The shockingly bad fiscal health of Chicago (and the financial engineering used to hide it)

State lawmakers and the city of Chicago owe taxpayers an honest assessment. It's a sad state of affairs when we have to get that assessment from a bond guru in Kentucky.

Chicago finances are even worse than I thought, which is saying quite a bit. I’ve written about the sorry state of Chicago finances on numerous occasions.

Kristi Culpepper, a bond guru, has gone over Chicago’s bond documents, investor presentations and Comprehensive Annual Financial Reports. She has uncovered things the city of Chicago does not want anyone to understand.

For example, Culpepper reports Chicago general obligation bond deals have been used by the city as a means to avoid servicing short-term debt.

“These bonds have received extraordinarily aggressive tax opinions. If the Internal Revenue Service ever gets around to scrutinizing them, your bonds probably won’t be tax exempt for long. Many of these uses of bond proceeds are not eligible for tax-exempt financing under the federal tax code,” says Culpepper.

That’s just the tip of the iceberg.

Who is Kristi Culpepper?

Intrigued? You should be.

Kristi Culpepper is a state government official with the Commonwealth of Kentucky. Among other things, she handles the structuring and sale of bonds for schools across the state. Previously, she worked for the Kentucky General Assembly analyzing state and local government bond issues and tracking the state’s capital construction programs. She has also worked at Merrill Lynch.

“Bond Girl”

Culpepper built up a huge following as “Bond Girl.” Bloomberg explains:

“Bond Girl, using the Twitter handle @munilass, had been posting commentary about state and city borrowing and issues beyond public finance since April 2011. Her sometimes-pointed posts attracted the attention of municipal-bond investors, bankers and analysts. Using her nom de Twitter, Culpepper sparred with other users, criticized public officials and vented about her life.

“Culpepper ‘is regarded as an authority on capital projects and debt by the Legislative body,’ according to a Kentucky Education Department website posted in November that announced her appointment. ‘She has worked with legislators, lobbyists, and attorneys to draft legislation and effect policy changes related to the state’s bonded indebtedness.’”

“Buyers and traders in the $3.7 trillion muni market had puzzled at the true identity of Bond Girl, Hector Negroni, co-founder of New York-based investing firm Fundamental Credit Opportunities, said in a telephone interview.

“‘For any bond geek like myself, she’s fascinating, well-informed and entertaining,’ Negroni said.”

How Chicago has used financial engineering to paper over its massive budget gap

I mention the above to prove Culpepper is highly regarded in the industry. She knows what she’s talking about.

Read her post here before scrolling down.

There is much within to digest. Anyone investing in Chicago “tax exempt” bonds need beware.

Meanwhile, and in regard to Culpepper’s piece, “The City of Chicago Mayor’s office did not respond to multiple calls and emails seeking comment on the matter,” Yahoo! Finance reports.

Politically and financially bankrupt

As I have stated many times, my belief is that Chicago is bankrupt; it’s just not officially recognized. Actually, Chicago is both politically and financially bankrupt.

The analysis from Culpepper confirms my belief. Her report provides many more details of what’s really behind Moody’s downgrade.

I wrote about the downgrade here.

When will Fitch and S&P catch up?

Chapter 9 bankruptcy test

My personal viewpoint on bankruptcy aside, it’s important to point out that Chapter 9 has a different insolvency test than corporate bankruptcy.

“It is not a balance sheet test, but a cash flow test. [The municipality] has to be in a position where it cannot make near-term payments on obligations as they come due (like within six months). This is one of several eligibility criteria. So Chicago is not bankrupt by definition (yet) and has a huge tax base. The biggest risk to residents (now) is that they are in for an absolutely massive property tax hike to pay for debt and pensions,” says Culpepper.

Pension liabilities

To learn more about the massive unfunded liabilities facing the city and state, see my March 2 article on the topic here.

World of hurt coming up

When the equity and junk-bond bubbles break (and they will), Illinois and numerous cities in the state will be in a world of hurt.

It is imperative that the Illinois General Assembly begin addressing these issues right now. Of course, California and numerous other states will be affected as well.

Needed legislation

Cities, municipalities and the state massively overpay for services because of the influence of public unions and onerous prevailing wages laws. This needs to stop now.

See my article, “Right-to-Work sweeps Midwest, heads for passage in Wisconsin” for legislative solutions on this front.

Raising taxes not the answer

Raising taxes is not the answer. Illinois taxpayer pockets are nowhere near deep enough to fix massive budget and pension underfundings.

