Chicago’s thirst for taxes

Cook County’s penny-per-ounce soda tax is just the latest in a long history of beverage taxes in Chicago.

Chicagoans are some of the most highly taxed residents in the country, paying over 30 separate taxes. Because there are so many different taxes, it can be hard for consumers to know exactly what is being taxed, and when. And Cook County’s penny-per-ounce sweetened beverage tax is causing the latest confusion. While polling shows 87 percent of residents disapprove of the new tax, these beverages have actually been taxed in other ways for years. Yet despite the revenues from these taxes, city and county government are thirsty for more.

Soda taxes

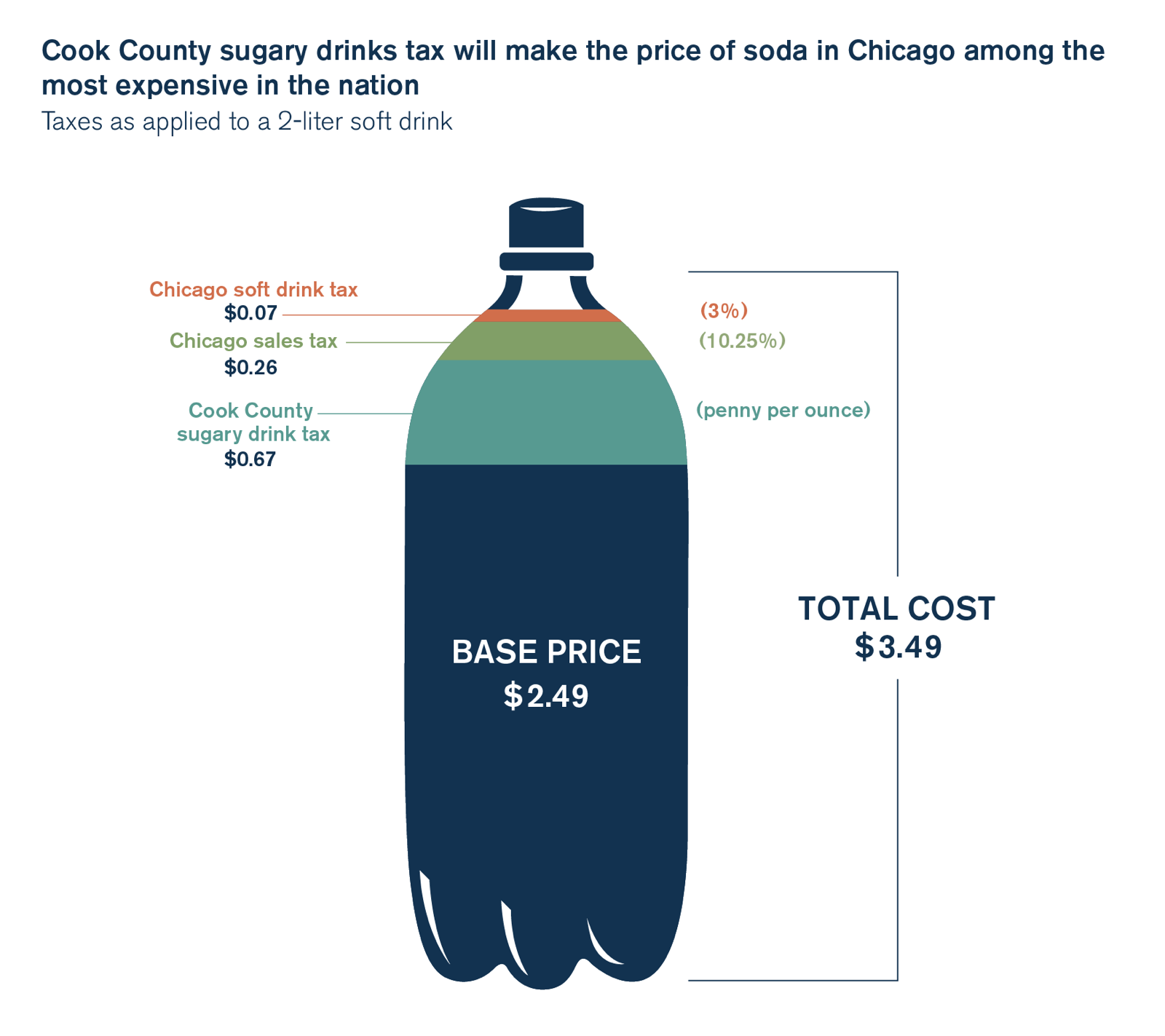

With Cook County’s new sweetened beverage tax, which took effect Aug. 2nd, soda in Chicago is some of the most expensive in the nation. A $2.49 2-liter bottle of soda now costs $3.49, an effective combined tax rate of 40 percent. This is due in part to the penny-per-ounce tax, but in the uproar over the new tax, the other taxes the city adds have often gone unnoticed.

Taxpayers are extremely familiar with Chicago’s combined sales tax of 10.25 percent but lost in the mix is a 3 percent soft drink tax that has been levied on retail purchases since 1994. Beverages covered under this tax include soda, sports drinks, sweetened tea, drinks with less than 50 percent fruit juice and water with natural sweetener. Some merchants even apply the tax to purchases of carbonated unsweetened water with added flavoring, such as lime-flavored sparkling water.

Retail purchases aren’t the only beverages subject to Chicago taxes. Fountain drinks carry their own tax of 9 percent of the cost of syrup. This tax is more difficult to grasp since it is charged to the retailer and is factored into the retail price of the drink. This also applies to fountain drinks served at a restaurant. These drinks, and the free refills that often come with them, are subject to the Cook County sugary drinks tax. Much like the 3 percent soft drink sales tax, the tax on fountain drinks has also been applied since the early 1990’s.

