QUOTE OF THE DAY

Belleville News Democrat: Tight Illinois budget still contains pet projects

The new state budget signed by Gov. Pat Quinn last week left lawmakers from both parties unhappy — but it didn’t leave them empty-handed.

Among expenses in the $35.7 billion spending plan, tucked into a document thousands of pages long, are millions of dollars for pet projects statewide. They range from a new school in House Speaker Michael Madigan’s Chicago district to money to promote a racetrack near St. Louis and funds to begin planning Illinois’ 200th birthday celebration — scheduled for 2018.

The items are part of a 2015 budget that legislators admit doesn’t include enough revenue to cover the state’s regular spending needs. Lawmakers defend the extras, saying they were for projects already in the works or badly needed for job creation and other purposes.

WirePoints: A Staggering Pension Decision Takes Illinois to the Brink

With the stroke of a pen last week the Illinois Supreme Court made subsidized healthcare insurance for public pensioners a constitutionally unalterable right.

In an instant, its decision in Kanerva v. Weems expanded the unfunded pension liabilities to which the state constitutional ban on benefit reductions applies by at least fifty percent — over $50 billion. That’s just for the six state pensions. The ruling will apply, however, to the other roughly 650 public pensions in Illinois, including Chicago’s. The total dollar impact on them isn’t available yet and it’s not in the court’s opinion because cost doesn’t matter, they clearly said, but we’ll soon see estimates that no doubt will exceed $100 billion for the state as a whole.

When has any state court imposed so large a cost on its other branches of government? Until last week, healthcare subsidies for pensioners were widely presumed to be discretionary and likely to be cut. The impact of making them unalterable is as unprecedented as it is overwhelming.

Politico: Why liberals are abandoning the Obamacare employer mandate

Robert Gibbs’ prediction that Obamacare’s employer mandate would — and perhaps should — be jettisoned shocked Democrats back in April.

By July, the former aide and longtime confidant of President Barack Obama had a lot more company. More and more liberal activists and policy experts who help shape Democratic thinking on health care have concluded that penalizing businesses if they don’t offer health insurance is an unnecessary element of the Affordable Care Act that may do more harm than good. Among them are experts at the Urban Institute and the Commonwealth Fund and prominent academics like legal scholar Tim Jost.

The employer mandate, Jost wrote in a Health Affairs post in June, “cries out for repair.” Repealing it “might not be such a bad idea,” if it’s replaced with something better for workers and businesses.

Crain’s : Pension chaos hits Chicago, Illinois budgets

The fireworks won’t officially fly until tonight, but yesterday’s decision in a key Illinois Supreme Court case has set off a first-class explosion in state and local government, potentially punching tens of billions of dollars in holes in their collective budgets.

Some elements of the court’s decision are drawing intense debate. But if the overnight consensus is anywhere near correct, everyone from City Hall and the Capitol to your local village and school board will have little option now but to dig deep, cut services and raise taxes a lot — and labor unions little incentive to compromise.

“The law in Illinois is now crystal clear: Politicians cannot break the promises made to Chicago teachers and other city employees,” crowed the Chicago Teachers Union in a statement. “Recently passed laws to cut promised retirement benefits are clearly unconstitutional.”

WSJ: Who Really Gets the Minimum Wage

President Obama is pushing hard for an increase in the federal minimum wage to $10.10, from $7.25. State and local governments have jumped on the bandwagon. Massachusetts has passed a minimum of $11, the highest state minimum in the country, and Seattle’s City Council has voted to raise the wage floor to $15 an hour over seven years; San Francisco is considering a hike to $15 too. The president and others argue that a higher minimum wage is needed to help poor and low-income families, who have suffered from stagnating wages and rising income inequality. But a higher minimum wage would do little for such families.

A higher minimum wage raises wages of low-wage workers, and even though most evidence points to job losses from higher minimum wages, the evidence doesn’t point to widespread employment declines. Thus, consistent with a recent Congressional Budget Office report, many more low-wage workers will get a raise than will lose their jobs. But that argument is about low-wage workers, not low-income families. Minimum wages are ineffective at helping poor families because such a small share of the benefits flow to them.

One might think that low-wage workers and low-income families are the same. But data from the U.S. Census Bureau show that there is only a weak relationship between being a low-wage worker and being poor, for three reasons.

