7-year negative returns in stocks and bonds, fraudulent pension promises

How did Illinois’ pension plans become so underfunded? In general, by promising far more than can possibly be delivered.

It is extremely refreshing to see a large, prominent and historically accurate fund manager lay it on the line.

GMO does that quarter after quarter, with no-nonsense projections.

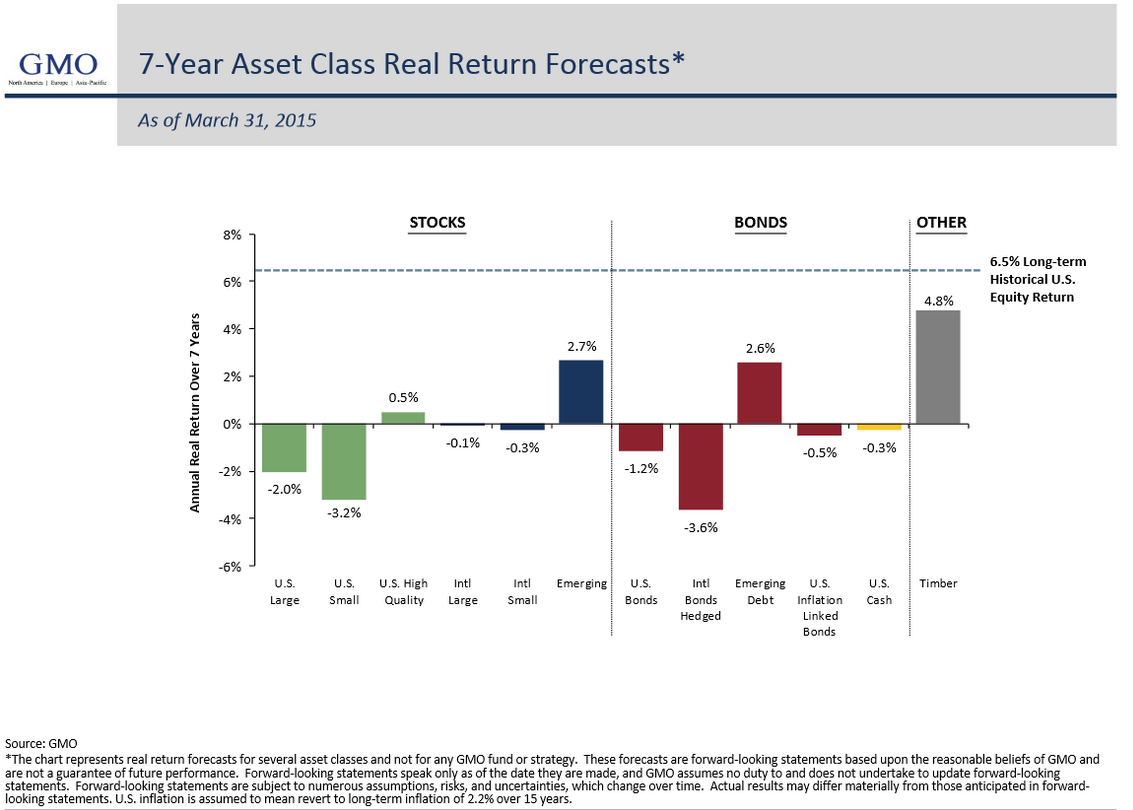

As of March 31, their seven-year asset class real return forecast is as follows.

Serious question for pension plans

Given pension-plan assumptions of between 7 and 8 percent annualized returns, how many of them can survive negative returns for seven years? It’s important to note that GMO is talking about “real” inflation-adjusted returns with an assumption of mean-reversion inflation to 2.2 percent over 15 years.

Still, that leaves U.S. equities at 0 to negative 1 percent returns and U.S. bonds at negative 2.4 percent returns.

Even if GMO is wrong by, for example, say 3 percent, many pension plans will be in deep serious trouble at those returns.

