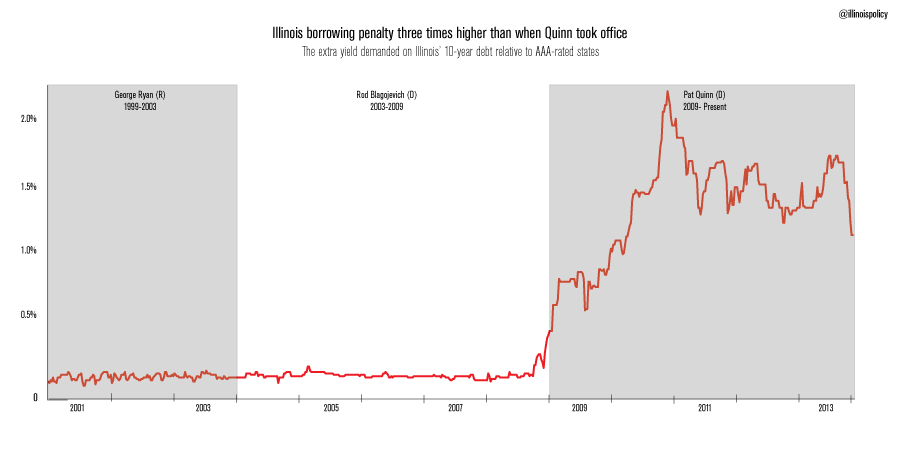

Illinois borrowing penalty still three times higher than when Quinn took office

It didn’t take long for Illinois’ spending machine to cram more debt down taxpayers’ throats. Only two months after signing a pension bill, Gov. Pat Quinn is borrowing yet another $1 billion to fund state construction projects. This will be the first large borrowing for Illinois since it passed Senate Bill 1, a pension fix...

It didn’t take long for Illinois’ spending machine to cram more debt down taxpayers’ throats.

Only two months after signing a pension bill, Gov. Pat Quinn is borrowing yet another $1 billion to fund state construction projects.

This will be the first large borrowing for Illinois since it passed Senate Bill 1, a pension fix that only dials back Illinois’ pension shortfall to 2011 crisis levels.

Quinn’s administration is touting the bond issue and its expected lower borrowing rate as part of what Quinn calls an Illinois “comeback.” After two years of worst-in-the-nation credit ratings and borrowing costs, the state has finally gotten a small reprieve. The state’s borrowing costs have fallen in the last six months as a result of the pension bill.

But while Quinn and others celebrate, the truth is Illinois still pays a penalty rate to lenders that is three times higher than when Quinn took office. And the extra yield that investors demand continues to be the highest in the nation.

Illinois is expected to pay nearly 1.5 percentage points more to borrow for 10 years when compared to the best-rated states in the nation, such as Iowa, Missouri and Indiana. That’s $150 million in extra interest costs for every $1 billion the state borrows.

And since Illinois’ new bonds won’t be fully paid off until 2039, that’s a lot in extra interest costs that could have gone to provide tax relief to hardworking Illinoisans who continue to struggle in Illinois’ weak economy.

Investors aren’t putting their money into Illinois because they see a well-run, transparent and fiscally responsible state. Instead, they’re getting a juicy premium for lending to the nation’s most fiscally irresponsible state – and a pledge from the government, backed by its “full faith and credit,” that Illinoisans will be forced to pony up more tax dollars if state coffers run dry.

At least that’s what investors are counting on. Here’s how municipal investor Konstantine Mallas of T. Rowe Price described it to Bloomberg:

“One of their [Illinois’] largest hurdles is on the revenue side,” Mallas said. Should lawmakers fail to extend the higher tax rates, it would be “very disappointing” for investors, he said.

That’s the game the Illinois General Assembly has been brokering for more than a decade. Spend money it doesn’t have. Borrow to close the gap. And then raise taxes on hardworking Illinoisans to pay back the debt.

That’s why Quinn is already calling for the next tax hike. He wants to convert Illinois’ constitutional flat tax to a progressive tax structure under which the more you make, the greater a percentage of your income Springfield takes.

After blowing through $25 billion in new tax revenues from the 2011 tax hike, it’s incredible lawmakers have the audacity to even propose this step.