Letter from CEO John Tillman

The Illinois Policy Institute was founded in 2002 with a vision for Illinois to be a beacon of prosperity that will shine across the Midwest and the nation. At the time, many people laughed at this idea. They had written Illinois off, believing there was no hope for reform.

But we saw a state with a rich history of hard work and entrepreneurialism that could rise once again. We set out to make Illinois a destination state – a place where people want to raise their families, to start and grow their business and to put down long-lasting roots.

Over the past 17 years, thousands of Illinoisans – like you – have partnered with us in this endeavor. Together, we’ve worked to reclaim our state from the entrenched interests that have controlled it for far too long. And we’ve stood up for hardworking Illinoisans from Chicago to Carbon- dale who’ve faced an overreaching government.

2018 was no exception.

In the pages that follow you’ll read about how your partnership equipped an Illinois state worker, Mark Janus, to stand up to one of the nation’s most powerful political forces, government unions. Because of you, Mark was able to take his fight all the way to the U.S. Supreme Court – and win. Mark’s case effectively created right to work for every government worker in the country. That means that more than 5 million government workers are now able to choose whether they want to keep thousands of dollars of their own, hard-earned money or pay it to a union. It will no longer be coerced from them.

You’ll also read how your support allowed us to stand up for 13-year-old Paul Boron. This young Illinoisan spent his summer at the center of an international media storm after his school district pressed felony charges, alleging Paul violated the state’s controversial eavesdropping law by recording audio of a meeting with his principal. The Illinois Policy Institute broke Paul’s story – leading to further reporting on CBS Morning News, the Daily Mail, New York Post and more – and funded his legal defense. Because of you, Paul won’t have a felony hanging over his head as he completes his first year of high school.

These are just two examples of how your sup- port is changing lives. In the following pages you’ll read many, many more – from students who now have the ability to attend the school of their choice thanks to opportunity tax credit scholarships to Illinoisans whose voices are finally being heard through our Lincoln Lobby activist network.

On behalf of all of us at the Illinois Policy Institute, thank you for your partnership. None of this would be possible without your continued support.

In liberty,

John Tillman CEO

Measuring impact

At the Illinois Policy Institute, we are relentless in finding new and better ways to measure success. This is a snapshot of how we measured the results of our work in 2018, which is covered in greater detail throughout this annual report.

WORKER FREEDOM

1 U.S. Supreme Court victory

5 million government workers freed from compulsory union dues

Post-Janus, the share of Illinois public-sector workers choosing not to send money to a union has doubled

The Illinois Policy Institute’s litigation arm, the Liberty Justice Center, won what the Washington Post called “the biggest labor case of the century” in Janus v. AFSCME – freeing more than 5 million government workers from compulsory union dues that violated their First Amendment rights. The share of Illinois public-sector workers choosing not to send money to their union has doubled following the Janus ruling, while those who choose to stay in the union enjoy the benefits of an organization that must earn their support.

