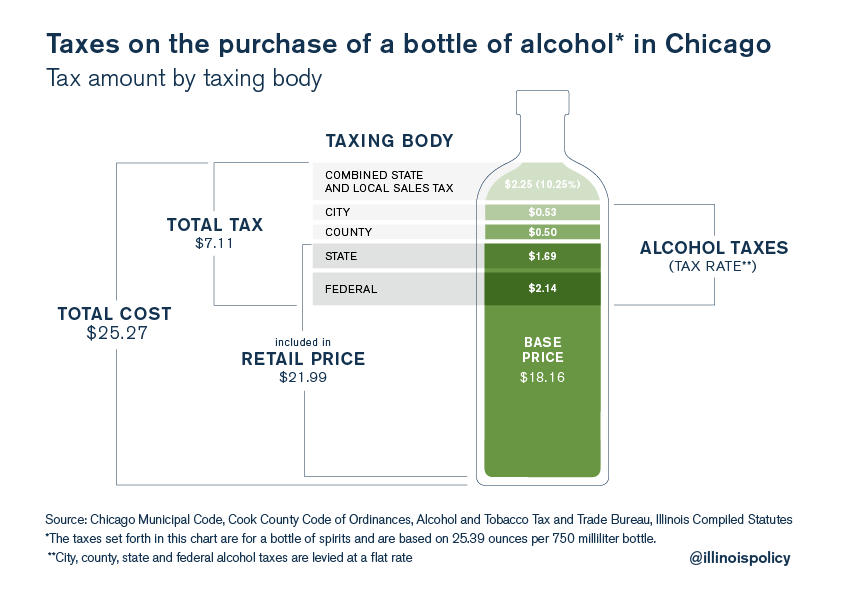

Chicago’s total, effective tax rate on liquor is 28%

The combined federal, state, county and city taxes on alcohol result in a 28 percent effective tax rate on a bottle of spirits bought in Chicago.

It costs a lot to make a cocktail in Chicago, even in your own home.

Take this example: A standard, 750 milliliter bottle of Absolut Vodka (40 percent alcohol by volume) costs $21.99 in Chicago – but the total taxes (seen and unseen) amount to $7.11. State alcohol taxes add $1.69 to the price of the liquor, while the federal government tacks on $2.14. These taxes are included in the price of the bottle, and consumers are generally unaware they are paying them. Add to those taxes $1.03 in city and county alcohol taxes and $2.25 for the city’s 10.25 percent sales tax – which is the highest among any major city in the nation. At the register, the consumer will pay $25.27 for that bottle of vodka. The total tax burden for this alcohol: 28.16 percent.

Each of these individual tax rates might seem innocuous on its own. But taken together, the tax burden on alcohol is significant.

So how did Chicago’s alcohol tax burden get so high? Here’s a breakdown of each portion of the tax.

At its inception, the first U.S. alcohol tax imposed to raise funds to pay back debts incurred during the Revolutionary War. Eventually, this became known as a “sin tax,” as some in society disapproved of drinking. Understanding the federal alcohol tax at a glance is not easy. For instance, wine is taxed at six different rates depending on its percentage of alcohol by volume or whether it is sparkling. The range for the wine tax is between $0.226 and $3.40 per gallon. Beer is taxed at a single rate of $18 per barrel (31 gallons). And spirits are taxed at $13.50 per gallon, though the law gives credit for wine and flavor content in spirits.

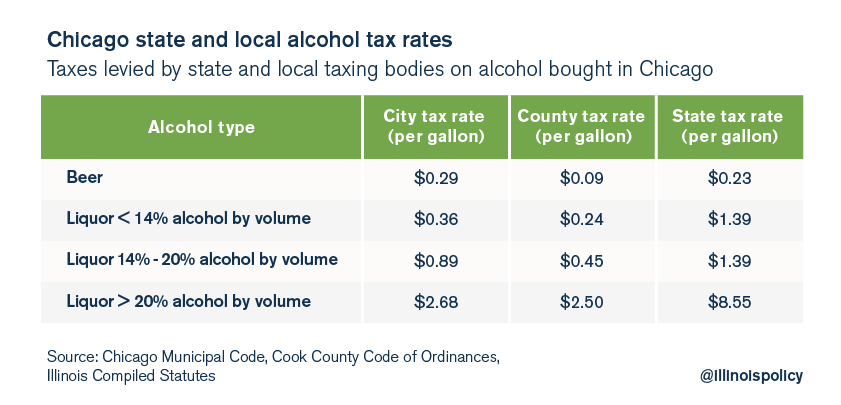

Chicago and Cook County have followed the federal government’s lead and have increased alcohol taxes several times, with the most recent increases occurring in 2007 for Chicago and 2011 for Cook County. Illinois last increased its alcohol tax in 2009.

By itself, a single tax rate may not seem egregious. However, when taken in context, a different story emerges. In Chicago, an alcohol purchase is hit with four separate taxes (city, county, state and federal).

There is a great range among the states when it comes to alcohol taxes. Seventeen states are liquor monopoly states where alcohol is sold from state-run stores. The remaining 33 states license sellers and collect the taxes. For those 33 states, there is a wide range of taxes collected. Beer is taxed as low as $0.02 per gallon in Wyoming and as high as $1.15 per gallon in Tennessee. Similarly, spirits are taxed as low as $1.50 per gallon in Maryland and as high as $14.27 per gallon in Washington. Illinois ranks 14th in the nation for its spirits tax rate, according to a 2014 study by the nonpartisan Tax Foundation.

While city, county and state taxing bodies all calculate these taxes based on alcohol by volume, with beer subject to a separate rate, the federal alcohol tax differentiates by type of alcohol. For example, the alcohol tax is different for wine ($1.07 per gallon), sparkling wine ($3.40 per gallon) and spirits ($13.50 per gallon).

Most people know that they will pay taxes on their purchases, especially alcohol purchases. But few are aware of exactly how much tax is taken and by which taxing bodies. The alcohol tax is another example of government’s constant reaching into the pockets of consumers. It also helps show why Chicago has one of the highest tax burdens in the country.