CNBC: America’s 10 worst states to live in

There are many ideal places around the country to raise a family, get a job and have a great recreational lifestyle. Then there are the states mired in problems that don’t get high marks for quality of life in America’s Top States for Business. We look at several factors—including crime rate, local attractions, health care and the environment—for the ranking. These 10 states rank last. If you call one of them home, you may disagree. But by the objective measures we consider in our Quality of Life category, these states have plenty of room for improvement.

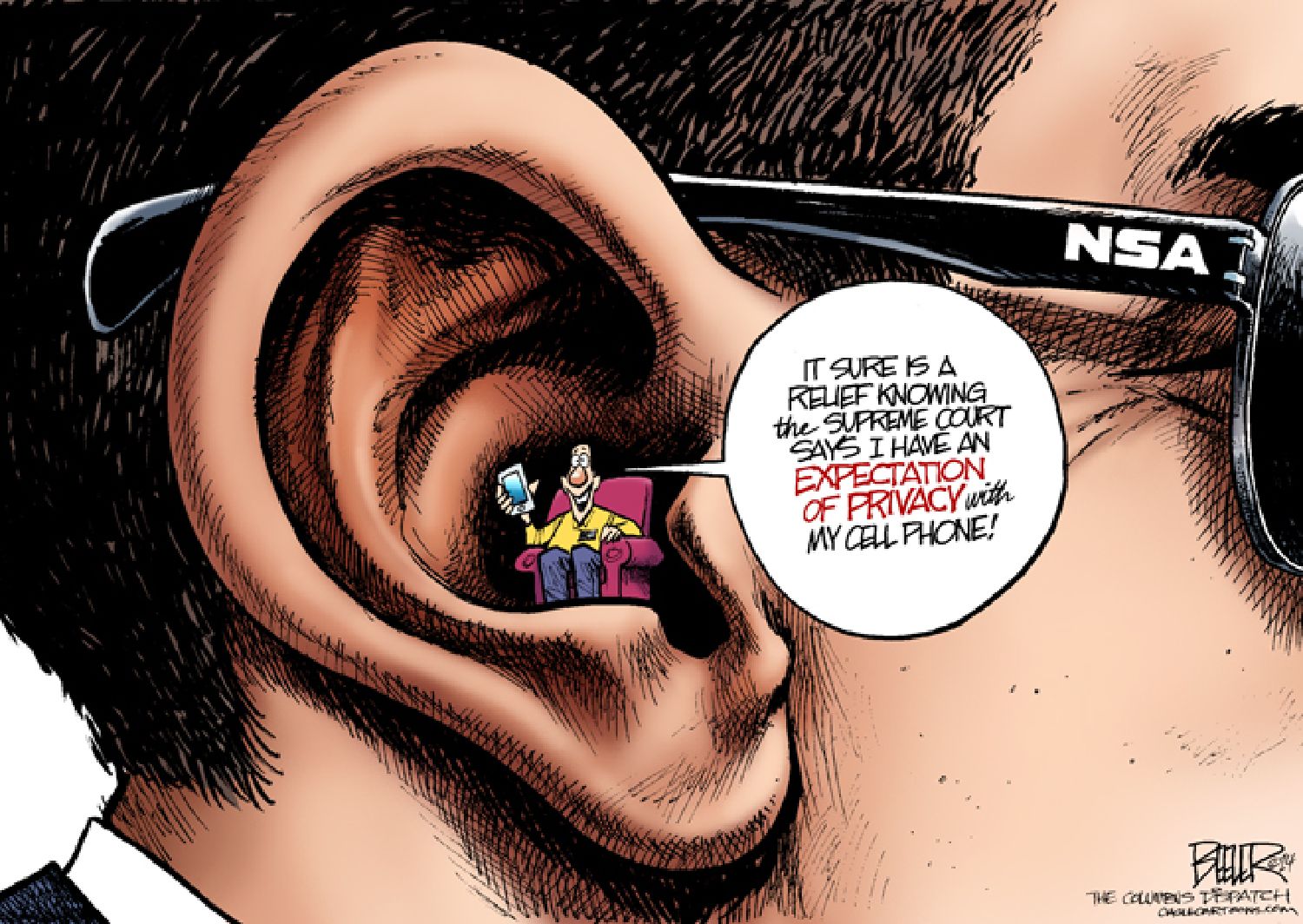

CARTOON OF THE DAY