The history of Illinois’ fiscal crisis

By Ted Dabrowski, John Klingner

The history of Illinois’ fiscal crisis

By Ted Dabrowski, John Klingner

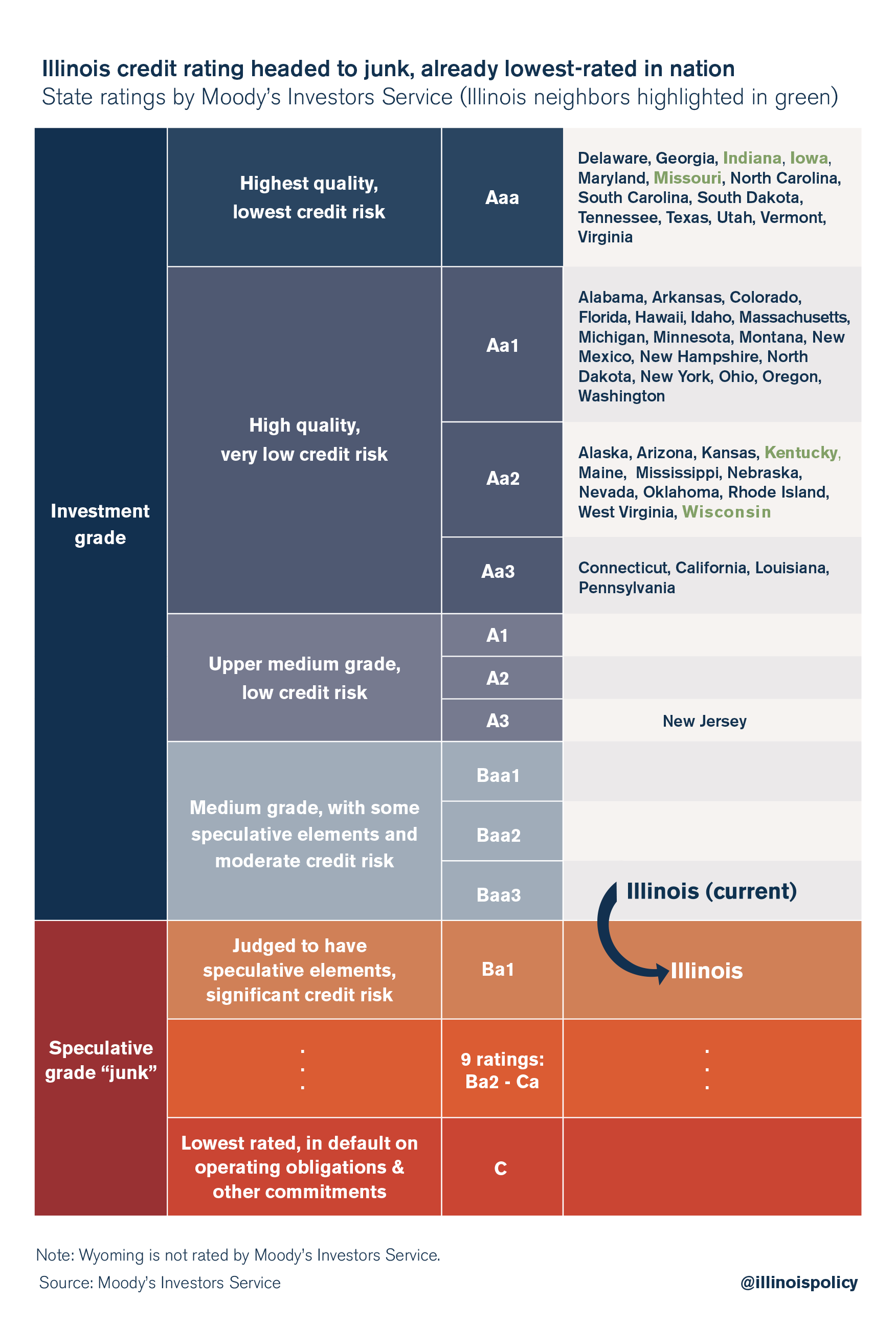

Illinoisans have experienced two difficult and chaotic years without a functioning state budget. The state can’t pay its bills, social services are shutting down and some universities are even threatening to close. The state’s credit rating, a proxy for the state’s overall reputation, is just one notch away from being rated junk.

