Illinois’ pension debt grew by $25B during 2011 income tax hike

Despite $30 billion in extra tax revenue, the politicians who passed Illinois’ 2011 income tax hike failed to solve Illinois’ pension crisis or pay off the state’s bill backlog.

What happens when government hikes income taxes by 67 percent but never reforms spending?

When Illinois politicians increased income taxes in 2011, the state brought in more than $30 billion in additional income tax revenue, but continued running huge deficits and racking up more long-term debt.

After lame-duck politicians pushed through the tax hike on the last day of lame-duck session, the income tax rate rose to 5 percent from 3 percent for individuals and to 9.5 percent from 7.3 percent for corporations. Politicians sold the tax hike under the guise of tackling pension debt, fixing the economy, and paying down an $8 billion backlog of bills.

The tax hike ran from 2011 through 2014.

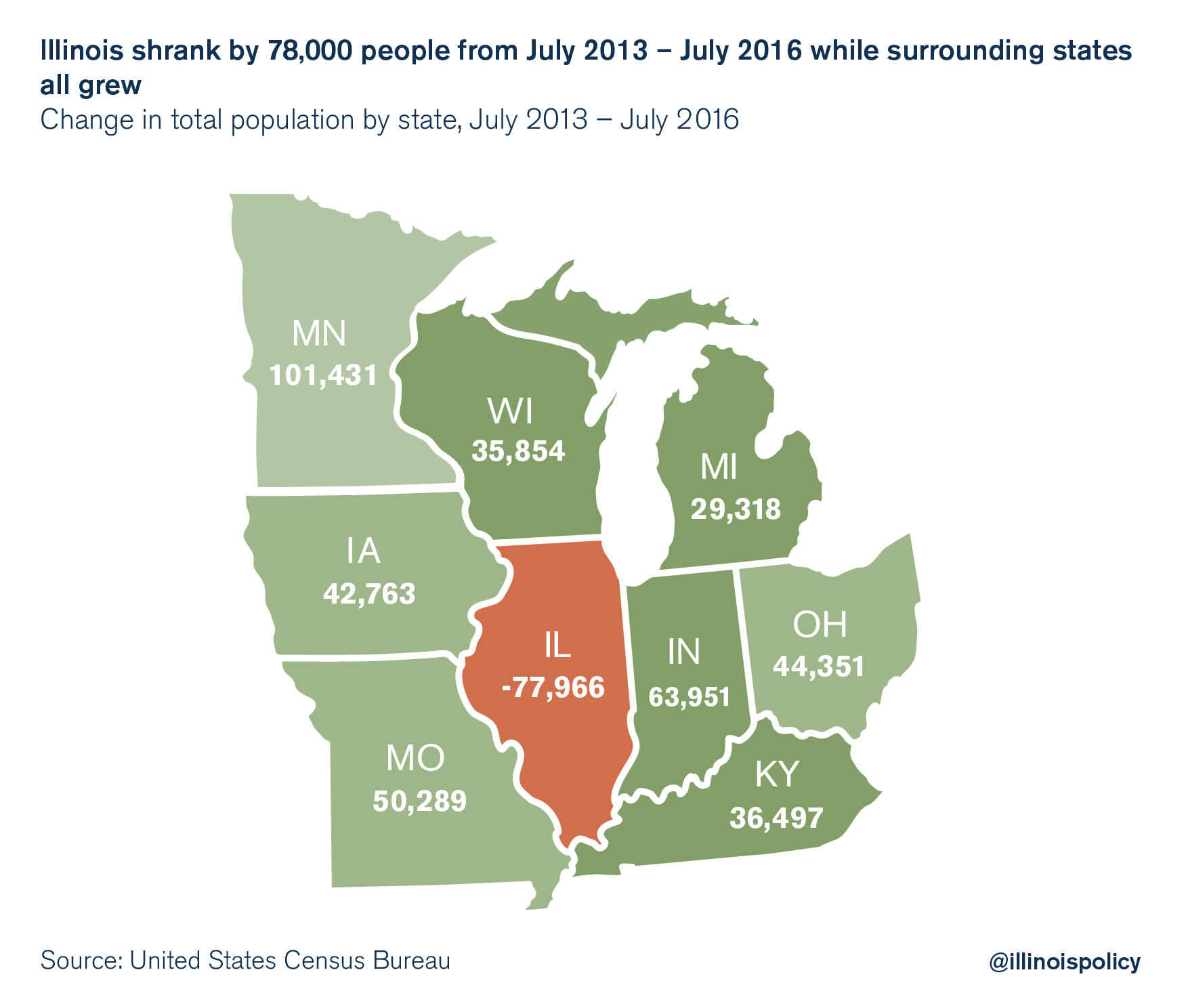

Yet after four years and nearly $32 billion in new tax revenue, Illinois’ economy was a wreck, and the backlog of bills still stood at $6.6 billion. Masses of people picked up and left the state. Illinois shrank every year from 2013-2016, and was the only Midwestern state to lose population on net.