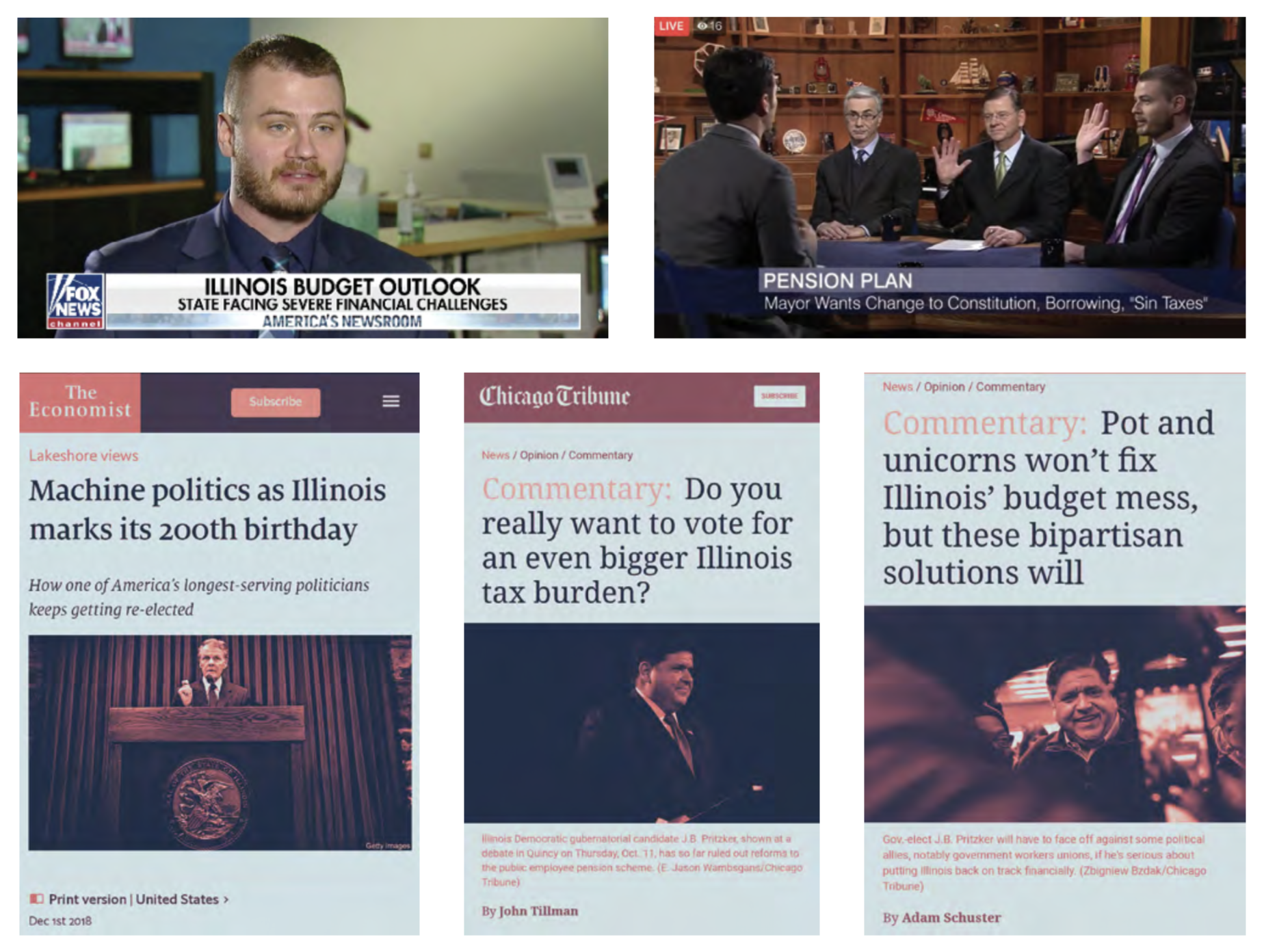

DRIVING THE CONVERSATION

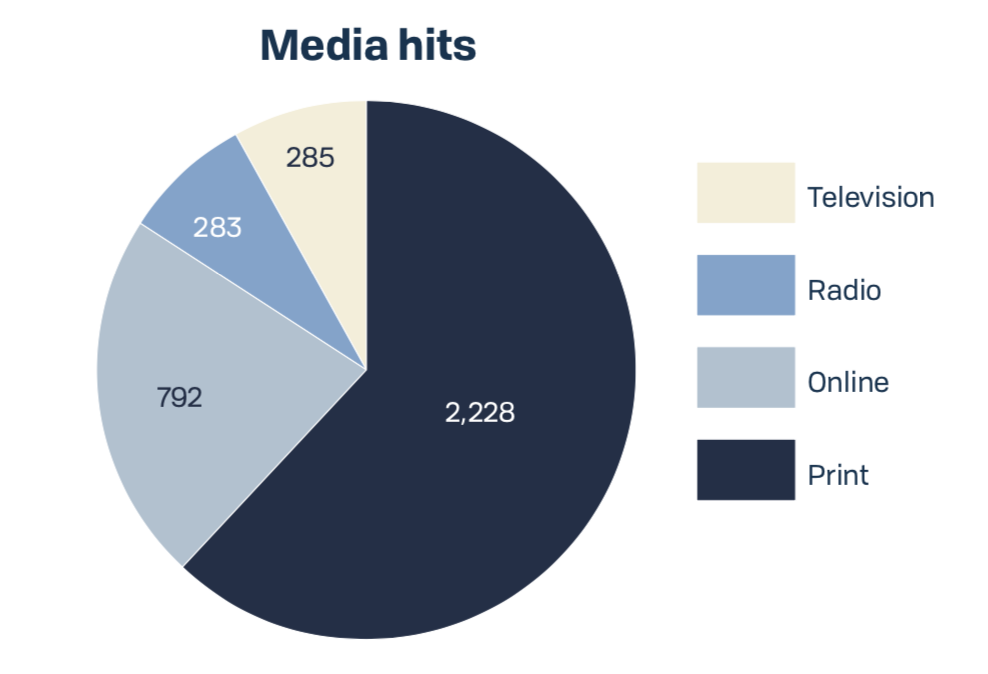

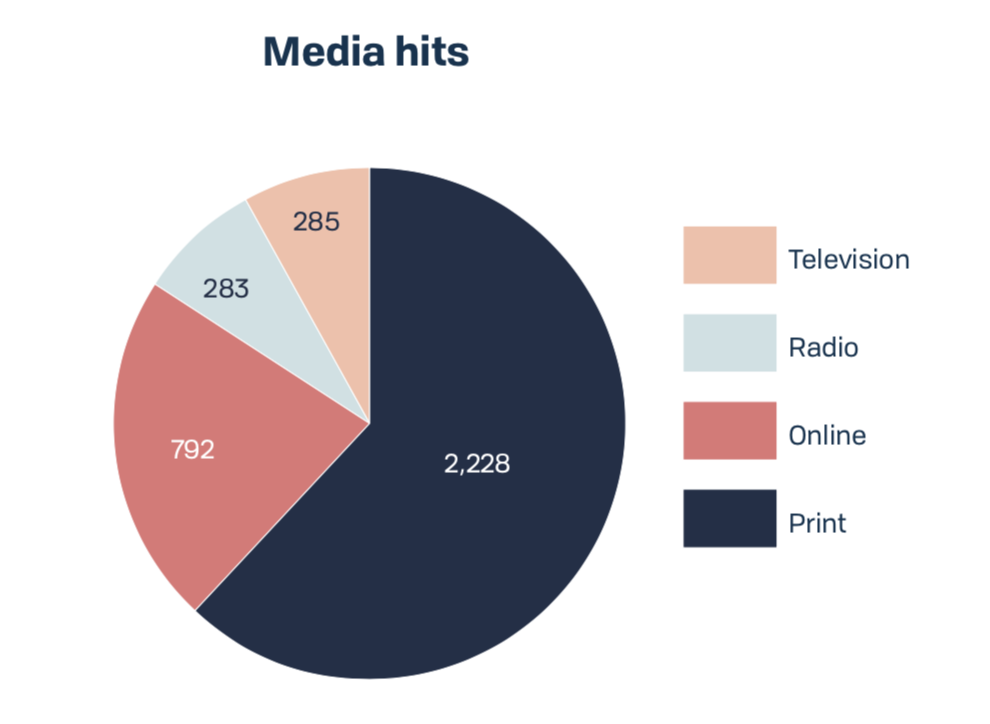

3,588 media hits in 2018

78% of media hits were neutral-to-positive and policy-focused.

TRANSFORMING APATHY INTO ACTIVISM

8,052 Lincoln Lobbyists

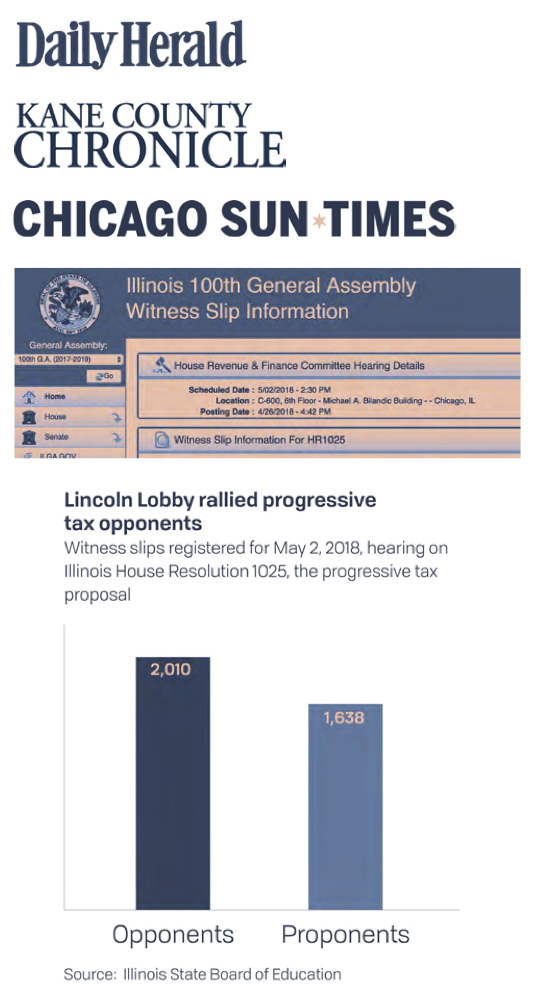

2,010 witness slips filed in opposition to House Speaker Mike Madigan’s progressive income tax resolution

Our activist community, the Lincoln Lobby, tripled in size to more than 8,000 members in 2018. Along the way, this dedicated group of taxpayer activists beat the largest union representing state workers, AFSCME Council 31, in driving witness slips on a key progressive tax resolution.

THE LOUDEST POLICY MEGAPHONE IN THE STATE

4.6 million visits to illinoispolicy.org

6.8 million engaged users on Facebook* 392,000 email subscribers

168,000 petition signatures

31,000 emails to lawmakers

5.1 million video views (Facebook and Youtube)

*Unique users who engaged with an Illinois Policy Facebook post (liked, shared, commented, etc.)

BIPARTISAN DEFENSE OF TAXPAYERS

Three Democrat and nine Republican sponsors of a spending cap constitutional amendment

Four bipartisan, pro-taxpayer bills passed into law

Zero progressive income tax amendments passing the Illinois General Assembly

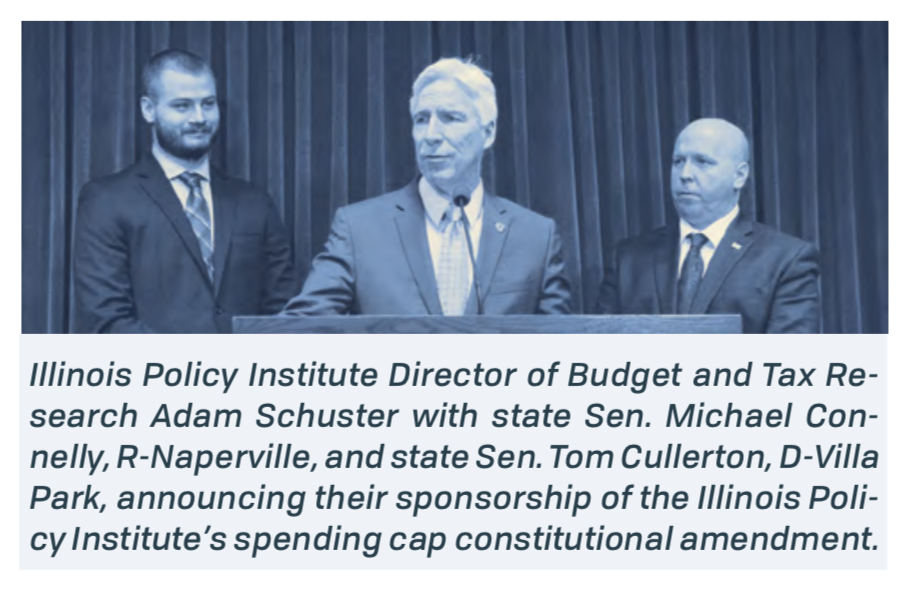

The Illinois Policy Institute’s spending cap constitutional amendment earned three Democrat and nine Republican sponsors in the Illinois Senate, and has been re-filed by chief sponsor state Sen. Tom Cullerton, D-Villa Park, already in 2019.

