QUOTE OF THE DAY

WSJ: Big Data and Chicago’s Traffic-cam Scandal

Big data techniques are new in the world. It will take time to know how to feel about them and whether and how they should be legally corralled. For sheer inanity, though, there’s no beating a recent White House report quivering about the alleged menace of “digital redlining,” or the use of big-data marketing tactics in ways that supposedly disadvantage minority groups.

This alarm rests on an extravagant misunderstanding. Redlining was a crude method banks used to avoid losses in bad neighborhoods even at the cost of missing some profitable transactions—exactly the inefficiency big data is meant to improve upon. Failing to lure an eligible customer into a sale, after all, is hardly the goal of any business.

The real danger of the new technologies lies elsewhere, which the White House slightly touches upon in some of its fretting about police surveillance. The danger is microscopic regulation of our daily activities that we will invite on ourselves through the democratic process.

The Economist: The criminalization of American business

WHO runs the world’s most lucrative shakedown operation? The Sicilian mafia? The People’s Liberation Army in China? The kleptocracy in the Kremlin? If you are a big business, all these are less grasping than America’s regulatory system. The formula is simple: find a large company that may (or may not) have done something wrong; threaten its managers with commercial ruin, preferably with criminal charges; force them to use their shareholders’ money to pay an enormous fine to drop the charges in a secret settlement (so nobody can check the details). Then repeat with another large company.

The amounts are mind-boggling. So far this year, Bank of America, JPMorgan Chase, Citigroup, Goldman Sachs and other banks have coughed up close to $50 billion for supposedly misleading investors in mortgage-backed bonds. BNP Paribas is paying $9 billion over breaches of American sanctions against Sudan and Iran. Credit Suisse, UBS, Barclays and others have settled for billions more, over various accusations. And that is just the financial institutions. Add BP’s $13 billion in settlements since the Deepwater Horizon oil spill, Toyota’s $1.2 billion settlement over alleged faults in some cars, and many more.

In many cases, the companies deserved some form of punishment: BNP Paribas disgustingly abetted genocide, American banks fleeced customers with toxic investments and BP despoiled the Gulf of Mexico. But justice should not be based on extortion behind closed doors. The increasing criminalisation of corporate behaviour in America is bad for the rule of law and for capitalism (see article).

WUIS: Illinois Schools In Pension Limbo

It’s expected to be some time before the courts decide whether Illinois can trim retirement benefits for public school teachers, university workers, and state employees. But the uncertainty continues to affect the credit outlook of schools and community colleges across the state.

Much of the political class in Illinois continues to insist the state’s pension problems have been solved. This summer, the Illinois Supreme Court decided the state Constitution prohibits the more modest step of making state retirees pay health insurance premiums. But self-styled reformers were undeterred.

The day of the court decision, Gov. Pat Quinn’s office said: “We believe the pension reform law is constitutional.”

Washington Post: 23 states still haven’t expanded Medicaid. Which could be next?

Thursday’s announcement that Pennsylvania will expand its Medicaid program brings the country one state closer to the original expansion outlined under Obamacare. But because of the Supreme Court’s 2012 decision making the expansion a voluntary program, there are still 23 states that haven’t expanded public health insurance to all of their low-income residents.

The expansion in Pennsylvania will add about 500,000 low-income to adults to the Medicaid rolls. According to numbers from the Kaiser Family Foundation, about 281,000 of those people were falling into what’s known as the “coverage gap”— people who don’t qualify for Medicaid but also don’t get subsidies for purchasing insurance on their own, either. About 4.5 million people across the country fall into this coverage gap, according to Kaiser.

State Medicaid programs generally cover some adult populations, like parents and disabled individuals, at varying income levels, but the Affordable Care Act’s Medicaid expansion expands eligibility to all low-income adults earning up to 133 percent of the federal poverty level, or about $15,500. Eligibility levels won’t change in the states that don’t expand, but adults earning above the federal poverty line, or about $11,500, can receive federal subsidies in those states to purchase private insurance on the health insurance exchanges — so they still have a coverage option. This graphic from Kaiser helps illustrate the coverage gap in practice:

CNBC: Can Walmart make $4 co-pay work for primary care?

Wal-Mart has played it safe when it comes to retail clinics, partnering with regional hospitals to offer services like flu shots. But now, the retailer is taking a more aggressive tack, with in-store branded clinics offering primary care at a price competitors may find hard to match.