The message Illinoisans will hear from many lawmakers is that Illinois’ dysfunction is the fault of the two-year budget impasse. They’ll be told that the crisis Illinois faces is due solely to the stalemate between Gov. Bruce Rauner and House Speaker Mike Madigan.

But Illinois’ fiscal crisis began years before the budget impasse.

The state’s fiscal collapse is the culmination of years, even decades, of budget gimmicks papered over Illinois’ structural spending problems, along with misplaced spending priorities that favor special interests over the people.

State politicians have used all sorts of loopholes, from pension ramps to issuing pension obligation bonds to temporary tax hikes to help “balance” the budget without reforms. And they’ve helped politicians from both parties preserve the status quo. Keeping the budget “balanced” meant lawmakers could spend more on their misplaced priorities.

The budgets under former Gov. Pat Quinn, for example, were “balanced” because of billions in borrowing, taxing and other budgetary maneuvers. Those maneuvers allowed lawmakers to avoid fixes to spending drivers such as pensions, government worker health care and local government subsidies.

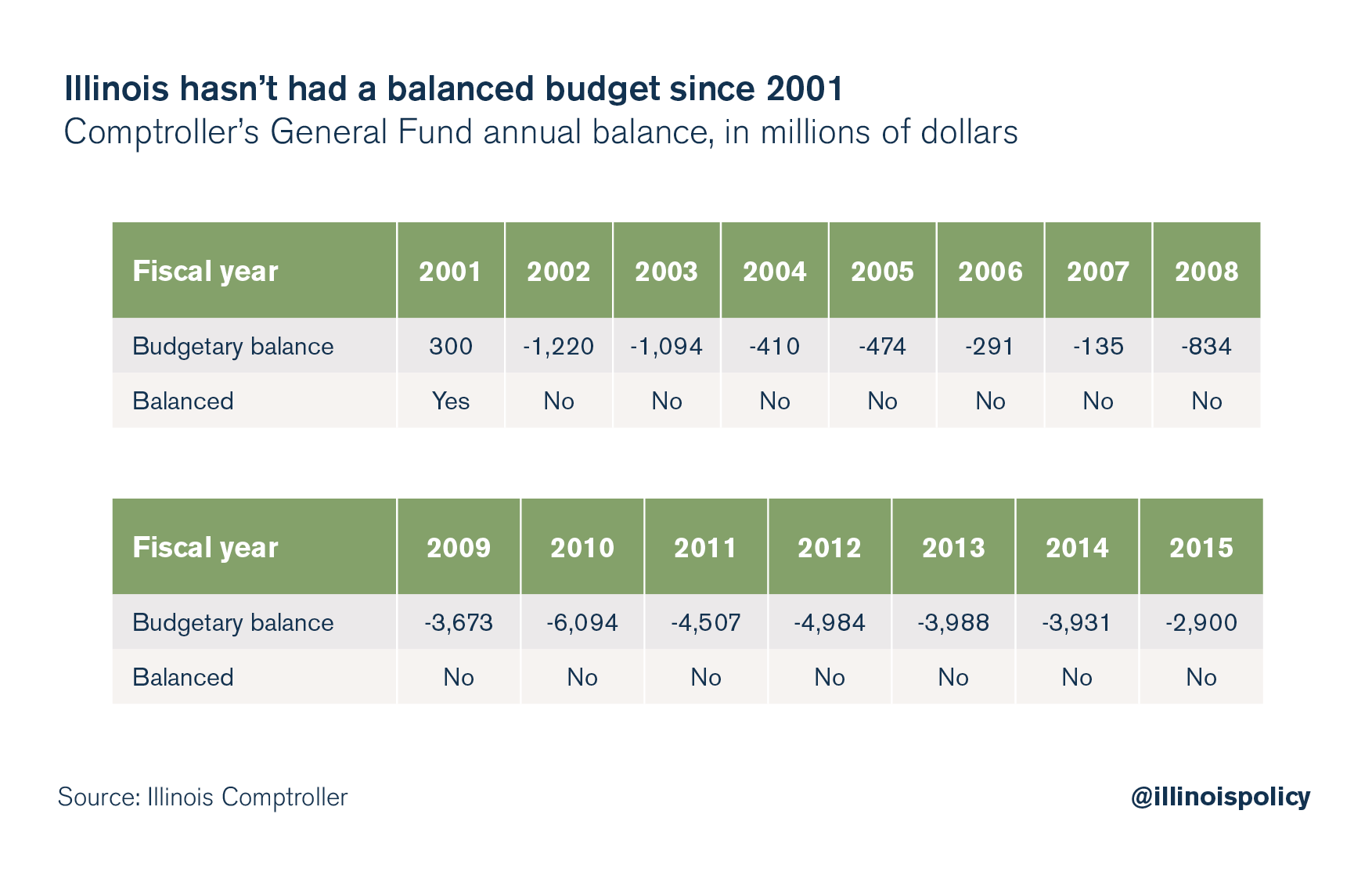

But the pattern of avoiding reform goes much further back. Former Gov. Jim Edgar in 1994 crafted a pension funding “ramp” that encouraged politicians’ bad habit of kicking the can down the road. And Illinois hasn’t balanced its budget since 2001, according to information from the state comptroller. Each year, lawmakers’ spending plans never left room to pay off the previous year’s unpaid bills.

Even 2011’s record temporary income tax hike only served to deepen Illinois’ crisis. Lawmakers promised a stable pension system, an elimination of the state’s unpaid bills, and a stronger economy. Instead, the General Assembly simply spent the money and left Illinois on a budgetary cliff.

Today, politicians have run out of ways to avoid reforms and paper over the crisis.

