Illinois state and local governments spend most in nation on pensions

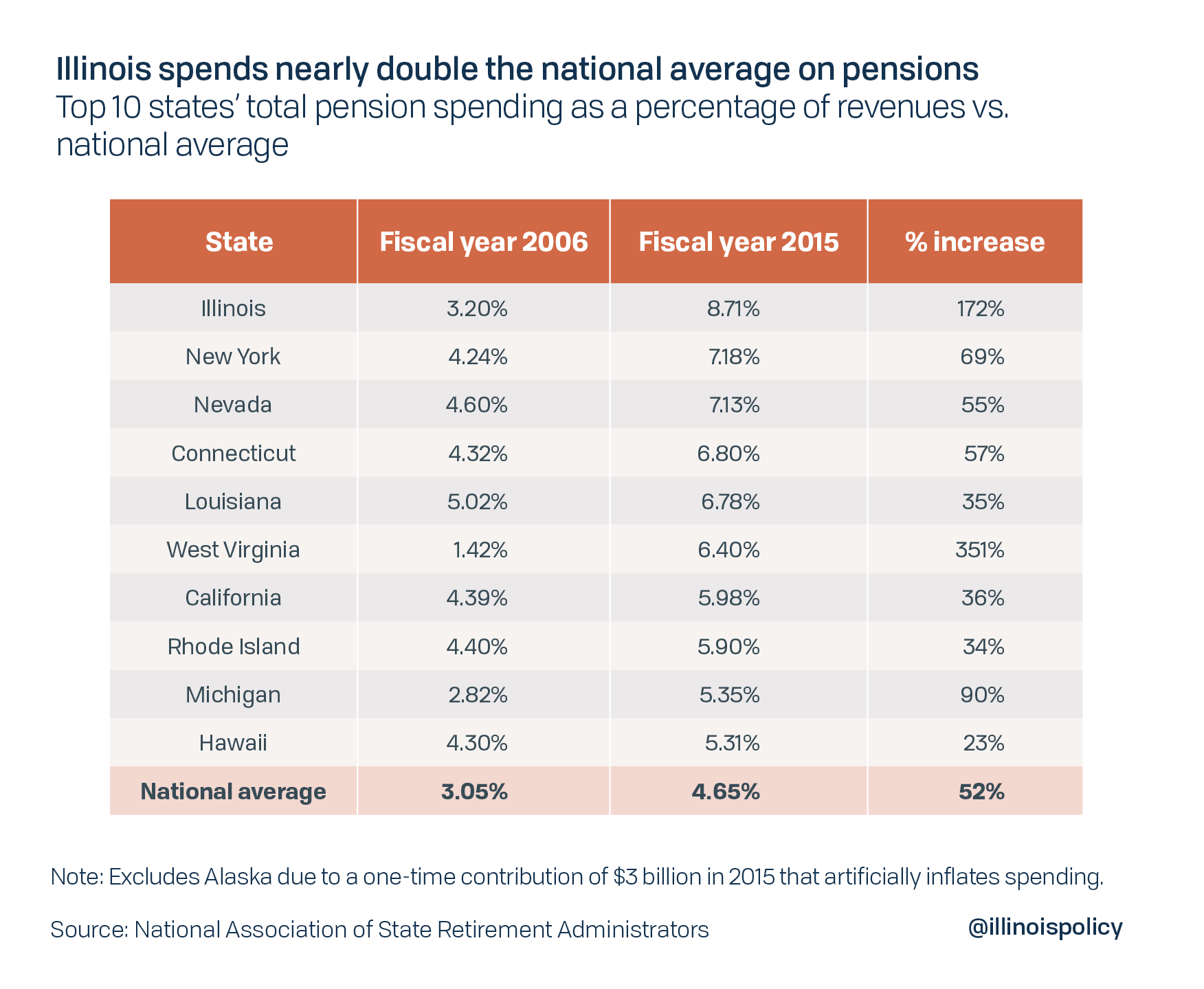

According to recent data, Illinois spends nearly double the national average on pensions, measured as a percentage of all state and local government spending.

Unfunded pensions for state and local government employees are a growing crisis nationwide. According to the Pew Charitable Trusts, the 50 states have accumulated a total of $1.4 trillion in unfunded pension liabilities, or the gap between money in pension funds and the value of promises made to government workers, not including local pension funds. Only four states’ pension funds have at least 90 percent funding ratios, despite the fact that taxpayer contributions have doubled over the past decade.

Many states are struggling with pension debt as a result of generous retirement benefits, unrealistic investment assumptions and a growing number of retirees living longer. However, Illinois’ pension crisis remains an outlier in its severity.

The most recent data from the National Association of State Retirement Administrators shows Illinois’ state and local governments spend the most in the nation on pension benefits as a percentage of all state and local revenue at 8.71 percent – nearly double the national average.

Illinois and West Virginia also stand out as states where pension spending has grown rapidly from fiscal year 2005 to 2015.

