Letter from the CEO

Everything at the Illinois Policy Institute and Illinois Policy is driven by our belief that the free market is the greatest force for good in the human sphere. We’re working toward an Illinois where every person can rise up and pursue their version of the American Dream. To make this vision a reality, we must transform bold, free-market solutions into bills that become law.

That’s why during the past two years, we researched which bills in Illinois move forward into law and why. Our team conducted an econometric study that analyzed more than 27,345 Illinois bills introduced during the past decade.

In this 2019 Annual Report, you will read about how we used this data to design a strategy around building strong partnerships with the most effective lawmakers and influencers – including nontraditional allies. As a result, last year more free-market bills advanced through the Illinois legislative process than ever before. And that success laid the groundwork for us working to ensure bills in our 2020 legislative agenda have bipartisan support – with both Republicans and Democrats as chief co-sponsors.

Because of your support, we’re finding common ground on some of the most important policy reforms in our state. We’re moving them forward to bring meaningful change. Continue reading onto page 16 to learn more about our refined approach to working in Springfield.

You’ll also read in this report about how Illinois Policy is building the largest taxpayer community in Illinois. Last year, more than 6.7 million Illinoisans visited illinoispolicy.org (including the FBI, who visited our articles about corruption and House Speaker Mike Madigan more than 1,200 times). You can read more about our record-breaking year of reach and growth on pages 20 and 30.

No one else is doing this work to transform Illinois. But because of your investment, Illinois Policy Institute and Illinois Policy are. We’re using economic research, building relationships with the most effective lawmakers and turning common-sense, free-market policy solutions into law.

Thank you for your support. You make it possible.

In liberty,

John Tillman

CEO and Chairman

Who we are

A nonpartisan, nonprofit research organization, the Illinois Policy Institute’s mission is to transform liberty principles into marketable policies that become law. The Institute’s vision is for Illinois to be a beacon of prosperity that will shine across the Midwest and the nation. To achieve these goals, the Institute generates practical policy solutions to unleash Illinois’ talent and entrepreneurial ability.

A nonpartisan, nonprofit advocacy organization, Illinois Policy exists to directly engage government officials on a vision of a freer, more prosperous society.

Winning the 'fair tax' fight

Mike Madigan’s first real job was a patronage job.

His father, a ward superintendent for Mayor Richard J. Daley, secured a stint for the future House speaker in the Chicago city law department while he was in law school. He made a good impression.

Naturally, Madigan’s second job was as a Democratic ward committeeman on the city’s southwest side. There, he turned municipal workers into foot soldiers for the party in the “machine” model Daley perfected. He was quickly moving up the political ranks. And his next job would be the most important one yet.

In 1970, Madigan was chosen as a delegate to the Illinois Constitutional Convention. And among many other topics, delegates needed to decide what the constitution should say about taxation.

Often forgotten is that until 1969, Illinois had no income tax at all. That’s the year Republican Gov. Richard Ogilvie signed into law a flat income tax of 2.5% on individuals and 4% on corporations. This worried many of the delegates, who publicly debated at the Statehouse whether the state constitution should allow for a progressive income tax. Specifically, they feared voters would reject a constitution allowing for new tax brackets and higher rates so soon after a historic tax hike.

This fear of taxpayer backlash is why the Illinois Constitution has a flat income tax protection. And 50 years later, it remains intact.

Madigan has since amassed the most concentrated power of any state lawmaker in American history, all with the backing of just a few thousand voters near Midway Airport.

But now, after his “yes” vote to put the progressive income tax constitutional amendment on the ballot and a flurry of 20 new tax and fee hikes totaling $4.6 billion, Madigan faces an unprecedented statewide referendum on that power.

Fighting back

For more than a decade, special interest groups in Illinois have been waging a strategic campaign to remove Illinois’ flat tax protection. But year after year, Illinois Policy defeated those efforts by developing strong research, prompting compelling media coverage and amplifying the voices of average Illinoisans in the halls of the Statehouse.

It wasn’t until 2019 that the stars finally aligned for proponents. More than $4 million in advertising backing the proposal, historic pressure from the governor’s office and an unprecedented flurry of end-of-session horse-trading in a $45 billion capital plan was enough to convince the necessary supermajority – on a party-line vote – to put the progressive tax amendment on the statewide ballot.

Convincing lawmakers is one thing. Now Illinois voters will have the historic opportunity to decide whether to support Madigan’s status quo or to reject giving Springfield more taxing authority.

How the numbers work

- In order for the progressive tax to go into effect, the ballot question must hit one of two thresholds: either 60% of those voting on the question or a majority of those voting in the election must vote “yes.”

- This fight will generate broad media attention as well as significant outreach from organizations on both sides of the issue. As a result, we expect the drop-off rate to be low and are therefore targeting a 50% threshold.

This fight will generate broad media attention as well as significant outreach from organizations on both sides of the issue. As a result, we expect the drop-off rate to be low and are therefore targeting a 50% threshold.

Fortunately, Illinoisans are already seeing through the “fair tax” rhetoric. And polling data shine a light on the path forward.

A We Ask America poll on the progressive tax in February 2019 found that 59% of respondents supported it. They re-ran the poll on May 29 and 30 and found support had fallen to 51% among likely voters. While this trend is obviously encouraging, here’s what is most notable: As stated earlier, Pritzker and his allies spent more than $4 million during that interim period. This meant they outspent us by nearly four to one.

Nevertheless, we’re the ones gaining ground with voters. And the truth is, the progressive tax is not exceedingly popular with the public at baseline.

We partnered in February 2019 with nationally recognized research firm Echelon Insights to conduct statewide polling on the progressive tax. The poll revealed that while 54% of respondents showed support for a neutral question on the progressive tax, support dropped by 11 percentage points – to 43% – when respondents heard more information about the tax.

On top of this, we conducted hundreds of rounds of A/B testing throughout the legislative session to determine which anti-progressive tax messages resonate most with voters. This means that we don’t simply have polling results, but actual data showing which messages compel voters to take action opposing the progressive tax.

Similar efforts in other states provide insight as well. The last two states to put a progressive income tax amendment on the ballot – Colorado in 2016 and Massachusetts in 2010 – both saw it voted down.

Our strategy

Pritzker and his allies revealed their strategy during the legislative fight: Spend millions on ads to amplify their message. This is a costly – and inefficient – strategy. We already know it can be beaten. That’s why instead of going toe-to-toe against Pritzker via media ad buys, we are focused on the following:

- Expand our community: We will grow our community – meaning those who have opted in to our email list – to 3 million Illinoisans. By building this audience we can message to individuals on a consistent basis with customized content.

- Grow our activist network: We will educate, engage and activate the most effective members of our community through our Lincoln Lobby activist network. This network will be activated in a number of ways, but especially to conduct personalized outreach and door-knocking.

- Capture earned media: Our team has developed relationships with members of the traditional media throughout the state and the nation. We will leverage this network to encourage editorial boards to oppose the progressive income tax, and continue to secure placements highlighting original Illinois Policy Institute research and op-eds from our leadership and policy teams exposing the dangers of a progressive income tax.

We are already executing on these three strategic imperatives, as you will see throughout this annual report: Learn more about the Lincoln Lobby on page 22, our marketing efforts on page 18 and media work on page 30.

The progressive income tax hike has nothing to do with fairness. It will rob Illinoisans of jobs and opportunity while exposing the middle class to further attacks on their income.

It has everything to do with power.

And through our work, Illinoisans will understand exactly that.