It’s become too hard to pass tax hikes because Illinoisans don’t want and can’t afford them. Borrowing is too difficult because the rating agencies are watching. And everybody is onto the gimmicks. All the while, Illinoisans are leaving in record numbers.

The only real and sustainable fix is structural reforms. A real budget – one that balances Illinois’ budget with structural reforms instead of tax hikes – is the solution Illinois needs.

Here are the facts on what has led Illinois to its current fiscal crisis.

Budgets during the Quinn administration

Critics of the current impasse point to the budgets approved during Quinn’s tenure as proof that the budget process was just fine until Rauner took office.

But the budgets the General Assembly passed during the Quinn administration were often built using gimmicks that ignored – or perpetuated – the state’s growing crisis.

2009, 2010 budgets borrowed to cover for pensions

In 2008 and 2009, Illinois’ pension contributions began to spike due to growing Edgar ramp requirements. Rather than reform pensions, Quinn resorted to taking out more debt to make the state’s 2010 and 2011 budgets balance.

Quinn took a page out of former Gov. Rod Blagojevich’s playbook and borrowed $3.5 billion to make the state’s required pension payment in 2010. He did the same the next year, borrowing another $3.7 billion.

In both cases, the borrowing exposed a fundamental flaw in Illinois’ balanced budget requirement: Proceeds from borrowing can count as budgetary revenue.

Billions in debt let Illinois politicians present a balanced budget. But the reality is Quinn’s borrowing shifted the state’s current-year obligations from the pension system to long-term bond repayments, spreading the burden to future taxpayers.

2011’s budget gimmick

In 2011, the General Assembly passed, and Quinn signed, a budget they claimed was balanced.

But the Illinois Policy Institute uncovered over $1 billion in additional, unfunded spending in the budget relating to Medicaid and other health care payments. Lawmakers extended the payment period of health care bills into the next fiscal year, then appropriated less funding to pay the remaining bills. That move allowed lawmakers to declare the 2011 budget “balanced.”