Due to the nature of fountain drinks, any establishment that sells pop from a fountain machine is treated as a restaurant for the purposes of taxing the drink. Accordingly, in the Loop, that fountain drink has two additional taxes on it. First is the 0.25 percent restaurant tax that is applied on all food and beverages throughout the city. The other is the 1 percent Metropolitan Pier and Exhibition Authority, or MPEA, Food and Beverage Tax. This tax is applied on food and beverage purchases within the MPEA boundaries: north to Diversey, south to the Stevenson Expressway, west to Ashland and east to Lake Michigan.

Cook County’s soda tax and others like it were implemented under the guise of improving public health. One argument in support of soda taxes is that individuals should just drink water. But in Chicago, that’s taxed as well.

Water taxes

In 2007, Chicago passed a five-cent per bottle water tax. The intention was that this tax would reduce the stream of plastic being discarded. Ald. George Cardenas, 12th Ward, told USA Today “It’s not a tax on water, it’s a tax on plastic.”

Of course, the bottled water tax is not the only tax being paid. Consumers must also pay the grocery sales tax rate of 2.25 percent. That means, on a 1-liter bottle of water purchased in Chicago for $1.49, taxes will tack on an additional $0.08. That’s an effective tax rate of 5 percent.

While not subject to the bottled water tax, plain carbonated water such as Perrier and LaCroix are taxed at the grocery sales tax rate. However, as noted above, some retailers apply the higher 10.25 percent and 3 percent beverage tax – a combined 13.25 percent tax – to purchases of carbonated unsweetened water with flavoring added.