Affecting 21,821 fellow Illinoisans and counting

There have been 21,821 Illinois public workers who decided unions didn’t represent their best interests since the U.S. Supreme Court freed them from forced union dues and fees on June 27, 2018.

That means those public employees have at least $13 million extra in their pockets, plus the freedom to decide how best to spend it. They are no longer forced to subsidize inherently political unions, and the union political stances with which they do not agree.

That $13 million was calculated with a conservative estimate of $600 per worker in annual dues or fees. That was another $600 per worker that was more likely to be spent within the Illinois economy.

Janus v. AFSCME started in Illinois, where about 370,000 public employees were given back their First Amendment rights for the first time in about 40 years. But the case’s impact was much broader, giving back the freedom to choose to about 5.5 million workers in 22 states.

The union sued in the case was the American Federation of State, County and Municipal Employees Council 31 in Illinois. That union in 2018 spent just 17 cents of every $1 on “representational activities” – the duties most expected of a union by its members – according to its federal filing.

That poor of a return on investment would prompt the Wise Giving Alliance, a project of the Better Business Bureau, to flag AFSCME. The alliance expects a nonprofit to spend at least 65% of its revenue on program activities.

Other public unions also spent money in ways that showed members were not their top priority. The Illinois Education Association from 2013-2018 spent just 13 cents of every $1 on representing workers, according to its federal filings.

Plaintiff Mark Janus, formerly a child support specialist for the state of Illinois, challenged the system that said it didn’t matter whether a government worker thought the union represented him or her well. The Illinois Policy Institute through its litigation partner, the Liberty Justice Center, and the National Right to Work Legal

Defense Foundation, helped end the world in which it didn’t matter whether a public worker liked the way the union focused on politics. They helped end the fear that failing to pay a union would cost public employees their jobs.

In 2019 the Illinois Policy Institute continued the work of the Janus decision by educating public employees about their rights.

Those efforts included:

- Continuing research on union spending priorities using federal filing documents.

- Utilizing research to develop educational materials for direct mail pieces, which have yielded the best levels of action. More than 150,000 direct mail pieces were sent to members of AFSCME and SEIU, public school employees, personal assistants, childcare providers and union retirees to help them choose whether to opt out of their union affiliations.

- Placing radio ads in Springfield and digital ads targeting state government buildings.

- Continuing surveys of public sector workers who opted out of their unions, focusing on the ease of process, reactions of unions and motivators for opting out of union membership.

- Working to mitigate the impacts of Senate Bill 1784, an attempt by state lawmakers to minimize the worker freedom gains from Janus v. AFSCME and give unions access to workers’ private email addresses and cell phone numbers.

As we look ahead to 2020, the Illinois Policy Institute plans to continue vigorous efforts to share information about worker freedoms with public employees. Work to document union spending will continue so public workers know whether their values mesh with the spending priorities of their union. We will research and test our messages and how we deliver those messages, as well as seek to deliver the information public workers find most useful and need, especially when unions are actively trying to keep members and potential members from learning about their rights.

With the right combination of strategies and effort, 2020 will see more workers get to voice their own political views as well as decide the best use of their hard-earned pay.

Legislative affairs: Building toward a better Illinois on a foundation of bipartisan relationships

This past year Illinois Democrats had a supermajority of lawmakers in both the House and the Senate, plus a new Democratic governor, J.B. Pritzker. In order to effectively pass taxpayer-friendly bills, we had to meet lawmakers where they were at and convince them our solutions would work. That’s where our journey began in 2019.

We filed a total of 12 bills and four constitutional amendments in 2019. Of these 16 pieces of legislation, 11 were championed by Democratic chief sponsors, and five by Republican chief sponsors. In total, Illinois Policy gained 73 unique sponsorships, with 47 from Democratic lawmakers and 26 from Republican. This means over 40% of the Illinois General Assembly helped to sponsor at least one of Illinois Policy’s proposals.

Undoubtedly, connecting with both Democratic and Republican lawmakers boosted our success. Illinois Policy received a total of seven committee hearings on our legislative agenda bills. Each hearing advanced our work to educate lawmakers and to ultimately pass taxpayer-friendly bills into law.

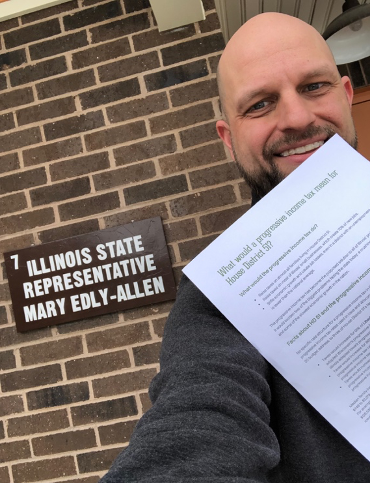

Our Lincoln Lobby activist network stepped up in big ways during the session. Lincoln Lobby members called their lawmakers to express their opinions on legislation, and they also filed witness slips with committees to express their position on bills in numbers that overwhelmed the opposition. Through these actions, the Lincoln Lobby provided a megaphone for taxpayers across the state to have their voices heard by the General Assembly.

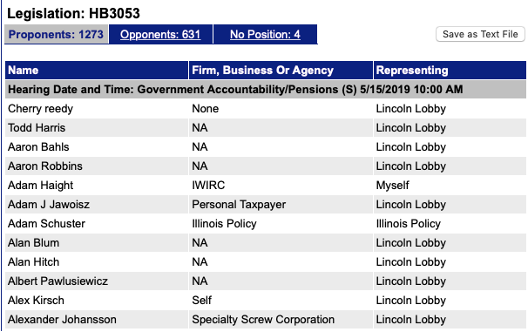

One Illinois Policy bill that received special attention and discussion was House Bill 3053, which would create the School District Efficiency Commission. This commission would review the state’s 852 school districts and make recommendations for consolidating districts as a way to direct more funding to classrooms and lower property taxes. Experts from Illinois Policy had the opportunity to testify on behalf of this bill in committee three separate times during the legislative session.

We were proud to see one of our criminal justice reforms, Senate Bill 482, pass both chambers unanimously and then be signed into law by the governor. This new law restores fairness by waiving the fee associated with expunging records of people who were wrongfully arrested, charged or convicted in Cook County.

The law is in place for a test period, but the Government Affairs team in 2020 is working to make the fee waiver permanent and extend it throughout Illinois. Also on the 2020 agenda is another push for the School District Efficiency Commission and major campaigns for changing the cost drivers and spending practices that are holding back Illinois.

Sturdy foundations were created in 2019 that we will use to build a path to a more transparent and prosperous Illinois.

Inspiring millions with a message of change

Without distribution, the best ideas have no impact. That’s the essence of our marketing philosophy at the Illinois Policy Institute. We are obsessed with delivering the right message to the right audience at the right time to spur meaningful action.

No other group in statehouse advocacy, in any state, is empowering so many people with the information and tools necessary to have their voices heard. Outgoing Senate President John Cullerton described how modern marketing has completely transformed the policymaking process in Illinois:

“The old model [for voters] is, ‘I’m busy. I’m hiring you. Go down to Springfield. Listen to testimony. Make your informed decisions. Every two years, I’ll check on you. And now, you just go directly to the legislator [who says], ‘We don’t need to listen to any tes- timony. I got 500 emails and 5,000 tweets retweeted saying I’ve got to vote for this bill.”

In 2019, millions of Illinoisans engaged with our message of change.