Lawmakers called that reduction in funding a “cut.” In reality, as the media and policymakers finally realized, it was really an increase in the state’s unpaid bills.

2015’s incomplete budget

When the state legislature passed its fiscal year 2015 budget, it ignored that the state’s temporary tax hike was set to expire in the middle of that fiscal year. The General Assembly deliberately sent Quinn a budget that was clearly out of balance.

“The General Assembly didn’t get the job done on the budget,” Quinn said at the time, according to the Chicago Tribune. “The General Assembly sent me an incomplete budget that does not pay down the bills but instead postpones the tough decisions.”

Some state agencies expected to run out of money halfway through that year. Unfunded spending built up a more than $1 billion year-end deficit.

The budget didn’t “balance” until Rauner – then newly elected – and Madigan approved $1.3 billion in fund sweeps and $300 million in cuts to education and other programs.

Illinois hasn’t had a true balanced budget since 2001

Even before Quinn came into office, lawmakers refused to enact spending reforms and live within the state’s means.

Their misplaced spending priorities and commitment to the status quo let them consistently overspend and pass unbalanced budgets – despite the state’s constitutional requirement of a balanced budget.

In fact, the last year Illinois had a balanced budget was in 2001, according to the Illinois comptroller.

Illinois politicians constantly used financial gimmicks – such as shifting funds and pushing off unpaid bills into the next year – to get around the balanced budget requirement.

And they never left enough room in the current year to pay down the previous year’s unpaid bills.