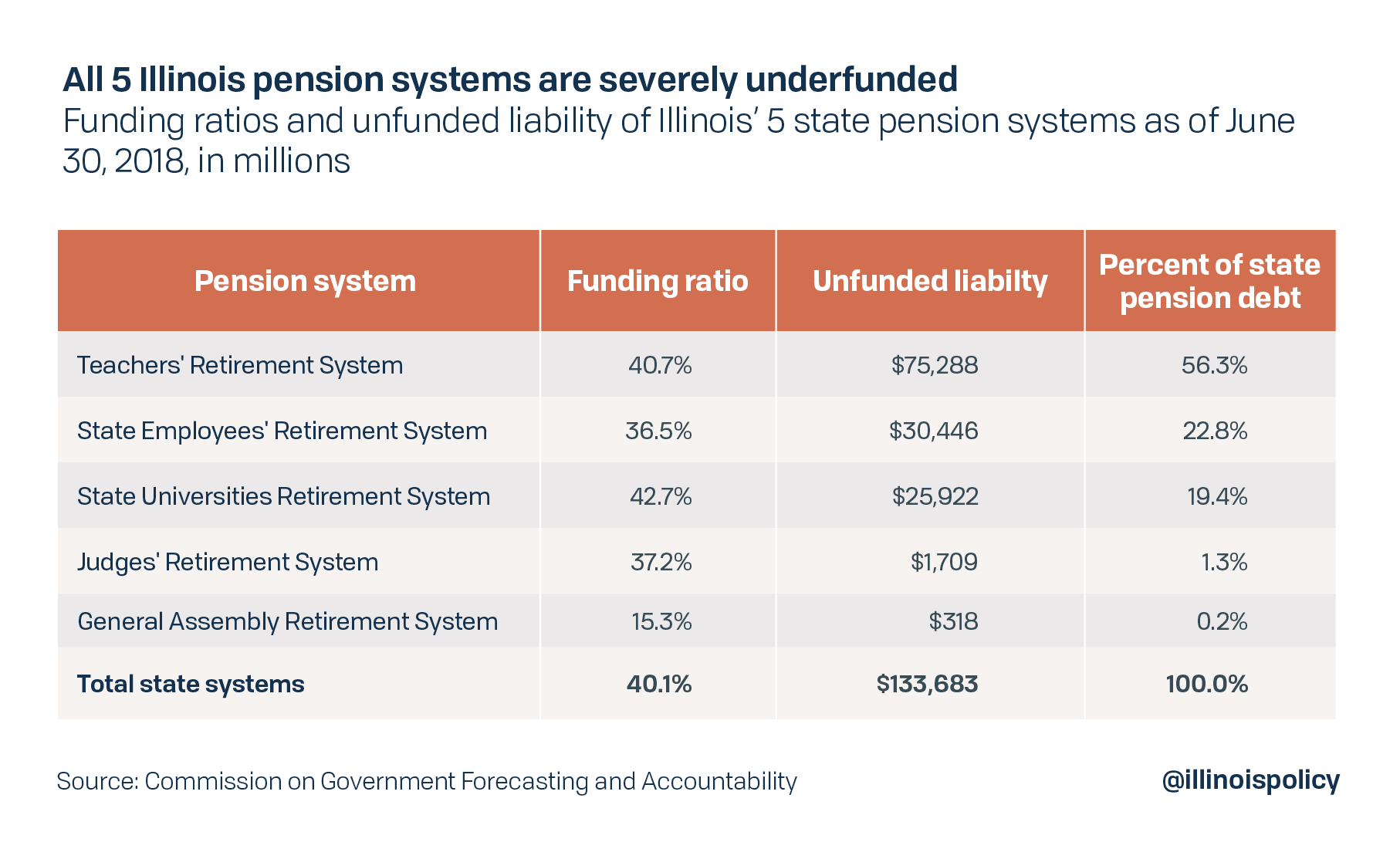

Total spending compared with total revenues is just one metric showing Illinois’ pension problem is the worst in the nation. Pension debt compared with revenues is another. Last year, Illinois set an all-time high record for state pension debt as a percentage of state revenues, at 601 percent.

The state’s five systems have at least $133 billion in pension debt, which does not even include local pension debt.

Pension-related expenditures now consume more than 25 percent of Illinois’ state budget, crowding out spending on social services, public safety and education.

In addition, a number of local governments are already hiking taxes and cutting core government services to pay for ever-rising pension contributions. For example, in 2018:

- The south Chicago suburb of Harvey faced an intercept of state money owed to the city and had to lay off 18 firefighters and 13 police officers. Pursuant to a subsequent settlement agreement, the city will divert certain tax revenues to its police and fire pension funds.

- Chicago faced a more limited intercept of state money, and its pension contributions are set to spike by more than $1 billion over the next five years, despite several tax and fee hikes enacted by Mayor Rahm Emanuel to pay for pensions.

- The city of Peoria had to eliminate 27 municipal workers and 38 public safety positions to make pension payments. Currently, 85 percent of the city’s property tax levy goes to pensions, and that’s projected to rise to 100 percent in fiscal year 2020.

- Rockford was advised to cut police and fire services and privatize the city water system to make pension payments.

- Three smaller communities saw special property tax hikes to pay for pensions: Jerome, Geneseo and Norridge.

Despite the severity of Illinois’ pension crisis, commonsense solutions exist that would protect both government workers’ retirement security and taxpayers.

By amending the state constitution to protect earned benefits, but allowing for changes in future benefit accruals, state lawmakers could pass a pension reform package that reduces annual pension contributions and fully funds the pension systems faster than planned under current law. This plan would enable state and local governments to honor promises made to both retirees and current workers – and would not cut a dime from their checks.

A growing chorus of voices has endorsed a constitutional amendment to enable meaningful pension reform. This includes outgoing Chicago Mayor Rahm Emanuel and the Civic Federation, a Chicago-based research organization.

Pension reform is necessary if lawmakers wish to protect those who will be most harmed by pension insolvency: government workers and retirees. Through meaningful reform, lawmakers would also protect taxpayers, stabilize state and local finances, and revive a state economy that for too long has been held back by tax hikes driven by pension costs.