The Illinois Policy Institute’s advocacy arm, Illinois Policy, had a direct hand in turning four pro-tax- payer bills into law with bipartisan support, in- cluding: Axing golden parachutes (SB 3604), pro- tecting small businesses from overregulation (HB 5253), promoting local government consolidation (SB 2543) and bringing transparency to education administrative spending (SB 3236).

Janus

June 27, 2018, was the final day of the U.S. Su- preme Court’s 2017-2018 term. And on that day, thousands waited eagerly to hear the high court’s ruling on what The Washington Post had called “the biggest labor case of the century.”

For decades, government workers in states like Illinois had been forced to pay money to highly political government unions in order to pursue careers in the public sector. That means more than 5 million public school teachers, firefighters, police and other government workers were all forced to give their money to a union just to keep their job.

But that all changed on that June summer day, thanks to one especially brave Illinoisan and thousands of Illinois Policy Institute supporters.

THE ROAD TO VICTORY

For many years, the Illinois Policy Institute heard from government workers frustrated by being forced to give a piece of their paycheck to a high- ly political union. But standing up to some of the most powerful political players in the state is no small task, and many chose to simply continue paying union fees.

Then we met a man who was willing to stand up to union leaders: Mark Janus.

Mark worked for the Illinois Department of Health- care and Family Services as a child support specialist who advocated for the children of separated parents. When Mark was hired, he never joined the union. In fact, he didn’t learn about the union’s role in his workplace until he noticed money coming out of his paycheck.

To keep his job, Mark was forced to pay thousands of dollars in fees to one of the most powerful political actors in Illinois: the American Federation of State, County and Municipal Employees.

Mark didn’t agree with the union, explaining, “The union’s fight is not my fight. For years it supported politicians who put the state into its current budget and pension crises … That’s not public service.”

And so, he decided to pursue legal action.

The National Right to Work Legal Defense Foundation and Liberty Justice Center, the litigation partner of the Illinois Policy Institute, represented Janus in his case before the U.S.

Supreme Court, arguing that these fees vio- lated his constitutional rights to freedom of speech and freedom of association.

On June 27, 2018, Mark won.

A LANDMARK RULING

It’s not common for the Supreme Court to directly overturn its own precedent. Rather, the court is likelier to dilute an earlier opinion without expressly overturning it.

But in Janus, the court explicitly overruled a prior opinion, Abood v. Detroit Board of Education, and declared forced union fees unconstitutional in the government worker context.

And the court went even further. The court concluded that government workers must clearly and affirmatively consent to any fee deductions. Justice Samuel Alito wrote in his majority opinion:

“Neither an agency fee nor any other payment to the union may be deducted from a nonmember’s wages, nor may any other attempt be made to collect such a payment, unless the employee affirmatively consents to pay … Unless employees clearly and affirmatively consent before any money is taken from them, this standard cannot be met.”

With this language, the court set forth the standard for determining whether dues or fees can be deducted from employee paychecks: Without clear and affirmative consent, government union dues or fees are unconstitutional.

This result goes beyond what was asked of the court, and provides not only guaranteed avenues of worker freedom, but also teed up subsequent litigation to ensure employers and unions comply.

A NEW ERA OF WORKER FREEDOM

The main issue in the Janus v. AFSCME case was pretty simple: Mark Janus was forced to pay for the political speech of a union just to keep his job. That violates his First Amendment rights.

But why does this case really matter?

It matters because it drives at the core of why the Illinois Policy Institute exists – to fight for the power of the individual over the government.

One outstanding Illinoisan, Joe Ocol, knows first- hand why ushering in a new era of worker freedom is so important.

Ocol is a math teacher on Chicago’s South Side. In 2005, one of his students was shot dead after leaving school. That day, Joe made it his mission to try to save lives by running an after-school chess program.

It started small, but his work has transformed the Englewood community, with his students win- ning local, state and national trophies for their play – and earning the scholarship money that comes along with them. Two of his top chess players recently gained admission to the highly selective Lindblom Math and Science Academy. The team’s standardized test scores consistently raise the school’s average.

That’s why when the Chicago Teachers Union held a one-day strike in 2016, Joe went to work anyways. In Joe’s mind, that one day without chess practice could cost his students their lives. His actions ending up costing Joe his union membership. CTU expelled him from the union for crossing the picket line, and he was still forced to pay full dues.

No longer. Because of Janus, Joe now has a stronger voice in where his money goes than one of the most militant labor unions in the country.

Joe is just one example. Millions of government workers have been forced to subsidize the agendas of politically powerful government unions – even if a worker disagreed with the agenda. But thanks to our supporters, that has all changed. Power has been restored to where it belongs: the individual.

LOOKING AHEAD

Despite the landmark ruling, government union leaders have pulled out all of the stops to prevent their members from exercising their newly restored rights. They’ve waged massive misinformation campaigns, for example, and inserted complicated contract clauses that make it difficult for workers to opt out.

Workers deserve to know the truth about their rights, as well as how their dues money is spent, in order to make an informed decision. That’s why we launched a massive educational campaign to make sure government workers understand their right to opt out of their union. Meanwhile, our litigation partner, the Liberty Justice Center, is filing cases on behalf of government workers who face undue barriers in exercising their right to opt out of paying money to a union.

Advancing bipartisan solutions

Meaningful reform requires cooperation between both political parties in Springfield. That is why Illinois Policy pushes substantive policies that draw reform-minded lawmakers from both sides of the aisle.

In 2018, Illinois Policy successfully brought both parties together to promote a number of pro-taxpayer reforms in Illinois.

A CONSTITUTIONAL SPENDING CAP

Senate lawmakers gave taxpayers cause for optimism last year by uniting to advocate for responsible budgeting in Springfield.

On April 26, 2018, state Sens. Tom Cullerton, D-Villa Park, and Michael Connelly, R-Naperville, held a joint press conference in front of dozens of media outlets declaring their support for the Illinois Policy Institute’s proposed constitutional amendment that would limit growth in state spending to the growth rate of the state’s economy.

Why is the amendment important? Because Illinois has not seen a balanced budget since at least 2001 – despite a constitutional requirement to do so. The amendment would limit spending growth to the average annual growth rate of Illinois’ per capita gross domestic product during the previous 10 years.

There are several reasons for Illinois’ consistently unbalanced budgets. One is overspending: The state spends more than it takes in. Another is the state’s process for estimating revenues when drafting its budget. Illinois’ revenue estimates are rarely on target. That’s not necessarily because state agencies are impractical, but because by its very nature revenue is difficult to estimate with the accuracy needed to avoid overestimating or underestimating by hundreds of millions of dollars.

A spending cap solves that problem by giving lawmakers a “magic number” – the 10-year average rate of state GDP – on which to base their budget discussions. They would no longer have to rely on revenue projections.

