QUOTE OF THE DAY

Tax Foundation: Top State Income Tax Rates

This map presents top individual income tax rates in each state for 2014. Income taxes are a major, and often complicated, component of state revenues. Furthermore, unlike sales or excise taxes which individuals pay indirectly, income taxes are levied directly on individuals, meaning that income taxes figure especially prominently in any discussion of tax burdens and public policies.

Income taxes are structured in many different ways throughout the states. Some are flat systems with one rate for all income, others offer progressive systems taxing different levels of income at different rates, while some states have no income tax at all. These taxes also change: since 2013, five states (Kansas, North Carolina, North Dakota, Ohio, and Wisconsin) reduced income taxes and one state (Minnesota) increased income taxes.

Chicago Tribune: Emanuel touts U. of C. study to show CPS gains

Mayor Rahm Emanuel used promising results from a University of Chicago study looking at the success of high school freshmen to pronounce that Chicago had turned a corner in education achievement.

“We are a city now on the move in the sense of achieving what I think every child deserves, a high quality education that prepares them for the rest of their lives,” Emanuel said, speaking at the release of a new study by the University of Chicago Consortium on Chicago School Research.

The Consortium released a report Thursday showing that schools’ efforts to improve the academic performance of ninth grade students resulted in higher graduation rates.

Crain’s: City loses millions on unneeded real estate, inspector general says

Cash-short Chicago could make many millions of dollars if it did a better job of disposing of unneeded real estate, but it doesn’t even keep a single list of what it owns.

That’s the bottom line of a report issued today by Chicago Inspector General Joe Ferguson that points to oddities like a $1 million building in the trendy River North area that is used only to provide free parking to 19 city workers and house two other city vehicles.

Chicago “does not periodically evaluate its utilized real property assets to determine if they are being used for the best possible purpose or should be sold,” the report says. While the Planning Department does maintain a list of “surplus” land that it’s been asked to sell, in fact “a citywide data set for real estate (holdings)” does not exist, the report says.

Chicago Tribune: Quinn now backs term limits for statewide elected officials

Democratic Gov. Pat Quinn said today he supports a Republican-backed proposal to limit how long statewide elected officials can serve and defended his term-limit credentials against criticism from GOP governor candidate Bruce Rauner.

“I support this proposed constitutional amendment and have supported term limits since 1994,” Quinn said in a statement issued through his governor’s office. “Constitutional amendments have long allowed the power of the people to translate into positive reform for Illinois government.”

A day earlier, Senate Republican leader Christine Radogno of Lemont introduced the proposed constitutional amendment, providing that no one could be elected to the same statewide office more than twice — effective with the results of the 2018 general election. The proposal is also supported by House GOP leader Jim Durkin of Western Springs.

Crain’s: Appeals court ruling looks ominous for pension changes

In a case with implications for the upcoming legal battle over pension reform, an Illinois appellate court in Springfield ruled that constitutional protections prevent the state from reducing mandated payments to county treasurers.

The pension protection clause of the Illinois Constitution, which says that workers’ retirement benefits can’t be diminished, is at the heart of lawsuits challenging statewide pension changes enacted late last year.

While the county treasurers’ case relies on other language in the constitution, the appellate court’s decision yesterday is analogous, using the same legal arguments and precedents that teachers and other state workers are pressing in court against pension reform.

Chicago Tribune: Officials propose ride share regulations

Chicago officials on Thursday presented revised proposals to regulate the new ride-sharing industry, and also tried to assure taxicab companies that they won’t be run out of business.The main argument offered by the Emanuel administration was that the vast majority of ride-share drivers — up to 75 percent — work only part time.”That is why we are proposing a structure that will create strong incentives for (ride-sharing) companies to stay true to the part-time practice of ride share, with bad consequences for companies that don’t,” Michael Negron, chief of policy in the mayor’s office, told the City Council’s Committee on License and Consumer Protection.

Chicago Sun Times: CPS to build selective-enrollment high school named for Obama

Mayor Rahm Emanuel on Thursday unveiled plans to use $60 million in tax increment financing funds to build another selective-enrollment high school for 1,200 students to be named for President Barack Obama.

