Letter from the CEO

2020 will forever be remembered as an “unprecedented” year. I think we all agree we never want to hear that phrase again, but for Illinois it really is true. The year brought so much loss, unemployment, loneliness and suffering – much as a result of government policies or missteps.

But with your unwavering commitment to fix Illinois, 2020 also brought us hope through tax-payers’ overwhelming defeat of the progressive income tax. Your investment in Illinois Policy helped us reveal the truth about the tax. Voters were activated who had never registered to vote, nor voted in previous elections. They were motivated to say, “No. More. Taxes.

What makes it even better is taxpayers didn’t just eke by with a minor victory – they crushed Gov.J.B. Pritzker’s “fair tax” plan, giving him and other elected leaders an opportunity to finally address the real problem: pensions.

Your support also ushered in the end of a 36-year era under Illinois House Speaker Mike Madigan.The nation’s longest-tenured Statehouse politician and the man who oversaw Illinois’ financial collapse could not garner enough votes from his own party to keep the speakership.

Madigan’s fall from power means so much more than simply one man being switched out for another. The system of corruption and power that he built for decades was constructed specifically around him. He orchestrated the patronage, the majority party purse strings, and of course, the system of House Rules that made him the sole arbiter of whether meaningful reforms passed into law.

A new speaker means a clear opportunity to help reset the way Illinois runs its government.Illinois Policy has been working for years to build relationships with lawmakers from all political stripes, and it’s evidenced by almost every bill in our legislative agenda this year having a Democratic chief sponsor, and many with Republican co-sponsors. We have never been in a more primed position to advance transformational reforms for Illinois taxpayers.

In the following pages you’ll read more about the strategies and impact of 2020’s wins, as well as the opportunity in front of us to advance real changes for Illinois.

2021 will (hopefully) not be as “unprecedented” as 2020 was. Because of your investment, the result may be many more unprecedented victories that result in a freer and more prosperous Illinois.

I am so proud to be on this journey with you. I can’t wait to see what we can accomplish together next.

John Tillman

Chairman and CEO

Who we are

Illinois Policy Institute

A nonpartisan, nonprofit research organization, the Illinois Policy Institute’s mission is to transform liberty principles into marketable policies that become law. The Institute’s vision is for Illinois to be a beacon of prosperity that will shine across the Midwest and the nation. To achieve these goals, the Institute generates practical policy solutions to unleash Illinois’ talent and entrepreneurial ability.

Illinois Policy

A nonpartisan, nonprofit advocacy organization, Illinois Policy exists to directly engage government officials on a vision of a freer, more prosperous society.

Madigan

How Mike Madigan fell, creating hope for Illinois

Exactly 50 years after first taking his seat in the Illinois House of Representatives, January marked the end of the longest reign of any legislative leader in American history.

Mike Madigan was denied the speakership after gripping that gavel for 36 of the past 38 years.

Forged in the notorious political machine ofChicago Mayor Richard J. Daley, “the VelvetHammer” was long thought to be politically un-touchable. Since 1983, a total of three Democratic House members had ever failed to vote for Madigan as speaker.

But on Jan. 13, he didn’t receive a single vote.

It was a critical shift in momentum that our state has not seen in decades.

How did it come to this?

Madigan gave a hint in a statement released after four of his allies were indicted in November aspart of a federal investigation into a utility company’s years-long scheme to bribe the speaker.

“Some individuals have spent millions of dollars and worked diligently to establish a false narrative that I am corrupt and unethical,” he said.

The narrative surrounding Madigan’s handling of Illinois’ twin crises – ethics and debt – reflected reality.

And that truth was illuminated through a campaign led by the Illinois Policy Institute.

As recently as 2009, Madigan had a neutral approval rating. Nearly 1-in-5 Illinois voters weren’t even sure who he was or had no opinion. In 2012,a plurality of Illinoisans (40%) had no opinion or didn’t know about the speaker.

Loosening the speaker’s grip on power – and transforming the state – would require a long campaign exposing Madigan’s influence over patronage jobs, property tax appeals, gerrymandered maps, political purse strings and the state’s finances.

And that’s exactly what Illinois Policy did.

Video, storytelling and grassroots mobilization were used to expose Madigan’s rise to power, his corruption and his destruction of Illinois in away that has never been done at the state level.The centerpiece of the marketing campaign was a full-length documentary that told the story of Madigan’s political career and how he consolidated power during his more than 40 years in office. The film, titled “Madigan: Power. Privilege.Politics.” also documented how Madigan personally profits from Illinois’ high property taxes.

The speaker’s name was even secured as a domain to host the film: michaelmadigan.com.

It revealed for the first time on screen the full picture of how Madigan’s policy priorities were designed to give him unmatched influence. Millions have since viewed parts or all of the film.

In addition to the documentary, the Illinois Policy team has published hundreds of articles and newspaper columns highlighting Madigan’s legacy of power politics. It created corresponding cartoons, radio segments, promotional materials and even a life-size Madigan mascot.