The spending cap amendment earned the sponsorship of three Democrats and nine Republicans in the Senate. The legislative session ended before the proposal reached the floor for a vote, but Illinois Policy has already begun building on last year’s bipartisan momentum to land a constitutional spending cap on voters’ ballots in 2020 – with Cullerton again at the helm.

In addition to bipartisan momentum on major spending reform, several taxpayer-friendly bills in which Illinois Policy had a hand reached the gov- ernor’s desk and became law.

The new laws include the following.

AXING ‘GOLDEN PARACHUTES’

Known as the “golden parachute bill,” former Gov. Bruce Rauner signed this measure into law in August 2018, protecting taxpayers from lavish severance payouts for outgoing government leaders. The law imposes a ceiling on government workers’ severance pay, capping payouts at the equivalent of 20 weeks of compensation. Most importantly, it establishes government severance packages as a privilege, as opposed to a right. For example, government employees terminated due to misconduct would be barred from receiving severance packages. The bill received chief co-sponsorships from seven Democrats – including Cullerton – and three Republicans.

PROTECTING SMALL BUSINESSES FROM OVERREGULATION

State Rep. Carol Sente, D-Vernon Hills, filed a bill in February 2018 that requires regulatory agencies to examine the potential economic impact proposed regulations might have on small businesses. Small businesses are hit hardest by overregulation, given their limited capacity to shoulder compliance costs compared to their larger counterparts. This measure is one small step toward protecting small business owners from unnecessary and burdensome regulations. Five Democrats and three Republicans added their chief co-sponsorships to the bill, which Rauner signed into law in August 2018.

LOCAL GOVERNMENT CONSOLIDATION

The Land of Lincoln has more units of local government than any other state in the nation. In February 2018, Cullerton – joined by a Senate Republican and Democrat – brought forth a bill making it easier to abolish one of the state’s most obscure forms of government: mosquito abatement districts. Many of those government bodies are simply wasteful, duplicating public services that could be more efficiently provided, or are already provided, by a larger unit of government. Three Republicans and two Democrats provided chief co-sponsorships for this bill, which also became law in August 2018.

BRINGING TRANSPARENCY TO EDUCATION ADMINISTRATIVE SPENDING

Illinois spends among the most in the Midwest per student on education. But the state’s educational outcomes lag. Where do those funds go? Illinois ranks eighth in the nation in administrative spending as a percentage of education spend- ing. Fortunately, state Sen. Andy Manar, D-Bunker Hill, introduced legislation last year to help shed light on school districts’ administrative spending. Cullerton signed onto the bill as chief co-sponsor in the Senate, and former state Rep. David Olsen, R-Downers Grove, spearheaded the bill in the House. The measure requires school districts to now report their administrative costs directly to the state. Rauner signed Manar’s bill in August 2018, and the law took effect immediately.

Expanding opportunity: Education tax credit scholarships take flight

For too long in Illinois, families were denied the most fundamental tool for ensuring quality in education: choice.

That’s why in 2017, Illinois Policy fought to empower students by pushing the Invest in Kids Act, a tax credit scholarship program that’s the first of its kind in Illinois. As the program took effect last year, families across the state were finally given the opportunity to choose schools based on the needs of their child, rather than their household’s ZIP code.

EMPOWERING DISADVANTAGED FAMILIES

The Invest in Kids Act took effect in January 2018. The program works like this: For every $1 in charitable donations to specific scholarship granting organizations, or SGOs, the state offers a 75-cent tax credit. The SGOs then award scholarships to eligible students.

Scholarships are limited to students whose family households live within 300 percent of the federal poverty line. But the program prioritizes the neediest students, offering the largest scholarships to those within 185 percent of the poverty line, as well as those who live in low-performing school districts.

When the state first opened scholarship applications for the program to the public, the Illinois Department of Revenue reported $36 million in approved SGO contributions within 48 hours. With contributions hovering around $41 million as of April 2018, the early surge in donations to the scholarship program has only been outmatched by the demand for scholarships.

OVERCOMING OBSTACLES

As the leading voice for taxpayers, the Illinois Policy Institute knew the Invest in Kids Act would be greeted with hostility by political interests invested in the status quo.

Sure enough, in 2018 the Invest in Kids Act landed in the crosshairs of then-gubernatorial candidate J.B. Pritzker, who called for the program to be discontinued “as soon as possible.” Some lawmakers floated a bill that could have derailed the program even before Pritzker took office.

That bill would have barred the Illinois State Board of Education from issuing tax credits in the event that the state failed to meet a “minimum funding level” for public school districts. But the state’s controversial “evidence-based” system hasn’t worked. By hinging the scholarship program on the funding targets of a broken system, the bill would have simply held more students hostage to that very system.

But by telling the stories of those without a voice in the debate – those who’d be most affected by its outcome – the Illinois Policy Institute made the moral case for preserving the scholarship program.

And the message resonated: the bill died in March 2018.

OVERWHELMING DEMAND

“The parents are overjoyed,” John Wilson told the Illinois Policy Institute in April. Wilson is the director of the Children’s Tuition Fund of Illinois, one of nine SGOs approved by the state. Scholarships awarded through the Children’s Tuition Fund have ranged between $1,800 and $12,900. But due to the program’s popularity, SGOs’ donation funds have struggled to keep pace with parents’ enthusiasm. “The current waitlist is over 5,000 student applications and grows each day,” Wilson said.

Empower Illinois, another SGO, received 24,000 applications when the program launched, causing its website to crash. When Empower Illinois President Myles Mendoza spoke to the Illinois Policy Institute last year, the group had received applications from 50,000 students.

The Big Shoulders Fund had to seal off scholarships within less than a month after receiving 12,000 applications. This reflected a “tremendous demand and need for educational opportunity,” according to the organization. The Children at the Crossroads Foundation also had to temporarily stop accepting scholarship applications because of the high volume of applicants.

GIVING A VOICE TO THE DISADVANTAGED

In making the case for the Invest in Kids Act, we highlighted the story of Marlene Suarez, a Chica- go mother of two young daughters. For years, Mar- lene had sacrificed a great deal of her paycheck for her second-grader and fifth-grader to attend a local Catholic school.

Unfortunately, money got tight for Marlene. Rising tuition costs last year forced her to consider taking her daughters out of their school.

But then, along with thousands of other lower-income families in Illinois, she was one of the lucky parents who received private school scholarships for her daughters.

“There’s tutors, there’s one-on-one always with the teachers, there’s more communication. Access to getting help is always there,” she told the Illinois Policy Institute. “… In a public [school] setting there is so much more violence that I’ve seen.”

We also highlighted Shannon Beier, who lives in Woodlawn, a South Side neighborhood long lacking in opportunity. Her children, too, were lucky winners of the scholarship money, allowing them to attend a faith-based school with which Beier has fallen in love.

“It’s a great school. It’s really diverse socioeconomically. We’re going to school with kids of all races who are way wealthier than us and have way less than us. And the teachers are really teaching them how to love to learn.”

“If we didn’t have the scholarships, we wouldn’t be able to go.”

FUTURE OF CHOICE

Schools should be determined by the needs of their children, not by the ZIP codes assigned to their homes. By expanding the school choices available to low-income households, the Invest in Kids Act is allowing students to be served according to their unique needs.

The Invest in Kids act was a critical first step toward student empowerment. By building on this momentum, the Illinois Policy Institute can continue fighting to bring school choice to every household in the Land of Lincoln.

Defending Taxpayers

Not even a full year after state legislators hiked income taxes in 2017, Illinois taxpayers once again found themselves – and their wallets – in the crosshairs of Springfield lawmakers.

In 2017 a 32-percent increase in the personal income tax and 33-percent increase in the corporate tax rate failed to sufficiently address the state’s ballooning debt and ever-increasing unfunded pension liability. Many lawmakers and political candidates, such as then-gubernatorial candidate J.B. Pritzker, returned to an old theme for fixing the state’s fiscal woes: the progressive income tax.

