QUOTE OF THE DAY

Connecticut Mirror: Connecticut becomes first state to pass $10.10 minimum wage

With partisan votes on a pocketbook issue that the White House and Connecticut Democrats hope will mobilize voters this fall, the General Assembly voted Wednesday for legislation that would raise the state’s $8.70 minimum wage to $10.10 by January 2017.

The bill, which was approved 21-14 in the Senate and 87-54 in the House, became an instant political talking point for Gov. Dannel P. Malloy and President Obama. Malloy is to sign the bill Thursday evening at Cafe Beauregard, the New Britain restaurant where Obama dined before a minimum-wage rally three weeks ago.

The state is the first to pass legislation establishing a $10.10 minimum wage. With a $9.32 minimum, Washington state now has the highest.

America’s K-12 public education system has experienced tremendous historical growth in employment, according to the U.S. Department of Education’s National Center for Education Statistics. Between fiscal year (FY) 1950 and FY 2009, the number of K-12 public school students in the United States increased by 96 percent, while the number of full-time equivalent (FTE) school employees grew 386 percent. Public schools grew staffing at a rate four times faster than the increase in students over that time period. Of those personnel, teachers’ numbers increased 252 percent, while administrators and other non-teaching staff experienced growth of 702 percent, more than seven times the increase in students.

That hiring pattern has persisted in more recent years as well. Between FY 1992 and FY 2009, the number of K-12 public school students nationwide grew 17 percent, while the number of FTE school employees increased 39 percent. Among school personnel, teachers’ staffing numbers rose 32 percent, while administrators and other non-teaching staff experienced growth of 46 percent, 2.3 times greater than the increase in students over that 18-year period; the growth in the number of teachers was almost twice that of students.

The two aforementioned figures come from “The School Staffing Surge: Decades of Employment Growth in America’s Public Schools.” This companion report contains more state-specific information about public school staffing. Specifically, this report contains:

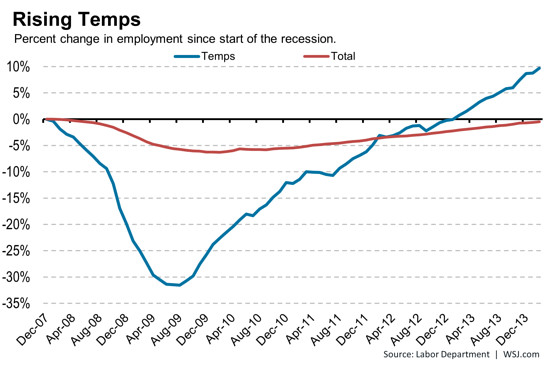

WSJ: Expect Surge in Temp Jobs to Continue

The surge in contract and “temp” jobs since the recession ended is likely to continue, a range of experts have said, in part because of slack in the labor market and decisions by many corporations to maximize flexibility in their work force.

CareerBuilder and Economic Modeling Specialists Intl. said in a new forecast on Thursday that more than 2.9 million workers had temporary jobs in 2013, up 28% from 2010. Roughly 10% of all new jobs created since the recession ended have been temp or contract jobs, according to various estimates. By many accounts, a record number of Americans now work in these positions, which can lead to full-time positions, but often don’t promise long-term certainty.

The biggest increase in temp jobs among major cities has been in Grand Rapids, Mich., according to the two companies, a trend they expect to continue. The number of temp workers in the western Michigan city has more than doubled since 2009 and they expect it to increase another 8% from 2013 to 2014. They also expect sizable increases in Indianapolis, Seattle, Orlando, and a number of other towns.

Chicago Tribune: Madigan’s millionaire tax proceeds

Democratic House Speaker Michael Madigan advanced his proposal to make people who make more than $1 million a year pay a higher income tax Thursday, but a separate measure calling for a broader graduated income tax in Illinois failed in the same House committee.

The Madigan proposal would ask voters in November to impose an additional 3 percent surcharge on income over $1 million, on top of the regular personal income tax rate. The measure, which would amend the state’s Constitution, went to the House floor on a 6-4 partisan roll call in the Revenue and Finance Committee.

The vote came one day after Democratic Gov. Pat Quinn called for making permanent the state’s 5 percent income tax for individuals rather than allowing it to drop to 3.75 percent as scheduled on Jan. 1.

WSJ: Which States Take the Most From the U.S. Government?

Delaware residents, who voted overwhelmingly for President Barack Obama in 2012, get 50 cents in federal funding for every $1 in federal income taxes they pay.

Mississippi — 55.5% for Mitt Romney — cashes in with $3.07 in federal funding for every dollar paid in income taxes.

Those findings come from a new analysis by WalletHub. The personal finance social network crunched returns on taxes paid to the federal government, federal funding as a percent of state revenue and the number of federal employees per capita to conclude that Red States “are altogether more reliant on federal funding than Blue States.”

The Mark Up: Half Of Uninsured Not Planning On Getting Coverage, Poll Finds

With less than a week left for customers to apply for insurance through the health care marketplaces, a poll released Wednesday finds that half of the people still without health coverage intend to remain uninsured.

Five million people have signed up for insurance since the marketplaces created by the federal health law opened in October. The official deadline to sign up without facing a financial penalty is March 31, although federal officials told news organizations Tuesday that consumers who begin the process before then and have had trouble with the technology will an extension of several weeks to finish the process. The Congressional Budget Office estimates by the year’s end, 6 million people will have obtained insurance on the marketplaces.

Pensions & Investments: Illinois governor outlines pension contribution increases in budget address

Illinois’ five state retirement systems would receive more than $6 billion in state contributions combined in the next fiscal year, beginning July 1, up 4.3% from the current fiscal year, according to a budget proposal released Wednesday by Gov. Pat Quinn.

Under the proposal, the Illinois Teachers’ Retirement System, Springfield, would get $3.4 billion;Illinois State Universities Retirement System, Champaign, $1.5 billion; Illinois State Employees’ Retirement System, Springfield, $1.1 billion; Illinois Judges’ Retirement System Springfield, $133.9 million; and Illinois General Assembly Retirement System, Springfield, $15.8 million.

The combined funding ratio of the five systems was 41% as of June 30, 2013, according to the budget proposal. Broken down by system on a fair-market value basis, the $42.8 billion TRS was 42.5% funded; $15.9 billion SURS, 43.7%; $12.4 billion SERS, 35.7%; $643 million JRS, 29.8%; and $54 million GARS, 17%.

In all, the five systems had a combined $67.9 billion in assets and $165.4 billion in liabilities as of June 30, according to the budget proposal.

CARTOON OF THE DAY