The FBI took notice of the Illinois Policy Institute’s groundbreaking work on the speaker, including its comprehensive analysis of how the House rules made him the most powerful legislative leader in the nation. In fact, the Institute’s coverage of Madigan’s corruption and power had been viewed by the FBI more than 1,200 times before news broke that the speaker was in federal prosecutors’ crosshairs.

By 2016, Madigan’s net approval rating had plummeted to -37. Further polling in 2019 showed a stunning 71% of voters statewide disapproved of the speaker.

For years, community members across the political spectrum asked the Institute howIllinois could get Madigan out of power. The answer was always the same: make his rank-and-file members fear their own voters, and thus their own political futures, more than they feared Madigan.

That is exactly what happened. And that is why building the state’s largest megaphone on policy and politics matters.

Today, the Illinois Policy Institute’s “earned audience” of active users who have opted into its community with their first name, last name, email address and ZIP code totals1.5 million. Its website, illinoispolicy.org, clocked 25million page views in 2020.

It uses that megaphone to ensure elected officials re-spect taxpayers more than they fear the political insiders, special interests and all those who have put Illinois on the wrong track for decades. It helped make Madigan a household name.

But Illinois will not change overnight because of Madigan’s ouster.

Without structural reforms he long worked to pre-vent, the state will continue down a path of high-er taxes, worsening social services and outmigration. For example, because of unsustainable pension promises, Madigan oversaw the long slide of Illinois from one of the most credit-worthy states in the nation to the least – teetering on the edge of “junk” status.

This momentous new day in Illinois state politics should not be just about a new face. It should be about a new way of doing the people’s business.

Commonsense ethics reforms, bringing democracy to the Illinois House through rules reform, and passing pension reform that protects Illinoisans reliant on social services, workers’ retirement security and taxpayers’ pocketbooks all remain as critical today as they ever were – no matter who is speaker.

But make no mistake: Madigan’s removal from power was a necessary first step to transforming Illinois into a beacon of prosperity that shines across the Midwest.

And it serves as a powerful reminder to Illinoisans that the state lies in the hands of voters making informed decisions about their future – not a permanent and unaccountable ruling class.

“Power is like beauty,” Madigan once said.

“Much of it is in the eye of the beholder.”

Progressive tax

The power of a think tank comes from its ability to deliver the right message to the right audience at the right time – and most importantly, to compel that audience to act.

In 2020, there was no more important effort than successfully educating Illinoisans on the dangers of a progressive state income tax. TheIllinois Policy Institute, along with coalition allies, achieved that goal. And in the end,Illinois voters decisively rejected Gov. J.B. Pritzker’s “fair tax” – with 54% “no” votes to 46% “yes.”

It was an overwhelming victory that transformed Illinois almost overnight. Crain’s Chicago Business described the new political landscape this way: “Now that Illinois voters have slammed the door on the ‘fair tax’ idea, the door to more substantive and fundamental change has been forcefully blown open.”

But this wasn’t supposed to happen.

Pritzker is the wealthiest governor in American history. And as recently as March 2020, a poll found 65% of Illinois voters supported the “fair tax.”

What changed?

Illinoisans got the truth.

The message

To succeed, the Institute needed to ensure Illinois residents – especially those from the center and even the left – understood the dangers of a progressive income tax. All of this hinged on finding the right message.

Polling found when residents understood that removing Illinois’ flat tax protection made a retirement tax more likely, support for the progressive tax quickly eroded. What’s more, this held true across all ages, racial groups and party affiliations. The Institute began infusing the retirement tax message into nearly all of its progressive tax content.

Illinois State Treasurer Mike Frerichs then boost-ed that message in June, when he said, “One thing a progressive tax would do is make clear you can have graduated rates when you are taxing retirement income. And I think that’s something that’s worth discussion.” Springfield political columnistRich Miller quickly noted these remarks “played right into [Illinois Policy’s] rhetoric.”

And then one month before Election Day, theInstitute reinforced the retirement tax message through a new and innovative approach: the Illinois Policy Institute recruited three Illinois retirees to be plaintiffs in a lawsuit challenging the misleading wording of the progressive tax ballot language, arguing it violates the IllinoisConstitution’s “free and equal” elections clause.Within just one week, the Illinois Policy Institute was featured in more than 400 legacy media placements regarding the lawsuit and the debate over whether the progressive tax opens the door to taxing retirement income.

Major political commentators began to report that message had penetrated with voters and was causing major problems for Pritzker and his progressive tax. In a segment highlighting the lawsuit, Mary Ann Ahern, political reporter at NBC 5 Chicago, noted,“The questions raised about retirement income clearly are having an impact on whether[the progressive tax] does pass.” And in a column titled,“Is Pritzker’s graduated tax plan in trouble?”, Crain’s Chicago Business columnist Greg Hinz explained,“The flap over retirement income, combined with other factors, now is endangering passage prospects for the amendment.”