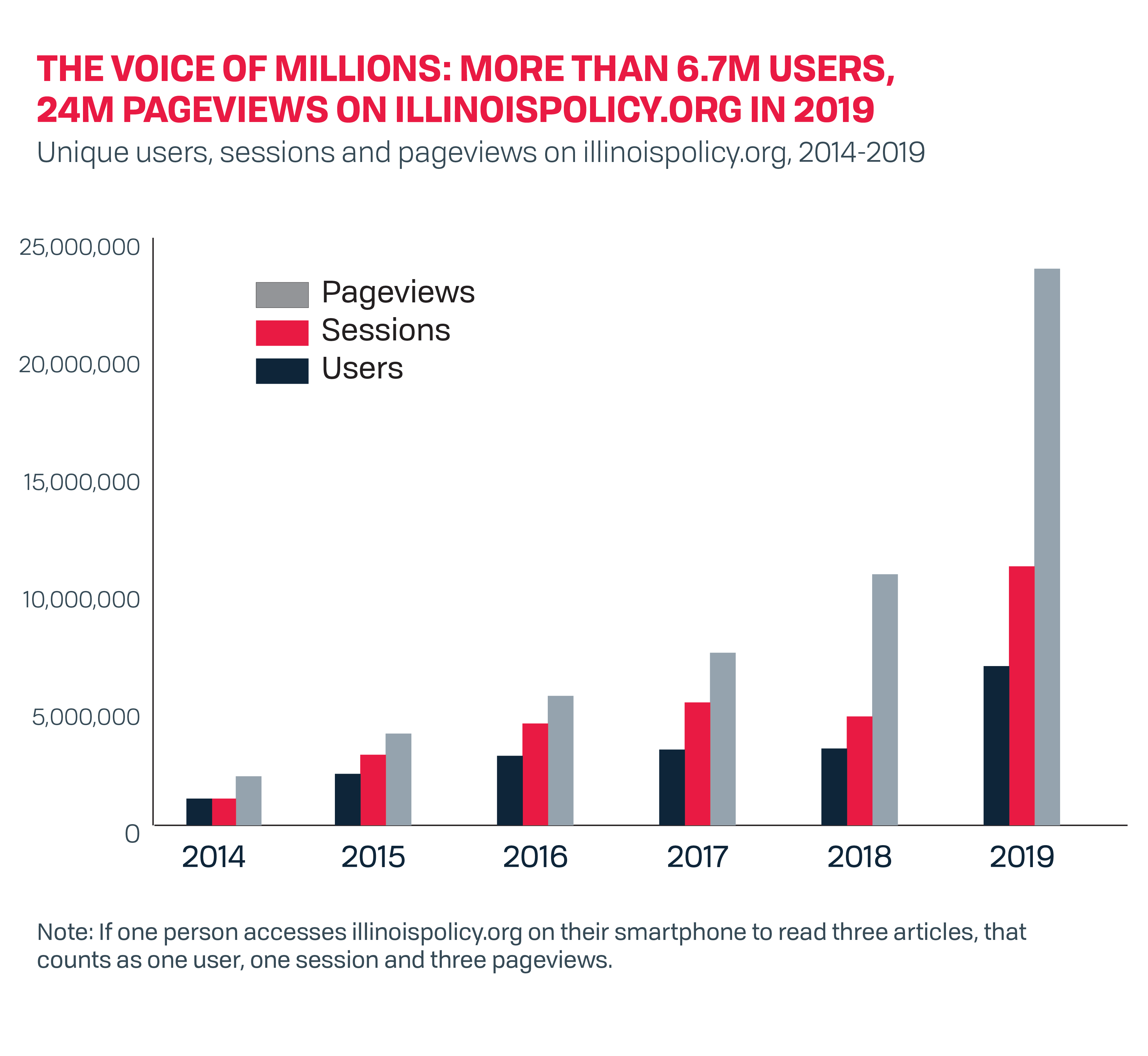

More than 6.7 million users (4.4 million confirmed in Illinois) clocked nearly 24 million pageviews on more than 500 pieces of content on illinoispolicy.org. Notably, a vast majority of that traffic was organic, meaning our content was so engaging that we didn’t need to spend money promoting it.

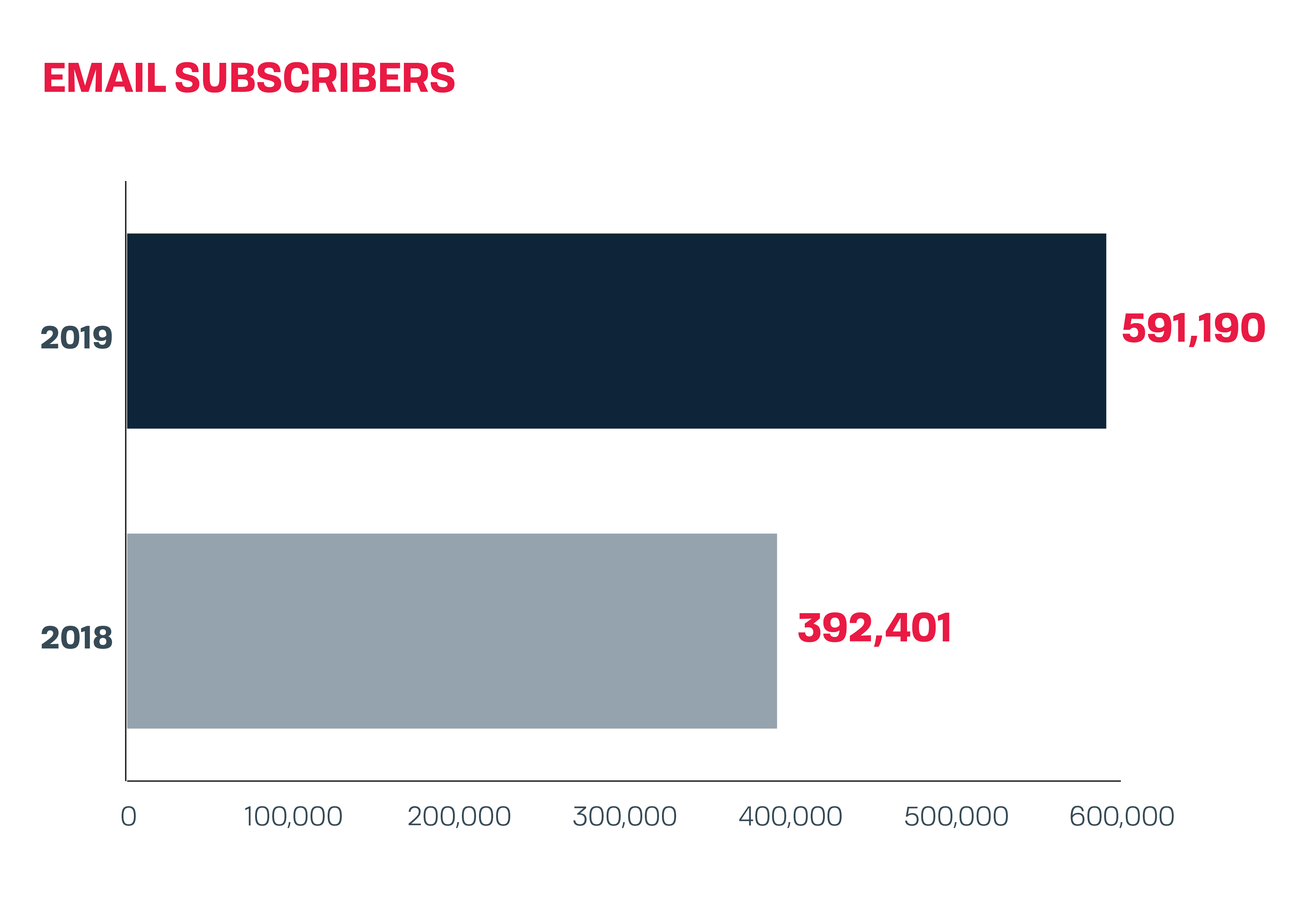

Even more important than our exploding viewership was increasing the number of Illinoisans subscribing to our email list – we upped subscriptions 50% in 2019 to nearly 600,000 Illinoisans. For context, around 250,000 people subscribe to the Chicago Tribune’s largest email list.