The new school will be built on Chicago Park District property near Skinner North Classical School, 640 W. Scott, a coveted choice for North Side parents. Barack Obama College Preparatory High School is expected to open in the fall of 2017 with a freshman class of 300, then add classes in each of the following three years.

Roughly 70 percent of the seats will be filled through the highly competitive admissions process already in place for Chicago’s 10 other selective-enrollment high schools. The remaining seats will be filled through a “neighborhood preference” already in place at Jones and Westinghouse College Prep.

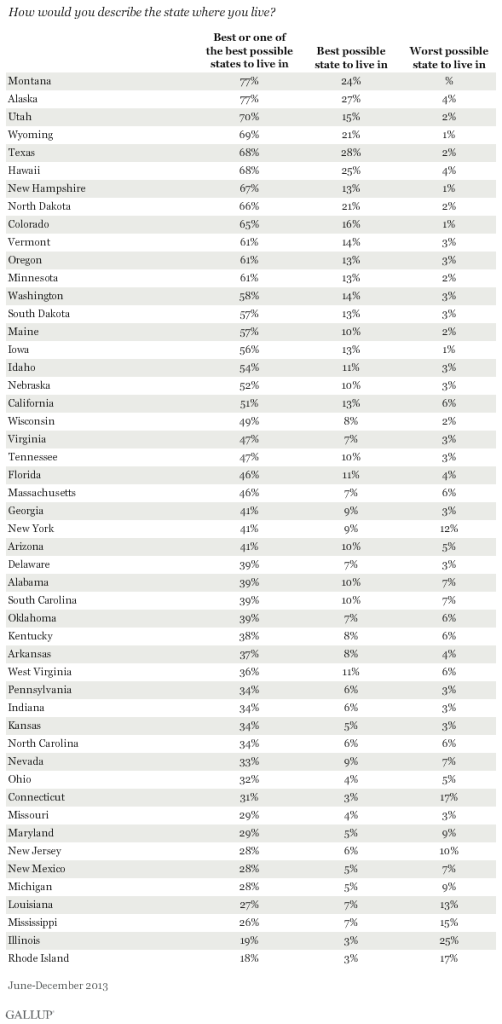

Washington Post: Illinois is the worst place to live, say people who live in Illinois

Illinois is the worst, according to the people who live there.

A new Gallup poll is out with information about how people who live in states feel about these states. So now we know that people in Montana really, really like living in Montana, while people in Illinois and Rhode Island are pretty sure they don’t live in one of the best places in the country.

Bloomberg: Illinois issues $750 million of bonds in third sale of 2014

Illinois, the lowest-rated U.S. state, issued $750 million of tax-exempt bonds in its third general-obligation sale of 2014.

The deal includes a portion maturing in May 2024 that priced to yield 3.38 percent, according to data compiled by Bloomberg. The yield is 1.01 percentage points above benchmark municipal bonds.

Today’s sale had wider spreads than those the state earned on a competitive offering two weeks ago, when its 0.93 percentage point spread for 10-year debt was the lowest since 2009. Today’s gap is still narrower than Illinois’s last negotiated sale in February, when it issued about $1 billion at an interest rate 1.11 percentage points above 10-year benchmark debt.

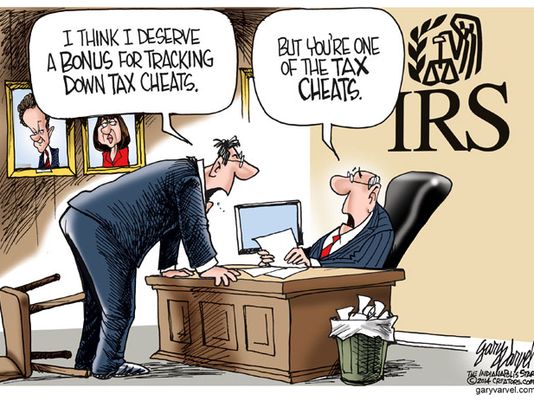

CARTOON OF THE DAY