Springfield’s police and firefighter pension shortfalls

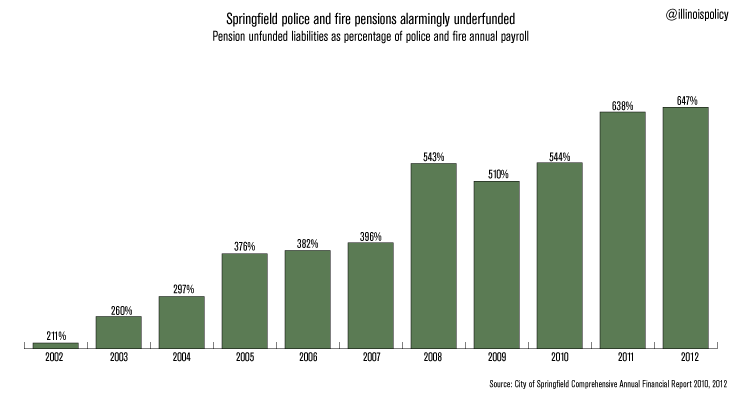

The city of Springfield owes $216 million in police and firefighter pension debt alone. This 2012 figure is 6.5 times larger than the $33.5 annual payroll for police and firefighters. Just 10 years earlier, the shortfall was two times larger. (A fully funded pension should have no shortfall.) Pension debts are dwarfing the payrolls that...

The city of Springfield owes $216 million in police and firefighter pension debt alone.

This 2012 figure is 6.5 times larger than the $33.5 annual payroll for police and firefighters. Just 10 years earlier, the shortfall was two times larger. (A fully funded pension should have no shortfall.)

Pension debts are dwarfing the payrolls that fund them, and taxpayers are expected to bail them out. And the problem for taxpayers will only get worse. The city now has more retired police and firemen receiving money from the pension funds than there are active workers contributing to them.

The Illinois Policy Institute recently published a study titled “The crisis hits home: Illinois’ local pension problem.” The audit measured 10 different metrics related to pensions to arrive at a holistic picture of how rising local pension costs are hurting each city’s fiscal health.

The city of Springfield performed dismally in the audit. It scored worst among the state’s 20 largest cities, and rising pension costs are now consuming every penny of the city’s general fund property tax revenues (those not already dedicated to items such as debt repayment).

Springfield’s pension shortfalls have grown despite a tripling in taxpayer contributions toward the police and firemen funds. In 2012, city – or taxpayer – contributions to pensions totaled $17.8 million. In 2002, they were just $5.8 million.

Unfortunately, all those extra taxpayer dollars have not improved the systems’ fiscal health. Instead, the fiscal health of Springfield’ police and firefighter pensions have continued to deteriorate.

The most recent Comprehensive Annual Financial Reports show those funds have collectively only $0.50 for every dollar they need to pay for future obligations. If those funds were in the private sector, they’d be deemed bankrupt.

This fact should deeply concern city workers. They are in danger of seeing their pensions cut.

But rather than actively work on a solution to the city’s problems, many of Springfield’s officials seem intent on burying their heads in the sand.

Ignoring the problem won’t make it go away. Inaction will only make cost Springfield taxpayers more, force further cuts in services and put worker retirements at further risk.

Visit illinoispolicy.org/springfield to learn more about Springfield’s pension crisis and the municipal pension problem as a whole.