Growing our community in this way not only allows us to cost-effectively spur mass action, it also allows us to educate our audience over time on the biggest problems facing our state.

Case in point, we conducted a survey of nearly 10,000 community members in 2019 and found that all else equal (party affiliation, income, race, occupation, etc.), there was a statistically significant relationship between how long they had been consuming our content and how likely they were to oppose the progressive income tax. This is part of the reason that while Gov. J.B. Pritzker spent $4 million promoting his progressive income tax constitutional amendment in spring 2020 – outspending his opponents 4:1 – the proposal’s popularity declined.

Our content changes hearts and minds on the issues that matter most. That’s why in 2020, our goal is to increase this community to more than 3 million Illinoisans.

Marketing metrics

Lincoln Lobby: Building a more perfect union for Illinois taxpayers

2019 was a transformative year for Illinois Policy’s official online activism arm.

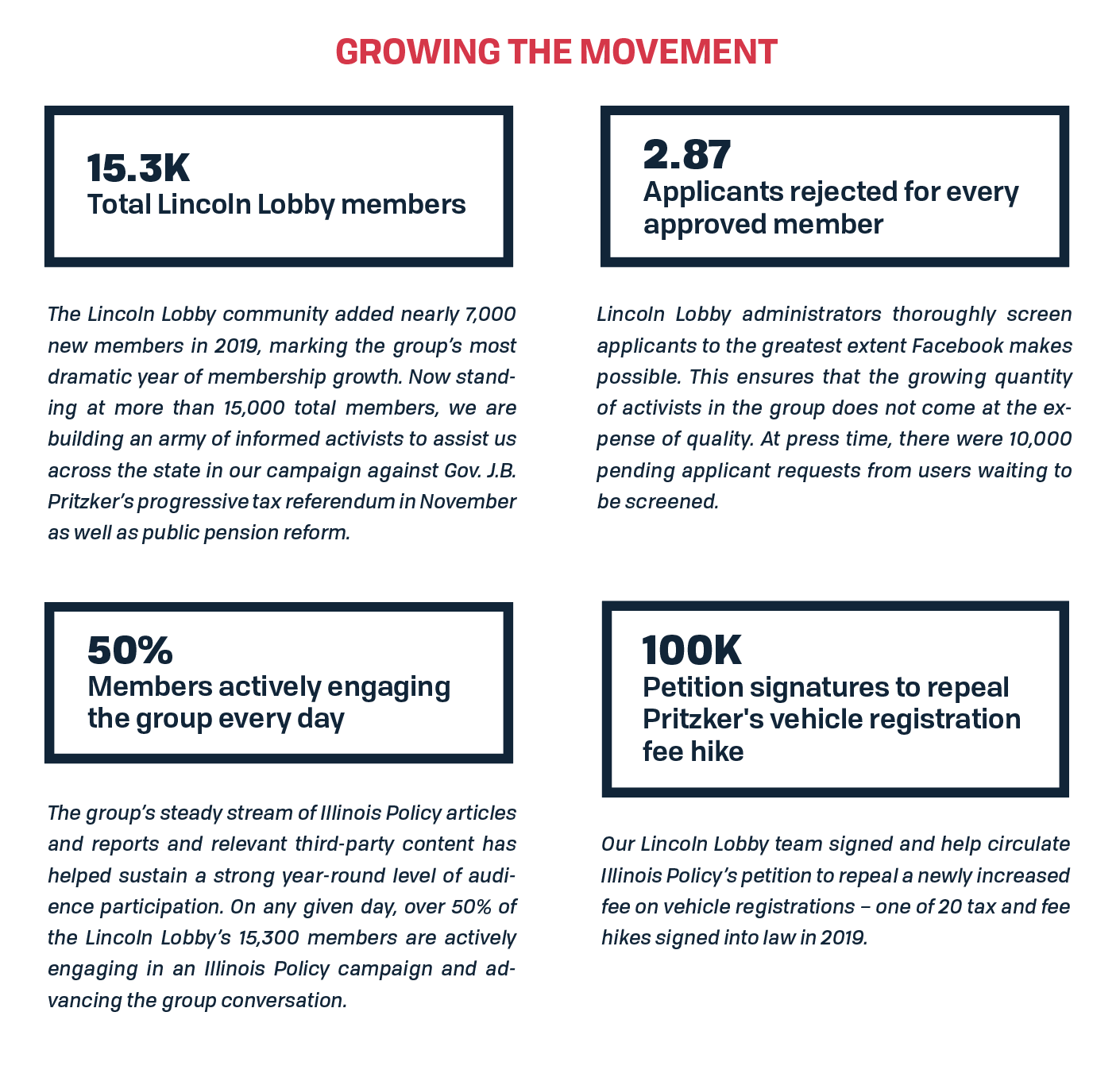

Launched as a private Facebook discussion group in 2017, the Lincoln Lobby community in 2019 made significant advances in asserting itself as an increasingly powerful force for policy change in Illinois.

Our community members in 2019 pushed for Illinois Policy’s agenda, showing up in large numbers to flood committee hearings with witness slips in support of Illinois Policy-backed bills, drafting letters to the editor in opposition to Gov. J.B. Pritzker’s progressive tax, signing and circulating Illinois Policy petitions on key issues, and attending exclusive in-person events designed to boost members’ knowledge and strengthen their skillsets as effective government watchdogs.

Below you’ll see some of the important ways in which we advanced liberty with the Lincoln Lobby in 2019.

Bringing it to life

During the year, Illinois Policy launched a series of meetups and events across the state, designed to foster camaraderie among Lincoln Lobby members while sharpening their skills as watchdogs and activists.

Hitting the streets

In 2019, we broke new ground with the Lincoln Lobby. In addition to our digital activism efforts, this past year saw members partake in campaigns away from the computer to raise awareness in their communities about the truth of Pritzker’s massive $45 billion capital plan and $3.7 billion progressive tax proposal.

Building the Lincoln Lobby brand

Every successful coalition needs a brand. And with thousands of engaged activists across Illinois, the Lincoln Lobby’s recognizable branding is well-represented in nearly all reaches of the state.

By advertising our brand with T-shirts, hoodies and car magnets, the Lincoln Lobby recruits new potential members to our movement every day, everywhere.

In 2019, Illinois Policy took the Lincoln Lobby’s branding to the next level. Seizing the moment to convey Illinoisans’ apprehension over Pritzker’s doubled gas tax, we launched a “pain in the gas” car magnet giveaway.

Because of the magnets’ immediate popularity, Illinois Policy expanded the giveaway beyond our Facebook group and took the campaign to the public, using the opportunity to drive more users to the Lincoln Lobby.

The demand we received highly exceeded expectations. And as a result, there are now more than 45,000 “pain in the gas” magnets on Illinois cars statewide.