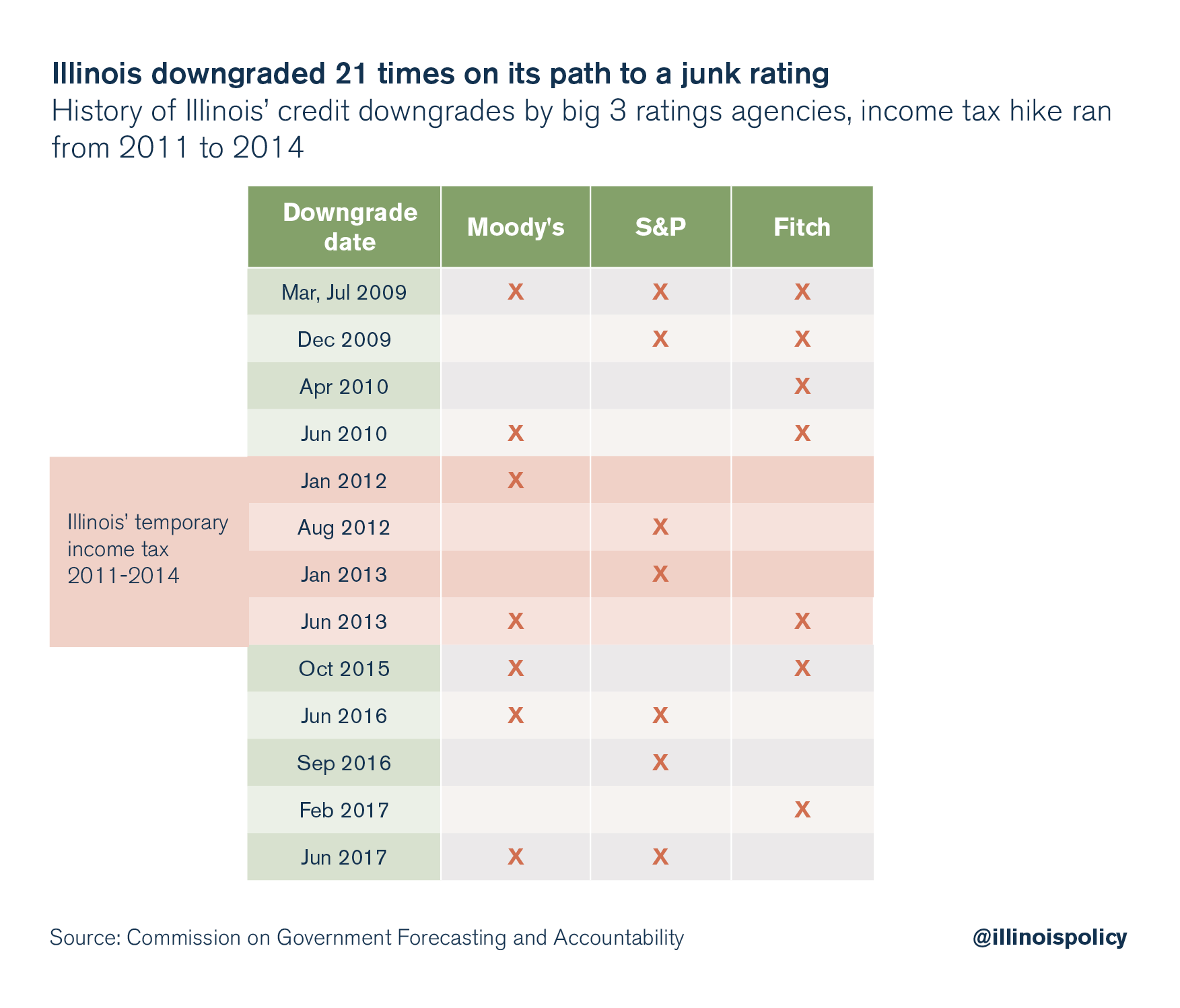

The accumulated effect of lawmakers’ financial games, however, did not escape the notice of the nation’s credit rating agencies.

Illinois’ credit rating was downgraded 13 times from 2009 through 2014. By 2010, Illinois was already the worst-rated state in the nation.

Since then, the stalemate has only served to highlight the depth of Illinois’ structural spending problems. The state’s credit rating has been downgraded further and is only one notch above junk status.

2011 tax hike only made the crisis worse

Even politicians’ go-to solution to Illinois’ financial crises – tax hikes – only succeeded in making the state’s problems worse.