Perhaps most importantly, the engagement outpaced Pritzker’s ballot committee despite being outspent 5:1. This is a result of a years-long strategy to build an engaged audience – both on social media platforms, such as Facebook, and most importantly, via amore than 1.5-million-strong earned audience. This base enabled the Institute to reach and activate a broad swath of Illinoisans in a much more efficient and effective way. On the left is a snapshot of the online engagement in the one-week period prior to the election.

Unleashing the volunteer army

Illinois Policy’s Lincoln Lobby activist network – made up of more than 21,000 Illinoisans – sent nearly 1 million text messages to target voters and contacted more than 20,000 voters in person. It focused this personalized outreach on low-turnout voters who were modeled as opposing the progressive tax. The volunteers reached out to remind them to vote, as well as provided information on where they could find their polling places.

The reach

Dominating the narrative

In the six months leading up to Election Day, media outlets statewide and nationwide covered the progressive tax proposal in Illinois more than 1,800 times. The Illinois Policy Institute was either mentioned or a main focus in 1,028 of these stories. That means every other story you would read about the progressive income tax amendment in Illinois featured Institute experts, research or the legal action challenging the biased ballot language.

The Institute’s original opinion pieces landed arguments against the tax in media outlets across the state – including every Chicago newspaper, many central Illinois papers and national outlets including National Review and The Wall StreetJournal. The Institute authored and published four times as many op-eds as the leading “fair tax” supporters and nearly 20 times as many op-eds as other opponents of the progressive tax.

The largest megaphone on digital

Illinois Policy’s earned audience – residents who have opted into its community with a first name, last name, email and ZIP code – surpassed 1.5million people in 2020. That audience base allowed it to dominate the progressive tax conversation online throughout 2020.

From Oct. 1 through Election Day, Institute content reached 6.8 million people and earned 2.8 mil-lion engagements (reactions, comments, shares or clicks) on social media. During the same time period, data from a third-party analytics firm revealed remarkable dominance of its message online: Of the top 100 best-performing posts across all digital media from all organizations involved in the progressive tax fight, measured by engagement, 80 came from the Institute team.

The result

All of this work led to two key results:

Persuasion: Among swing voters casting their ballots early, 22% said the primary reason they voted “no” was because the progressive tax made a retirement tax more likely – meaning the retirement tax message alone may have accounted for as many as 625,000 votes against the “fair tax.” Illinois Policy identified, tested and then amplified this message.

Activation: More than 70,000 low-propensity voters modeled as likely to vote “no” on the progressive tax submitted their vote early after receiving a text message from a LincolnLobby activist or using Illinois Policy’s online polling place lookup tool. These are Illinoisans who had not voted in the previous four general elections and likely would not have voted if not for Illinois Policy outreach.

The future

The decisive defeat of the progressive tax is the most consequential pro-taxpayer victory in Illinois in the past 50 years. We are now living in anew Illinois – with new opportunities to advance long-needed reforms.

And here is the best part: Your investment has al-lowed the Institute to build unrivaled assets – an engaged audience of millions of Illinoisans, along with a robust activist network – that can be leveraged in future policy battles that foster a freer, more prosperous Illinois.

Union opt-out

In the initial 18 months after the U.S. SupremeCourt’s landmark Janus v. AFSCME decision, public-sector unions typically honored opt-out requests with little pushback. But that start-ed changing in early 2020, after Illinois Gov. J.B.Pritzker signed Senate Bill 1784 the previous December. That bill amended Illinois labor laws to prohibit government employers from stopping the deduction of union dues unless the union approved – making unions the sole gatekeepers of the opt-out process.

That unchecked authority led to unions more frequently imposing time restrictions on when members could stop dues and even – in hundreds of circumstances – ignoring opt-out requests entirely.

Those obstructions created an urgent need for the Institute to develop a thorough procedure for identifying viable clients and referring them for legal assistance.

The effort paid off in the filing of three separate lawsuits

Hydie Nance v. SEI

Perhaps one of the most egregious union obstructions in 2020 was created by SEIU HealthcareIllinois and Indiana, the union that represents personal assistants and child care providers participating in federal programs handled by the Illinois Department of Human Services.

After helping over 850 caregivers send letters opting out of the union, we discovered SEIU was ignoring the letters. The caregivers did not have their dues stopped, and the union never acknowledged receiving the forms. When caregivers pursued answers from the union with our assistance, they were told various mistruths about the opt-out process. Some were told letters had to be accompanied by a copy of a photo ID; others were told letters sent on a form created by a third party (i.e., the Institute) were not“legitimate”; and some continued to be ignored.

We then identified a personal assistant willing to file a lawsuit against the union giant for wrongfully refusing to honor her repeated re-quests to stop her dues deductions, and for re-payment of the dues she had been charged in the meantime. In May 2020, the National Right to Work Legal Defense Foundation filed a federal class action lawsuit on behalf of caregiver Hydie Nance. By August, NRTW had obtained a settlement from SEIU. While the case did not reach the point of becoming a class action, the settlement included agreements by the union to:

- Honor opt-out requests that are not accompanied by a photo ID;

- Honor requests submitted on a form created by an outside organization; and

- Go back and honor requests it had previously rejected for those reasons.