Having fought to defeat the idea twice already in previous years, Illinois Policy Institute research showed how devastating a progressive tax would be to Illinois taxpayers and to our state’s economy. While the plan is always sold as a means to tax millionaires and billionaires, making “the rich” pay their “fair share,” Institute research showed our state’s spending problems would dictate that a progressive tax entail a large tax hike on middle-class taxpayers.

Proposed progressive tax rates introduced in Springfield would have handed a tax increase to Illinoisans making as little as $17,300 per year.

Institute research also showed that moving from a flat income tax to a progressive income tax structure would lead to slower economic growth in a state that was already struggling with a sluggish economy. Income inequality would grow faster, too.

So when Springfield lawmakers started pushing for a progressive tax through a constitutional amendment on the 2018 ballot, the Institute activated its community to push back and ultimately defeat the progressive tax. Again.

BEARING WITNESS

In April 2018, in response to Illinois Policy’s efforts to sign lawmakers onto a resolution opposing the progressive tax, House Speaker Mike Madigan introduced his own resolution in support of moving Illinois to a progressive tax structure.

The usual suspects immediately rallied to the cause. AFSCME Council 31 – one of the state’s largest and most powerful public sector unions – alerted its members to file witness slips in support of the progressive tax resolution.

In turn, the Institute activated the Lincoln Lobby – a group of its most dedicated activists throughout the state – to file witness slips opposed to Madigan’s resolution.

In the end, 2,010 members of the Institute’s community filed witness slips and more than 30,000 taxpayers signed petitions opposing the progressive tax. Institute activists’ efforts exceeded those of AFSCME, who managed to drive only 1,638 of their members to file witness slips in support of the progressive tax. Keep in mind that AFSCME boasts about 75,000 members in Illinois with roughly 40,000 of them state employees.

NOW TESTIFY

Illinois Policy work opposing the progressive tax didn’t end there.

In May 2018, the Illinois House Revenue and Finance Committee held a public hearing on Madi- gan’s progressive tax resolution. The roster of individuals and organizations there to provide testimony was heavy with those arguing in support of scrapping the flat income tax structure in favor of a progressive tax.

Lawmakers on the committee also heard from Chief Economist Dr. Orphe Divounguy and Government Affairs Legislative Analyst Mindy Ruckman about Institute research. They were told of the deleterious impact of a progressive tax on our state’s still-lagging economy and on already over- taxed Illinoisans, who are increasingly looking to beat a path out of the state.

The hearing provided an opportunity for Illinois Policy’s team of experts to demonstrate to lawmakers the depth of its research, as well as to provide a voice for Illinois taxpayers who know they can’t afford another tax increase.

DEFEATED, FOR NOW

In the end, the efforts of the Institute’s community, experts and government affairs team all contributed to 53 representatives, including state Rep. Jerry Costello, D-Smithton, and the entire Republican caucus, signing on to a competing resolution in opposition. It ensured the progressive tax failed to receive the required supermajority of 71 repre- sentatives necessary to put it on the November 2018 ballot.

FUELING A REJECTION OF GAS AND MILEAGE TAXES

In their continued search for revenue to drive their spending plans, legislators and Pritzker floated two new tax ideas in late 2018.

Once again, the Institute was there with the facts and its activist community to stand up for Illinois taxpayers.

During his campaign, Pritzker suggested he was open to implementing a vehicle miles traveled, or VMT, tax on Illinois drivers. “It’s only fair if you’re on a road and traveling on that road then you should pay your fair share on the road like everybody else is paying,” Pritzker in January 2018 told the Daily Herald.

A similar proposal introduced by Senate President John Cullerton in 2016 would have required Illinois motorists to install a tracking device to monitor mileage in their cars, or to pay a flat fee of $450 per year.

Immediately following Pritzker’s election on Nov. 6, 2018, opposition to the VMT tax blew up.

In just the seven days following Election Day, more than 76,000 Illinoisans signed the Insti- tute’s petition opposing the VMT tax. All told, more than 110,000 taxpayers have signed the petition against the VMT tax.

With the arrival in January 2019 of the 100th General Assembly’s lame-duck session came an effort to pass a hike in the state’s gas tax. Chicago Mayor Rahm Emanuel suggested the gas tax needed to at least double to fund a capital spending bill.

Once again, the Institute provided taxpayers with the research and a means to make their voice heard.

In the first week of January, more than 6,000 Illinoisans signed a petition to oppose a motor fuel tax increase. The quick reaction led lawmakers to drop the idea of pushing through a gas tax increase in the lame duck session.

With tens of thousands of taxpayers signing these petitions in such a short time, it should serve as a reminder to lawmakers in the 101st General Assembly that Illinoisans have had enough of tax increases.

FIGHT ON

While these victories were good news for Illinois taxpayers, the fight against the progressive tax, the gas tax, the VMT tax and other tax increases is far from over. With the progressive tax being a central plank in Pritzker’s campaign, we can be sure that some in Springfield will continue to push for it in Illinois.

And you can be sure the Illinois Policy Institute will continue to be there to defend taxpayers.

A victory for the little guy

Paul Boron won’t have a felony hanging over his head as he completes his first year of high school. But Illinois’ eavesdropping law means others like him might not be so lucky.

The young Illinoisan spent his summer at the center of an international media storm after his school district pressed felony charges, alleging a then-13-year-old Boron violated the state’s eavesdropping law by recording audio of a meeting with his principal.

On Nov. 15, however, the lawyers prosecuting the Manteno Community Unit School District No. 5 complaint dismissed the indictment at a hearing at the Kankakee County Courthouse.

The Illinois Policy Institute broke Boron’s story on illinoispolicy.org – leading to further reporting on Boron’s case on CBS Morning News, the Daily Mail, New York Post and more – and funded his legal defense with assistance from online donations. Institute Senior Fellow David Camic coordinated the defense.

“I’m just relieved and elated to know my son won’t be mislabeled as a felon,” Boron’s mother Leah McNally said. “We are beyond grateful for all the help and support.”

Boron’s case is yet another chapter of controversy surrounding Illinois’ eavesdropping law, which is among the nation’s most severe.

As an eighth grader at Manteno Middle School, Boron said he argued with his principal and assistant principal for approximately 10 minutes in the reception area of the school secretary’s office, with the door open to the hallway. When Boron told them he was recording, the principal allegedly told Boron he was committing a felony and ended the conversation.

Two months later, Boron was charged with one count of eavesdropping – a class 4 felony in Illinois.

An assistant state’s attorney for Kankakee County wrote in the petition to bring the charge that Boron “used a cellphone to surreptitiously record a private conversation between the minor and school officials without consent of all parties.”

Terri Miller, president of the nonprofit Stop Educator Sexual Abuse, Misconduct and Exploitation, thought the district was wrong to bring the charge due to the chilling effect on students seeking to expose wrongdoing.

“What child is going to come forward and try the same thing?” she said. “It will have a deterrent effect on children to report, to speak up when something is wrong.”

Further, First Amendment advocates and other legal experts think the state’s eavesdropping law could be vulnerable to a constitutional challenge. Boron is far from the only one snagged in Illinois’ eavesdropping law for seemingly harmless behavior.

Christopher Drew, an artist arrested for selling artwork on a Chicago sidewalk in 2009, was charged with a felony for recording the incident. Bridgeport resident Michael Allison was charged with a felony in 2010 for recording his own court hearing after officials failed to provide a court reporter. Also in 2010, Chicagoan Tiawanda Moore was charged with a felony for recording conversations with Chicago Police Department investigators regarding her sexual misconduct complaint against an officer.