Witnessing change

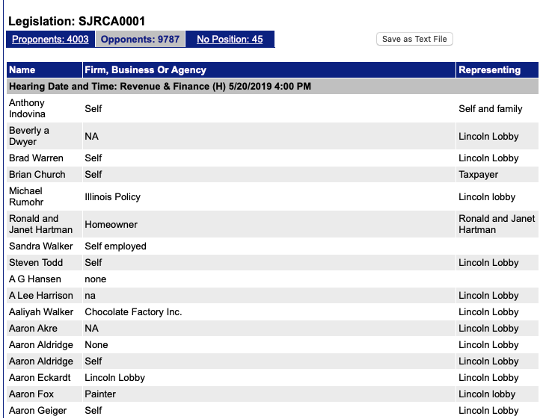

The Lincoln Lobby came out in full force this past year to make members’ voices heard on key legislation, massively outperforming the competition when it came time to file witness slips against the progressive tax (Senate Joint Resolution Constitutional Amendment 1) and in support of Illinois Policy’s education efficiency bill (House Bill 3053).

Recognizing talent

The Illinois Policy team makes it a point to recognize – and reward – talent when we see it. Our top activists regularly receive Lincoln Lobby swag and accessories. In some cases, they get an exclusive illustration by Illinois Policy’s famed cartoonist, Eric Allie.

What’s next?

Illinois Policy’s Lincoln Lobby members this year will be fighting on the front lines against the progressive income tax referendum. By spreading our research content, attending our town hall events, hitting the streets to canvass targeted districts and working the phones to urge Illinoisans to vote “no,” our engaged community will help defeat Gov. J.B. Pritzker’s so-called “fair tax” at the ballot box Nov. 3.

Cleaning up state and local government

Illinois’ reputation for corruption was firmly buttressed during 2019, with federal agents raiding homes, offices and public buildings searching for proof that political leaders had put their private interests ahead of the public’s interests. But the crisis of betrayals by leaders in township halls on up to the Statehouse gave the Land of Lincoln fertile ground for reform.

The Illinois Policy Institute was ready, with original anti-corruption research and reform measures now serving as the foundation for historic action.

Institute research in 2019 showed Illinoisans the true cost of corruption for the first time: more than $550 million a year in lost economic opportunity. Between 2000 and 2017, the total loss was at least $9.9 billion, or a $779 cost to each person in Illinois.

Another hidden cost is the loss of trust by Illinoisans in their government. Before the federal raids began, 3 in 4 Illinoisans in 2016 said they didn’t trust state government – the lowest ranking in the nation. Imagine the results if Gallup were to repeat the poll in light of federal corruption indictments of two state senators and a state representative.

The Institute documented the raids, charges, resignations and sentences, but early on investigated the red-light traffic cameras that were a common thread in many of the federal investigations. It also advanced the debate by offering the first comprehensive look at the cameras across the state. Hundreds of Freedom of Information Act requests yielded data showing how drivers paid more than $1 billion in red-light camera fines between 2008 and 2018. The Institute spread that finding by partnering with CBS 2, but then saw 78 other media outlets pick up the story including Crain’s Chicago Business, the Chicago Sun-Times, ABC 7, WGN-AM and WBBM-AM. The investigation prompted lawmakers to file legislation to ban the cameras and Illinois Comptroller Susana Mendoza in early 2020 decided to stop helping local governments collect red-light ticket fines.

Original content from the Institute also exposed mismanagement of an effort to obtain an Amtrak stop and the conduct of former Lake Forest City Manager Bob Kiely, one of the state’s highest-paid public employees at $250,000 a year. In October a grand jury issued a felony official misconduct indictment which stated Kiely failed to get city approval before funneling $200,000 to a lobbyist in pursuit of the Amtrak stop.

All told, corruption content produced by the Illinois Policy Institute prompted 171 media stories. The content also gained a significant audience as web traffic from FBI users averaged nearly a hit a day, with the most-visited stories demonstrating they were using Institute content to better understand the shape and history of Illinois corruption.

Illinois’ corruption crisis presents an opportunity for policy solutions to emerge. That’s why Illinois Policy had anti-corruption bills and key legislative sponsors ready and willing to advance real change in 2020 and beyond. Those solutions include:

- Adopting revolving door restrictions on state lawmakers becoming lobbyists.

- Empowering the Illinois legislative inspector general to investigate lawmaker corruption. As is, this muzzled watchdog office must seek approval from a panel of state lawmakers before opening investigations, issuing subpoenas and even publishing summary reports.

- Mandating state lawmakers recuse themselves from votes in which they have a conflict of interest. There is no current state law or even parliamentary rule requiring Illinois lawmakers to disclose a conflict of interest or to excuse themselves from voting on issues where they have personal or private financial interests.

- Reforming the Illinois House rules, which grant more concentrated power to the House speaker than any other legislative rules in the country.

- Passing a bipartisan constitutional amendment to end politically drawn legislative maps in Illinois.

Illinois has seen four of the past 10 former governors land in prison. Gov. J.B. Pritzker himself became the subject of a federal investigation involving tax fraud over removing toilets from a Chicago mansion to save $331,000 on property taxes.

Pritzker campaigned in part on rooting out corruption. He was silent on the issues in 2019, but in early 2020 found motivation from federal agents and policy answers championed by the Illinois Policy Institute. In the coming year, Illinois Policy will continue to encourage state leaders to step up to pass the reforms so Illinois is known less for its culture of corruption and once again as the home of Honest Abe.

Regulations sour youngster's lemonade stand

About one-third of Kankakee residents live below the poverty line. The city is also home to one of the highest crime rates in the state.

Eleven-year-old Hayli Martenez is trying to change that.

“A lot of little girls around here might not want to start a business,” she said. “But I know that they can. And they would actually love to.”

Like many Kankakee kids, Hayli does not come from a wealthy background. And after city officials demanded she shut down her neighborhood lemonade stand, she was made to feel like a criminal.

Hayli ran Haylibug Lemonade with the help of her mom, Iva. They started their sidewalk business in 2017. One cup cost 50 cents. And the proceeds went to Hayli’s college fund.

“It was kind of scary [at first] because we liked to stay in the house. We didn’t like to come outside because of all the stuff happening around here,” Hayli said.

“As we kept doing it, I got to see everybody smile when they tasted my lemonade. It was just … wow. They were lining up to get my lemonade.”

But the city’s code cops were having none of it.

Soon after the Kankakee Daily Journal profiled Haylibug Lemonade in July, the Martenezes got a visit from the city and the county health department, telling them to shutter the stand or risk fines.

Illinois is one of 14 states where residents are allowed to set up lemonade stands without a permit, according to Country Time Lemonade.

But health officials cited concern over the Martenezes’ home. Because of a dispute with the water company, which included Iva being incorrectly charged for service on a neighboring property, and falling behind on bills, they did not have running water in the house behind their lemonade stand. They often slept at friends’ homes overnight but stayed by the stand during the day.

Iva and Hayli made their lemonade with bottled water, not tap. Their sources at the local grocery store always let them know when Hayli’s supplies were on sale.

Where city regulators see opportunities to intervene, any teacher or businessperson sees the hallmarks of a good entrepreneur: Perseverance, problem-solving and putting customers first.

Hayli started serving lemonade and asking for donations. Not charging.

Illinois has a reputation for making business harder than it needs to be for entrepreneurs across the state. But often forgotten are the home-based businesses that make up the fabric of any strong community: whether it’s a kid’s lemonade stand or a grandmother’s famous bake sale cookies.