That was a major win against a union that had specifically rejected opt-out requests generated by our campaign.

Troesch v. Chicago Teachers Union & Chicago Board of Education

When the Chicago Teachers Union went on strike in October 2019, the Institute assisted several educators in opting out of the union so they could cross the picket lines and go to work without facing union punishment.

Two of those Chicago Public Schools employees were Joanne Troesch, a technology coordinator at Jones College Prep, and Ifeoma Nkemdi, a second-grade teacher at Newberry Math and Science Academy.

While Joanne and Ifeoma were allowed to opt out of union membership, the union forced them to continue paying dues until August 2020, claim-ing their membership agreements committed them to paying dues through the school year.

The Institute once again partnered with Nation-al Right to Work, which filed a federal lawsuit against the union and school district in May 2020.That lawsuit remains pending in district court.

Should Joanne and Ifeoma succeed, it could mean teachers in Chicago Public Schools – and perhaps other areas of the state – will be free to stop paying dues outside of the time restrictions imposed by their union.

Ramon Baro v. Lake County Federation of Teachers

On Aug. 30, 2019, Waukegan District 60 teacher Ariadna Ramon Baro opted out of her union, the Lake County Federation of Teachers. Ariadna’s story highlights the tricks unions play to induce teachers into union membership.

At employee orientation 10 days earlier, Ariadna was told she would be charged union dues even if she chose not to be a union member – something that expressly contradicted the U.S. Supreme Court’s decision in Janus.

Ariadna subsequently learned about her rights and opted out through the Institute’s website. Despite opting out in August – the union’s timeframe for opting out and stopping dues – her request was denied. The union claimed she had to wait an entire year – until August 2021 – to stop her union dues.

Like the Troesch case, a successful outcome will push back against unions’ restrictive timeframes that infringe on teachers’ constitutional right to disaffiliate with their unions.

COVID-19

Illinois Gov. J.B. Pritzker enacted some of the nation’s strictest business shutdown orders in the wake of the COVID-19 outbreak, closing restaurants, bars and thousands of other businesses deemed “non-essential.” And while Pritzker’s focus and message remained centered on COVID cases, hospitalizations and positivity rates throughout 2020, the Illinois Pol-icy Institute amplified the voices of those grappling with the economic ramifications of his actions.

Bringing the stories of small business owners to life

The Institute focused relentlessly on Illinois’ un-employment crisis throughout the COVID-19lockdowns, providing real-time analysis on jobs numbers and economic indicators. But we didn’t just share data and facts. We also gave a voice to the small business owners and workers who were being ignored by the state.

We shared the story of Kristan Vaughan, who operates Vaughan Hospitality Group, with seven Irish pubs in Chicago and its suburbs. “So much of our lives, so many activities center around our businesses,” Vaughan told us. “My son took his first steps in the restaurant. We’re here all the time. It would just be heartbreaking to lose them.

Two months after Kristan’s story was featured on the Institute’s website, The Wall Street Journal wrote about her experience and the hard-ships she and many other small business owners are facing.

How did Kristan’s story go national? Because the first group WSJ reporter Eric Morath thought of in Illinois was the Institute. Morath reached out to our team directly in May, complementing our work on small business storytelling and asking us to connect him with some of the people we featured.

We also told the story of Katie Anderson, owner of Anderson’s Candy Shop. Things were dark during the spring lockdowns: “We don’t want to have to slash hours but if I don’t have the business, I won’t be able to employ my staff. My sales today were 60% below what they were this day last year. Now that the governor has issued a stay-at-home order, I would imagine sales will drop even farther.”

But after the Institute told her story, her sales picked up and social media embraced her business. She wrote to the Institute: “Just as important, however, if not more, is the emotional impact that the reaction to the piece has had on my family. Feeling the support from people around the state has lifted my dad out of the deep, fear-and-anger-filled depression he had sunk into in the days before the piece ran. The reaction to the piece from your subscribers has given all of us, but my Dad in particular, hope that things might be recoverable, and it might be OK.”

These are just two examples of the 65 small business owners and workers the Institute high-lighted throughout the year.

Holding Pritzker accountable

We showed that while other states made quick changes to handle the onslaught of unemployed workers, Pritzker failed to make necessary adjustments. Instead, desperate residents were left waiting hours or days on the phone for help.

Not only did Pritzker’s administration fail those who needed aid, they also compromised applicants’ personal information.

In May, the Institute provided exclusive FOIA in-formation to Fox 32’s Mike Flannery showing 32,000 Illinoisans’ Social Security numbers and other personal information was exposed by anew unemployment system. Fox ran the exclusive story on May 21, featuring Vice President of Marketing Austin Berg, who discussed IDES’ mismanagement and held state officials accountable for their mistakes

The Institute was also the first to call for Pritzker to pause the state’s $261 million in scheduled automatic pay raises for state workers. We noted other Democratic governors, including those inNew York, Virginia, Minnesota and Pennsylvania, had already taken similar steps to rein in government spending during the COVID-19 outbreak.

