Progressive income tax hike could be up to 47% for Illinois small businesses

Small businesses face a potential income tax hike nearly 5 times larger than corporations under Gov. J.B. Pritzker’s “fair tax” amendment.

Illinois Gov. J.B. Pritzker has extended his stay-at-home order to at least the end of May in order to combat the spread of COVID-19. The extension means many small businesses will remain shuttered, with their odds of long-term survival dropping daily.

At the same time, the governor is doubling his push to scrap Illinois’ constitutionally protected flat income tax and enact a progressive income tax hike expected to take $3.7 billion a year from the Illinois economy. In an April 15 press conference, NBC-5 reporter Mary Ann Ahern asked Pritzker if it was time to reconsider his progressive income tax hike. Instead of considering the possibility of removing the amendment from the November ballot, the governor said Illinois “need[s] it now more than ever.”

But the income tax hike would hit the state’s largest job creators – small businesses – the hardest.

“I believe that if they impose the progressive tax you will see even more people leave the state,” said Michael Patricoski, a dentist from Palos Heights. “You could never run a business as the state runs using our money. They think it is an unending wallet upon which they can draw money from. You cannot continue to outspend your revenue.”

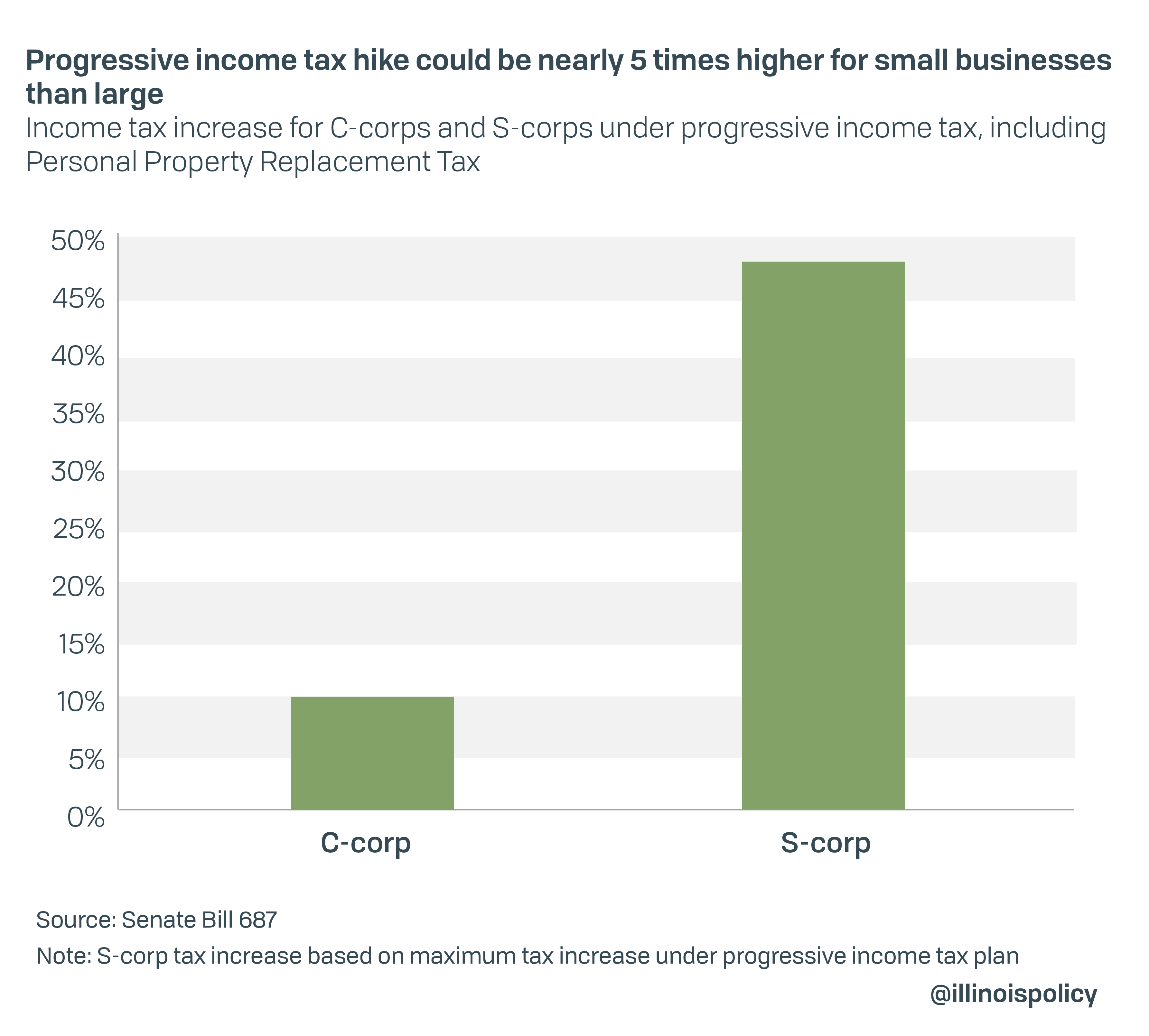