Illinois’ pension plans

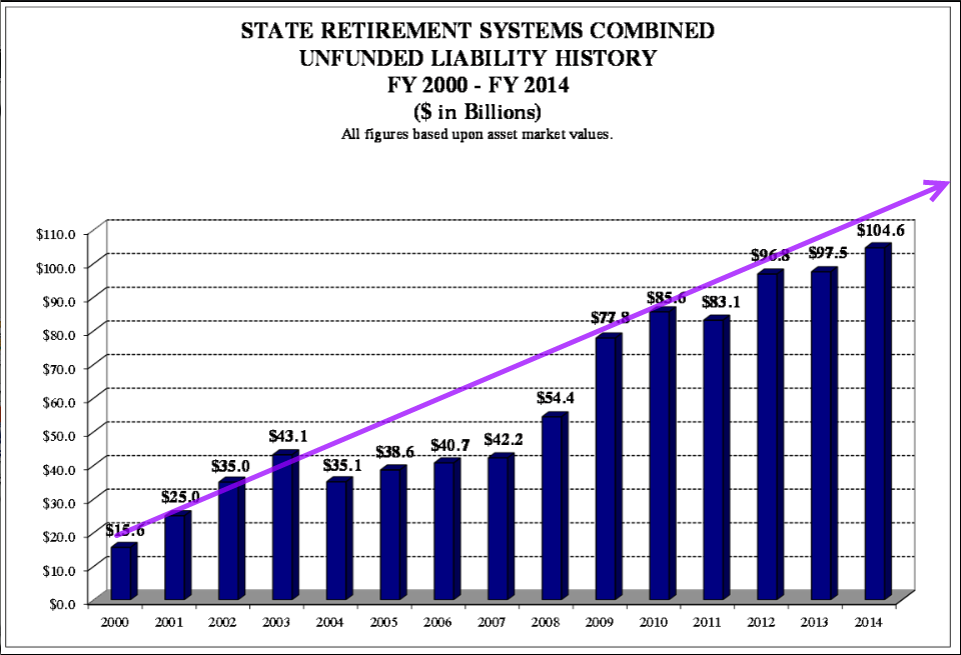

In spite of an enormous rally in the stock market since 2009, Illinois’ pension plans are only 39 percent funded.

A special pension briefing from the Commission on Government Forecasting and Accountability last November shows the state’s retirement systems are in dismal shape.

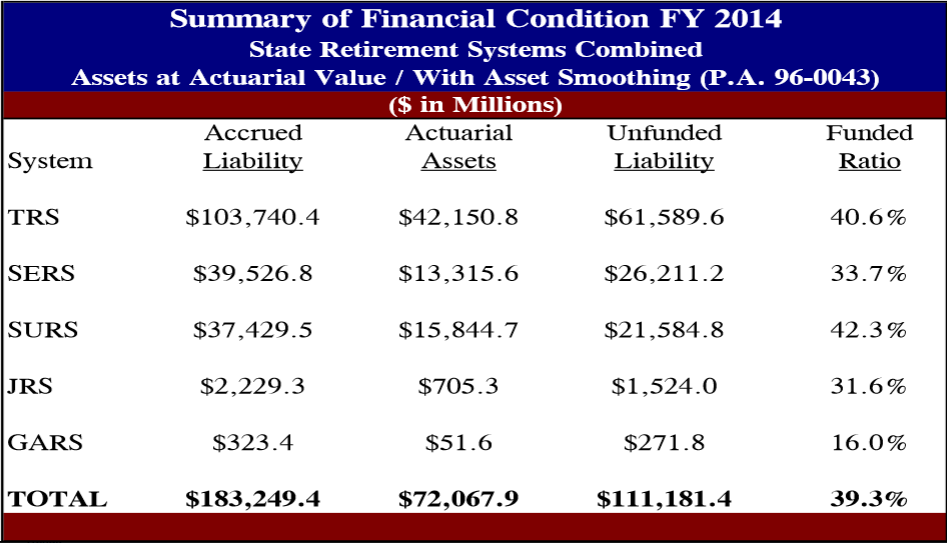

Unfunded liabilities

- Teachers’ Retirement System (TRS): $61.6 billion

- State Retirement Systems (SERS): $26.2 billion

- State Universities Retirement System (SURS): $21.6 billion

- Judicial Retirement System (JRS): $1.5 billion

- General Assembly Retirement System (GARS): $0.3 billion

The above numbers show actuarial (smoothed) asset valuations.

In spite of the massive stock market rally, Illinois liabilities increased every year since 2011.

For still more details, see “Illinois pension plans 39% funded, taxpayers on the hook for $105 billion in liabilities: It will get worse.”

Any notion that pension shortfalls can be balanced on the backs of Illinois taxpayers needs to vanish now.

How did Illinois plans become so underfunded? In general, by promising far more than can possibly be delivered.

Summary of liabilities and unfunded ratios

Congratulations go to the Illinois General Assembly for having one of the worst – if not the worst – pension plan in the entire nation. GARS is 16 percent funded.

No doubt, that increases pressure on the General Assembly to put the burden of bailing out the system on the backs of Illinois taxpayers.

Fraudulent promises

Pension promises were not made in good faith.

Rather, they were the direct result of the powerful influence government unions have on state lawmakers, mayors and other officials.

Illinois taxpayers cannot be held accountable for the corruption of public officials by public unions. Fraudulent promises will be held “null and void” in any fair court of law in the nation.

Given the 31 percent funding of the Judges’ Retirement System, the sorry state of Illinois pensions is likely headed to federal courts.