A reporter from Franklin News Foundation’s news-wire service then asked Pritzker at his daily press conference if he would consider delaying state worker raises. Pritzker replied, “That’s not something we’re currently having discussions about.

We drew attention to Pritzker’s remarks and soon legacy media outlets – including Chicago’s NPR affiliate, WBEZ – began to cover the story as well.

Unleashing our activist network

On May 15, Pritzker quietly filed a new executive order to change how businesses that violated his stay-at-home order would be punished. Under the new order, business owners could be charged with a Class A misdemeanor crime, resulting in a maximum penalty fine of $2,500 and up to one year in prison.

Illinois Policy quickly alerted residents to Pritzker’s new order. But we didn’t stop there.

Our government affairs team worked with stateRep. Keith Wheeler, a member of the Joint Committee on Administrative Rules, or JCAR, to get the rule pulled. JCAR is a little-known committee made up of 12 members: six Republicans and sixDemocrats. In order to successfully block an administrative rule, at least eight of the 12 members must approve an objection.

All of the Republican members announced their opposition to Pritzker’s rule leading up to the hearing. That meant we needed to flip two Democratic members to defeat it. We immediately launched a campaign to do just that.

In less than 48 hours leading up to the hear-ing, our community sent 20,062 unique emails to the 12 members of JCAR. And while most of the members’ offices had disconnected their phone lines, we ran a hyper-targeted robocall campaign for three Democratic members who still had functioning phones and were high-value targets – this added 60 calls into lawmaker offices, including more than 40 to state Rep. Mike Halpin, a Democrat whose district borders Iowa.

Our strategy worked. Public health officials announced the rule would be repealed, indicating the governor did not have the votes needed to avoid public rejection from Democratic lawmakers.

But Pritzker didn’t stop there. After being forced to withdraw his executive order, the governor announced his intention to codify his rule through the legislative process. Our team immediately identified 13 Democratic lawmakers who we believed were most likely to vote “no” on a bill. In less than 24 hours, our community sent an additional 11,000 emails to these targets, urging them to stand up to the governor.

And once again, we prevailed.

The governor finally conceded and was clearly frustrated with members of the General Assembly, saying:

“Well my understanding is that legislation [on the shutdown order] … is something that the legislature does not appear to want to raise and hold a vote on … I’ll be very disappointed [if they don’t pass it]… they don’t seem to want to help in any way dealing with the COVID-19 crisis.”

Marketing

Despite many struggles, 2020 proved to be the most successful year ever for Illinois Policy’s content – both in reach and impact. In fact, 2020 was the culmination of our team’s “earned audience” strategy.

Earned audience members opt into our community with their first name, last name, email address and ZIP code. These opt-ins are critical because they reduce the cost of delivering our message to the right audiences at the right time to spur action. Growing our community in this way has not only empowered us to cost-effectively spur mass action on behalf of taxpayers, it also allows us to educate our audience overtime on the biggest problems facing our state.

Our earned audience grew from 392,000 at the end of 2018, to 590,000at the end of 2019, to 1.5 million in 2020.

In addition, nearly 9 million users clocked more than 35 million page views on illinoispolicy.org in 2020– smashing our previous records. Illinois Policy also published a record 65 Your Story profiles, providing a mega-phone to our community members suffering under the status quo.

This reach matters because our competition for mind-share is not just with a given politician or special interest group, but with everything vying for Illinoisans’ attention. For example, look at how Illinois Policy stacked up against the largest TV news stations in the state for the two weeks leading up to Election Day. The chart below compares their nightly news audience to our average daily digital audience, which consists of unique engaged Facebook users, website visitors and email opens.

Illinois Policy wielded power on par with these major media companies to deliver the truth about the state’s most important ballot question in 50 years – to tell the stories of who would be harmed – every day. Our content reached 6.8 million people and earned a staggering 2.8 million engagements (reactions, comments, shares or clicks) on social media from Oct. 1 through Election Day.

he dominance of Illinois Policy’s retirement conversation was just one example of this. Awareness that a progressive income tax would make a retirement tax more likely skyrocketed from July to October – increasing by 20 percentage points in the general population and 30 points among a key voter segment: Illinoisans over age 55.

In the end, the megaphone mattered. It remains ready for the future.