Hostility to home-based businesses prevents thousands of Illinois children like Hayli, not to mention adults, from serving their community through food.

That strips many young people of a critical learning opportunity. And for those who have few other options in order to make ends meet, they run the risk of hefty fines and embarrassment.

Health codes aren’t going away anytime soon. And no one is arguing against effective prevention of food-borne illnesses. But regulators should recognize that ensuring community health doesn’t just take the form of surprise inspections and heavy-handed regulations. It means allowing people to share their own special talents with their neighborhood, even if they don’t have the money or clout of an established business.

By August, media accounts generated an outpouring of support and fundraising efforts were underway to back Hayli. Her home again had running water and the stand was back in business.

But more importantly, her college fund grew significantly thanks to donations from Country Time, Illinois Policy Institute supporters and others. She now has a business management tutor and is learning marketing, money management and tactics to invest her money so it grows.

Still, Kankakee may have seen the last of Hayli’s lemonade. While she was discouraged by the regulatory interference, Iva said the switch is because her daughter is making a business decision. Hayli’s new business venture is DJing events, and the young entrepreneur knows to seize opportunity and that time is money.

“She said, ‘Mom, why sit out there selling lemonade all day for $5 or $10 when I can do an event for a few hours and make $250?’” Iva said.

Shaping the conversation

While Illinois Gov. J.B. Pritzker’s push to put a progressive income tax on the ballot in November 2020 flooded the news, the Illinois Policy Institute emerged as the strongest and most respected taxpayer voice in the state.

Not only did the Institute prove a progressive income tax would not provide promised property tax relief, but it also held policymakers in Springfield accountable for corruption and unethical practices.

The Institute stood out as the first to tally up the nearly 20 new or increased tax and fee hikes politicians passed in Springfield in 2019. A doubled gas tax, increased vehicle registrations and trade-in taxes would all more than eliminate any relief from a progressive income tax in Illinois. That message took shape from the top down.

The Institute’s research informed the opinions of numerous editorials in national outlets such as The Wall Street Journal, the National Review, Reason, the Washington Post, Forbes and CNN Business.

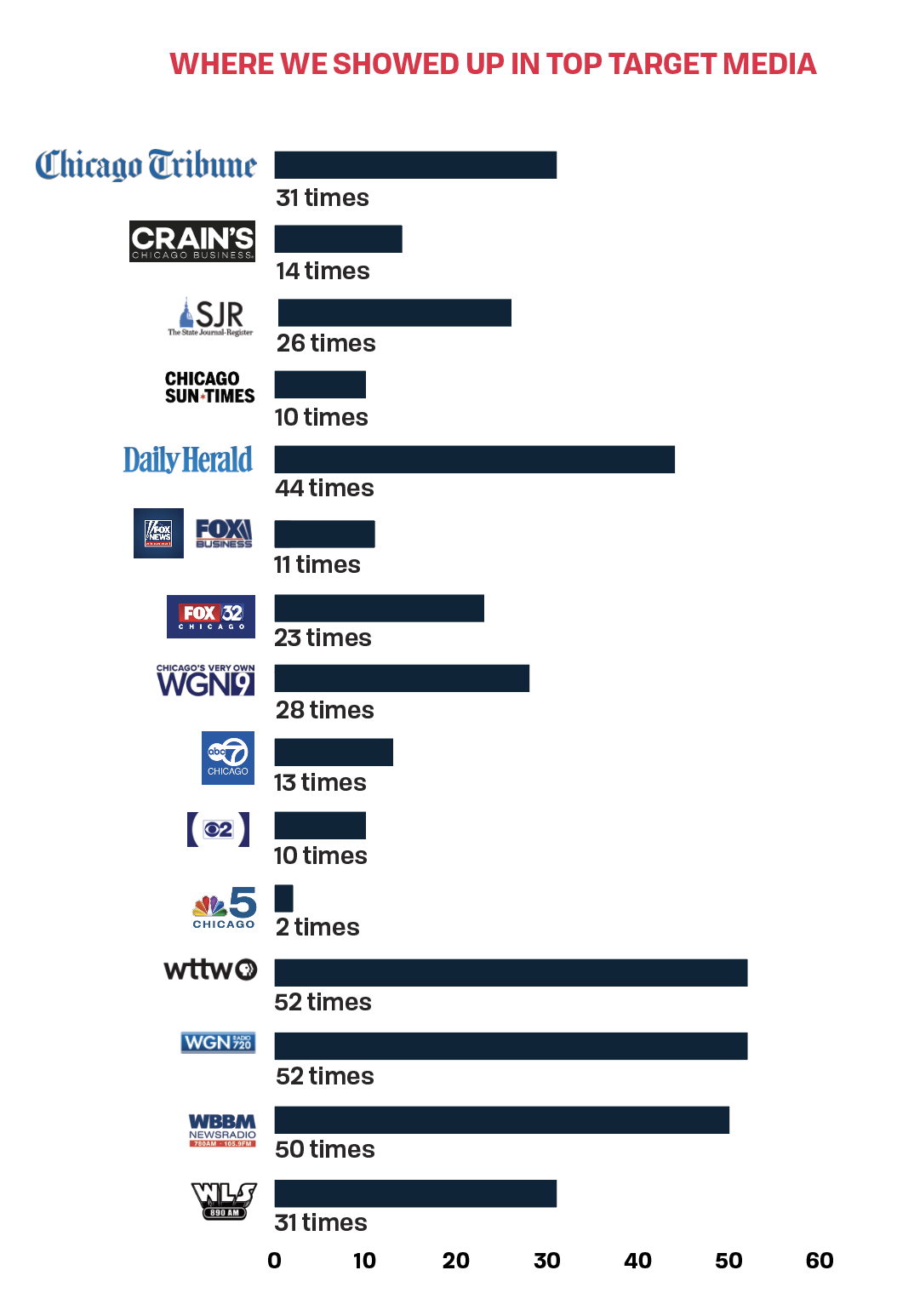

With consistent production from the Institute’s research and policy teams, the communications team had more content to promote with state and local media than ever. This resulted in a record number of inbound media requests and nearly 90% of all media hits focusing on the Institute’s policy solutions in a neutral or positive tone. This means the Institute’s voice is more trusted and valuable than ever in media.

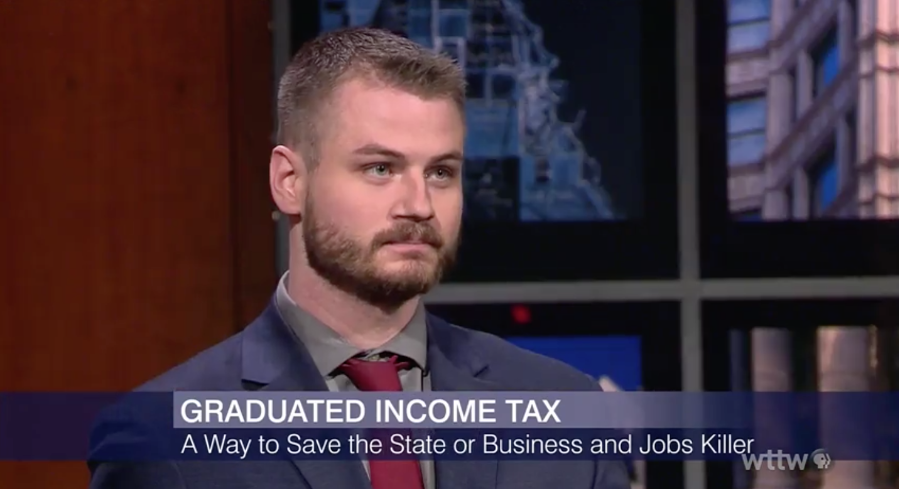

By the end of the year, Institute experts could be seen on every Chicago TV news outlet for the very first time, from quick features on ABC 7 and WGN to regular guest appearances on WTTW’s “Chicago Tonight,” a show insiders turn to for news and commentary on the city and state’s most pressing policy issues.