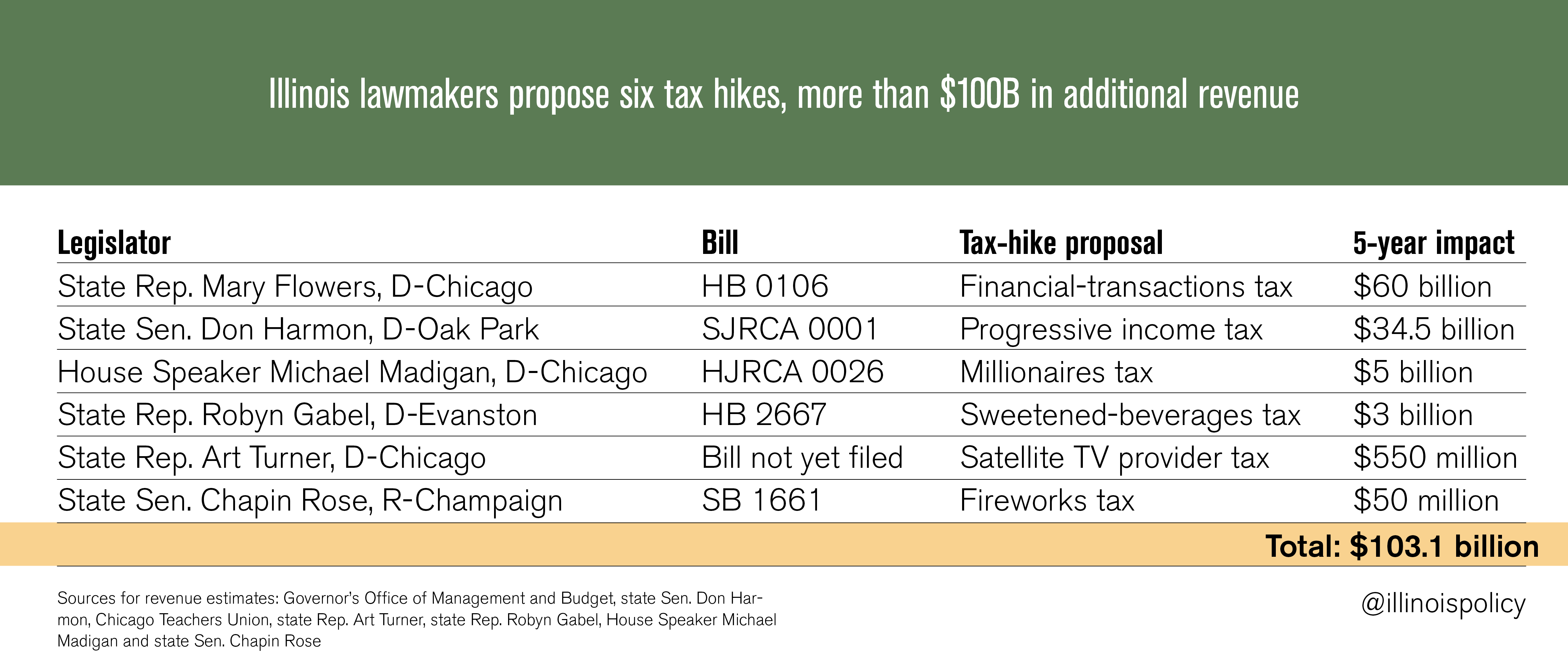

Unfortunately, Illinois lawmakers don’t see it that way. Check out the massive proposed tax hikes.

The array of six tax hikes proposed by Illinois lawmakers this legislative session adds up to more than the state’s total projected general-fund spending in fiscal years 2016, 2017 and 2018 – combined.

The big problem with raising taxes is it will never stop, and will not solve the problem any more than it did in Detroit.

Businesses and mobile individuals will be driven out of the state. Moreover, tax hikes forestall the ability of municipalities to declare bankruptcy.

Bankruptcy law and pension reform

Rather than burden taxpayers, Illinois desperately needs legislation to:

- Enroll all government employees in 401(k)-style, defined-contribution plans

- Allow municipalities to set their own benefit levels, rather the state dictating them through one-size-fits all mandates

- Allow cities and municipalities to declare bankruptcy

Frank discussion needed

As I wrote on March 3, “Chicago’s only possible salvation is bankruptcy – a name that cannot be spoken.”

The Illinois General Assembly and the city of Chicago both need to admit the sorry state of affairs instead of opting for can-kicking exercises that make the inevitable day of reckoning worse.

So, instead of playing shell games with derivatives, general obligation bonds and interest rate swaps, and instead of using long-term financing to fund ongoing needs, how about a frank discussion of everything discussed above?

State lawmakers and the city of Chicago owe taxpayers an honest assessment. It’s a sad state of affairs when we have to get that assessment from a bond guru in Kentucky.

Unsurprisingly, Chicago city officials would not comment.

Image credit: Chris Smith