Private groups receiving Illinois tax dollars rally for higher taxes

Nonprofit organizations that receive taxpayer money advocate for higher taxes on the taxpayers who fund their operations and salaries.

Illinois’ budget crisis presents an opportunity for the state to change how it manages its finances, which could finally end the budgeting practices that cause Illinois to lurch from one shortfall to the next. Spending reforms could also provide certainty and stability for those who look to government for support.

Unfortunately, a number of social-service groups that receive the bulk of their funding from taxpayers don’t see it that way. Instead of backing sensible spending reforms, these organizations advocate for increasing taxes on Illinoisans. Many of these groups run almost entirely on government grants.

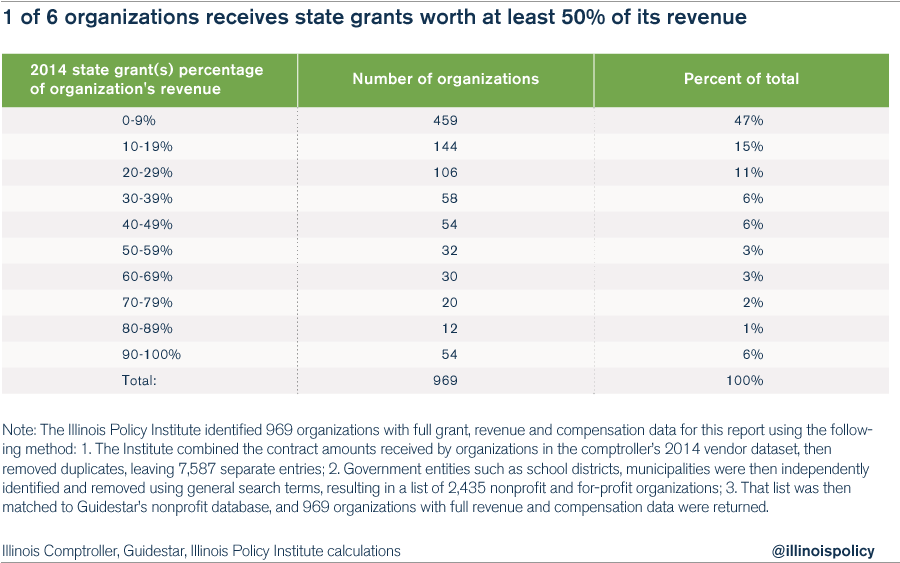

As of 2014, 1 of every 6 private organizations that accept state funding received a grant that equaled 50 percent or more of its annual revenue, according to an analysis of Illinois comptroller data.

For example, in 2014, Illinois Action for Children, a human-services organization, received $24 million in government contracts that provided 71 percent of its annual budget.

Illinois Action for Children did not spend all of that grant money on serving children, however. The organization received a $1 million grant from the state to renovate its offices with new carpeting, and to purchase new vehicles.

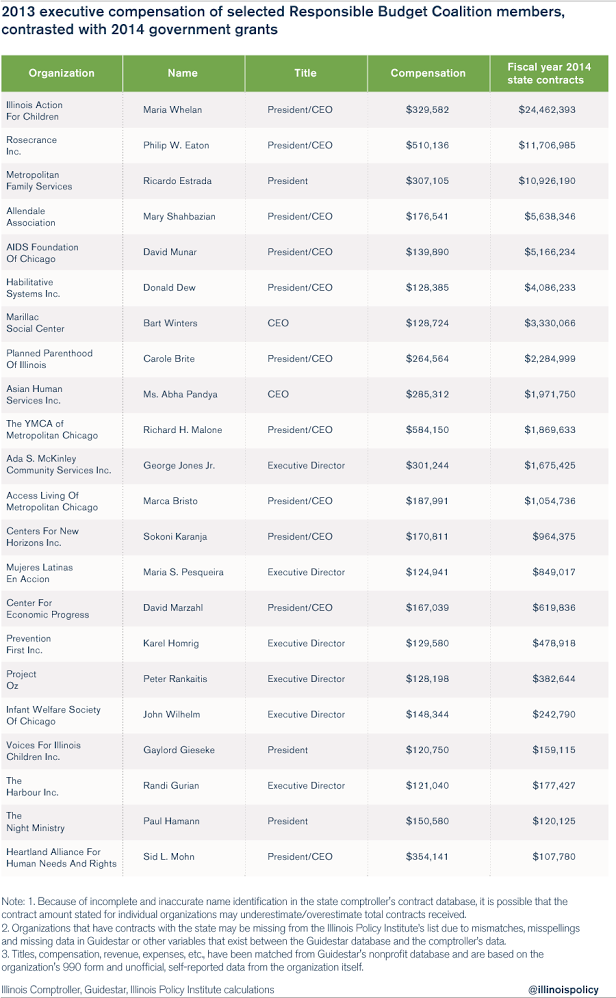

Illinois Action for Children belongs to one of the most vocal groups advocating for tax hikes, the Responsible Budget Coalition. In a recent press release, the coalition stated its agenda: “The only real choice to make is how to raise the revenue we need to invest in our future.”

Many of the directors and CEOs of the coalition members earn six-figure salaries even as their organizations rely on hundreds of thousands of dollars – if not millions – from taxpayers.

There is nothing wrong with providing competitive salaries to heads of nonprofits funded by private donors and foundations. Such donors choose to give their money to those organizations.

However, that’s not the case with government-funded nonprofits: Taxpayers have no say in whether their money goes to supporting these groups.

A recent article in the Daily Herald pointed out that it’s unclear what results these organizations are achieving. The problem isn’t spending money on salaries – the problem is that since these are private organizations funded by state dollars, taxpayers have no idea how these groups spend their money. The state imposes few requirements on taxpayer-funded nonprofits to demonstrate results.

The right answer to the budget crisis is not to squeeze more money from taxpayers but to enact long-term reforms that promote an environment in which more Illinoisans can thrive, reducing the strain on nonprofits and social services.