Debunking the progressive income tax

With the progressive income tax gaining support in Springfield, the Illinois Policy Institute shed light on exactly what it would mean to everyday Illinoisans: yet another tax hike.

The Institute was the first to debunk Pritzker’s claims that a progressive tax would only hurt the richest 1% by calculating the economic harm. It estimated initial rates as well as by how much revenue would fall short to harm all Illinoisans. These insights resulted in more than 500 media outlets picking up the Institute’s original research and cementing its experts as the “go-to” voice of opposition.

By the end of 2019, despite lawmakers approving the progressive income tax and officially moving it to the November 2020 ballot, we secured nearly 800 media placements on explaining the issue to the public.

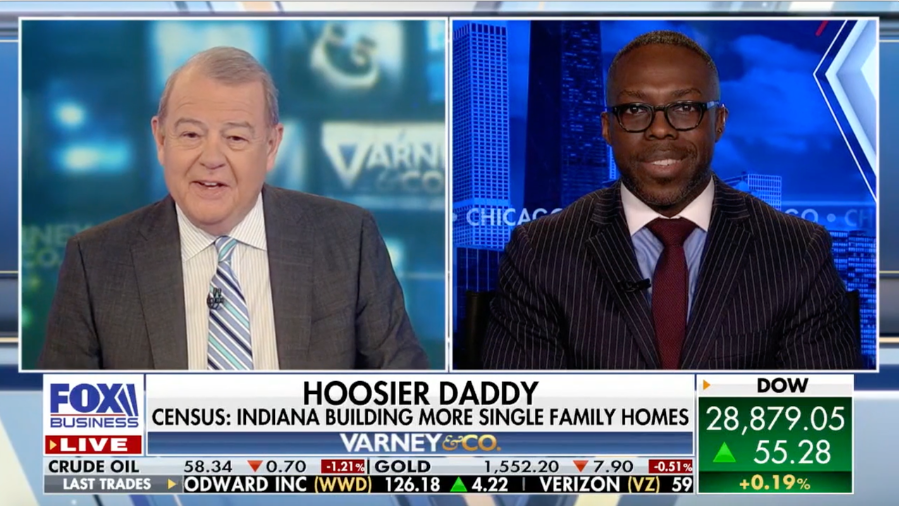

Appearances included multiple media placements on WTTW, Fox 32, WBBM-AM, WGN-AM, WLS-AM, the Chicago Tribune and Fox Business Network.

Driving the anti-corruption narrative

With dozens of state and local government officials facing federal investigations during the course of 2019, the Institute capitalized on the opportunity to shine a light on the causes of institutional corruption in Illinois, looking beyond the names of wrong-doers to expose the rules allowing unethical practices to take root in the first place.

After promoting the research team’s findings on how corruption costs Illinoisans at least $550 million each year, the Associated Press picked up the Institute’s call for change, resulting in nearly 50 media placements across the nation.

About the same time, the Institute unveiled an exclusive investigation into the Chicago area’s red-light camera cash grab. Forging crucial media relationships to release the report, IPI partnered with CBS 2 and the story caught fire across local media.

With nearly 100 placements in just one month, outlets such as Crain’s Chicago Business, the Chicago Sun-Times, ABC 7, WGN-AM and WBBM-AM covered the story. The investigation even sparked lawmakers to propose legislation that would have eliminated photo-enforced traffic lights statewide. And state Comptroller Susana Mendoza announced in early 2020 that the state would no longer assist local governments with ticket collection.

Translating union costs

The Institute offered up the only research on the costs of the longest-ever Chicago Teachers Union strike in 2019. The Institute answered what every media outlet needed to know: what does this contract mean for homeowners’ property tax bills?

This credibility earned the Institute media placements on CBS 2, NBC 5, ABC 7, WGN, Fox 32 and WTTW – every TV outlet in Chicago, for the first time ever. In total, the Institute earned nearly 200 media placements in only three months.

The Institute’s media push and constant output of new data resulted in the city’s three main legacy newspapers opining in opposition to the strike. The Chicago Tribune, the Chicago Sun-Times and Crain’s Chicago Business were infused with the Institute’s overall message that the strike was not in students’ best interests, but instead about the union’s political clout.