Media

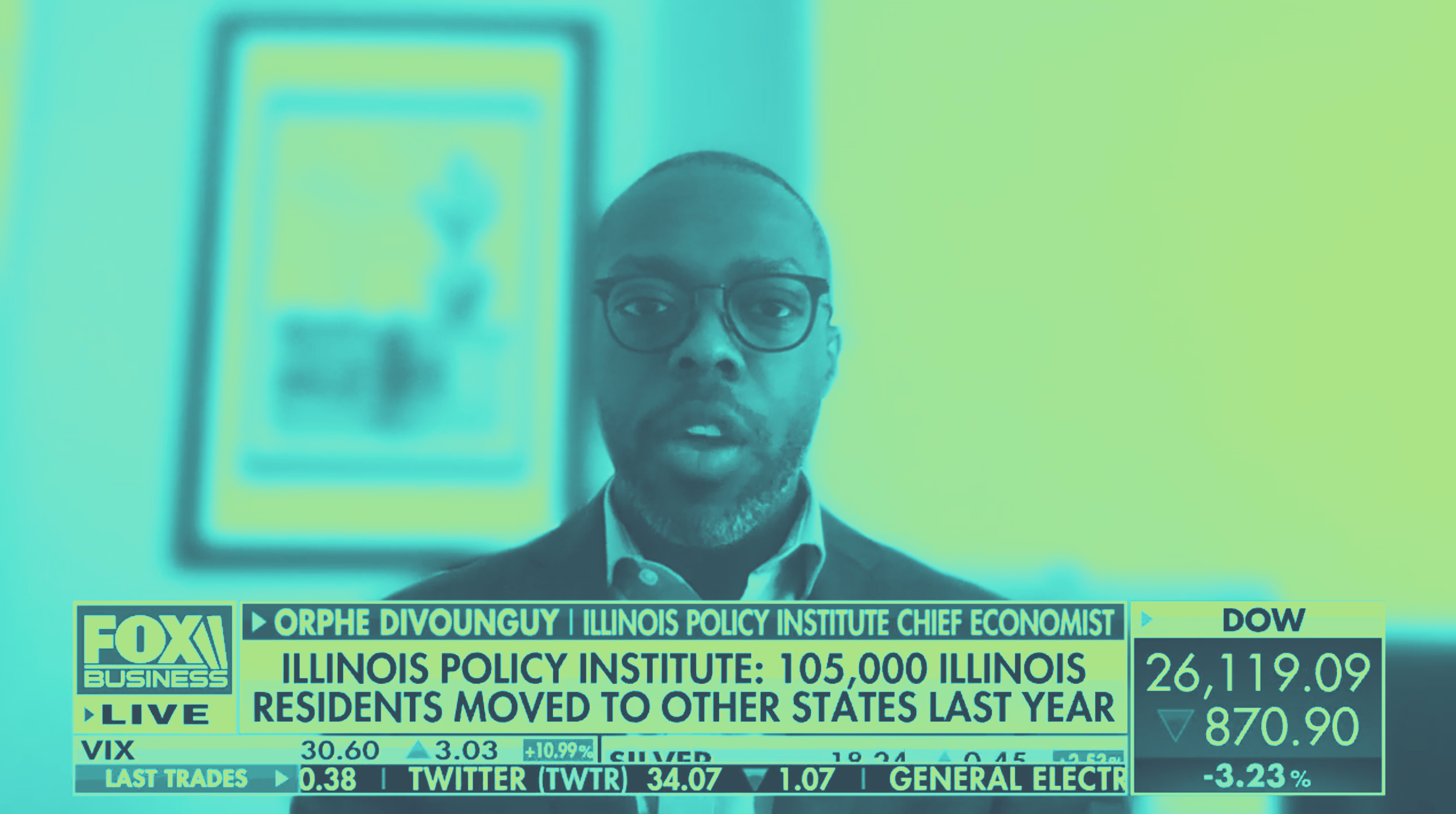

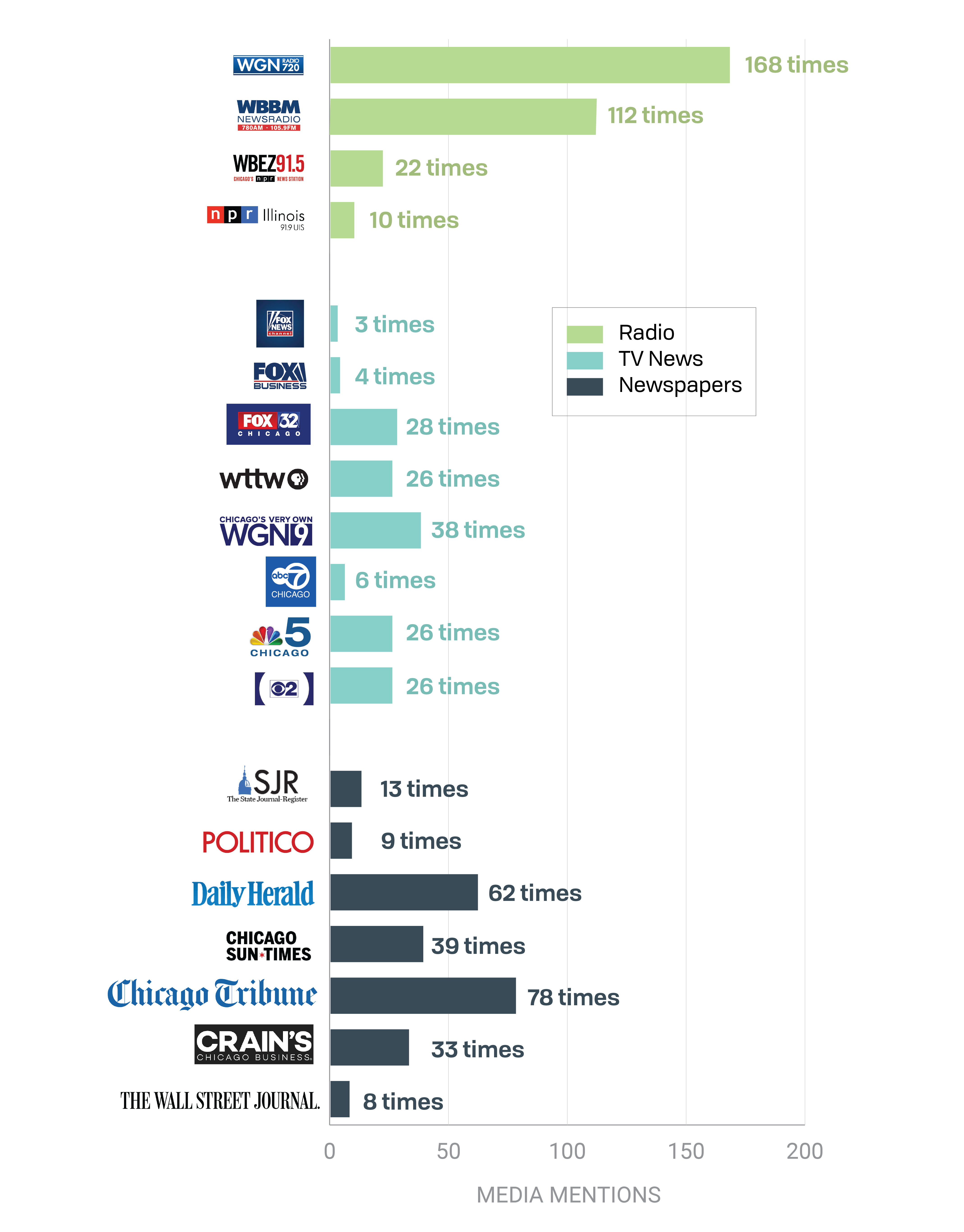

In 2020, the Illinois Policy Institute’s brand made big advances with legacy media. Our reputation as a trusted source was solidified among media outlets including WGN, Fox 32, Chicago Tribune and The Wall Street Journal. The communications team secured high-impact media placements to move the narrative on some of the most important policy battles taking shape across the state, including a sound defeat of the progressive income tax.

In total, the Illinois Policy Institute and Illinois Policy were in the news 3,482 times during the year. Ninety-three percent of the time the Institute was mentioned with a neutral or positive tone, and the mention was focused on our policy agenda. This measure matters, because it’s a sign that people are taking our ideas and solutions seriously.

Our ability to penetrate legacy media gives the Institute third-party validation that exposes our work to new and larger audiences on the issues that matter most.

COVID-19

As soon as the COVID-19 pandemic hit Illinois, Illinois Policy Institute researchers began sharing original analysis on what the economic consequences meant for the state. By stressing how severe the downturn was, experts became go-to sources for how a downturn would damage the Illinois economy and served as a balance to daily COVID-19 numbers coming from the state.

We were the leading source on the economic implications of the pandemic and associated lockdowns in Chicago and across Illinois.

Notable moments:

- There were over 800 state and national media placements on the economic effects of COVID-19 and Illinois’ harsh lockdown measures.

- CEO John Tillman secured COVID-19-related op-eds in both the Chicago Tribune and the Chicago Sun-Times on the same day.