At the heart of each of these cases was Illinois’ status as an “all-party consent” state. Essential- ly, recording a variety of common interactions unless all parties consented could be deemed a felony offense. Meanwhile, federal law and a majority of states allow for one-party consent.

In March 2014, the Illinois Supreme Court struck down Illinois’ eavesdropping law, holding that it “criminalize[d] a wide range of innocent conduct” and violated residents’ First Amendment rights.

In the wake of the Supreme Court ruling state lawmakers in December 2014 passed a new eavesdropping statute, including changes aimed at explicitly allowing residents to record police, for example. But the new law kept the “all-party consent” provisions intact and introduced a vague standard for when a person must get consent for recording.

Specifically, the new law made it a felony to surreptitiously record any “private conversation,” defined as “oral communication between [two] or more persons” where at least one person has a “reasonable expectation” of privacy.

Boron’s case raises a number of questions critics pointed out in the debate surrounding the 2014 law. Namely, when does someone have a “reasonable” expectation of privacy? And is it fair to expect Illinoisans to know where to draw that line in their everyday lives?

Illinois prosecutors have proven all too willing to bring charges for a variety of innocent-seeming conduct under the state’s eavesdropping law. And without action from Springfield, it’s unlikely Boron will be the last one caught in its crosshairs.

Spurring action to stop corruption

Keeping an eye on local government is more difficult in Illinois than in any other state.

That’s because our state contains more layers of government than any other, and public officials with convenient arrangements aren’t exactly keen to share their secrets.

Some of the most obscure quasi-governments in Illinois are called regional development authorities, or RDAs. And following an Illinois Policy Institute investigation in summer 2018, one of Illinois’ most active regional development authorities – the Upper Illinois River Valley Development Authority, or UIRVDA – has ended a lucrative agreement with the side business of its executive director. And Kane County officials have started a public investigation of the body.

UIRVDA Executive Director Andrew Hamilton has collected nearly $1 million from the authority since 2010 in executive pay ($537,499); reimbursements ($291,859); and payments to his closely related side business, Opportunity Alliance LLC ($128,314).

But UIRVDA discontinued its $1,000 monthly retainer agreement with Opportunity Alliance following the Institute’s investigation. And reform efforts in Springfield, along with further investigations by government officials, could bring about more change.

OBSCURE AUTHORITIES WITH QUESTIONABLE GOVERNANCE

Illinois is home to 10 RDAs. These little-known organizations are spread across the state, located in areas determined to need special economic development assistance. Their powers and revenue are derived primarily from their bonding authority. RDAs can secure longer-term financing at a lower interest rate on behalf of private businesses, and can help establish enterprise zones, which come with their own subsidies and tax perks.

Andrew Hamilton is the executive director of eight of the state’s 10 RDAs, while also running Opportunity Alliance. Opportunity Alliance’s web- site boasted its ability to secure state enterprise zones and tax abatements, as well as other “government access services.” The Illinois Policy Institute was the first to report on Hamilton’s private company and control of multiple RDAs.

RDAs overseen by Hamilton have facilitated hundreds of millions of dollars in financing to private businesses over the years, as well as enterprise zone benefits. In return, he and Opportunity Alliance have received more than $2 million in pay and reimbursements from those RDAs since 2010, according to documents obtained under the Freedom of Information Act.

REFORM EFFORTS

Reform efforts led by Gov. Bruce Rauner’s administration would have ended many of Hamilton’s remaining relationships with RDAs across the state.

In early May, the governor’s office sent a letter to the Illinois Department of Commerce and Economic Opportunity requesting that the agency stop approving any enterprise zone applications brought by RDAs until state lawmakers pass a series of reform measures.

The House unanimously passed a bill including those reforms later that month, but the bill later died in the Senate. Fortunately for taxpayers, the Kane County investigation remains active and these little-known government bodies have never before faced such intense public scrutiny.

Lincoln Lobby: Transforming apathy into activism

In January 2017, we organized a protest of the Illinois House of Representatives re-electing Mike Madigan to his 17th term as House speaker. The Facebook event we created to plan the protest generated an abnormally high amount of engagement, activity and conversation. To capitalize on this activity, we launched a private Facebook group as a home for the top activists looking to build a digital community and make a difference in the future of the state.

It was the birth of the Lincoln Lobby.

The private Facebook group is helping to keep us ahead of the trends on that platform. With Facebook’s algorithms limiting the ability of most posts to reach more than a small percentage of our total audience, the Facebook group provides a way to more effectively reach our most active and engaged community members. Our content regularly appears in their Facebook notifications when new information is added, and they are instrumental in pushing out and sharing that content with a broader audience.

During 2018 the Lincoln Lobby grew from just over 2,500 members to nearly 9,000 members who commented over 250,000 times on more than 7,400 posts. The engagement, activity and activism are some of the best we’ve seen from our digital community.

SEND IT IN A LETTER

In order to strengthen the voice of the taxpayer, we are empowering our Lincoln Lobby members by encouraging them to write letters to the editors of their local papers. From pension reform to property taxes, Lincoln Lobby members share how the state’s poor policy decisions have taken a toll on their personal lives. Their compelling stories from throughout the state give voice to and support for positive reform.

Laura Valdez is a longtime member of the Lincoln Lobby. While she’s soon packing up to move out of state, she still felt compelled to spark change where she’s lived for the past two decades. She provided insightful commentary in the group, which is where she first expressed interest in writing a letter to the editor. Our media team reached out to Laura, working to make sure she had the information she needed and the support she wanted to best craft her message. She submitted letters to three local papers, and all three were published.

Her letter walked readers through the struggles she’s endured to pay rising property taxes while her home value continues to decline. Although she loves living near her friends and family, Illinois has continued to push her and her husband out. She eloquently described how the progressive tax would only worsen her situation, and its threat ultimately confirmed her decision to move.

So far Lincoln Lobby members have had their letters to the editor published in the Chicago Sun- Times, Daily Herald, Kane County Chronicle and several other local papers. In 2019, we’ll continue to help Lincoln Lobby members send letters to the editor in support of our legislative agenda.

CRASHING THE PARTY

During the push for the progressive tax in 2018, state Rep. Michelle Mussman, D-Schaumburg, hosted a town hall meeting to talk with her constituents about the proposed change in Illinois’s income tax structure. We encouraged Lincoln Lobby members to attend the town hall, equipped with our research on the negative effects the progressive tax would have on our state. They asked Mussman to oppose a progressive tax.

During the hour-long meeting, Lincoln Lobby members politely but firmly questioned Mussman about her support for a progressive tax and the consequences it would have for taxpayers and the state’s economy. In fact, Lincoln Lobby members made up the majority of the attendees in the audience that night.

Near the end of the hour, one Lincoln Lobby member asked Mussman if she’d support Speaker Madigan for another term if she was reelected in November. After explaining that she couldn’t answer that question because she “didn’t know who the candidates for Speaker are yet,” a member of Mussman’s staff quickly informed the crowd that the event was over.

WITNESS

When Speaker Madigan filed a resolution in the House supporting a progressive tax, we again activated the Lincoln Lobby to speak out in opposition. More than 2,000 people, including many members of the Lincoln Lobby, registered online as witnesses and filed their public opposition to scrapping Illinois’ flat tax and implementing a progressive tax.

The Lincoln Lobby succeeded in helping to drive nearly one-quarter more registered witnesses in opposition to the progressive tax than AFSCME Council 31, one of the most powerful public sector unions in the state, could drive in support of a progressive tax.

With our legislative agenda before the Illinois General Assembly in 2019, we will continue to empower the activists in the Lincoln Lobby to make their voice heard by filing witness slips in support of legislation that will transform our state and in opposition to bills that will only make our problems worse.