Alcohol taxes

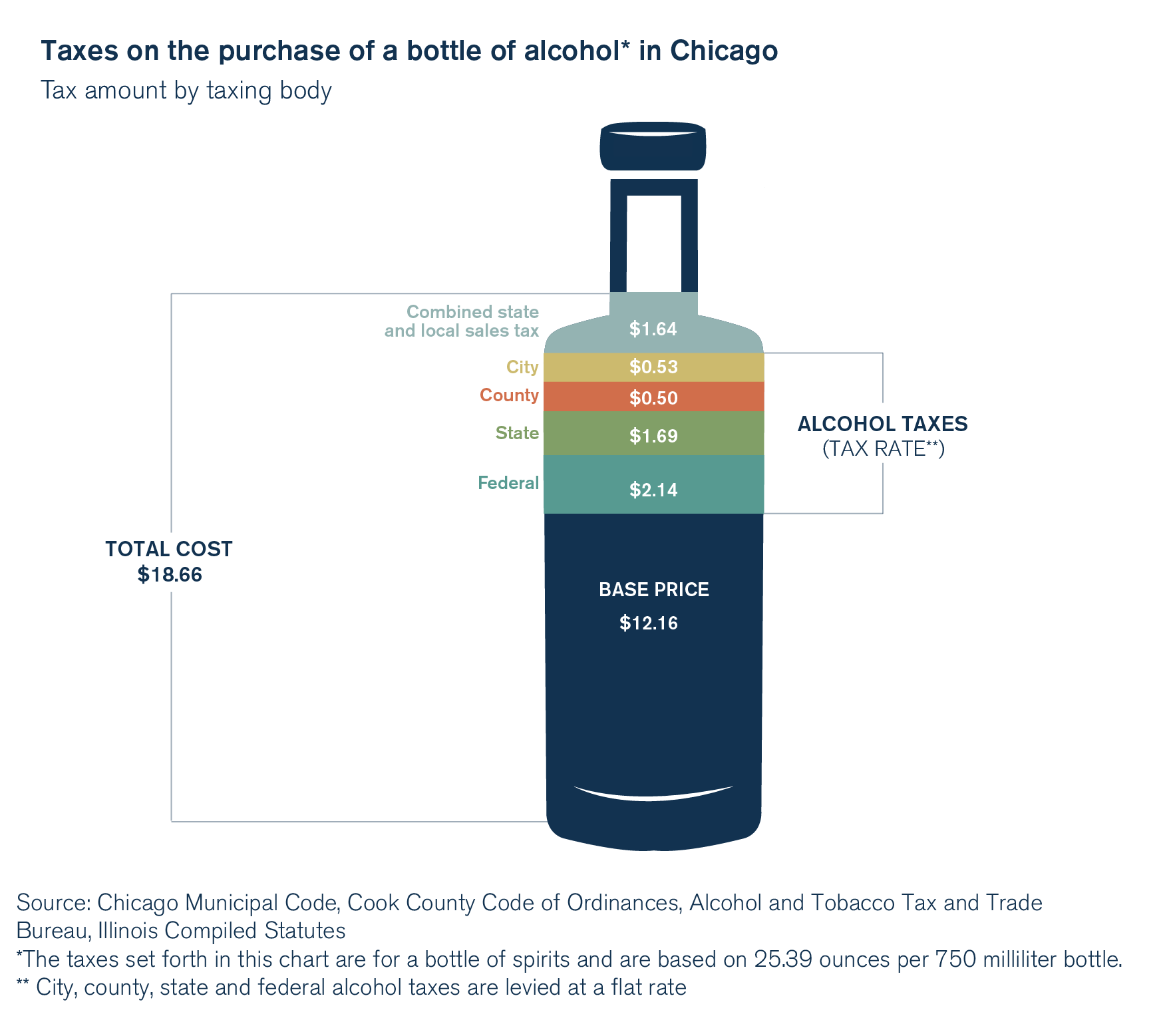

Alcohol in Chicago is also subject to various taxes. For example: A standard, 750 milliliter bottle of Absolut Vodka (40 percent alcohol by volume) costs $15.99 in Chicago – but the total taxes – seen and unseen – amount to $6.53. The retail price of $15.99 includes the base price of $12.16, state alcohol taxes of $1.69 and $2.14 in federal taxes. These taxes are included in the price of the bottle, and consumers are generally unaware they are paying them. Add to those $1.03 in city and county alcohol taxes and $1.64 for the city’s combined 10.25 percent sales tax – which is the highest among any major city in the nation. At the register, the consumer will pay $18.66 for that bottle of vodka. The total tax burden for this alcohol: 41 percent.

Most people know that they will pay taxes on their purchases. But few are aware of exactly how much tax is taken, by which taxing bodies, and for what purpose. The taxes on beverages are just another example of Chicago reaching into consumers’ pockets in a way that is often not easily decipherable. These beverage tax grabs are some of the reasons Chicago has one of the highest tax burdens in the country.