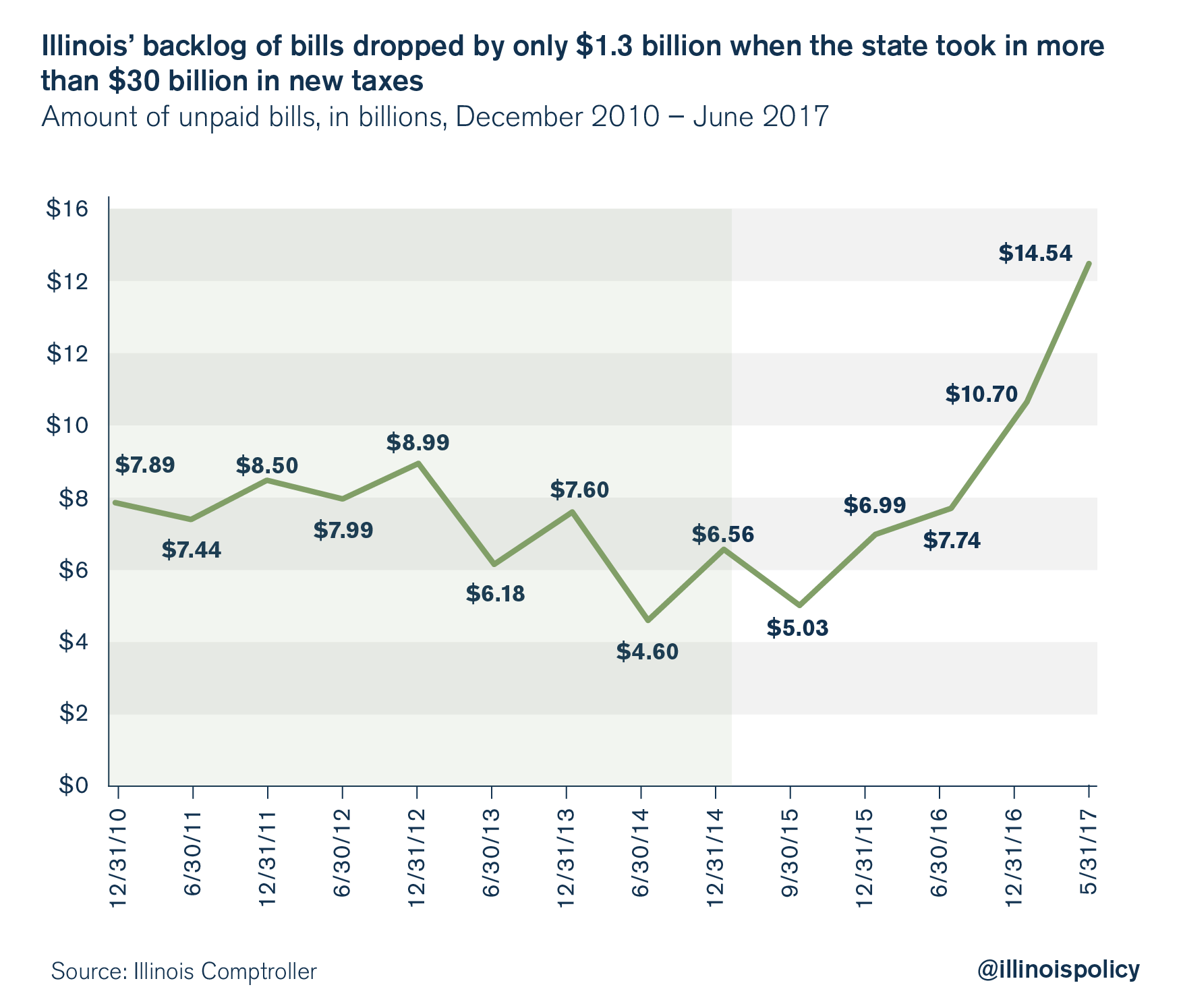

Politicians barely made a dent in Illinois’ unpaid bills

Illinois’ backlog of bills declined to $6.6 billion from $7.9 billion during the years of the tax increase.

That’s a measly $1.3 billion reduction in unpaid bills during a time when the state took in more than $30 billion of additional tax revenue, according to the Illinois comptroller’s website.

In other words, it took $31.6 billion of new tax revenue to reduce the backlog of bills by $1.3 billion.

Not only did the backlog of bills barely budge, but the pension debt also exploded.