Positive, policy-focused coverage

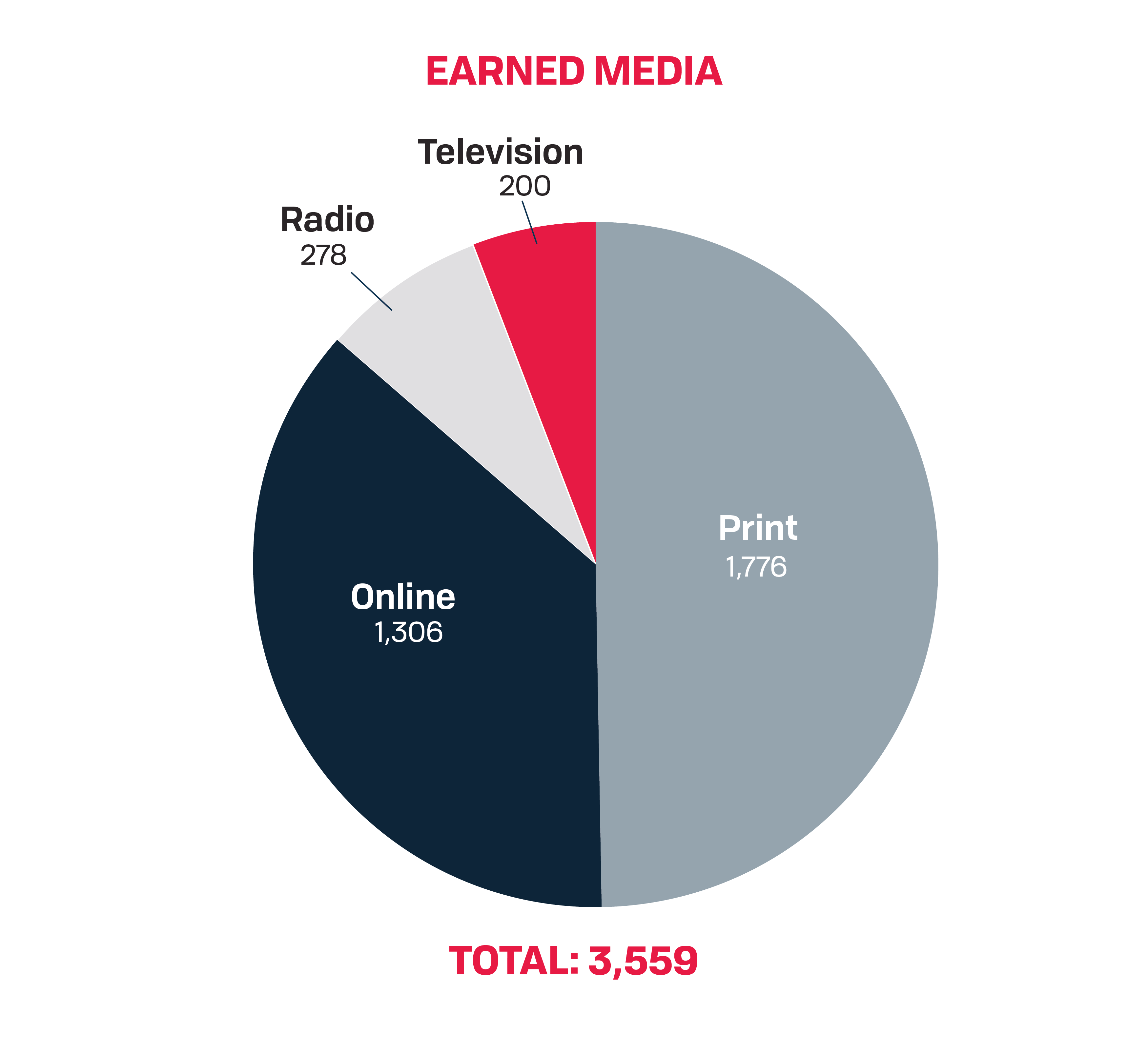

The Illinois Policy Institute ended 2019 with record-breaking positive media coverage. Featured in every Chicago TV outlet along with all the major radio and print publications across the state, the Institute earned more than 3,000 media placements highlighting the organization’s policy solutions in a neutral or positive light.

In total, nearly 90% of Illinois Policy’s media placements in 2019 were neutral-to-positive in tone and focused on policy. In comparison, 78% of the total media mentions in 2018 were neutral-to-positive, policy-focused hits. In 2017, respected media mentions made up only 50% of the Institute’s total.

This change of tone coupled with the increase in overall media mentions signals the improvement of Illinois Policy’s brand and reputation as a trusted policy leader and resource.

Media metrics

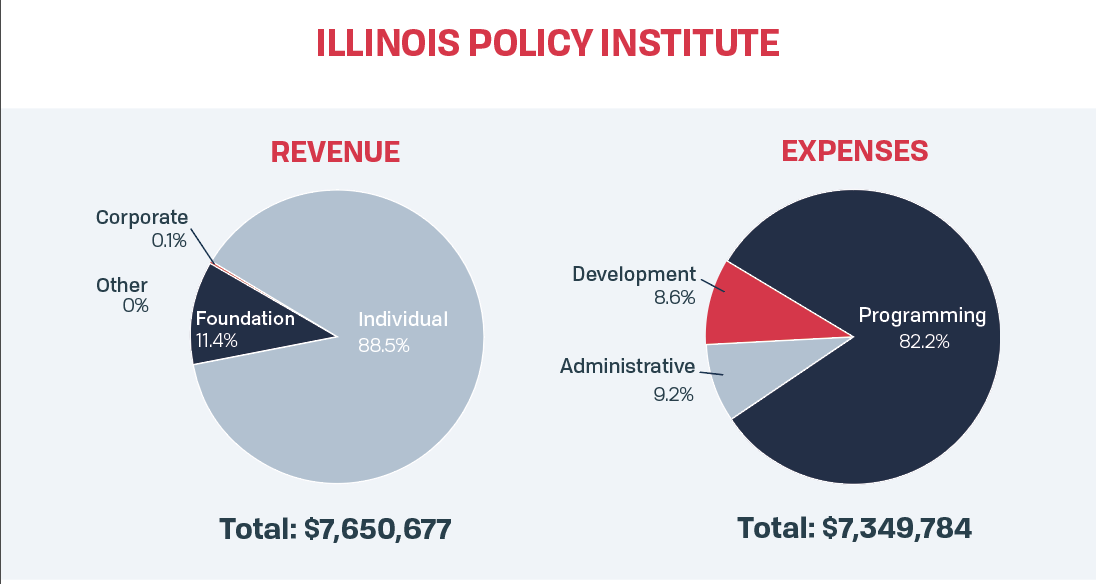

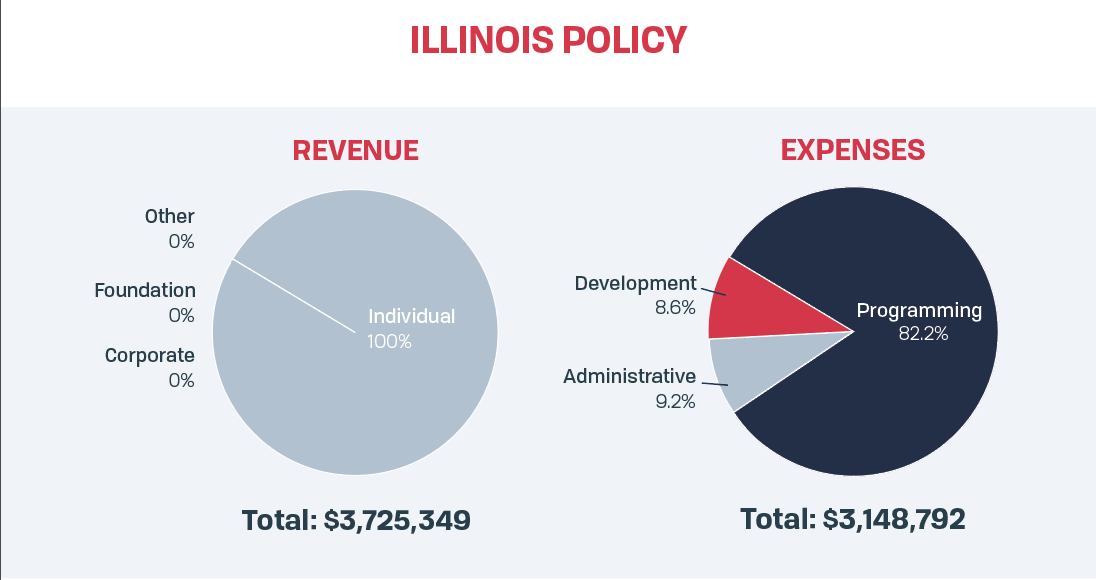

Financials

What you fight for is who you are

In 2002, the Illinois Policy Institute was founded to “promote personal freedom and prosperity in Illinois.”

Eighteen years later, the Illinois Policy Institute has grown into one of the greatest forces in the nation to fight for the rights and dignity of people, not government.

A Spanish philosopher said, “Tell me what you pay attention to, and I’ll tell you who you are.” I think we can go one step farther: “Tell me what you fight for, and I’ll tell you who you are.”

Most people fight for their family, their friends, their faith. But we fight for something more. We fight for the people who most need our help.

That is why I’m so proud to be part of the Illinois Policy Institute. Our donors, our community and our team are aligned and fighting for people who have nobody else to fight for them, such as the poor, the disadvantaged and the vulnerable.

Together, we fought and protected school choice so youngsters such as Jalyn Baker can go to the schools of their choice, and not be forced into failing neighborhood schools.

Together, we fight for worker freedom so Ifeoma Nkemdi, a Chicago teacher who loves the students in her class, could continue to teach them rather than join a strike that “didn’t fit with the values that I have.”

Together, we fight against corruption so our tax dollars are spent on services for those most in need, not for tax increases to fund political greed and failure.

This is who we are, and this is who we fight for. It all is possible because of you and your partnership, generosity and your investment in our mission.

The fight for individual dignity has never been greater.

In the year ahead, we have an opportunity to take significant steps toward rebuilding the American Dream for all people in Illinois. I’m grateful for your partnership, and together, look forward to fighting for freedom with you.

![]()

Matt Paprocki

President and Chief Operating Officer