- CBS 2 Chicago TV reporters leveraged Institute experts twice in one week to help with an investigation into problems with the Illinois Department of Employment Security mishandling unemployment claims.

- When lawmakers began calling for a federal bailout, the Institute shared a policy response that called for no government dollars without strings attached. We helped The New York Times publish the exclusive first report on the Illinois bailout request, which dictated the terms of the conversation for the rest of the year.

- Senior Director of Budget and Tax Research Adam Schuster co-authored an op-ed in the Chicago Tribune with U.S. Rep. Darin LaHood on the virtues of the Institute’s first-ever federal legislation, theTaxpayer Protection Program. The message gained momentum with over 30 media stories, leading Los Angeles Times business columnists to write about the idea and CNBC’s The Closing Bell to ask Gov. J.B. Pritzker about Illinois’ pension problems.

- Chicago’s WBEZ radio and WGN TV, along with The Wall Street Journal, all utilized the Institute’s “Your Story” heroes to chronicle the suffering of Illinoisans during the pandemic. In total, the Illinois Policy Institute told the story of 65 business owners and workers who were being failed by government actions.

Progressive tax

The Institute launched a lawsuit over the misleading language printed on the Illinois ballot and mailed to residents around the state about Pritzker’s progressive income tax. The lawsuit and our exclusive release of this news created an avalanche of coverage on the dangers of passing this tax hike proposal. The coverage helped turn public opinion against Pritzker’s tax proposal.

Notable moments:

- Altogether, the Illinois Policy Institute was mentioned in about 1,100 media reports on the progressive tax. Over 450 media placements were on the lawsuit, which drew attention to the idea that the progressive tax would harm retirees.