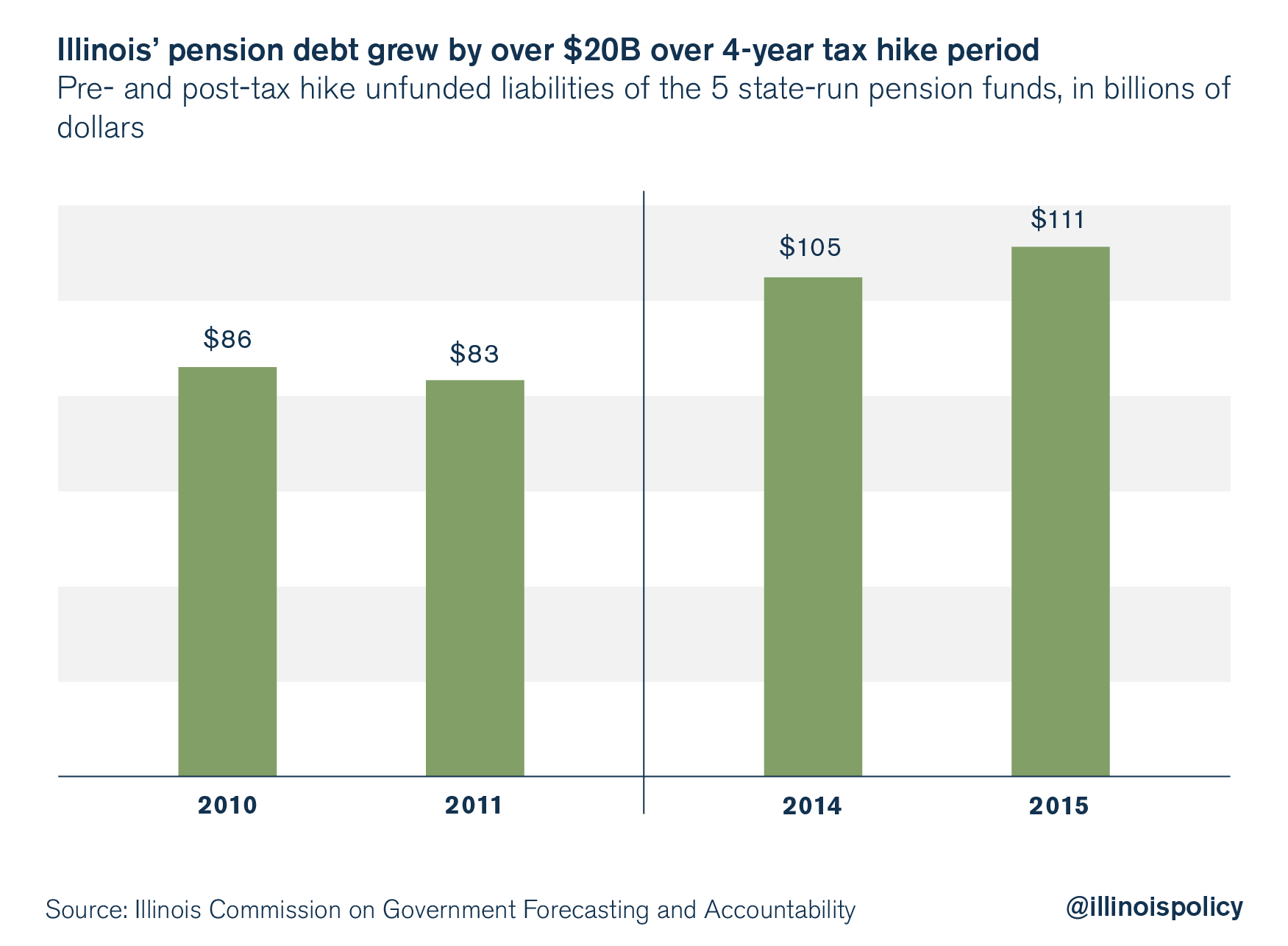

In 2011, Illinois politicians enacted a record 67 percent income tax hike on individuals and a 46 percent corporate income tax hike. Springfield politicians promised the additional revenue would stabilize the pension crisis, pay down the state’s unpaid bills and help the economy.

The tax hike took an additional $32 billion from taxpayers’ wallets from 2011 through 2014. Yet none of the politicians’ promises came true.

The state’s bills weren’t paid off. Instead, they were reduced by less than $2 billion. The state still had $6.6 billion in unpaid bills to go when the tax hike expired.

Illinois also suffered one of the weakest economic recoveries in the nation. The state’s manufacturing base collapsed and never recovered as in neighboring states. In fact, Illinois still has fewer jobs now than it did in the year 2000.

And Illinois’ pensions didn’t get any better. The debt taxpayers owe worsened by more than $20 billion over the four-year tax hike period.

That $20 billion-plus increase occurred despite the fact that most, if not all, of the tax hike went to pay for Illinois’ growing pension costs.

Prior to the tax hike, politicians had put off dealing with the state’s growing pension crisis by borrowing. Blagojevich issued a massive $10 billion pension bond in 2003 to paper over the problem.

Quinn then borrowed a total of $7 billion to pay for pensions in 2010 and 2011. Required pension contributions jumped from 2007 to 2009, putting even more pressure on the budget in the absence of reforms.

And when borrowing was no longer an option, the General Assembly passed the temporary income tax hike under the pretense it would fix many of Illinois’ woes.

According to Senate President John Cullerton, at least 90 percent of the tax hike revenues – out of a total of $32 billion – went to fund the state’s growing pension obligations.

New money didn’t solve Illinois’ finances. Instead, it relieved Illinois lawmakers from pressure to enact needed spending reforms.

Lawmakers simply spent the money and left Illinois on a budgetary cliff when the tax hike expired.