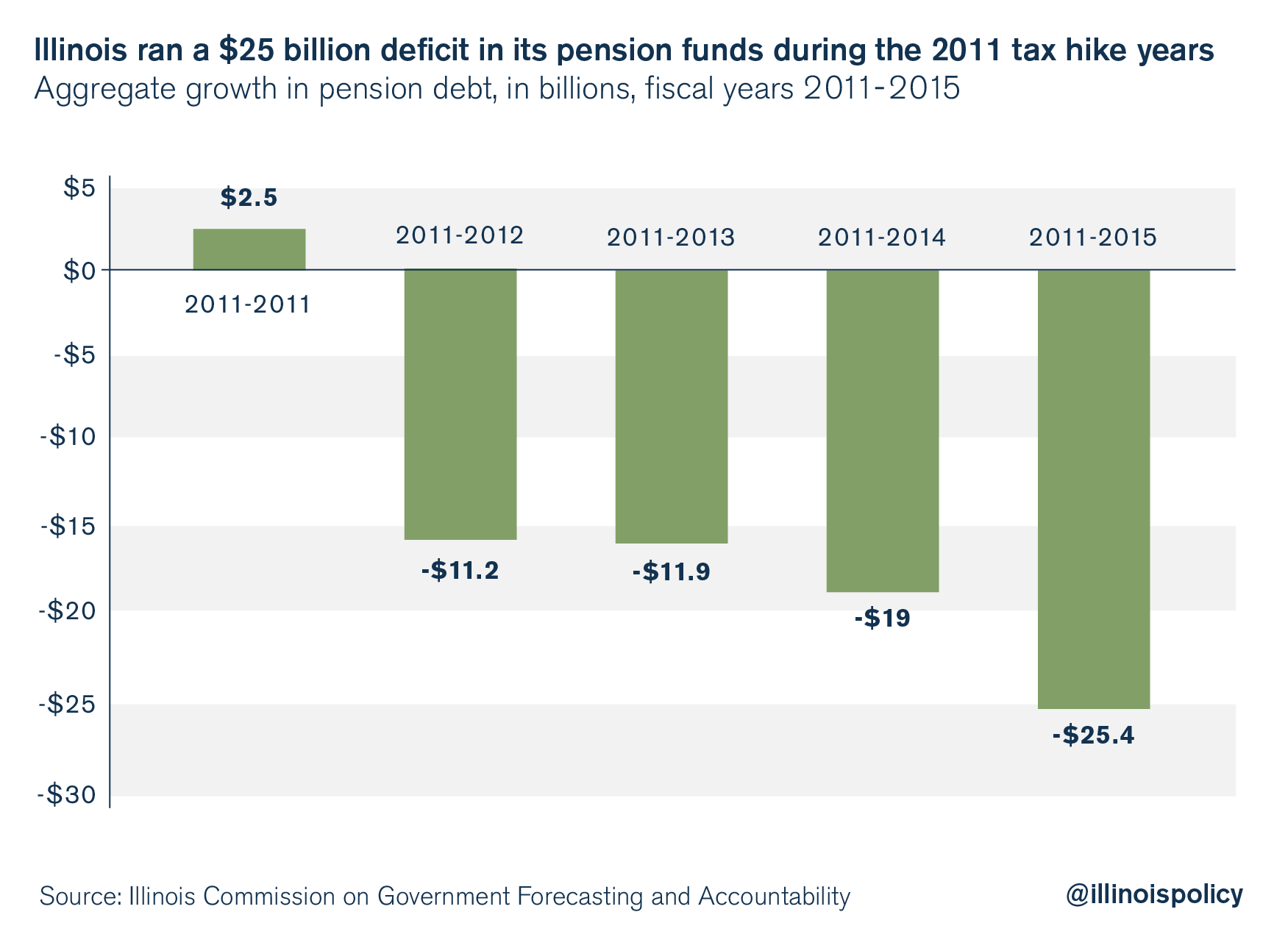

Illinois’ pension debt rose more than $25B from 2010 through 2015

Most of the new tax revenue from the 2011 tax hike was intended for pension payments, according to Illinois Senate President John Cullerton. And yet the pension debt exploded by $25 billion during the same time period, a deficit rate of $5 billion per year over five fiscal years.

The pension debt grew to $111 billion in fiscal year 2015 from $85.6 billion in fiscal year 2010. The aggregate pension deficit was $25 billion from fiscal year 2010 through fiscal year 2015, a rate of $5 billion per year.