- Every Chicago TV and radio station covered the Institute’s progressive tax lawsuit. Greg Hinz from Crain’s wrote that the lawsuit could signal the downfall of the progressive tax. He was right.

- With 18 published op-eds, Illinois Policy Institute experts secured four times as many op-eds as the leading progressive tax supporters.

- From September through Election Day, the Institute participated in six panels, debates and speaking events to give Illinoisans the facts on the progressive tax.

- Following robust newspaper editorial outreach, every Chicago newspaper – except for the union-owned Sun-Times – opined against the progressive tax. In total, 16 newspapers around the state told their readers to “vote no”on the ballot question. The Wall Street Journal was among the newspapers that called on voters to reject a progressive tax, citing Illinois Policy Institute messaging and material.

Madigan’s downfall

After 50 years in office, House Speaker Mike Madigan came under fire with a federal investigation into his dealings with Commonwealth Edison. This brought attention to original Institute research that found Illinois grants its House speaker more power than most other states – including the exclusive ability to decide which lawmakers hold committee positions and which bills become law.

In addition, the Institute shared reports with the media that highlighted how Illinois’ pension debt grew 753% under Madigan’s leadership.

Notable moments:

- The Institute secured 83 media placements about Mike Madigan and the need for corruption reform and House Rules changes.

- The Daily Herald, Chicago Tribune and The Wall Street Journal used Illinois Policy Institute research to opine that Madigan should step down as House speaker and the House Rules should be reformed to encourage a more open democracy.

- Original op-eds by John Tillman in Governing Magazine, by Matt Paprocki in the Chicago Sun-Times and Amy Korte in the Daily Herald shared why Madigan wielding his power as House speaker hurt Illinois taxpayers.

- Two Chicago Magazine articles used Illinois Policy Institute expertise as background on how Madigan and House Rules led to corruption in the state.

Financials

The Illinois Policy Institute and Illinois Policy’s unaudited financial information for fiscal year 2020 (Jan. 1, 2020, to Dec. 31, 2020) is shown to the right. Combined operating income was $11,957,749, and net assets totaled $3,824,434. Program expenses accounted for 81.3% of combined operating expenses.

Both the Illinois Policy Institute and Illinois Policy accept no government funding. All of our work is made possible thanks to thousands of Illinoisans who choose to stand with us.

Letter from the president

What makes the Illinois Policy Institute special is that we take issues that are politically impossible, and we apply pressure to turn them into the politically inevitable.

During the past year, we have seen pressure and focus result in the overwhelming defeat of the progressive tax, and the ouster of the most powerful politician in Illinois history, Mike Madigan. We will use it again to reform our broken and corrupt pension system.

In March 2020, six months before the election, the progressive tax was positioned to pass by over 33%. Meanwhile, Gov. J.B. Pritzker had donated over $50 million to his propaganda campaign supporting the tax increase. At that point, stopping the progressive tax seemed impossible. But right there is what makes the Illinois Policy Institute different. With your partnership, we went to work with the goal of finding the right message, for the right audience, at the right time.

In November 2020, the progressive tax failed by over 7%: a 40% flip in six months. With countless other advocates, we helped turn the politically impossible into the politically inevitable.

Hours after the election results came in, U.S. Sens. Tammy Duckworth and Dick Durbin were calling for the resignation of Madigan as state party leader. Their calls were soon followed by 19 members of his own caucus seeking his ouster as House speaker.

Five years ago, Madigan was viewed neutrally in this state. In fact, most people did not know who he was. But we saw he was using “legal corruption” to amass power. Taxpayers were paying the bill.

We decided we wanted to make Mike Madigan a public name. We wrote thousands of stories about him. We exposed the way he was able to amass unprecedented power in Illinois. Our articles were viewed by the FBI over 1,200 times. We wrote and produced a documentary about him.

In that time, his favorables went 50 points underwater. People understood the truth. By January 2021, Madigan’s own caucus threw him out as speaker.

Impossible? Inevitable.

Up next, we will take on the impossible task of reforming the Illinois public pension system. The system is bankrupting our state, harming many for the benefit of few.

In the past 20 years, spending on the Illinois pension system has increased by 501%. Spending has decreased by 32% for the services our state’s most vulnerable citizens depend on.

Against the backdrop of cuts for child protection, losses of scholarships for low-income students and reductions in law enforcement is Lawrence Wyllie. The former Lincoln-Way school superintendent is receiving $340k per year as a public pension. Since he was indicted for embezzlement in 2017, Wyllie has received over $1 million in pension benefits.

This unfair and corrupt system needs to change.The Illinois Policy Institute will be fighting to fix it. And the good news is, the majority of Illinoisans agree with us. A recently released poll shows 51%of Illinois residents want to see comprehensive pension reform.

Another impossibility is becoming inevitable.And this is only possible because of your partnership. On behalf of the Illinois Policy Institute, and the 12.6 million Illinois taxpayers, “thank you!”

Matt Paprocki

President and COO