That’s why the state’s credit rating suffered. Illinois was downgraded five times from 2011 through 2014, meaning rating agencies wanted to see structural changes, not just more revenues.

The growth in politicians’ misplaced priorities

Illinois politicians have resisted major spending and pension reforms, meaning much of Illinois’ spending is programmed to rise automatically. As a result, the major cost drivers, including pensions, state worker benefits and Medicaid have crowded out core government services.

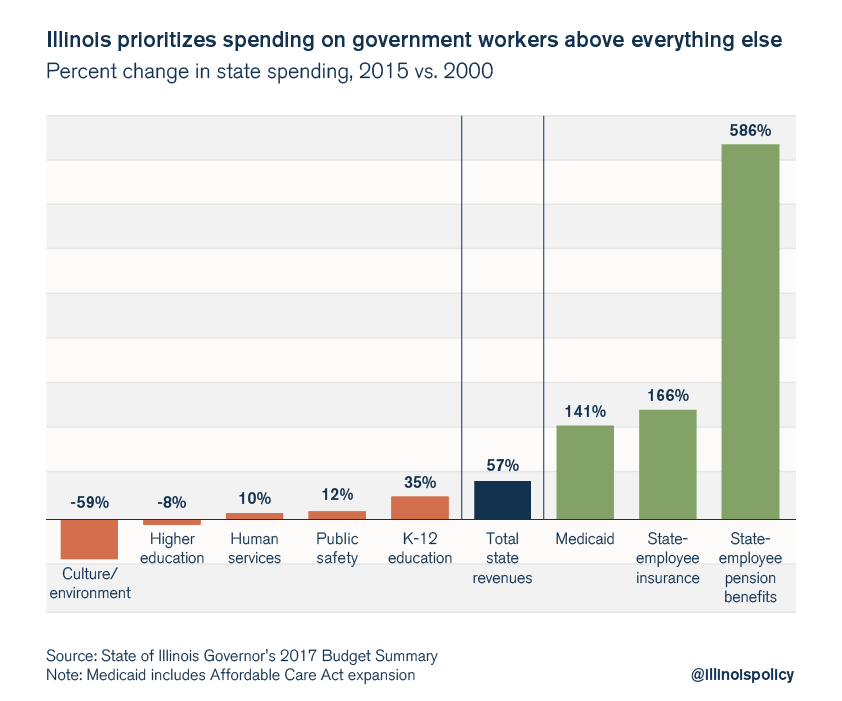

Take spending since the turn of the century.

In 2015, the state revenues were up $13 billion, or 57 percent more, than in 2000 – a healthy 3.1 percent increase each year.

Unfortunately, skyrocketing pension costs, up $6 billion, and state employee insurance costs, up more than $1 billion, consumed nearly 60 percent of that total increase.

Meanwhile, spending for higher education, social services and K-12 education all suffered.

Tax hike proponents will argue that additional tax revenues will solve this problem, but tax increases cannot solve this pattern of misplaced priorities. The budgets of the last 15 years show that, despite more than adequate tax revenues, Illinois politicians will avoid reforms and overspend on their favored programs, rather than provide for the social and core services they verbally champion.

Structural reforms are the only solution to Illinois’ crisis

The repeated use of budgetary gimmicks, debt and more taxes has gotten Illinois into its current mess. Only when lawmakers stop resorting to those tactics can Illinois begin to turn around.

Illinoisans agree with that. Fabrizio, Lee & Associates conducted an Illinois Policy Institute-commissioned survey in February, which found nearly 80 percent of Illinoisans surveyed agree that “Illinois state lawmakers should pass major structural reforms before passing any tax increase.”

Illinoisans need a comprehensive reform budget that includes not just a property tax freeze, but reforms to pensions, Medicaid, higher education and state worker compensation. The state can’t leave those fixes for later – certainly not if it means higher taxes and more gimmicks.

That’s why the Illinois Policy Institute has a plan that reforms more than $7 billion in spending.

It gives Illinoisans what they’re looking for – a balanced budget without tax hikes.