Small businesses are responsible for 60% of the net job creation in Illinois and are the businesses most at risk from the economic fallout of COVID-19. Unfortunately, the progressive income tax hike would be the largest for these businesses. Small businesses could face an income tax hike nearly five times larger than that for large businesses.

While the total corporate income tax rate – including the Personal Property Replacement Tax – will be hiked by 10% (from 9.5% to 10.49% when including the replacement tax), the tax hike for pass-throughs could be up to 47% (6.45% to 9.49% when including the replacement tax).

New research shows fewer than half of all U.S. small businesses expect to re-open this year if the crisis lasts more than four months. For the small businesses that do manage to survive, the last thing their owners and employees need is a tax hike to crush them while they’re attempting to get back on their feet.

“The things [the state] has done recently tax-wise, lord have mercy. What’s left to tax?” said Dave Jordan, owner of The Wagon restaurant in Decatur, Illinois. “You put this progressive income tax on the ballot – you don’t see how that’s going to make things better. The old saying, you can’t tax your way out of poverty … or into prosperity. It’s a cliché but it’s true.

Research has shown that an increase in the top marginal tax rate is associated with a decrease in hiring activity of entrepreneurs and lower wages for their employees.

Without continued relief provisions from the state government, businesses will struggle to survive, and job creation in Illinois will remain subdued as other states do their best to recover.

