Transparency before tax hikes

No matter how you feel about government spending, most of us agree that the people have a right to know how their tax money is being spent. This means that before a local government raises taxes on their citizens, it should be transparent about how current tax dollars are being spent. Unfortunately, most of Illinois’...

No matter how you feel about government spending, most of us agree that the people have a right to know how their tax money is being spent. This means that before a local government raises taxes on their citizens, it should be transparent about how current tax dollars are being spent.

Unfortunately, most of Illinois’ 6,963 local governments are not transparent about how they are spending taxpayer dollars. Only 53 local governments in Illinois have won the Illinois Policy Institute’s Sunshine Award.

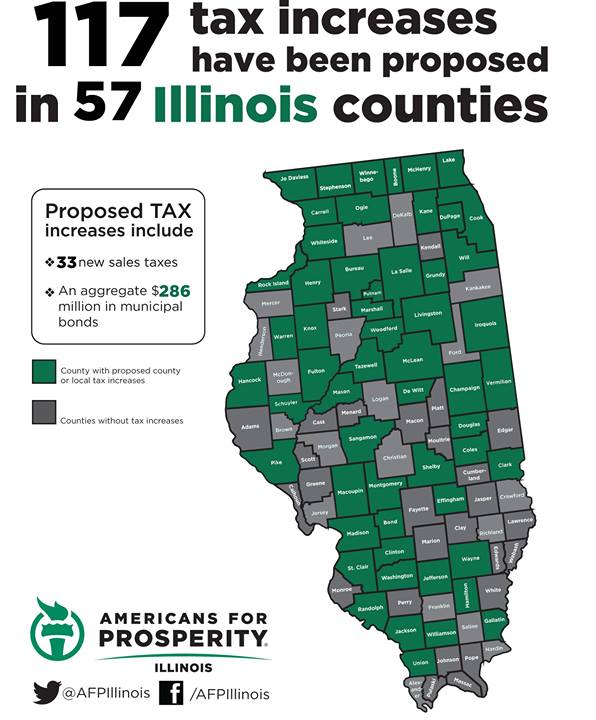

Tax hikes without transparency might happen in the Tuesday primary elections, as residents across the state will be voting on 117 local tax increase referendums in 57 different Illinois counties, according to Americans for Prosperity-Illinois.

Before approving these tax hikes, voters should find out if their local government is being transparent about how existing tax dollars are being spent.

If a local government isn’t posting online information such as employee compensation, financial audits, a check register and other items on the Illinois Policy Institute’s 10-Point Transparency Checklist, they shouldn’t be asking taxpayers for more money.

Illinois residents already pay the second-highest property tax rates, and shoulder the ninth-highest state and local tax burden per capita in the country. If these referendums pass, this burden would increase even more.

In sending more than $20 billion dollars a year to local governments, the state of Illinois has an obligation to require local governments to account for how that money is being spent. State legislators could do this by enacting comprehensive online transparency standards proposed by the Local Government Transparency Act, filed by state Rep. Jeanne Ives, R-Wheaton.

The bill would require all local governments with a budget of more than $1 million per year to have a website and to post basic information about public spending online.

With transparency comes the opportunity for accountability. With $500 million being lost to public corruption each year in Illinois, local governments can’t afford not to be transparent.

Online transparency gives citizens the opportunity to put a stop to fraud, waste and abuse of public resources.

Perhaps if local government were more transparent to citizens, they would find that they don’t really need to raise taxes after all.