LINCOLN LOBBY DAY

Lincoln Lobby members for the first time gathered in Springfield to lobby state lawmakers during the 2018 fall veto session. Seven members from across Illinois traveled to the state capital and spent the day learning about bills, getting pointers from Illinois Policy lobbyists and then heading to the House and Senate. They were able to speak with their lawmakers and established personal connections. Three of the Lincoln Lobby members were interviewed in the capitol rotunda by a reporter from the Illinois News Network.

More Lincoln Lobby Days are planned, including training so members are well informed and more effective when they speak to lawmakers in Springfield or back in their home districts.

EXCLUSIVITY

Lincoln Lobby members are also privy to exclusive content that helps to keep them engaged and in the know about what’s happening in our state. Members get sneak previews of Eric Allie’s cartoons before they’re finished. They can ask our policy experts questions that are answered in videos explaining policy issues and our research. Our government affairs team provides regular updates from the Statehouse on what legislation is moving. Our marketing team has created exclusive video content for the Lincoln Lobby, as well as giving Lincoln Lobby members sneak previews of video and other content we’re working on before we make it available to the public.

LOBBY ON

As we work to move our legislative agenda forward, shape the conversations and change the narrative in Illinois, the Lincoln Lobby will continue to be a key channel for growth and activism as we write Illinois’ comeback story.

Shaping the conversation

Illinois’ costly gubernatorial election took up lots of ink in 2018, but undergirding every policy debate and many front pages was Illinois Policy Institute research and messaging about the issues affecting Illinoisans the most.

Experts from the Institute achieved a record num- ber of appearances in outlets consumed by polit- ical influencers and decision-makers across the state and country, appearing alongside other dis- tinguished guests on WTTW’s “Chicago Tonight” during three different panels, for example.

One of the biggest victories in 2018 was that Institute authors secured regular monthly opinion slots in legacy media including the State Journal-Register and Crain’s Chicago Business, allowing us to control the narrative and get our ideas in front of key audiences. Our original opinion pieces were also published twice in the Chicago Tribune after not being picked up by this outlet for an entire year.

Relationships with national reporters led to our budget and tax and economic research being highlighted and shaping the narrative in outlets such as the Wall Street Journal, the Economist, the Weekly Standard and Fox News.

SPENDING CAP ALTERNATIVE

While lawmakers enacted another unbalanced budget, our team drummed up support for an alternative: a spending cap that ties government spending to economic growth. This policy was the brainchild of our talented policy team, but it was only after a relentless media push that this important solution took root in legacy media and the Statehouse. A press conference featuring a bipartisan group of lawmakers supporting the solution helped the policy garner attention across the state from Peoria, Springfield and Rockford to Chicago and the suburbs. Ultimately, media mentioned the spending cap more than 128 times during a three-month-long budget process.

ESTABLISHING THE PROPERTY TAX NARRATIVE

Illinois Policy Institute research paved the way for connecting the narrative on skyrocketing property taxes to out-of-control pension costs.

Chicago media such as CBS, WBBM, Crain’s Chicago Business and Joliet Times-Weekly cited our work when acknowledging that pensions are a reason property taxes are on the rise. Nobody else was connecting the dots on this property-tax cost-driver, and our original research on the subject inspired editorial boards such as the Daily Herald and Chicago Tribune to call for a pension solution to alleviate the state’s nation-leading property-tax burden.

POSITIVE POLICY-FOCUSED COVERAGE

2018 was a strong year for the Institute, not only in terms of total media coverage but also because we strengthened our brand perception. This was proven by the total change in tone when it comes to how the legacy media covers us.

In total, 78 percent of Illinois Policy’s media hits in 2018 were neutral-to-positive and policy focused, cementing our reputation as a trusted policy leader and resource.

Marketing: Expanding our reach

The Illinois Policy Institute’s success in digital marketing has been built not on what reaches every- one, but rather on engaging content that reaches those who want to take action – and empowering them with the tools and information to do so.

The success of this strategy and the health of our digital community were evident throughout 2018. But don’t take our word for it.

In April 2018, Chicago Ald. Ameya Pawar launched a media property called “One Illinois” with the explicit goal of challenging our online influence. Of course, imitation is the sincerest form of flattery. As Politico’s Natasha Korecki described it at the time:

“[T]he very creation of a site intended to serve as a counterforce to the agenda-driving Illinois Policy Institute is a telling admission of the powerful role the right-leaning group has played in the most populous Midwestern state. The IPI has shown an ability to drive the debate and influence action in the Illinois Legislature, including whipping opposition to key votes.”

Springfield political blogger Rich Miller also described the specter of our influence over incoming Gov. J.B. Pritzker’s administration in his November Chicago Sun-Times column:

“Governor-elect J.B. Pritzker has taken the prospect of an immediate income tax hike off the table … He said it “could” be done by using exemptions and tax credits for the working poor and the middle class to shield them from higher income tax rates. But he hasn’t really talked about the idea since April … Not to mention that an immediate tax hike – even if it is only on upper-income earners – could mar and complicate his first months in office and give groups like the Illinois Policy Institute a reason to stoke up public opposition against him.”