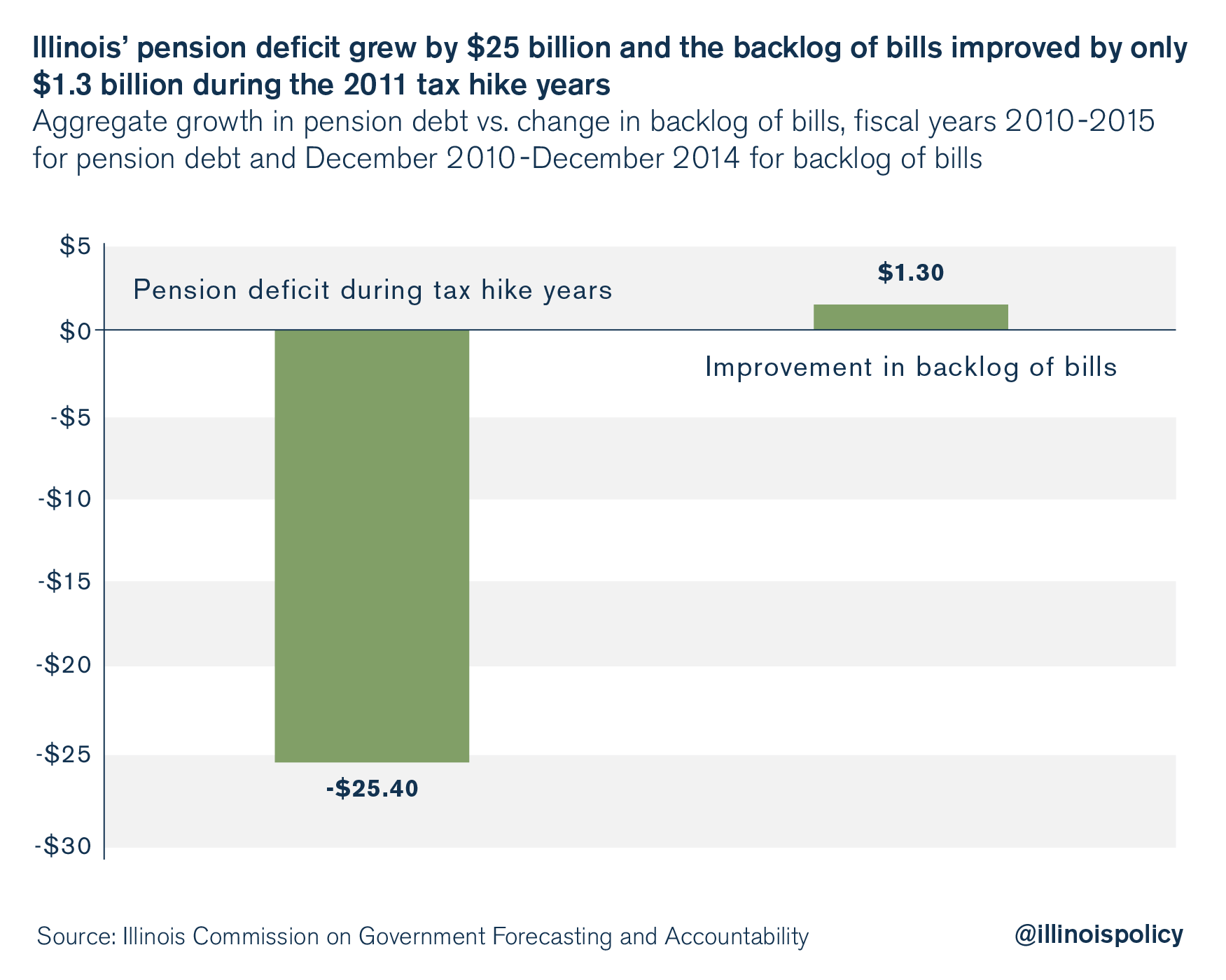

So while the backlog of bills declined by $1.3 billion, the pension deficit increased by $25 billion. Deficits exploded during the tax hike years because of Illinois’ incredibly bad debt math and failure to address spending drivers.

Illinois started shrinking during the 2011 income tax hike

Illinois’ deficits and long-term debts became substantially worse during the tax hike years. Tax increases could not solve a broken pension system and runaway spending. But one thing about the Land of Lincoln did change: The population started shrinking.

From July 2013 to July 2016, Illinois shrank by 78,000 people, while every state around Illinois and nearly every state in the country grew. The reason Illinois shrank is because so many people left for other states.

The 2011 income tax increase is not the only reason Illinois started shrinking, but it certainly made the problem worse. And nothing has been fixed. Illinois government has not made a good faith effort to get its finances in order by reforming pensions and rolling back the expensive perks that it has granted to special interest groups.

The majority of working-age Illinois voters want to leave the state, according to a fall 2016 poll released by the Paul Simon Public Policy Institute. Among all Illinoisans surveyed, the No. 1 reason cited for wanting to leave was taxes.

Only reform can save Illinois

The 2011 tax hike failed by all measures: It did not improve the economy, the backlog of bills barely budged, and the pension deficit exploded. Most importantly, the gusher of new tax revenue allowed Illinois politicians to kick the can down the road on reform – putting off the hard decisions for a later day.

Additional tax hikes should not even be a part of the discussion until spending reforms are put in place to make the state’s finances sustainable. At the current trajectory, Illinois’ debts can easily spiral out of control and become unpayable regardless of how much tax rates are increased.

Pensions need to be reformed, as do other major government spending drivers such as government union collective bargaining, Medicaid spending, prevailing wage rates, procurement and purchasing rules, and a bloated education bureaucracy.

Until government gets its house in order, the Illinois families who finance the government should reject any additional tax increases.