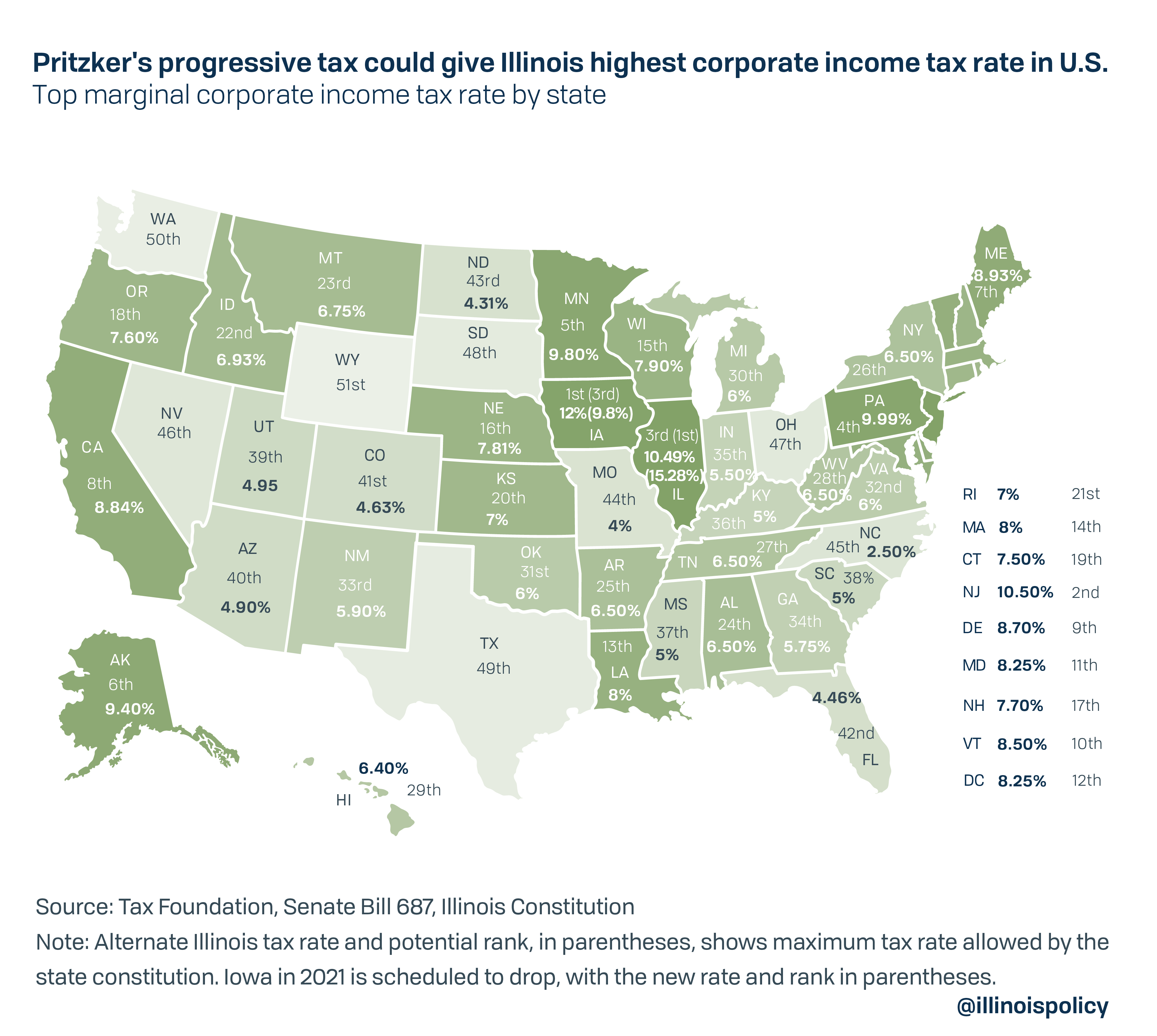

All of this is not to say that larger businesses are getting off unharmed in this proposal, either. Beyond the hike on pass-through business income, Pritzker’s progressive income package would also hike Illinois’ total corporate income tax rate by 10% to at least 10.49%, and the state constitution would allow for a corporate tax rate as high as 15.28% under the proposed rates.

For context, the nation’s highest marginal corporate income tax rate is 12% in Iowa, according to the Tax Foundation. And that’s scheduled to drop to 9.8% in 2021. The second-highest is New Jersey at 10.5%, putting Illinois in a virtual tie for the highest tax on business income should Pritzker’s new rates take effect.

Economists are in near-unanimous agreement: reducing the harm of recessions requires expansionary monetary and fiscal policy. That means avoiding tax hikes while continuing to fund the programs Illinoisans truly need. Instead of enacting a dangerous income tax hike that would hit small businesses the hardest and would kneecap any potential economic recovery, Illinois should protect its flat income tax and lawmakers should back the resolution introduced May 18, House Joint Resolution 123, to remove the question from the ballot.

Contrary to the governor’s claims, a progressive income tax hike is the exact opposite of what Illinois lawmakers should be doing in the midst of the COVID-19 crisis that has put over 1 million Illinoisans out of work, and after the first year on record in which Illinois lost private-sector jobs amid a national boom.