“It was important to Wal-Mart that we be able to maintain or be a price leader in this space,” said Jennifer LaPerre, Wal-Mart U.S. senior director for health and wellness, who is overseeing the rollout of the company’s new Walmart Care Clinics.

LaPerre was in Carrollton, Georgia, in the foothills of the Appalachian mountains, to open the ninth Walmart Care Clinic. Three more are planned this year as part of a pilot program to offer primary care services such as health screenings and disease management of conditions like diabetes and high blood pressure in-store.

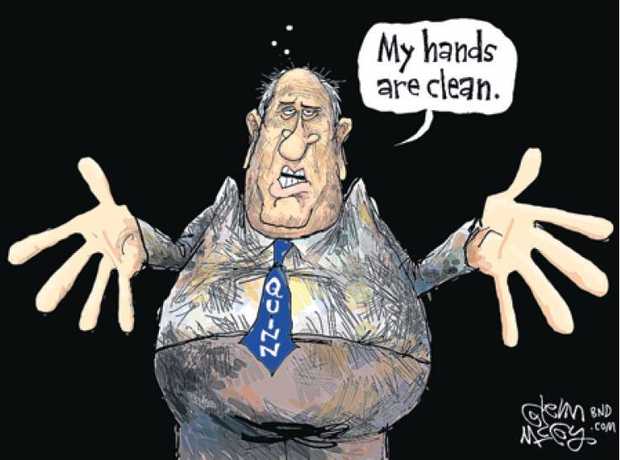

Chicago Tribune: The shaky mantle of ‘reformer’

llions of dollars in state grant money was scattered haphazardly over Democratic voting enclaves, where much of it was misspent, lost or otherwise unaccounted for, a state audit says.

Hundreds of applicants were clouted into positions at the Illinois Department of Transportation under a phony job classification meant to circumvent rules against patronage hiring, an inspector general’s investigation concludes.

These are not the sorts of things we expected to see on Gov. Pat Quinn’s watch.

MarketWatch: Money is not the answer for our bloated public education system

As kids return to school, many sincere education specialists see that the way to improve student achievement is to put more resources in schools. Another approach is to bring education closer to the home, and the home community, the model pioneered by the Neighborhood Outreach Connection in South Carolina’s Low Country. When NOC, as the group is known, comes to a community, test scores go up and crime rates go down.

America spends, and has for many years spent, more on education per student than any other country in the world, according to the Department of Education. Yet according to the international Programme for International Student Assessment tests, average American student achievement is only mediocre. Contrary to what many education advocates argue, increased spending by itself has not and will not help.

Neighborhood Outreach Connection, the brainchild of Narendra Sharma, a retired World Bank economist from Fiji with 32 years of experience, is bringing services such as tutoring, mobile health units and entrepreneurship initiatives directly to six low-income communities in South Carolina’s Low Country. By purchasing apartments in low-income housing developments and converting them into classrooms, NOC is succeeding in raising the academic performance among some of the poorest students in the state and the country.

Reason: California Embraces Pension-Spiking Bonanza

After reading new state rules that detail 99 categories of “special pay” that can be used to spike a public employee’s pension, I was tempted to ask my editor for “special deadline pay” for filing columns on time. Maybe that boost could also lead to a higher pension calculation. Then again, like most private-sector workers, I don’t receive a pension. So never mind.

Pardon my facetiousness, but the decision by the California Public Employees’ Retirement System (CalPERS) to engage this week in a pension-spiking extravaganza is infuriatingly brazen, even for Sacramento. It undermines the governor’s pension-reform law, although Jerry Brown’s objections to the CalPERS action seem lukewarm.

Under the current public pay system, clerical employees get extra cash for typing and taking dictation — activities that seem like basic parts of the job description. Likewise, police officers who attend physical-fitness programs get paid extra. Librarians get extra payments if they routinely help library patrons find books and resources.

Charles Krauthammer: The best way to keep companies in U.S.

The Obama administration is highly exercised about “inversion,” the practice by which an American corporation acquires a foreign company and moves its headquarters out of the U.S. to benefit from lower tax rates abroad.

Not fair, says President Barack Obama. It’s taking advantage of an “unpatriotic tax loophole” that hardworking American families have to make up for by the sweat of their brow. His Treasury secretary, Jack Lew, calls such behavior a violation of “economic patriotism.”

Nice touch. Democrats used to wax indignant about having one’s patriotism questioned. Now they throw around the charge with abandon, tossing it at corporations that refuse to do the economically patriotic thing of paying the highest corporate tax rate in the industrialized world.

CARTOON OF THE DAY