would never follow.

A private sector firm would never invest capital in a corrupt, fiscally unsound company without first demanding major reforms, changes in governance, and additional oversight.

But that’s exactly what the Civic Federation is recommending to taxpayers: bail out the failed and irresponsible policies of Illinois’ political class that have nearly bankrupted the state. The Civic Federation is acting as an agent of the status quo – asking for more from taxpayers without demanding the reforms – fiscal, economic and governmental– that could actually change Illinois for the better.

The Civic Federation should demand Springfield enact necessary reforms first, before any additional tax hikes on Illinoisans are even discussed.

That’s exactly what the Institute’s Budget Solutions 2018 proposes – balancing Illinois’ budget through structural reform and not a dime in tax increases.