Déjà vu: Illinois faces $8.5 billion in unpaid bills and calls for a tax hike

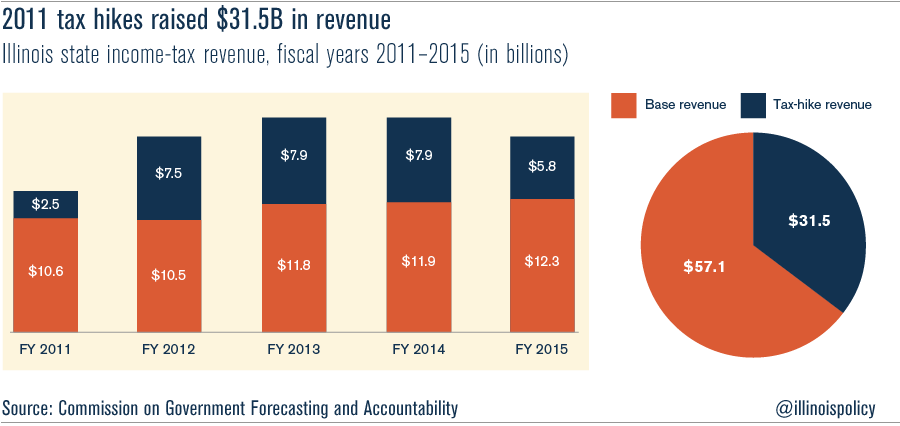

The 2011 income-tax hike was supposed to address the state’s unpaid bills and ailing government-worker pensions; but five years and $31 billion in additional revenues later, Illinois’ unpaid bills are back up to 2011 levels, and the state’s government-worker pension debt has soared to $111 billion.

According to the Illinois comptroller, the state’s official backlog of unpaid bills will reach $8.5 billion by the end of 2015 due to the current budget stalemate.

If that number sounds familiar, that’s because it’s the same amount of unpaid bills Illinois had backlogged in January 2011, the same month the General Assembly passed a record 67 percent personal-income and 46 percent corporate-income tax hike.

That combined tax increase was, according to politicians at the time, supposed to pay down the state’s bills and fix the pension crisis.

But the tax hike failed. Five years and $31 billion dollars in additional revenues later, Illinois is back to the same amount in unpaid bills and is experiencing a record $111 billion pension shortfall.

In the coming months, many lawmakers will suggest that another tax hike is necessary to fix the state’s budget crisis. Illinois House of Representatives Speaker Mike Madigan has already said just that.

But Illinoisans shouldn’t listen.

The result of the last tax increase has proved that more revenues won’t solve Illinois’ financial woes – they’ll only end up heaping an additional burden on struggling taxpayers.

Instead, Illinois must pass real spending, economic and pension reforms if it wants to get back on track.