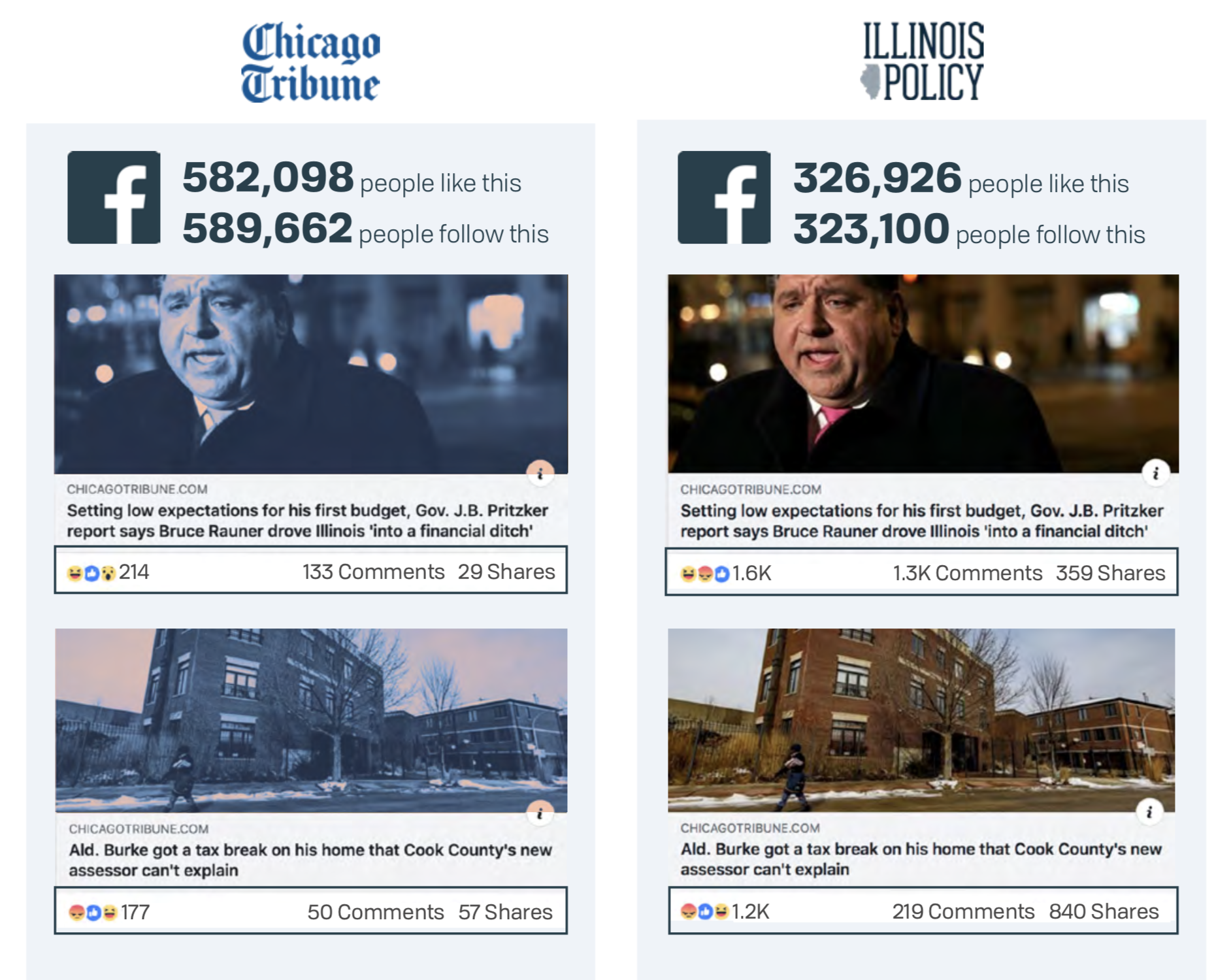

Korecki and Miller describe our fundamental power: delivering the right message to the right audience at the right time. The data on our community show the scope of that power. For example, take a look at how the same content performs when delivered to the Chicago Tribune’s Facebook community compared with Illinois Policy’s Facebook community. While the Tribune has nearly double the number of followers as Illinois Policy, the same articles generated 5 to 10 times more engagement (likes, comments and shares) on our channel.

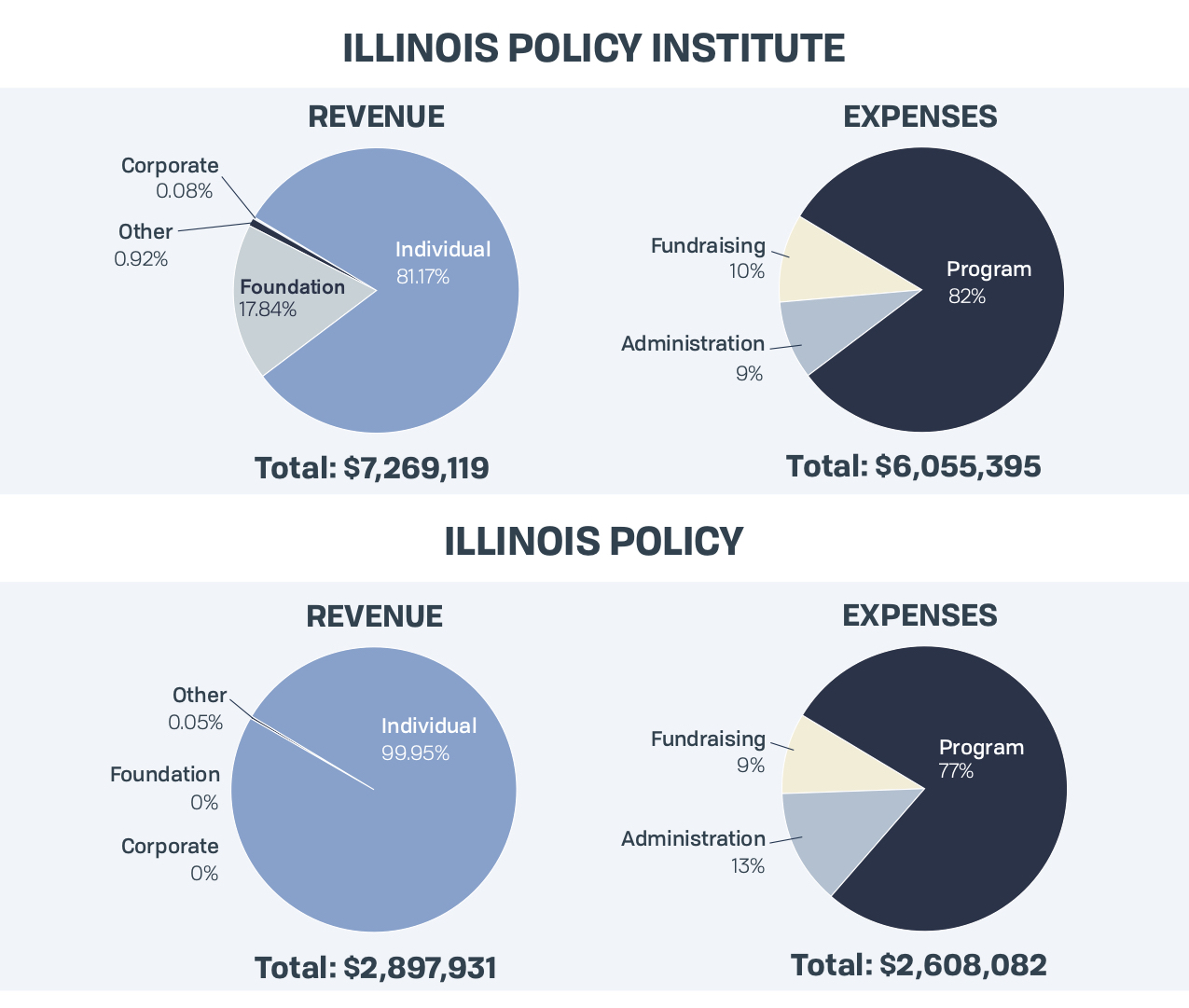

Financials

The Illinois Policy Institute and Illinois Policy’s unaudited financial information for fiscal year 2018 (January 1, 2018 to December 31, 2018) is shown below. Combined operating income was $10,167,050, and net assets totaled $2,637,149. Program expenses accounted for 80 percent of combined operating expenses.

Both the Illinois Policy Institute and Illinois Policy accept no government funding. All of our work is made possible thanks to thousands of Illinoisans who choose to stand with us.

Looking ahead

In 2002, the Illinois Policy Institute was founded on the duty to protect free market principles. But what separates the Illinois Policy Institute from merely being a “think tank” is our mission of taking those free market principles, turning them into marketable policies – and most importantly, passing them into law.

Advancing free market principles is more than just sound public policy. It is a moral imperative. As our CEO John Tillman often says, “the free market is the greatest force for good ever created in the human sphere.” It has accounted for astounding reductions in poverty, increases in prosperity and even extended life expectancies. It has done more to lift the poor and disadvantaged than any other force in the history of the world. That is why for nearly two decades, we at the Illinois Policy Institute have done more than defend the public policy argument, but we’ve also advanced the moral case for the free market.

And we don’t stop there. Along with our partner advocacy organization Illinois Policy, we work to change laws to improve the lives of the millions of people who call Illinois home.

In 2019, Illinois Policy is building a legislative agenda that will address the biggest problems in Illinois. We will work to pass a constitutional amendment to fix our state’s public pension crisis. We will introduce and pass legislation to reduce the more than 7,000 units of local government that are driving up property taxes. We will fight to keep Illinois’ income tax flat and fair. And we will do all of these things with bipartisan support.

The problems facing Illinois’ future are not partisan in nature, and neither – as the data show – are the solutions.

Our team recently conducted an econometric study that reviewed all bills that have passed into law in Illinois over the past 10 years. The study concluded that 95 percent of our current laws have had bipartisan support. In other words, partisan bills (regardless of party) often have a bleak future. If we want to pass our ideas into law, we need support from both sides of the aisle.

That’s why this upcoming year, every bill on our legislative agenda will have a both a Democrat and Republican co-sponsor.

The battle to protect the free market has never been as urgent. And the flag of freedom must be held by both Republicans and Democrats. At the Illinois Policy Institute, we will lead the charge to protect those freedoms.

Thank you for your partnership. And I look forward to an amazing year to come.

Gratefully,

Matt Paprocki

Executive Vice President